"This guy ever quit?"

--Cosmo Renfro (The Fugitive)

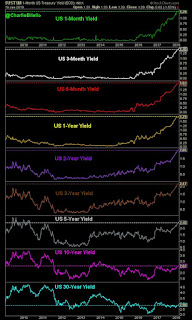

No quit to rising long bond yields. Ten yr now well above the 2.6% Maginot. Not much technical resistance between here and 3%.

Perhaps the bond ghouls are doing the math on the pricey spending proposals suggested in last night's State of the Union address. With more borrowing imminent, creditors will demand higher rates.

no positions

Wednesday, January 31, 2018

Tuesday, January 30, 2018

Conference Board Euphoria

Well I'm heavenly blessed and worldly wise

I'm a peeping tom techie with x-ray eyes

Things are going great

And they're only getting better

--Timbuk 3

Extreme measurements in sentiment keep on coming. The difference between Conference Board measures of consumer confidence and personal savings rate has not been this wide since...just before the credit collapse of 2008...and the dot come bust of 2000 before that.

Oh, and the Conference Board survey of consumer expectations for higher stock prices has never registered a higher reading.

When the future seems so bright that you have to wear shades, remember that you'll be at a disadvantage if the lights suddenly switch off.

I'm a peeping tom techie with x-ray eyes

Things are going great

And they're only getting better

--Timbuk 3

Extreme measurements in sentiment keep on coming. The difference between Conference Board measures of consumer confidence and personal savings rate has not been this wide since...just before the credit collapse of 2008...and the dot come bust of 2000 before that.

Oh, and the Conference Board survey of consumer expectations for higher stock prices has never registered a higher reading.

When the future seems so bright that you have to wear shades, remember that you'll be at a disadvantage if the lights suddenly switch off.

Monday, January 29, 2018

Interest Expense Rising

I hear hurricanes a blowin'

I know the end is coming soon

I hear rivers overflowin'

I hear the voice of rage and ruin

--Creedence Clearwater Revival

Another consequence of higher interest rates: more money paid by the federal government to service debt.

If interest rates should double from here, cost to service federal debt goes north of $trillion. And imagine having to borrow even more in an increasing interest rate environment.

no positions

I know the end is coming soon

I hear rivers overflowin'

I hear the voice of rage and ruin

--Creedence Clearwater Revival

Another consequence of higher interest rates: more money paid by the federal government to service debt.

If interest rates should double from here, cost to service federal debt goes north of $trillion. And imagine having to borrow even more in an increasing interest rate environment.

no positions

Sunday, January 28, 2018

When CBs Stop Buying

No place for beginners or sensitive hearts

When sentiment is left to chance

No place to be ending but somewhere to start

--Sade

Contrary to popular opinion, including that of the president, stocks have been going up not because of a strengthening economy--but because of asset buying by central banks worldwide. The correlation is unmistakable.

Now CBs are 'tapering' purchases. Some plan outright sales. The projected impact on stocks is not pretty.

It won't matter until it does. And then it will matter a lot.

no positions

When sentiment is left to chance

No place to be ending but somewhere to start

--Sade

Contrary to popular opinion, including that of the president, stocks have been going up not because of a strengthening economy--but because of asset buying by central banks worldwide. The correlation is unmistakable.

Now CBs are 'tapering' purchases. Some plan outright sales. The projected impact on stocks is not pretty.

It won't matter until it does. And then it will matter a lot.

no positions

Labels:

central banks,

intervention,

risk,

technical analysis,

Trump

Saturday, January 27, 2018

Open For Business

It may take a little time

A lonely path, an uphill climb

Success or failure will not alter it

--Howard Jones

Of his speeches thus far as president, Donald Trump's address at the World Economic Forum in Davos may have been his best. For those unaware, the Davos event is an annual gathering with a recurring theme of how to plan and control economic activity around the globe. As such, it attracts elitists and statists of all stripes.

Trump's predecessor, Barack Obama, used the Davos platform to wax apologetically about America's economic capabilities and position, and to pledge his support for collectivist pet projects such as global warming. In fact, one has to go back several administrations to Ronald Reagan to find a US president who has taken an overtly pro-market stance at Davos.

That drought was broken yesterday when Trump took the podium. After sharing ways that his administration has removed stifling restrictions on US production and trade, he declared that, "America is open for business, and we are competitive once again."

At the outset Trump acknowledged that he was there to "represent the interests of the American people and to affirm America's friendship and partnership in building a better world." The US can do this best, he argued, through production and trade. Subsequently, he suggested that leaders in other countries who take similar stances will build a better world. He is correct, as it is production and trade done in axiomatic self-interest--not selfishness--that advances standard of living in a virtuous cycle.

Trump highlighted the virtues of cutting taxes and regulation ("Regulation is stealth taxation") in building economic momentum and shared empirical examples of its positive effects during his first year in office. He also spoke of lifting restrictions on energy production, thereby firing a shot across the bow of curtailed production in the name of 'climate change. He also spoke of securing a US immigration system that "is stuck in the past." In Trump-esque language the president promoted "lifting people from dependence to independence because we know the single best anti-poverty program is a very simple and very beautiful paycheck."

It is hard not to relish in the hand ringing among the Davos statists that must have coincided with these remarks...

Trump's speech was not without some warts. For instance, he said that the US "support[s] free trade but it must be fair." When presidents use the word 'fairness' it is almost always a code word for use of government force to advance a political agenda. By definition, free trade has no rules or restrictions. On the other hand, bilateral trade agreements such as those suggested by the president at Davos restrict trade rather than free it. Free trade requires no treaty.

There was also no mention of the burgeoning debt that envelops the US and the world. Unless quickly reversed, this debt will surely darken the light currently being generated by some positive domestic policies.

Still, it has been so long since the we have heard a pro-market, however imperfect, voice unapologetically projecting from the world stage that Trump's "Open For Business" remarks provide a source of inspiration.

A lonely path, an uphill climb

Success or failure will not alter it

--Howard Jones

Of his speeches thus far as president, Donald Trump's address at the World Economic Forum in Davos may have been his best. For those unaware, the Davos event is an annual gathering with a recurring theme of how to plan and control economic activity around the globe. As such, it attracts elitists and statists of all stripes.

Trump's predecessor, Barack Obama, used the Davos platform to wax apologetically about America's economic capabilities and position, and to pledge his support for collectivist pet projects such as global warming. In fact, one has to go back several administrations to Ronald Reagan to find a US president who has taken an overtly pro-market stance at Davos.

That drought was broken yesterday when Trump took the podium. After sharing ways that his administration has removed stifling restrictions on US production and trade, he declared that, "America is open for business, and we are competitive once again."

At the outset Trump acknowledged that he was there to "represent the interests of the American people and to affirm America's friendship and partnership in building a better world." The US can do this best, he argued, through production and trade. Subsequently, he suggested that leaders in other countries who take similar stances will build a better world. He is correct, as it is production and trade done in axiomatic self-interest--not selfishness--that advances standard of living in a virtuous cycle.

Trump highlighted the virtues of cutting taxes and regulation ("Regulation is stealth taxation") in building economic momentum and shared empirical examples of its positive effects during his first year in office. He also spoke of lifting restrictions on energy production, thereby firing a shot across the bow of curtailed production in the name of 'climate change. He also spoke of securing a US immigration system that "is stuck in the past." In Trump-esque language the president promoted "lifting people from dependence to independence because we know the single best anti-poverty program is a very simple and very beautiful paycheck."

It is hard not to relish in the hand ringing among the Davos statists that must have coincided with these remarks...

Trump's speech was not without some warts. For instance, he said that the US "support[s] free trade but it must be fair." When presidents use the word 'fairness' it is almost always a code word for use of government force to advance a political agenda. By definition, free trade has no rules or restrictions. On the other hand, bilateral trade agreements such as those suggested by the president at Davos restrict trade rather than free it. Free trade requires no treaty.

There was also no mention of the burgeoning debt that envelops the US and the world. Unless quickly reversed, this debt will surely darken the light currently being generated by some positive domestic policies.

Still, it has been so long since the we have heard a pro-market, however imperfect, voice unapologetically projecting from the world stage that Trump's "Open For Business" remarks provide a source of inspiration.

Labels:

climate,

competition,

debt,

Depression,

energy,

EU,

freedom,

immigration,

markets,

media,

Obama,

productivity,

regulation,

socialism,

taxes,

Trump

Friday, January 26, 2018

Gap Up Opens

I get up

And nothing gets me down

--Van Halen

Jason Goepfert adds another sentimental record to the list: gap up opens.

As the saying goes, better mind those gaps...

no positions

And nothing gets me down

--Van Halen

Jason Goepfert adds another sentimental record to the list: gap up opens.

If it seems like stocks gap up every morning, it's because they do.— SentimenTrader (@sentimentrader) January 26, 2018

The futures have opened regular trading hours in positive territory in 25 out of the past 30 sessions.

That's the most ever.

As the saying goes, better mind those gaps...

no positions

Thursday, January 25, 2018

Why Hillary Wasn't Indicted

I want to know

What you're thinking

There are some things you can't hide

--Information Society

Article proposes that primary reason why FBI Director Comey did not indict Hillary Clinton was that subsequent prosecution would have revealed former President Obama knowingly participated in the unsecured information exchange and then could be implicated in the coverup.

Here's hoping that the investigation gets to the bottom of the previous administration's lawlessness.

What you're thinking

There are some things you can't hide

--Information Society

Article proposes that primary reason why FBI Director Comey did not indict Hillary Clinton was that subsequent prosecution would have revealed former President Obama knowingly participated in the unsecured information exchange and then could be implicated in the coverup.

Here's hoping that the investigation gets to the bottom of the previous administration's lawlessness.

Wednesday, January 24, 2018

Falling Dollar

Here comes the rain again

Falling on my head like a memory

Falling on my head like a new emotion

--Eurythmics

One of the last things market participants probably expected in the midst of 'strong' economic news is a weakening dollar. After breaking long term support in the 91-92 zone, the Dollar Index is marking 3+ yr lows.

Technically, there's a lot of space between the current print and new support.

Although currency movements can be difficult to interpret, inquiring minds are wondering what dollar traders are sniffing out. Inflation? Trade wars? Weakening US global position?

Dunno cookmo. Do know that weakening dollar is a tailwind for gold priced in USDs. As such, I'll be keeping half an eye on this one.

position in gold

Falling on my head like a memory

Falling on my head like a new emotion

--Eurythmics

One of the last things market participants probably expected in the midst of 'strong' economic news is a weakening dollar. After breaking long term support in the 91-92 zone, the Dollar Index is marking 3+ yr lows.

Technically, there's a lot of space between the current print and new support.

Although currency movements can be difficult to interpret, inquiring minds are wondering what dollar traders are sniffing out. Inflation? Trade wars? Weakening US global position?

Dunno cookmo. Do know that weakening dollar is a tailwind for gold priced in USDs. As such, I'll be keeping half an eye on this one.

position in gold

Labels:

Depression,

dollar,

gold,

inflation,

intervention,

technical analysis

Tuesday, January 23, 2018

Thirty Year Trend Ending?

We thought just for an instant

We could see the future

We thought for once we knew

What really was important

--Til Tuesday

Eyes continue to migrate to Treasury yields and the 10 yr yield chart in particular. Is the 30+ yr secular decline in interest rates about to meet its technical demise?

May be the most important chart on the planet.

no positions

We could see the future

We thought for once we knew

What really was important

--Til Tuesday

Eyes continue to migrate to Treasury yields and the 10 yr yield chart in particular. Is the 30+ yr secular decline in interest rates about to meet its technical demise?

May be the most important chart on the planet.

no positions

Monday, January 22, 2018

Perverse Incentive

And if your head explodes with dark forebodings too

I'll see you on the dark side of the moon

--Pink Floyd

During a federal government shutdown, Congress still gets paid. Seems very wrong at first blush. On the other hand, if Congress didn't get paid during a shutdown, then there would be less incentive among lawmakers to shut parts of government down.

Of course, since they are getting paid, there is zero chance that Congress would voluntarily shut themselves down (which, until we have lawmakers who remain faithful to the Constitution, is what we need).

Paying Congress during government shutdowns is what is known as a perverse incentive.

I'll see you on the dark side of the moon

--Pink Floyd

During a federal government shutdown, Congress still gets paid. Seems very wrong at first blush. On the other hand, if Congress didn't get paid during a shutdown, then there would be less incentive among lawmakers to shut parts of government down.

Of course, since they are getting paid, there is zero chance that Congress would voluntarily shut themselves down (which, until we have lawmakers who remain faithful to the Constitution, is what we need).

Paying Congress during government shutdowns is what is known as a perverse incentive.

Sunday, January 21, 2018

Purdue Annual Letter

"When I signed up for the course, I thought I was playing it smart. I thought, 'I'll take shop. It'll be such as easy way to maintain my grade point average.'"

--Brian Johnson (The Breakfast Club)

Interesting annual letter from Purdue University President Mitch Daniels. Purdue made headlines last spring when it acquired the assets of online education provider Kaplan.

Daniels updates stakeholders on the Kaplan acquisition and how the institution plans to integrate the Kaplan assets into its higher ed processes. It remains to be seen whether a top tier institution can simultaneously do both face-to-face and distance education exceptionally well.

I found Daniels' comments on gradeflation particularly interesting. The evidence at Purdue is consistent with what is happening elsewhere: grades are drifting higher without commensurate improvement in student skills. Here is his central concern:

"In too many places, 'self-esteem' has apparently taken precedence over candor in student assessment. For many of our arriving students, anything less than an A comes as a jolt and a rude surprise. The student evaluations of our faculty which are collected at the end of each term are thought by many to be heavily tilted toward professors who are less demanding or inclined to easier grading."

I can attest to his latter point. Want better end-of-course evals? Grade easier.

Daniels admits that his "bias on the topic is evident." Further, he states that, "I believe that, in a sea of leniency, a university that maintains tough standards of performance will set itself and its graduates apart in a highly positive way."

Perhaps, but there be a wind in the face of an institution that seeks to attract large numbers of students by advertising candor and rigor in its evaluation systems. Students have been conditioned to seek out 'easy' classes and professors in order to achieve the highest mark possible.

I should add that Daniels writes like a CEO who demonstrates solid understanding of his organization's external environment and internal strengths/opportunities. Purdue is fortunate to have him.

--Brian Johnson (The Breakfast Club)

Interesting annual letter from Purdue University President Mitch Daniels. Purdue made headlines last spring when it acquired the assets of online education provider Kaplan.

Daniels updates stakeholders on the Kaplan acquisition and how the institution plans to integrate the Kaplan assets into its higher ed processes. It remains to be seen whether a top tier institution can simultaneously do both face-to-face and distance education exceptionally well.

I found Daniels' comments on gradeflation particularly interesting. The evidence at Purdue is consistent with what is happening elsewhere: grades are drifting higher without commensurate improvement in student skills. Here is his central concern:

"In too many places, 'self-esteem' has apparently taken precedence over candor in student assessment. For many of our arriving students, anything less than an A comes as a jolt and a rude surprise. The student evaluations of our faculty which are collected at the end of each term are thought by many to be heavily tilted toward professors who are less demanding or inclined to easier grading."

I can attest to his latter point. Want better end-of-course evals? Grade easier.

Daniels admits that his "bias on the topic is evident." Further, he states that, "I believe that, in a sea of leniency, a university that maintains tough standards of performance will set itself and its graduates apart in a highly positive way."

Perhaps, but there be a wind in the face of an institution that seeks to attract large numbers of students by advertising candor and rigor in its evaluation systems. Students have been conditioned to seek out 'easy' classes and professors in order to achieve the highest mark possible.

I should add that Daniels writes like a CEO who demonstrates solid understanding of his organization's external environment and internal strengths/opportunities. Purdue is fortunate to have him.

Labels:

competition,

education,

institution theory,

measurement

Saturday, January 20, 2018

Government Shutdowns

"Shut it down. Shut it down NOW!"

--Telco Supervisor (Die Hard)

With a 'government shutdown' seemingly pending, let's review some process and history. As discussed here, routine activities of most federal agencies are funded prior to the start of each fiscal year (October 1) by one or more regular appropriations acts. These are acts of Congress.

When a regular appropriations act is delayed, then a continuing resolution (CR) can be passed by Congress to provide interim budgetary funding.

The Antideficiency Act prohibits expenditure of federal funds in the absence of appropriations except for government activities involving "the safety of human life or the protection of property." Because this language can be broadly interpreted, a practical implication of this exception is that a large portion of government remains in operation regardless of whether a CR is in place or not.

When a regular appropriation or CR is not in place, then a 'funding gap' occurs. A funding gap may occur at the start of a fiscal year or anytime a CR expires without a replacement. When a funding gap occurs, federal agencies begin to shutdown non-excepted activities and furlough non-excepted personnel. Because it has been customary to retroactively pay furloughed personnel for time missed once the 'shutdown' has ended, these temporary layoffs amount to paid vacations.

Since 1977, there have been 18 funding gaps. The most recent of these occurred under the Obama administration in Fall of 2013 and lasted 16 days. The stated concern at the time was raising the debt ceiling, something that, ironically, Barack Obama had been on the record as previously opposing. Sadly, the John Boehner-led GOP ultimately caved.

The 2013 event constituted the first 'government shutdown' since December of 1995, when the last of the previous 17 funding gaps was closed.

As in 2013, both Democrats and Republicans are pointing fingers accusing each other as being responsible for 'shutting down the government'--as if shuttering government was bad.

I long for the day when we witness the opposite. When both parties trip over themselves to take credit for shrinking the size of government and transferring another increment of power from the State into the hands of the people.

--Telco Supervisor (Die Hard)

With a 'government shutdown' seemingly pending, let's review some process and history. As discussed here, routine activities of most federal agencies are funded prior to the start of each fiscal year (October 1) by one or more regular appropriations acts. These are acts of Congress.

When a regular appropriations act is delayed, then a continuing resolution (CR) can be passed by Congress to provide interim budgetary funding.

The Antideficiency Act prohibits expenditure of federal funds in the absence of appropriations except for government activities involving "the safety of human life or the protection of property." Because this language can be broadly interpreted, a practical implication of this exception is that a large portion of government remains in operation regardless of whether a CR is in place or not.

When a regular appropriation or CR is not in place, then a 'funding gap' occurs. A funding gap may occur at the start of a fiscal year or anytime a CR expires without a replacement. When a funding gap occurs, federal agencies begin to shutdown non-excepted activities and furlough non-excepted personnel. Because it has been customary to retroactively pay furloughed personnel for time missed once the 'shutdown' has ended, these temporary layoffs amount to paid vacations.

Since 1977, there have been 18 funding gaps. The most recent of these occurred under the Obama administration in Fall of 2013 and lasted 16 days. The stated concern at the time was raising the debt ceiling, something that, ironically, Barack Obama had been on the record as previously opposing. Sadly, the John Boehner-led GOP ultimately caved.

The 2013 event constituted the first 'government shutdown' since December of 1995, when the last of the previous 17 funding gaps was closed.

As in 2013, both Democrats and Republicans are pointing fingers accusing each other as being responsible for 'shutting down the government'--as if shuttering government was bad.

I long for the day when we witness the opposite. When both parties trip over themselves to take credit for shrinking the size of government and transferring another increment of power from the State into the hands of the people.

Labels:

government,

Obama,

property,

self defense,

socialism,

time horizon,

Trump

Friday, January 19, 2018

Failure to Yield

We thought just for an instant

That we could see the future

We thought for once we knew

What really was important

--Til Tuesday

A year ago bond maven Bill Gross argued that 2.6% represented the Maginot line of resistance for 10 yr Treasury yields. Over the past couple of days, 10 yr yields broke thru that level.

In fact, yields are marking multi-year highs across the Treasury spectrum.

To review, higher yields are bearish for stocks because a) fixed income alternatives appear increasingly more attractive to income-oriented investors and b) higher interest rates are deadly for leveraged economies (like ours).

When this begins to matter to stocks in a big way is anyone's guess. That higher yields will matter is not a guess, however.

That we could see the future

We thought for once we knew

What really was important

--Til Tuesday

A year ago bond maven Bill Gross argued that 2.6% represented the Maginot line of resistance for 10 yr Treasury yields. Over the past couple of days, 10 yr yields broke thru that level.

In fact, yields are marking multi-year highs across the Treasury spectrum.

To review, higher yields are bearish for stocks because a) fixed income alternatives appear increasingly more attractive to income-oriented investors and b) higher interest rates are deadly for leveraged economies (like ours).

When this begins to matter to stocks in a big way is anyone's guess. That higher yields will matter is not a guess, however.

Labels:

balance sheet,

bonds,

leverage,

risk,

sentiment,

technical analysis,

time horizon,

yields

Thursday, January 18, 2018

Tax Cuts and Prosperity

Arthur: What is his punishment for? Answer me!

Ganis: He defied our master, Marius. Most of the food we grow is sent out by sea to be sold. He asked that we keep a little more for ourselves, that's all.

--King Arthur

Current arguments against tax cuts, claiming that they do little to spur incomes or investment, are foolish. Taxes forcibly take production from people. Income is, by definition, an individual's rightful share of output generated by productive effort. When people keep more of their production, their incomes are higher. Simple math.

Investment comes only from production that has been set aside (a.k.a. 'saving'). When people keep more of their production due to tax cuts, then more resources are available for saving and, consequently, for investing. Again, simple math.

The plethora of announcements since the recent tax cut bill was signed into law--announcements of bonuses and raises for workers and of investments in plant, property, and equipment, merely demonstrate the obvious.

Stated differently, tax cuts advance prosperity. Only those who blindly worship the State would attempt to argue otherwise.

Ganis: He defied our master, Marius. Most of the food we grow is sent out by sea to be sold. He asked that we keep a little more for ourselves, that's all.

--King Arthur

Current arguments against tax cuts, claiming that they do little to spur incomes or investment, are foolish. Taxes forcibly take production from people. Income is, by definition, an individual's rightful share of output generated by productive effort. When people keep more of their production, their incomes are higher. Simple math.

Investment comes only from production that has been set aside (a.k.a. 'saving'). When people keep more of their production due to tax cuts, then more resources are available for saving and, consequently, for investing. Again, simple math.

The plethora of announcements since the recent tax cut bill was signed into law--announcements of bonuses and raises for workers and of investments in plant, property, and equipment, merely demonstrate the obvious.

Stated differently, tax cuts advance prosperity. Only those who blindly worship the State would attempt to argue otherwise.

Wednesday, January 17, 2018

Pulitzer's Reprise

"A free press, like a free life, sir, is always in danger."

--Ed Hucheson (Deadline U.S.A.)

Hard to imagine that today's mainstream media could be further from Joseph Pulitzer's 'able, disinterested' ideal and closer to his 'cynical, mercenary, demogogic' fault line.

What he didn't envision was the technological advancement of media platforms which instills competition and offers alternatives for information consumers.

Stated differently, the interested mainstream media is gradually losing control of the market.

--Ed Hucheson (Deadline U.S.A.)

Hard to imagine that today's mainstream media could be further from Joseph Pulitzer's 'able, disinterested' ideal and closer to his 'cynical, mercenary, demogogic' fault line.

What he didn't envision was the technological advancement of media platforms which instills competition and offers alternatives for information consumers.

Stated differently, the interested mainstream media is gradually losing control of the market.

Tuesday, January 16, 2018

Fear of Missing

"Ever wonder why fund managers can't beat the S&P 500? Because they're sheep. And sheep get slaughtered."

--Gordon Gekko (Wall Street)

Which is worse for a money manager?

a) 100% invested in stocks just like everyone else and subsequently losing 30% similar to the rest of the field.

b) 0% invested in stocks while everyone else is 100% invested in stocks and consequently missing a 30% upside move.

If a) occurs, then your fund (comprised primarily of your client's money) loses money--at least on paper. But everyone else is in a similar boat. Your performance is in line with the field. If your clients are angry, where else can they go? All funds are down.

If b) occurs, then your fund hasn't lost a dime. On a relative basis, however, you are lagging the field. You have not made money for your clients like other managers have. Angry clients now see alternatives to you. They start pulling funds and placing them elsewhere. Pretty soon, you're out of a job.

The career risk associated with b) makes this a far scarier scenario for most financial professionals. As noted here, even when there are investment strategies that have been tested to outperform over time by staying on the sidelines during big moves (both up and down), money managers shy away from them because they fear missing some of the upside.

It is this fear of missing that ultimately leads to dominant strategies that bring catastrophic losses to most fund managers.

--Gordon Gekko (Wall Street)

Which is worse for a money manager?

a) 100% invested in stocks just like everyone else and subsequently losing 30% similar to the rest of the field.

b) 0% invested in stocks while everyone else is 100% invested in stocks and consequently missing a 30% upside move.

If a) occurs, then your fund (comprised primarily of your client's money) loses money--at least on paper. But everyone else is in a similar boat. Your performance is in line with the field. If your clients are angry, where else can they go? All funds are down.

If b) occurs, then your fund hasn't lost a dime. On a relative basis, however, you are lagging the field. You have not made money for your clients like other managers have. Angry clients now see alternatives to you. They start pulling funds and placing them elsewhere. Pretty soon, you're out of a job.

The career risk associated with b) makes this a far scarier scenario for most financial professionals. As noted here, even when there are investment strategies that have been tested to outperform over time by staying on the sidelines during big moves (both up and down), money managers shy away from them because they fear missing some of the upside.

It is this fear of missing that ultimately leads to dominant strategies that bring catastrophic losses to most fund managers.

Monday, January 15, 2018

Greatest Economic Threat

Everybody wants you to be special

And everybody wants you to be high

They throw you down a rope

When you're in trouble, baby

Screamin', 'save me'

Then they charge you with the rescue blues

--Ryan Adams

Courtesy of MacroMaven Stephanie Pomboy, plot of consumer spending alongside expectations for higher stock prices. As Steph puts it, "stocks are now the single greatest threat to the economy...heaven forbid the market ever goes down!"

You can bet that policymakers understand the above relationship. If markets experience a down draft, then you can bet that policymakers will, in the words of the Maven, "cue the helicopters!"

And everybody wants you to be high

They throw you down a rope

When you're in trouble, baby

Screamin', 'save me'

Then they charge you with the rescue blues

--Ryan Adams

Courtesy of MacroMaven Stephanie Pomboy, plot of consumer spending alongside expectations for higher stock prices. As Steph puts it, "stocks are now the single greatest threat to the economy...heaven forbid the market ever goes down!"

You can bet that policymakers understand the above relationship. If markets experience a down draft, then you can bet that policymakers will, in the words of the Maven, "cue the helicopters!"

Labels:

Fed,

intervention,

measurement,

risk,

sentiment,

technical analysis

Sunday, January 14, 2018

Rock On

And where do we go from here?

Which is a way that's clear?

--Dave

When I was playing baseball, I constantly scanned all major league hitters for ideas that I might incorporate into my approach at the plate. In the later years of my game, two players in particular had out sized influence. One was Don Mattingly. I liked how he got ready at the plate.

The other was Rafael Palmeiro. Since first seeing him in the star studded College World Series of 1985, I liked his stance, how he cocked his hands as he lifted his foot, and that pretty swing and one-handed release. I borrowed profusely.

After putting up Hall of Fame numbers that included 569 HRs and over 3000 hits, Palmeiro's career sadly ended in a controversy over PEDs. His name quickly left the Hall of Fame ballot after garnering little support from the writer/voters.

About a week ago I was stunned to learn that Rafael Palmeiro has been training for a comeback. While not sure any team will take a flyer on a 53 year old, even one who looks to be in excellent shape, I am certain that his swing is still sweet.

Which is a way that's clear?

--Dave

When I was playing baseball, I constantly scanned all major league hitters for ideas that I might incorporate into my approach at the plate. In the later years of my game, two players in particular had out sized influence. One was Don Mattingly. I liked how he got ready at the plate.

The other was Rafael Palmeiro. Since first seeing him in the star studded College World Series of 1985, I liked his stance, how he cocked his hands as he lifted his foot, and that pretty swing and one-handed release. I borrowed profusely.

After putting up Hall of Fame numbers that included 569 HRs and over 3000 hits, Palmeiro's career sadly ended in a controversy over PEDs. His name quickly left the Hall of Fame ballot after garnering little support from the writer/voters.

About a week ago I was stunned to learn that Rafael Palmeiro has been training for a comeback. While not sure any team will take a flyer on a 53 year old, even one who looks to be in excellent shape, I am certain that his swing is still sweet.

Watching a guy not too far from my age still rockin' 'em like that makes me want to hit the cage...Bat speed coming along. Swing feels great. pic.twitter.com/D18vLJhDKC— Rafael Palmeiro (@Rafael_Palmeiro) January 11, 2018

Saturday, January 13, 2018

Historic Advsior Bullishness

I've been looking so long at these picture of you

That I almost believe that they're real

I've been living so long with my pictures of you

That I almost believe that the pictures are

All I can feel

--The Cure

Charts keep rolling in that picture the extreme nature of current markets. Below we have the Investors Intelligence report that estimates the sentiment of financial newsletter writers (a.k.a. financial 'advisors').

As indicated, those publishing financial advice have never been more bullish--at least since 1987. Yes, that's the same 1987 associated with the -20% Dow day.

no positions

That I almost believe that they're real

I've been living so long with my pictures of you

That I almost believe that the pictures are

All I can feel

--The Cure

Charts keep rolling in that picture the extreme nature of current markets. Below we have the Investors Intelligence report that estimates the sentiment of financial newsletter writers (a.k.a. financial 'advisors').

As indicated, those publishing financial advice have never been more bullish--at least since 1987. Yes, that's the same 1987 associated with the -20% Dow day.

no positions

Friday, January 12, 2018

On the CAPE

Winding roads that seem to beckon you

Miles of green beneath a sky of blue

--Patti Page

As observed here, there have been only three periods where the cyclically adjusted price to earnings (CAPE) ratio of the S&P 500 Index has been north of 30:

1) August to September, 1929

2) June 1997 to March 2002

3) Now

The previous two periods suggest a couple of things. One is that time above 30 can be short (one month in 1929) or long (five years from 1997 to 2002).

The other thing is that once the CAPE peaks, it falls a long way. After its 1929 peak, CAPE fell about 80%. After the 2000 peak, the ratio dropped by about half. Moreover, those declines tend to occur rather quickly.

As CAPE founder Robert Shiller has observed, earnings growth is often highest just before big market declines. The same holds true for valuations.

Miles of green beneath a sky of blue

--Patti Page

As observed here, there have been only three periods where the cyclically adjusted price to earnings (CAPE) ratio of the S&P 500 Index has been north of 30:

1) August to September, 1929

2) June 1997 to March 2002

3) Now

The previous two periods suggest a couple of things. One is that time above 30 can be short (one month in 1929) or long (five years from 1997 to 2002).

The other thing is that once the CAPE peaks, it falls a long way. After its 1929 peak, CAPE fell about 80%. After the 2000 peak, the ratio dropped by about half. Moreover, those declines tend to occur rather quickly.

As CAPE founder Robert Shiller has observed, earnings growth is often highest just before big market declines. The same holds true for valuations.

Thursday, January 11, 2018

Monetary Malpractice

Drawn into the stream

Of undefined illusion

Those diamond dreams

They can't disguise the truth

--Level 42

Nice comment here. Despite clearing recession nearly nine years ago, monetary policy remains at recessionary levels.

Of undefined illusion

Those diamond dreams

They can't disguise the truth

--Level 42

Nice comment here. Despite clearing recession nearly nine years ago, monetary policy remains at recessionary levels.

What's wrong with this picture?When the US expansion hits 9 years in June 2018 the market is expecting a Fed Funds rate of 1.50-1.75%. That is below the Fed Funds Rate at the time of the Lehman bankruptcy (2.00%) when the US economy was in the midst of its worst recession since the Great Depression.— Charlie Bilello (@charliebilello) January 5, 2018

Wednesday, January 10, 2018

Yield Competition Underway

When the feeling's right

I'm gonna run all night

I'm gonna run to you

--Bryan Adams

Last month we suggested that higher yields on fixed income will create a competition with stocks for investment capital. Some early evidence of this is showing up in REITS...

...and utilities.

The higher the yield in 'risk free' Treasuries and other fixed income assets, the less attractive stocks--even 'high yielding' ones--will appear to investors.

My sense this will become more apparent if we experience an air pocket in stocks as it will snap investors out of their hypnotic 'stocks only go up' state. When that occurs, investors will run en masse to bonds as they 'rediscover' the 'safety' of fixed income.

no positions

I'm gonna run all night

I'm gonna run to you

--Bryan Adams

Last month we suggested that higher yields on fixed income will create a competition with stocks for investment capital. Some early evidence of this is showing up in REITS...

...and utilities.

The higher the yield in 'risk free' Treasuries and other fixed income assets, the less attractive stocks--even 'high yielding' ones--will appear to investors.

My sense this will become more apparent if we experience an air pocket in stocks as it will snap investors out of their hypnotic 'stocks only go up' state. When that occurs, investors will run en masse to bonds as they 'rediscover' the 'safety' of fixed income.

no positions

Labels:

bonds,

markets,

real estate,

risk,

sentiment,

technical analysis,

yields

Tuesday, January 9, 2018

Debt-Laden and Poorer

Hundred dollar car loan

Two hundred rent

I get a check on Friday

But it's already spent

--Huey Lewis & the News

As observed here, although the stock market is at all time highs, Americans generally owe more, save less, and are poorer than a generation or so ago. A greater fraction of Americans have more debt than they have money in the bank than at any point since 1962.

About 30% of households have negative net worth despite the recovery in housing and stocks. Median net worth is below 1989 levels. If this was adjusted for inflation, then the results would be considerably worse.

Two hundred rent

I get a check on Friday

But it's already spent

--Huey Lewis & the News

As observed here, although the stock market is at all time highs, Americans generally owe more, save less, and are poorer than a generation or so ago. A greater fraction of Americans have more debt than they have money in the bank than at any point since 1962.

About 30% of households have negative net worth despite the recovery in housing and stocks. Median net worth is below 1989 levels. If this was adjusted for inflation, then the results would be considerably worse.

Labels:

balance sheet,

debt,

measurement,

saving,

socialism

Monday, January 8, 2018

Sunday, January 7, 2018

Ironic Idiocy

"Define irony. A bunch of idiots dancing on a plane to a song made famous by a band that died in a plane crash."

--Garland Greene (Con Air)

Nassim Taleb builds on our post yesterday with the below tweet.

Anti-Trumpers cope with their post-election cognitive dissonance with juvenile ad hominem strategies, i.e., "Trump's an idiot."

Those strategies are not completely satisfactory, of course, because the human mind will whisper to the accuser, "If he's an idiot who has achieved much success, then what does that make you?"

So the mind has to rationalize further. "It was dumb luck." Or better yet, "He rigged the game...it was FIXED!"

Enter Russians, et al.

The last thing cognitively dissonant individuals want to face is the realization that the lion's share of responsibility for a) not achieving as much as the designated antagonist, and b) severely underestimating the designated antagonist's capabilities...lies with them.

Quite ironically, such thought processes foster idiocy.

--Garland Greene (Con Air)

Nassim Taleb builds on our post yesterday with the below tweet.

1) When a collection of journos getting around minimum wage call someone consistently successful "an idiot", one is entitled to invoke Wittgenstein's ruler:— Nassim Nicholas Taleb (@nntaleb) January 6, 2018

you don't just use a ruler to measure the table, but the table to measure the ruler.

(in Fooled by Randomness) pic.twitter.com/vhEqJJsJZK

Those strategies are not completely satisfactory, of course, because the human mind will whisper to the accuser, "If he's an idiot who has achieved much success, then what does that make you?"

So the mind has to rationalize further. "It was dumb luck." Or better yet, "He rigged the game...it was FIXED!"

Enter Russians, et al.

The last thing cognitively dissonant individuals want to face is the realization that the lion's share of responsibility for a) not achieving as much as the designated antagonist, and b) severely underestimating the designated antagonist's capabilities...lies with them.

Quite ironically, such thought processes foster idiocy.

Labels:

manipulation,

media,

reason,

regulation,

Russia,

Trump

Saturday, January 6, 2018

Trump's Play

"I've been played by a grand piano by the master, Gekko the Great."

--Bud Fox (Wall Street)

The mainstream media and other Donald Trump detractors can't seem to shake their whopper of a case of post election cognitive dissonance. They keep trying to convince others that they are smart and Trump is dumb.

Trump says something and they react with condescension.

It never seems to cross their minds that they are being played.

--Bud Fox (Wall Street)

The mainstream media and other Donald Trump detractors can't seem to shake their whopper of a case of post election cognitive dissonance. They keep trying to convince others that they are smart and Trump is dumb.

Trump says something and they react with condescension.

It never seems to cross their minds that they are being played.

Friday, January 5, 2018

Uncharted Rydex Territory

Got my bag

Got my reservation

Spent each dime

I could afford

--Doris Day

Lots of people joining the president in jumping on the market bandwagon. Positive start to the trading year adds to the market's parabolic shape.

Human nature being what it is, these higher prices are attracting investors like moths to flame. One measure of how optimistic market participants are becoming comes from the Guggenheim (formerly 'Rydex') series of mutual funds that offer both bullish and bearish alternatives for active managers. Comparing Rydex bullish vs bearish assets offers an interesting take on prevailing sentiment.

As reported here, the ratio of Rydex bullish:bearish is in uncharted territory. After screaming higher over the past couple of months, the ratio is at an all time high as of Jan 2.

While correspondence is not perfect, extremes in the bull:bear trend in both directions have been useful harbingers of significant trend reversals over the past few years.

Investors are once again demonstrating that they want to jump on the train before it leaves the station--even if the sentimental journey ultimately derails.

no positions

Got my reservation

Spent each dime

I could afford

--Doris Day

Lots of people joining the president in jumping on the market bandwagon. Positive start to the trading year adds to the market's parabolic shape.

Human nature being what it is, these higher prices are attracting investors like moths to flame. One measure of how optimistic market participants are becoming comes from the Guggenheim (formerly 'Rydex') series of mutual funds that offer both bullish and bearish alternatives for active managers. Comparing Rydex bullish vs bearish assets offers an interesting take on prevailing sentiment.

As reported here, the ratio of Rydex bullish:bearish is in uncharted territory. After screaming higher over the past couple of months, the ratio is at an all time high as of Jan 2.

While correspondence is not perfect, extremes in the bull:bear trend in both directions have been useful harbingers of significant trend reversals over the past few years.

Investors are once again demonstrating that they want to jump on the train before it leaves the station--even if the sentimental journey ultimately derails.

no positions

Labels:

markets,

measurement,

risk,

sentiment,

technical analysis,

Trump

Thursday, January 4, 2018

Zero Debt Again

Maybe someday

Saved by zero

I'll be more together

--The Fixx

After paying off my home mortgage several years ago, I promised myself to remain debt free. Simply put, debt reduces freedom.

In January 2016 I broke that vow when I bought a vehicle on ridiculous 0.1% annual financing terms for a 24 month loan. The interest expense on a multiple five figure loan amounted to a couple hundred dollars.

Fast forward two years. Just made my final payment on the car loan. Although the cost was trivial, am grateful to carrying zero debt again.

Saved by zero

I'll be more together

--The Fixx

After paying off my home mortgage several years ago, I promised myself to remain debt free. Simply put, debt reduces freedom.

In January 2016 I broke that vow when I bought a vehicle on ridiculous 0.1% annual financing terms for a 24 month loan. The interest expense on a multiple five figure loan amounted to a couple hundred dollars.

Fast forward two years. Just made my final payment on the car loan. Although the cost was trivial, am grateful to carrying zero debt again.

Wednesday, January 3, 2018

Death Cult Collectivism

Ivan Danko: I do not understand this sport.

Art Ridzik: You're not supposed to. It's completely American.

Ivan Danko: We play baseball now in Soviet Union.

Art Ridzik: Are you kidding me? This is our national pastime! It'd be a helluva world series, though, wouldn't it?

Ivan Danko: We will win.

--Red Heat

Mises points out one of many problems with collectivist doctrine. Many groups, or collectives, exist. Commitment to one collective requires condemnation of other groups. Individuals are told to sacrifice their inner selves and fight for a particular collective ideal. One true state exists; others must be condemned.

As such, collectivist doctrines are "harbingers of irreconcilable hatred and war to the death."

Art Ridzik: You're not supposed to. It's completely American.

Ivan Danko: We play baseball now in Soviet Union.

Art Ridzik: Are you kidding me? This is our national pastime! It'd be a helluva world series, though, wouldn't it?

Ivan Danko: We will win.

--Red Heat

Mises points out one of many problems with collectivist doctrine. Many groups, or collectives, exist. Commitment to one collective requires condemnation of other groups. Individuals are told to sacrifice their inner selves and fight for a particular collective ideal. One true state exists; others must be condemned.

As such, collectivist doctrines are "harbingers of irreconcilable hatred and war to the death."

Tuesday, January 2, 2018

Secularizing Catholic Universities

"This university...it's not for everybody."

--Father Cavanaugh (Rudy)

Interesting review of the secularization of Catholic universities in America, including key events in the last few decades that have driven the trend.

One reaction is that, from a theoretical perspective, the secularization of Catholic campuses should not be surprising. To the extent that institutes of higher learning depend on public resources--whether those resources are tangible (e.g., money) or intangible (e.g., respect and legitimacy)--then we should expect institutions with religious foundations to shed those affiliations if need be in order to procure those resources.

Another reaction is that this phenomenon demonstrates how diametrically opposed statism is with the Catholic faith. Professors, administrators, and other stakeholders who want to promote statist ideas on a Catholic campus face little choice but to sever traditional Church ties and replace them with a secular or 'modern' alternative. The story of the Jesuits as told by the author is particularly instructive here.

While likely beyond the scope of the article, the author fails to note that this secularization process has been underway at Catholic grade schools and high schools as well.

Sadly, the entire system of Catholic education is shedding values that made it unique. The process of secularization nudges Catholic ed toward the mediocrity that it was founded to replace.

--Father Cavanaugh (Rudy)

Interesting review of the secularization of Catholic universities in America, including key events in the last few decades that have driven the trend.

One reaction is that, from a theoretical perspective, the secularization of Catholic campuses should not be surprising. To the extent that institutes of higher learning depend on public resources--whether those resources are tangible (e.g., money) or intangible (e.g., respect and legitimacy)--then we should expect institutions with religious foundations to shed those affiliations if need be in order to procure those resources.

Another reaction is that this phenomenon demonstrates how diametrically opposed statism is with the Catholic faith. Professors, administrators, and other stakeholders who want to promote statist ideas on a Catholic campus face little choice but to sever traditional Church ties and replace them with a secular or 'modern' alternative. The story of the Jesuits as told by the author is particularly instructive here.

While likely beyond the scope of the article, the author fails to note that this secularization process has been underway at Catholic grade schools and high schools as well.

Sadly, the entire system of Catholic education is shedding values that made it unique. The process of secularization nudges Catholic ed toward the mediocrity that it was founded to replace.

Monday, January 1, 2018

Yellow Dog

It's the night

My body's weak

I'm on the run

No time for sleep

--Christopher Cross

According to the Chinese zodiac, 2018 is the year of the dog. If gold were a canine, I wonder what kind of dog it will be this year. Will it be a mangy mutt that lays down on the floor? Or will it be a sleek greyhound that runs like the wind?

Longer term technicals suggests gold may be readying for a race. The multi-year downtrend line has been broken. Over the past few months, gold has been consolidating in a flag pattern. Gold's direction out of that taper should be telling.

Is gold about to leave the dog pound?

position in gold

My body's weak

I'm on the run

No time for sleep

--Christopher Cross

According to the Chinese zodiac, 2018 is the year of the dog. If gold were a canine, I wonder what kind of dog it will be this year. Will it be a mangy mutt that lays down on the floor? Or will it be a sleek greyhound that runs like the wind?

Longer term technicals suggests gold may be readying for a race. The multi-year downtrend line has been broken. Over the past few months, gold has been consolidating in a flag pattern. Gold's direction out of that taper should be telling.

Is gold about to leave the dog pound?

position in gold

Subscribe to:

Posts (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)