Casey Ryback: I support women's lib. Don't you?

Jordan Tate: When it works in my favor.

--Under Siege

Interesting twist on research into gender pay differences. The researchers limited their study to unionized bus and train operators. By narrowing the sample to union workers, the study reduced the chance that pay decisions could be influenced by manager bias. Consequently, the researchers could focus on the behavior of workers themselves rather than on the role of supervisory decisions.

A pay gap was in fact found. But the gap could be explained entirely by different choices made by men and women workers. Women used the Family Medical Leave Act (FMLA) to take more unpaid time off than did men. Women worked fewer overtime hours as well. Even after controlling for dependents, the researchers found that women valued time away from work more than men did.

The study's findings also highlight the reality that even when men and women have the same job titles and job descriptions, the work that they do should not be assumed to be homogeneous. In this case, people who work irregular hours simply are not doing the same work as people who work extremely regular hours. Similarly, workers who choose to take time off every few years (for, say, maternity or childcare needs) are not doing the same work as those who rarely take time off.

This study confirms, yet again, that claims of women being paid less due to gender bias is an empirically untrue statement.

Thursday, February 28, 2019

Wednesday, February 27, 2019

Moral Hazard and the Fed

Jacob Moore: You know what moral hazard is, Ma? You know what that means?

Sylvia Moore: No.

Jacob Moore: It means that once you get bailed out, what's to stop you from taking another shot.

--Wall Street: Money Never Sleeps

Jim Cramer touches on the key reason behind the stock market's huge move off the late December lows. Market participants know that they have the Fed watching their backs.

This creates a classic moral hazard--one that will end in tears at some point.

But right now the Fed is telling investors to buy 'em, and they're doing just that.

Sylvia Moore: No.

Jacob Moore: It means that once you get bailed out, what's to stop you from taking another shot.

--Wall Street: Money Never Sleeps

Jim Cramer touches on the key reason behind the stock market's huge move off the late December lows. Market participants know that they have the Fed watching their backs.

This creates a classic moral hazard--one that will end in tears at some point.

But right now the Fed is telling investors to buy 'em, and they're doing just that.

Tuesday, February 26, 2019

Going Higher?

She's so high

Like Cleopatra, Joan of Arc

Or Aphrodite

--Tal Bachman

Despite the twisty stochastics and resistance directly overhead, the major indexes trade great. Dips have been shallow and quickly bought. A money trade has been buying in the morning for the daily rise.

A pullback here after the run off the Xmas Eve lows (we're nearly 20% higher since then) seems intuitive. It may also be a healthy thing for the bulls. But they sure trade like they want to go higher.

btw, all time high for the SPX resides just a couple percent higher at about 2925.

Like Cleopatra, Joan of Arc

Or Aphrodite

--Tal Bachman

Despite the twisty stochastics and resistance directly overhead, the major indexes trade great. Dips have been shallow and quickly bought. A money trade has been buying in the morning for the daily rise.

A pullback here after the run off the Xmas Eve lows (we're nearly 20% higher since then) seems intuitive. It may also be a healthy thing for the bulls. But they sure trade like they want to go higher.

btw, all time high for the SPX resides just a couple percent higher at about 2925.

Monday, February 25, 2019

Asset Allocation

Another night in any town

You can hear the thunder of their cry

Ahead of their time

They wonder why

--Journey

Previously we discussed the primary asset classes available to investors: cash, fixed income, equities, and alternative assets. How investors blend them together in their portfolios is known as asset allocation (AA). Studies suggest that AA matters more to investment returns over time than does the choice of particular securities inside each asset class.

Asset allocation is a personal thing, meaning that there is no one particular allocation pattern right for everyone. An individual's AA can depend on many factors including age, personal tolerance for risk, one's general view of the world, and estimation of value offered by risky asset classes.

Let's see how these factors associate with three model AA patterns that employ various combinations of the four primary asset classes. (Note, however, that this is for demonstration purposes only. Portfolios do not have to be invested in all four asset classes.)

1) "High cash" portfolio: 60% cash, 20% fixed income, 10% equities, 10% alternative assets.

High cash portfolios are attractive for older people who need more certainty from their investments during retirement. People with lower risk tolerance will also prefer more cash. This particular AA is also 'defensive' in nature. If you have a pessimistic 'macro' outlook, or if you believe that risky asset classes such as stocks are overvalued, then cash-rich portfolios are also a good fit. Note that alternative assets such as gold help offset the risk of holding lots of cash--if the purchasing power of cash declines because of inflation, then gold and other hard assets usually increase in price to compensate. Also note that equities in high cash portfolios often consist of large stalwart company stocks that pay steady dividends.

2) "Balanced" portfolio: 25% cash, 35% fixed income, 35% equities, 5% alternative assets.

Balanced portfolios are spread more evenly among the three 'traditional' asset classes of cash, fixed income, and equities with perhaps a sliver of alternative assets for insurance. Middle aged individuals and those with a medium risk tolerance match well with balanced AAs. People who have no strong views either way when it comes to state of the world or valuation of risky assets also tend to be good fits with the balanced approach. Balanced portfolios can be a good in-between step for people who want to move toward more extreme 'risk on' or 'risk off' positions in the AA spectrum. By seeking balance first, those individuals can sense whether they are moving in the right direction.

3) "Growth" portfolio. 10% cash, 10% fixed income, 75% equities, 5% alternative assets.

Growth portfolios are characterized by high allocations toward equities. As a general rule, equities carry the most potential for reward--but they also carry the most potential for loss (read: risk). The high risk:reward profile of growth portfolios is a good match for young people since their age allows them to time to a) participate significantly in bull market runs and b) recoup losses that happen periodically in bear market declines. Growth AAs also attract individuals with high risk tolerance. If you have an optimistic macro view of the world, and/or you think that stocks and other risky assets are undervalued, then growth-oriented asset allocations match well with your outlook. Growth portfolios sometimes ditch the insurance of alternative assets to gain a bit more 'juice' from their capital (for better or worse).

Again, the above AAs merely demonstrate some possibilities. How you tailor your particular portfolio, and how you adjust it over time, is unique to you.

You can hear the thunder of their cry

Ahead of their time

They wonder why

--Journey

Previously we discussed the primary asset classes available to investors: cash, fixed income, equities, and alternative assets. How investors blend them together in their portfolios is known as asset allocation (AA). Studies suggest that AA matters more to investment returns over time than does the choice of particular securities inside each asset class.

Asset allocation is a personal thing, meaning that there is no one particular allocation pattern right for everyone. An individual's AA can depend on many factors including age, personal tolerance for risk, one's general view of the world, and estimation of value offered by risky asset classes.

Let's see how these factors associate with three model AA patterns that employ various combinations of the four primary asset classes. (Note, however, that this is for demonstration purposes only. Portfolios do not have to be invested in all four asset classes.)

1) "High cash" portfolio: 60% cash, 20% fixed income, 10% equities, 10% alternative assets.

High cash portfolios are attractive for older people who need more certainty from their investments during retirement. People with lower risk tolerance will also prefer more cash. This particular AA is also 'defensive' in nature. If you have a pessimistic 'macro' outlook, or if you believe that risky asset classes such as stocks are overvalued, then cash-rich portfolios are also a good fit. Note that alternative assets such as gold help offset the risk of holding lots of cash--if the purchasing power of cash declines because of inflation, then gold and other hard assets usually increase in price to compensate. Also note that equities in high cash portfolios often consist of large stalwart company stocks that pay steady dividends.

2) "Balanced" portfolio: 25% cash, 35% fixed income, 35% equities, 5% alternative assets.

Balanced portfolios are spread more evenly among the three 'traditional' asset classes of cash, fixed income, and equities with perhaps a sliver of alternative assets for insurance. Middle aged individuals and those with a medium risk tolerance match well with balanced AAs. People who have no strong views either way when it comes to state of the world or valuation of risky assets also tend to be good fits with the balanced approach. Balanced portfolios can be a good in-between step for people who want to move toward more extreme 'risk on' or 'risk off' positions in the AA spectrum. By seeking balance first, those individuals can sense whether they are moving in the right direction.

3) "Growth" portfolio. 10% cash, 10% fixed income, 75% equities, 5% alternative assets.

Growth portfolios are characterized by high allocations toward equities. As a general rule, equities carry the most potential for reward--but they also carry the most potential for loss (read: risk). The high risk:reward profile of growth portfolios is a good match for young people since their age allows them to time to a) participate significantly in bull market runs and b) recoup losses that happen periodically in bear market declines. Growth AAs also attract individuals with high risk tolerance. If you have an optimistic macro view of the world, and/or you think that stocks and other risky assets are undervalued, then growth-oriented asset allocations match well with your outlook. Growth portfolios sometimes ditch the insurance of alternative assets to gain a bit more 'juice' from their capital (for better or worse).

Again, the above AAs merely demonstrate some possibilities. How you tailor your particular portfolio, and how you adjust it over time, is unique to you.

Labels:

asset allocation,

bonds,

cash,

fund management,

retirement,

risk,

time horizon,

valuation,

yields

Sunday, February 24, 2019

Looking Backward

"The thing is I can't afford to pay the heat and I had to send my kids to live with relatives. They keep cutting shifts down at the dock. You just don't get picked every day. I sold everything I got to anybody who would buy. I went on public assistance at the relief office. They gave me thirteen dollars. I need another eighteen dollars and thirty eight cents so I can pay the heating bill and get the kids back."

--Jim Braddock (Cinderella Man)

Prof DiLorenzo discusses the absurdity of the recently proposed 'Green New Deal' in the context of both an 19th century novel about a socialist utopia and the original New Deal. In 1888 Edward Bellamy wrote Looking Backward, a novel about a character who falls asleep for 113 years and wakes up in the year 2000 to find America turned into a socialist utopia.

Similar to proposals littering the Green New Deal, the utopia guaranteed jobs for everyone, free education, and equal pay for all. All of these programs were funded by the single U.S. employer, the federal government. Everyone retired at the age of 45 with comfortable pensions.

The message, of course, was that the evils of society could be eradicated by the mandates, controls, and regulation of totalitarian government--like the Green New Deal.

Propelled by Marx and Engels work, socialism was in its heyday in the late 1800s. As such, Looking Backward found a receptive audience. Numerous Edward Bellamy societies sprung to life. Socialist communes designed with the book's utopian blueprint were also established. All of them failed, which would serve as forewarning for the string of country-level socialist experiments that would implode in the years ahead.

The Green New Deal is named after the original New Deal, a constellation of government programs promoted by FDR to combat the Great Depression during the 1930s. Leftists still attempt to hawk the story line that the New Deal pulled America out of the Depression. Several popular books, including the work of Shlaes (2007) help put this conjecture to rest. DiLorenzo prefers to cite the academic work of Cole and Ohanian (2002, 2004) who published articles in top economic journals concluding that New Deal programs did not cure the Depression. Instead, these programs extended the economic malaise and made things worse.

The policies of the Green New Deal pack far more destructive power than its original predecessor in a quest to achieve Bellamy's socialist utopia. As all socialist designs do, it presumes that a small group of planners in a room can plan a complex economy better than the millions of individual actors that produce and trade each day. The New Green Deal once again demonstrates socialism's fatal conceit.

References

Cole, H.L. & Ohanian, L.E. (2002). The U.S. and U.K. Great Depressions though the lens of Neoclassical Growth Theory. American Economic Review, 92(2): 28-32.

Cole, H.L. & Ohanian, L.E. (2004). New Deal policies and the persistence of the Great Depression: A general equilibrium analysis. Journal of Political Economy, 112(4): 779-816.

Shlaes, A. (2007). The forgotten man: A new history of the Great Depression. New York: HarperCollins.

--Jim Braddock (Cinderella Man)

Prof DiLorenzo discusses the absurdity of the recently proposed 'Green New Deal' in the context of both an 19th century novel about a socialist utopia and the original New Deal. In 1888 Edward Bellamy wrote Looking Backward, a novel about a character who falls asleep for 113 years and wakes up in the year 2000 to find America turned into a socialist utopia.

Similar to proposals littering the Green New Deal, the utopia guaranteed jobs for everyone, free education, and equal pay for all. All of these programs were funded by the single U.S. employer, the federal government. Everyone retired at the age of 45 with comfortable pensions.

The message, of course, was that the evils of society could be eradicated by the mandates, controls, and regulation of totalitarian government--like the Green New Deal.

Propelled by Marx and Engels work, socialism was in its heyday in the late 1800s. As such, Looking Backward found a receptive audience. Numerous Edward Bellamy societies sprung to life. Socialist communes designed with the book's utopian blueprint were also established. All of them failed, which would serve as forewarning for the string of country-level socialist experiments that would implode in the years ahead.

The Green New Deal is named after the original New Deal, a constellation of government programs promoted by FDR to combat the Great Depression during the 1930s. Leftists still attempt to hawk the story line that the New Deal pulled America out of the Depression. Several popular books, including the work of Shlaes (2007) help put this conjecture to rest. DiLorenzo prefers to cite the academic work of Cole and Ohanian (2002, 2004) who published articles in top economic journals concluding that New Deal programs did not cure the Depression. Instead, these programs extended the economic malaise and made things worse.

The policies of the Green New Deal pack far more destructive power than its original predecessor in a quest to achieve Bellamy's socialist utopia. As all socialist designs do, it presumes that a small group of planners in a room can plan a complex economy better than the millions of individual actors that produce and trade each day. The New Green Deal once again demonstrates socialism's fatal conceit.

References

Cole, H.L. & Ohanian, L.E. (2002). The U.S. and U.K. Great Depressions though the lens of Neoclassical Growth Theory. American Economic Review, 92(2): 28-32.

Cole, H.L. & Ohanian, L.E. (2004). New Deal policies and the persistence of the Great Depression: A general equilibrium analysis. Journal of Political Economy, 112(4): 779-816.

Shlaes, A. (2007). The forgotten man: A new history of the Great Depression. New York: HarperCollins.

Labels:

bureaucracy,

Depression,

government,

intervention,

markets,

productivity,

regulation,

socialism,

theory

Saturday, February 23, 2019

Income, Saving, and Investing

We

Are young but getting old before our time

--Joe Jackson

Income is the stream of economic resources generated from production. A primary source of income is a job. Pay from a job is called a wage. Wage-related income constitutes fruits of your labor. After the government takes some via taxes, the remainder is yours to consume.

But you don't have to consume it all. Although consumption raises your standard of living today, it leaves little for tomorrow. Setting some of your income aside (i.e., saving) enables you to keep some resources squirreled away for a rainy day.

Some of those savings could be invested. Investing commits resources today toward projects with potential to generate additional resources in the future. Saving used for investment purposes is sometimes called capital. Capital investment is the way that prosperity improves over time, because capital is transformed into machines and other tools (both tangible and intangible) that improve productivity and create more wealth. It is that increase in wealth that elevates standard of living.

If you choose to consume all of your income then you will live better in the here and now. However, you may be jeopardizing your future standard of living if you have not saved or invested. Because the future is uncertain, your future income may be lower than expected and your future expenses may be higher than expected. In such cases, savings would have come in handy. Moreover, without savings there can be no investment capital to fund productivity improvements that raise standard of living not just for you--but for the world.

The sooner you begin saving and investing a portion of your income, the better.

Are young but getting old before our time

--Joe Jackson

Income is the stream of economic resources generated from production. A primary source of income is a job. Pay from a job is called a wage. Wage-related income constitutes fruits of your labor. After the government takes some via taxes, the remainder is yours to consume.

But you don't have to consume it all. Although consumption raises your standard of living today, it leaves little for tomorrow. Setting some of your income aside (i.e., saving) enables you to keep some resources squirreled away for a rainy day.

Some of those savings could be invested. Investing commits resources today toward projects with potential to generate additional resources in the future. Saving used for investment purposes is sometimes called capital. Capital investment is the way that prosperity improves over time, because capital is transformed into machines and other tools (both tangible and intangible) that improve productivity and create more wealth. It is that increase in wealth that elevates standard of living.

If you choose to consume all of your income then you will live better in the here and now. However, you may be jeopardizing your future standard of living if you have not saved or invested. Because the future is uncertain, your future income may be lower than expected and your future expenses may be higher than expected. In such cases, savings would have come in handy. Moreover, without savings there can be no investment capital to fund productivity improvements that raise standard of living not just for you--but for the world.

The sooner you begin saving and investing a portion of your income, the better.

Labels:

capital,

debt,

government,

productivity,

risk,

saving,

taxes,

time horizon

Friday, February 22, 2019

Blowups

"I hate losses, sport. Nothing ruins my day more than losses."

--Gordon Gekko

Sooner or later stock investors must cope with blowups. A blowup is when a stock suddenly tanks following the release of unexpectedly negative news about the underlying company. A common venue for blowups is the quarterly earnings cycle where financial reports are released and often complemented by conference calls between company executives and the analyst community.

After the bell yesterday, Kraft Heinz Co (KHC) blew up following the release of its earnings and a slew of negative news. Rather than finesse several bad news items over a period of time, it appeared KHC management decided to push it all out the door at once. In addition to a considerable earnings miss, unsuspecting investors and analysts were greeted with news of an SEC investigation into accounting practices, a $15 billion write-down of brand assets, and a substantial dividend cut.

Needless to say, the news hit the stock pretty hard. From a Thursday close of about $48, the stock immediately gapped 10% lower in after-hours trading before closing the evening at about $38. After gapping down $2 more in pre-market trading it opened this morning at $36 and has never been up for air since then. Currently it's trading around $35/share, down a cool 27% from yesterday on gigantic volume.

What's an investor in KHC to do? If you know the company's situation well and you can see a bright future on the other side of this episode then you'll probably hold on, or perhaps buy more. However, the fact that the avalanche of negative news released by management blind-sided many people--including analysts who supposedly follow the company closely--suggests that many stockholders may not sufficiently understand their investment positions. This is a recipe for trouble.

To be sure, it can be painful to realize a sudden and unforeseen investment loss. But when stock blowups are grounded in complex and difficult-to-handicap situations like this one, it is sometimes better to cut and run.

no positions

--Gordon Gekko

Sooner or later stock investors must cope with blowups. A blowup is when a stock suddenly tanks following the release of unexpectedly negative news about the underlying company. A common venue for blowups is the quarterly earnings cycle where financial reports are released and often complemented by conference calls between company executives and the analyst community.

After the bell yesterday, Kraft Heinz Co (KHC) blew up following the release of its earnings and a slew of negative news. Rather than finesse several bad news items over a period of time, it appeared KHC management decided to push it all out the door at once. In addition to a considerable earnings miss, unsuspecting investors and analysts were greeted with news of an SEC investigation into accounting practices, a $15 billion write-down of brand assets, and a substantial dividend cut.

Needless to say, the news hit the stock pretty hard. From a Thursday close of about $48, the stock immediately gapped 10% lower in after-hours trading before closing the evening at about $38. After gapping down $2 more in pre-market trading it opened this morning at $36 and has never been up for air since then. Currently it's trading around $35/share, down a cool 27% from yesterday on gigantic volume.

What's an investor in KHC to do? If you know the company's situation well and you can see a bright future on the other side of this episode then you'll probably hold on, or perhaps buy more. However, the fact that the avalanche of negative news released by management blind-sided many people--including analysts who supposedly follow the company closely--suggests that many stockholders may not sufficiently understand their investment positions. This is a recipe for trouble.

To be sure, it can be painful to realize a sudden and unforeseen investment loss. But when stock blowups are grounded in complex and difficult-to-handicap situations like this one, it is sometimes better to cut and run.

no positions

Labels:

risk,

sentiment,

technical analysis,

valuation,

yields

Thursday, February 21, 2019

Defibrillating Markets

Working too hard

Can give you a

Heart attack ack ack ack ack

--Billy Joel

Note contrast in volatility in uptrends vs downtrends. Intra-day range narrows as prices go higher, lending an air of solitude to bullish trends.

When the trend reverses, however, intra-day price movement expands to multiples of the uptrend range. Check out the size of the red candles vs the white candles.

As markets pulled out of their late December lows, observe the gradual decline in volatility as the uptrend gained traction.

Reminds me of a defibrillating heart on the verge of a heart attack that pulls back from the brink and returns to normal beating patterns.

Can give you a

Heart attack ack ack ack ack

--Billy Joel

Note contrast in volatility in uptrends vs downtrends. Intra-day range narrows as prices go higher, lending an air of solitude to bullish trends.

When the trend reverses, however, intra-day price movement expands to multiples of the uptrend range. Check out the size of the red candles vs the white candles.

As markets pulled out of their late December lows, observe the gradual decline in volatility as the uptrend gained traction.

Reminds me of a defibrillating heart on the verge of a heart attack that pulls back from the brink and returns to normal beating patterns.

Wednesday, February 20, 2019

Gold Strength

Hey now, hey now

Don't dream it's over

Hey now, hey now

When the world comes in

--Crowded House

Gold marking 10 month highs this am. Gold is a bet on disorder, whether that disorder be monetary, social, etc.

Probably not coincidentally, minutes from the last FOMC meeting are due out this afternoon. Many anticipate that the Fed will reiterate its 'pause and patience' stance on monetary policy. An easy monetary stance by the Fed can be construed as being a step toward monetary disorder--given the large amounts cash created by aggressive central bank policies that would remain in the system.

With run-ups in many risk markets approaching 20% since chatter began nearly two months ago that the Fed would become more dovish, it is easy to see the release of the FOMC minutes as a 'sell-the-news' event. But I would definitely not bet on it, given recent market strength.

Will continue watching gold for clues...

position in gold

Don't dream it's over

Hey now, hey now

When the world comes in

--Crowded House

Gold marking 10 month highs this am. Gold is a bet on disorder, whether that disorder be monetary, social, etc.

Probably not coincidentally, minutes from the last FOMC meeting are due out this afternoon. Many anticipate that the Fed will reiterate its 'pause and patience' stance on monetary policy. An easy monetary stance by the Fed can be construed as being a step toward monetary disorder--given the large amounts cash created by aggressive central bank policies that would remain in the system.

With run-ups in many risk markets approaching 20% since chatter began nearly two months ago that the Fed would become more dovish, it is easy to see the release of the FOMC minutes as a 'sell-the-news' event. But I would definitely not bet on it, given recent market strength.

Will continue watching gold for clues...

position in gold

Tuesday, February 19, 2019

Losses Recouped

'Cause I'm back on the track

And I'm beating the flack

Nobody's gonna get me on another rap

--AC/DC

Major market indexes are up 18-20% from the Christmas Eve lows. They are recouped virtually all losses incurred during the December swoon.

As noted here, a major factor in the turnaround has been the Fed's signal that it will be more 'patient' w.r.t. future monetary policy moves. Market participants are interpreting this to mean that future rate increases are on hold for the foreseeable future.

There is also chatter that the Fed will prematurely end its 'quantitative tightening' program and operate with far more of those monetized bonds on its balance sheet than originally forecast. Stated differently, nearly $4 trillion of money created out of thin air by the Fed to purchase those bonds will remain in the system for market participants to enjoy.

The technical picture suggests that the current rally is getting pretty stretched. However, as past history has shown, eras of easy money and credit often facilitate overbought markets getting even more overbought.

And I'm beating the flack

Nobody's gonna get me on another rap

--AC/DC

Major market indexes are up 18-20% from the Christmas Eve lows. They are recouped virtually all losses incurred during the December swoon.

As noted here, a major factor in the turnaround has been the Fed's signal that it will be more 'patient' w.r.t. future monetary policy moves. Market participants are interpreting this to mean that future rate increases are on hold for the foreseeable future.

There is also chatter that the Fed will prematurely end its 'quantitative tightening' program and operate with far more of those monetized bonds on its balance sheet than originally forecast. Stated differently, nearly $4 trillion of money created out of thin air by the Fed to purchase those bonds will remain in the system for market participants to enjoy.

The technical picture suggests that the current rally is getting pretty stretched. However, as past history has shown, eras of easy money and credit often facilitate overbought markets getting even more overbought.

Labels:

balance sheet,

bonds,

Fed,

inflation,

intervention,

money,

moral hazard,

risk,

sentiment,

technical analysis

Monday, February 18, 2019

Primary Asset Classes

"The most valuable commodity I know of is information. Wouldn't you agree?"

--Gordon Gekko (Wall Street)

Investors generally choose from four primary asset classes:

1) Cash. Cash is the fundamental asset class upon which other asset classes are based. It is denominated in units of currency (e.g., dollars). Cash is liquid, meaning that it is easily exchanged at its nominal value (e.g, 'one dollar'). It carries low short-term risk, meaning that its value is unlikely to decrease over the next few days or weeks. Over longer periods of time, however, the value of cash can decline in inflationary environments when the creation of additional money (typically by government) causes the purchasing power of cash to go down.

That said, the primary objective of cash is capital preservation. In uncertain times, or as a parking place for investment capital until better opportunities arise, cash can be an attractive asset class.

2) Fixed income. Fixed income includes a variety of investment vehicles ranging from bonds (both government and corporates) to certificates of deposit (CDs). Fixed income securities usually pay predetermined streams of income to their owners over the life of the investment. The timing of these payments is nearly always pre-set as well (e.g., monthly, semi-annually, annually, at maturity). This predictability is an attractive feature of fixed income instruments. A primary risk for owners of fixed income is 'credit risk,' meaning that it is possible that the borrower who sold the debt may default on some or all payments. To compensate, investors demand higher interest rates from debtors deemed to be riskier.

The primary objective of fixed income is predictable income or cash flow.

3). Equities. Equities, also known as stocks, are investments in for-profit companies. Partial ownership of a company is obtained by purchasing its shares either directly or via funds (mutual funds or exchange traded funds (ETFs)) that hold its shares. Equity shares can commonly be purchased on a stock exchange such as the New York Stock Exchange (NYSE) or the National Association of Securities Dealers Automated Quotations (commonly called the 'NASDAQ').

Stocks entitle the owner to participate in future wealth-building activities of the company that can result in share price appreciation (a.k.a. 'capital gains') or dividend payouts. Of course, owners also face risk that the company may not perform well in the future, thereby causing share prices to drop or dividend payouts to decline/terminate. The risks associated with stock ownership generally exceed those associated with either cash or fixed income. However, the rewards are generally greater as well. (Remember that risk and reward are related: the higher the risk, the higher the prospective reward, and vice versa. If that was not the general rule, then markets would have trouble functioning)

The primary objectives of equity ownership are capital appreciation and dividend income.

4) Alternative assets. The three asset classes discussed above--cash, fixed income, and equities-- are considered 'conventional' asset classes and comprise the bulk of investment portfolios. However, over the past few decades, financial market innovations have enabled investors to gain exposure to another group of assets called alternative assets. Alternative assets, sometimes termed 'hard assets' because they typically involve tangible goods, include commodities (such as oil, farm products, and gold), real estate, and even collectibles such as art. In the old days investors wishing to own alternative assets had to buy the tangible property and hold it in physical form. Today, many alternative assets have been 'securitized,' meaning that investors can readily buy exposure to them through ETFs and related vehicles. Many of these securities carry idiosyncratic risks, however, and investors must understand these risks before getting involved with this group.

Alternative assets can be attractive from two standpoints. Owning hard assets such as real estate or gold can be an effective way to hedge against inflation and other forms of financial or social disorder. If the value of the dollar goes down, for example, then the price of land or gold typically goes up. Another feature of alternative assets is that their value often moves up and down in a manner that is weakly or even negatively correlated to stocks and bonds--making this asset class an attractive way to diversify an investment portfolio.

The primary objectives of alternative assets, then, are inflation/disorder protection and diversification.

One of the major decisions facing investors involves 'asset allocation,' or how to divide their capital among the four above asset classes. We'll discuss in a future post.

position in gold

--Gordon Gekko (Wall Street)

Investors generally choose from four primary asset classes:

1) Cash. Cash is the fundamental asset class upon which other asset classes are based. It is denominated in units of currency (e.g., dollars). Cash is liquid, meaning that it is easily exchanged at its nominal value (e.g, 'one dollar'). It carries low short-term risk, meaning that its value is unlikely to decrease over the next few days or weeks. Over longer periods of time, however, the value of cash can decline in inflationary environments when the creation of additional money (typically by government) causes the purchasing power of cash to go down.

That said, the primary objective of cash is capital preservation. In uncertain times, or as a parking place for investment capital until better opportunities arise, cash can be an attractive asset class.

2) Fixed income. Fixed income includes a variety of investment vehicles ranging from bonds (both government and corporates) to certificates of deposit (CDs). Fixed income securities usually pay predetermined streams of income to their owners over the life of the investment. The timing of these payments is nearly always pre-set as well (e.g., monthly, semi-annually, annually, at maturity). This predictability is an attractive feature of fixed income instruments. A primary risk for owners of fixed income is 'credit risk,' meaning that it is possible that the borrower who sold the debt may default on some or all payments. To compensate, investors demand higher interest rates from debtors deemed to be riskier.

The primary objective of fixed income is predictable income or cash flow.

3). Equities. Equities, also known as stocks, are investments in for-profit companies. Partial ownership of a company is obtained by purchasing its shares either directly or via funds (mutual funds or exchange traded funds (ETFs)) that hold its shares. Equity shares can commonly be purchased on a stock exchange such as the New York Stock Exchange (NYSE) or the National Association of Securities Dealers Automated Quotations (commonly called the 'NASDAQ').

Stocks entitle the owner to participate in future wealth-building activities of the company that can result in share price appreciation (a.k.a. 'capital gains') or dividend payouts. Of course, owners also face risk that the company may not perform well in the future, thereby causing share prices to drop or dividend payouts to decline/terminate. The risks associated with stock ownership generally exceed those associated with either cash or fixed income. However, the rewards are generally greater as well. (Remember that risk and reward are related: the higher the risk, the higher the prospective reward, and vice versa. If that was not the general rule, then markets would have trouble functioning)

The primary objectives of equity ownership are capital appreciation and dividend income.

4) Alternative assets. The three asset classes discussed above--cash, fixed income, and equities-- are considered 'conventional' asset classes and comprise the bulk of investment portfolios. However, over the past few decades, financial market innovations have enabled investors to gain exposure to another group of assets called alternative assets. Alternative assets, sometimes termed 'hard assets' because they typically involve tangible goods, include commodities (such as oil, farm products, and gold), real estate, and even collectibles such as art. In the old days investors wishing to own alternative assets had to buy the tangible property and hold it in physical form. Today, many alternative assets have been 'securitized,' meaning that investors can readily buy exposure to them through ETFs and related vehicles. Many of these securities carry idiosyncratic risks, however, and investors must understand these risks before getting involved with this group.

Alternative assets can be attractive from two standpoints. Owning hard assets such as real estate or gold can be an effective way to hedge against inflation and other forms of financial or social disorder. If the value of the dollar goes down, for example, then the price of land or gold typically goes up. Another feature of alternative assets is that their value often moves up and down in a manner that is weakly or even negatively correlated to stocks and bonds--making this asset class an attractive way to diversify an investment portfolio.

The primary objectives of alternative assets, then, are inflation/disorder protection and diversification.

One of the major decisions facing investors involves 'asset allocation,' or how to divide their capital among the four above asset classes. We'll discuss in a future post.

position in gold

Labels:

asset allocation,

bonds,

cash,

commodities,

debt,

energy,

fund management,

gold,

government,

inflation,

money,

oil,

property,

real estate,

risk,

yields

Sunday, February 17, 2019

Vet-Free Journalism

With a boulder on my shoulder

Feelin' kind of older

I tripped the merry-go-round

With this very unpleasin'

Sneezin' and wheezin'

The calliope crashed to the ground

--Manfred Mann's Earth Band

Recent walk-backs by mainstream media outlets regarding the CovCath DC incident and the fake hate crime incident in Chicago demonstrate one again how little vetting journalists do when they report situations that appear to fit their views of the world.

If a situation aligns with your personal biases, then you will readily admit it as 'truth.' You will be less prone to think critically and pursue the other side of the story. Doing so would be painful and produce negative psychic income. The cognitive dissonance would be difficult to cope with.

The greater the personal bias, the lower the vetting of incidents that, on the surface, seem consistent with one's point of view. Because today's journalists tend to be psychologically invested in similar ideologies, the entire media industry is inevitably guilty of faulty, vet-free reporting of particular types of incidents on a routine basis.

Feelin' kind of older

I tripped the merry-go-round

With this very unpleasin'

Sneezin' and wheezin'

The calliope crashed to the ground

--Manfred Mann's Earth Band

Recent walk-backs by mainstream media outlets regarding the CovCath DC incident and the fake hate crime incident in Chicago demonstrate one again how little vetting journalists do when they report situations that appear to fit their views of the world.

If a situation aligns with your personal biases, then you will readily admit it as 'truth.' You will be less prone to think critically and pursue the other side of the story. Doing so would be painful and produce negative psychic income. The cognitive dissonance would be difficult to cope with.

The greater the personal bias, the lower the vetting of incidents that, on the surface, seem consistent with one's point of view. Because today's journalists tend to be psychologically invested in similar ideologies, the entire media industry is inevitably guilty of faulty, vet-free reporting of particular types of incidents on a routine basis.

Saturday, February 16, 2019

Prosperity Lost from Early Retirement

The light of deep regret

Let me see what I don't get

--Hipsway

Previously we offered that early retirement reduces overall prosperity because able-bodied workers are not producing goods and services that society can benefit from. That lost production could have been added to the stock of wealth that increases standard of living. But it doesn't because early retirees leave the work force prematurely.

To gain a sense of the material impact of early retirement, suppose the following. A person enters the workforce at 21 years of age making $50,000. That $50K is the monetary reflection of the individual's take-home production. Suppose also that this individual's productivity increases 2% annually (in-line with the average national real non-farm business productivity improvement reported by the BLS) until age 55. After that, productivity (and wages) don't increase annually (a conservative estimate to be sure). Assume also that the person is no longer productive at age 65 (also a conservative assumption) at which time he/she retires.

The cumulative wages (production) of that person would be as follows:

21: $50,000

25: $260,262

30: $547,486

35: $864,671

40: $1,214,868

45: $1,601,515

50: $2,028,404

55: $2,499,724

60: $2,989,893

65: $3,480,062

Now, what if the person retires at age 55--ten years before their productive capacity terminates? That person would have foregone $980,338 worth of production--about 28% of the individual's lifetime production potential. The loss is especially high because of the increase in productive capacity accumulated over time through experience and learning.

Even if individuals catch FIRE and save enough early in life to 'afford' to retiree early (most, of course, will still need to draw from the incomes of others to do so), the foregone opportunity to further enrich both themselves and others that occurs when they step away from some of their most productive years represents a high cost to society.

Let me see what I don't get

--Hipsway

Previously we offered that early retirement reduces overall prosperity because able-bodied workers are not producing goods and services that society can benefit from. That lost production could have been added to the stock of wealth that increases standard of living. But it doesn't because early retirees leave the work force prematurely.

To gain a sense of the material impact of early retirement, suppose the following. A person enters the workforce at 21 years of age making $50,000. That $50K is the monetary reflection of the individual's take-home production. Suppose also that this individual's productivity increases 2% annually (in-line with the average national real non-farm business productivity improvement reported by the BLS) until age 55. After that, productivity (and wages) don't increase annually (a conservative estimate to be sure). Assume also that the person is no longer productive at age 65 (also a conservative assumption) at which time he/she retires.

The cumulative wages (production) of that person would be as follows:

21: $50,000

25: $260,262

30: $547,486

35: $864,671

40: $1,214,868

45: $1,601,515

50: $2,028,404

55: $2,499,724

60: $2,989,893

65: $3,480,062

Now, what if the person retires at age 55--ten years before their productive capacity terminates? That person would have foregone $980,338 worth of production--about 28% of the individual's lifetime production potential. The loss is especially high because of the increase in productive capacity accumulated over time through experience and learning.

Even if individuals catch FIRE and save enough early in life to 'afford' to retiree early (most, of course, will still need to draw from the incomes of others to do so), the foregone opportunity to further enrich both themselves and others that occurs when they step away from some of their most productive years represents a high cost to society.

Labels:

capacity,

measurement,

productivity,

retirement,

socialism,

specialization,

time horizon

Friday, February 15, 2019

Fool for the City

Breathing all the clean air

Sitting in the sun

When I get my train fare

I'll get up and run

--Foghat

Yesterday Amazon (AMZN) announced that it was trashing plans to build a second headquarters (HQ2) facility in NYC. Leftist politicians immediately rejoiced, proclaiming that they had won a great victory against a corporate behemoth.

This is damn foolish. Capital costs alone for the facility were estimated at $5 billion, and the company planned to employ tens of thousands at the site--most of them in high paying professional positions. The multiplier effect on the local economy of such a project is head spinning.

Consequently, their cheers will turn to tears.

Sitting in the sun

When I get my train fare

I'll get up and run

--Foghat

Yesterday Amazon (AMZN) announced that it was trashing plans to build a second headquarters (HQ2) facility in NYC. Leftist politicians immediately rejoiced, proclaiming that they had won a great victory against a corporate behemoth.

This is damn foolish. Capital costs alone for the facility were estimated at $5 billion, and the company planned to employ tens of thousands at the site--most of them in high paying professional positions. The multiplier effect on the local economy of such a project is head spinning.

AMZN joins the unfortunate exodus from New York's increasingly hostile environment. At some point, New York politicians will realize that they are driving capital, and prosperity, away from their state.Rather than blaming Florida for stealing New York's population, possibly @NYGovCuomo could adopt policies that gave New Yorkers a reason to stay in the state. More regulations, more taxes, and even more gov spending haven't apparently made NY a more attractive place to live. https://t.co/zDWQ6FSFFj— John R Lott Jr. (@JohnRLottJr) February 15, 2019

Consequently, their cheers will turn to tears.

Labels:

capital,

intervention,

socialism,

supply chain management,

taxes

Thursday, February 14, 2019

Who's the Threat?

"You have murdered our women, and our children, and bombed our cities from afar, like cowards, and dare to call US terrorists?"

--Salim Abu Aziz (True Lies)

Ron Paul's map bids an obvious question:

--Salim Abu Aziz (True Lies)

Ron Paul's map bids an obvious question:

Who should feel threatened by whom in this situation?We're told repeatedly that Iran is a major threat to the United States.— Ron Paul (@RonPaul) February 13, 2019

The foreign policy of the United States should be as Thomas Jefferson advised: "Peace, commerce, and honest friendship with all nations-entangling alliances with none." pic.twitter.com/O2HnJOCGpM

Wednesday, February 13, 2019

Regulation by Force

"Forty years I've been asking permission to piss. I can't squeeze a drop without say-so."

--Ellis Boyd 'Red' Redding (The Shawshank Redemption)

I constantly marvel at how some people propose to intervene in the lives of others and regulate those lives thru use of government force. It seems second nature to them. They propose such regulation without batting an eye.

They forget, conveniently, that it is every person's unalienable right to live unregulated lives. They cast aside our founding principle of liberty by seeking to control others via strong armed government agents.

Those seeking to regulate others are therefore principals of violence.

--Ellis Boyd 'Red' Redding (The Shawshank Redemption)

I constantly marvel at how some people propose to intervene in the lives of others and regulate those lives thru use of government force. It seems second nature to them. They propose such regulation without batting an eye.

They forget, conveniently, that it is every person's unalienable right to live unregulated lives. They cast aside our founding principle of liberty by seeking to control others via strong armed government agents.

Those seeking to regulate others are therefore principals of violence.

Labels:

agency problem,

government,

intervention,

Jefferson,

liberty,

natural law,

regulation,

socialism,

war

Tuesday, February 12, 2019

Credit vs Cash Money

The world's a nicer place in my beautiful balloon

It wears a nicer face in my beautiful balloon

--5th Dimension

There are two types of fiat money. Credit money is created when a bank or similar entity loans funds. It 'mints' money for the debtor, but the money is not free and clear. The loan must be paid back. Thus, the inflation caused by the credit money's creation reverses to a deflationary event when the loan is retired (or defaulted on). Credit money is ultimately deflationary.

Cash money is created by a government agency (e.g., Treasury) or associated authority (e.g., Fed) that produces cash money in either physical form using a printing press or using a mouse click in electronic account. Because money created in this manner is not linked to a liability, it is far more durable and more difficult to extract from the system. Cash money is ultimately inflationary.

It wears a nicer face in my beautiful balloon

--5th Dimension

There are two types of fiat money. Credit money is created when a bank or similar entity loans funds. It 'mints' money for the debtor, but the money is not free and clear. The loan must be paid back. Thus, the inflation caused by the credit money's creation reverses to a deflationary event when the loan is retired (or defaulted on). Credit money is ultimately deflationary.

Cash money is created by a government agency (e.g., Treasury) or associated authority (e.g., Fed) that produces cash money in either physical form using a printing press or using a mouse click in electronic account. Because money created in this manner is not linked to a liability, it is far more durable and more difficult to extract from the system. Cash money is ultimately inflationary.

Monday, February 11, 2019

Filling Out Their Forms

"I just want to tell each of you that I wouldn't do that. I wouldn't and I will not."

--Brian Johnson (The Breakfast Club)

When you are getting to know a new acquaintance, do you seek a form that shows the profile of that person w.r.t. demographic traits such as skin color, gender, income level, political affiliation, etc.?

Many people, it seems, need that form. If they cannot get it, then they will fill it out themselves.

Upon meeting new people, do you find yourself filling out their forms?

--Brian Johnson (The Breakfast Club)

When you are getting to know a new acquaintance, do you seek a form that shows the profile of that person w.r.t. demographic traits such as skin color, gender, income level, political affiliation, etc.?

Many people, it seems, need that form. If they cannot get it, then they will fill it out themselves.

Upon meeting new people, do you find yourself filling out their forms?

Sunday, February 10, 2019

(Un)Affordable Housing

Our house

It has a crowd

There's always something happening

And it's usually quite loud

--Madness

As Ryan McMaken and Tom Woods observe, the most straightforward way to make housing more affordable is to build more of it (ECON 101). Instead, policymakers want to subsidize housing.

It has a crowd

There's always something happening

And it's usually quite loud

--Madness

As Ryan McMaken and Tom Woods observe, the most straightforward way to make housing more affordable is to build more of it (ECON 101). Instead, policymakers want to subsidize housing.

Housing subsidies discourage supply and increase demand. Consequently, prices will ____. (Put on your ECON 101 hats)One way to get more affordable housing is by building more housing. But most policymakers seem more interested in schemes for subsidizing housing instead. https://t.co/2tYoTW0l4u— Ryan McMaken (@ryanmcmaken) February 5, 2019

Saturday, February 9, 2019

Eternal Rights of Spring

And now that your rose is in bloom

A light hits the gloom on the grey

--Seal

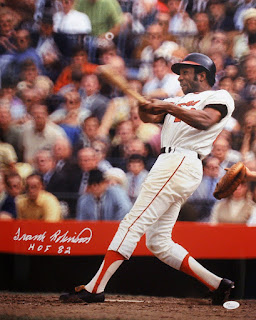

With Spring Training doors opening this week, thought I'd post another pic in honor of Frank Robinson. Pulling his equipment bag along with some R161s out of his convertible Caddy in 1950s Tampa.

A happy reminder that the rights of spring rest eternal.

A light hits the gloom on the grey

--Seal

With Spring Training doors opening this week, thought I'd post another pic in honor of Frank Robinson. Pulling his equipment bag along with some R161s out of his convertible Caddy in 1950s Tampa.

A happy reminder that the rights of spring rest eternal.

Friday, February 8, 2019

Robby

And when the night is cold and dark

You can see, you can see light

'Cause no one can take away your right

To fight

And never surrender

--Corey Hart

By the time I was old enough to recognize and remember baseball players, Frank Robinson had already been traded from the Reds to the Orioles in what was perhaps the worst trade in MLB history. But he was still my favorite.

He played hard. He hit the ball hard. In fact, my Dad used to say that he always knew when Robinson was hitting during batting practice by the sound--the ball sounded different coming off his bat.

One of my favorite Frank Robinson stories wrote itself during 1961 season. The Reds were in LA in the midst of a neck-and-neck late summer pennant race vs the Dodgers. Don Drysdale was on the mound for the Dodgers and twirling a gem shutout in a 0-0 game. Robinson came to the plate late in the game and Drysdale flipped him--as Drysdale was prone to do. Robby got up, dusted himself off, and deposited the next pitch far over the LF fence for what became the game winning HR.

The Reds never looked back after winning that game and took the NL flag.

Frank Robinson died yesterday at the age of 83.

You can see, you can see light

'Cause no one can take away your right

To fight

And never surrender

--Corey Hart

By the time I was old enough to recognize and remember baseball players, Frank Robinson had already been traded from the Reds to the Orioles in what was perhaps the worst trade in MLB history. But he was still my favorite.

He played hard. He hit the ball hard. In fact, my Dad used to say that he always knew when Robinson was hitting during batting practice by the sound--the ball sounded different coming off his bat.

One of my favorite Frank Robinson stories wrote itself during 1961 season. The Reds were in LA in the midst of a neck-and-neck late summer pennant race vs the Dodgers. Don Drysdale was on the mound for the Dodgers and twirling a gem shutout in a 0-0 game. Robinson came to the plate late in the game and Drysdale flipped him--as Drysdale was prone to do. Robby got up, dusted himself off, and deposited the next pitch far over the LF fence for what became the game winning HR.

The Reds never looked back after winning that game and took the NL flag.

Frank Robinson died yesterday at the age of 83.

Thursday, February 7, 2019

Sitting for Socialism

Oh, sweet freedom, carry me along

We'll keep the spirit alive

On and on

--Michael McDonald

Eyepopping visual following President Trump's SOTU remarks concerning creeping socialism in a republic founded on the principle of liberty. Republicans stand and cheer while most Democrats sit.

We'll keep the spirit alive

On and on

--Michael McDonald

Eyepopping visual following President Trump's SOTU remarks concerning creeping socialism in a republic founded on the principle of liberty. Republicans stand and cheer while most Democrats sit.

Picture's worth a thousand words. Would think future campaigns can use this to their advantage.In case you missed it, the best 3 lines in #SOTU https://t.co/I9CVV0HFs2— Roger Ream (@rogerrream) February 6, 2019

Wednesday, February 6, 2019

Slumdog Bankers

I was born in the wagon of a travelin' show

My mama used to dance for the money they'd throw

Papa would do whatever he could

Preach a little gospel

Sell a couple bottles of Dr Good

--Cher

The Pomboy Girl says it better than me:

My mama used to dance for the money they'd throw

Papa would do whatever he could

Preach a little gospel

Sell a couple bottles of Dr Good

--Cher

The Pomboy Girl says it better than me:

The notion that the Fed is an independent institution is farcical."I am not a slut!"— steph pomboy (@spomboy) February 5, 2019

after dinner with the president and the Treasury Secretary this evening Powell releases statement that the fed's policy decisions will be based on "objective, non political" analysis.

Is that chocolate cake on his face?? pic.twitter.com/ciYAXvj5ZI

Tuesday, February 5, 2019

Protection Agencies

"Think, Frank, think. The same government that trained me to kill trained you to protect. Yet now you want to kill me while up on that roof I protected you. They're gonna write books about us, Frank."

--Mitch Leary (In the Line of Fire)

They will come indeed.

Not only does this discourage entrepreneurship, but it can be seen as government-sponsored protection for big established businesses because agency rules/regs raise barriers to entry and reduce competition.

Big Business welcomes its protection agencies.

--Mitch Leary (In the Line of Fire)

They will come indeed.

Not only does this discourage entrepreneurship, but it can be seen as government-sponsored protection for big established businesses because agency rules/regs raise barriers to entry and reduce competition.

Big Business welcomes its protection agencies.

Labels:

agency problem,

competition,

entrepreneurship,

government,

regulation,

security,

socialism

Monday, February 4, 2019

PC Bowl

"You are fined one credit for a violation of the Verbal Morality Statute."

--Moral Statute Machine (Demolition Man)

Each year, the Super Bowl becomes increasingly difficult to watch. It is laced with so much innuendo related to diversity, social justice, et al. that it may as well be called the PC Bowl.

A microcosm of society at large, it seems.

--Moral Statute Machine (Demolition Man)

Each year, the Super Bowl becomes increasingly difficult to watch. It is laced with so much innuendo related to diversity, social justice, et al. that it may as well be called the PC Bowl.

A microcosm of society at large, it seems.

Sunday, February 3, 2019

Modern Monetary Theory

"I don't believe you're seriously considering listening to these men."

--Walter Peck (Ghostbusters)

Bloomberg piece discusses 'modern monetary theory' (MMT). As the author notes, MMT is not new. It is based on the ludicrous notion that governments can borrow forever with no adverse consequences. "What if the government does not have to pay back what it borrows, now or forever?"

That such a question is seriously considered reflects just how far off the rails we already are.

Of course, policymakers have been proceeding as if MMT was already in force. Federal debt is now close to $22 trillion. Central banks around the world have been monetizing debt for years with trillion$ created out of thin air to buy government bonds and related obligations.

The author raises the specter of hyperinflation springing from these policies but wonders why big inflation has yet to arise from all of the money printing so far. One reason is that most of the trillion$ created by central banks have remained within the financial system. Look at long term price charts of stocks, for example, for pictures of what big time inflation looks like.

Once these dollars make their way out of financial system containment and spread into goods and service economic systems, then the inflationary horse put in motion by MMT will really start to gallop.

--Walter Peck (Ghostbusters)

Bloomberg piece discusses 'modern monetary theory' (MMT). As the author notes, MMT is not new. It is based on the ludicrous notion that governments can borrow forever with no adverse consequences. "What if the government does not have to pay back what it borrows, now or forever?"

That such a question is seriously considered reflects just how far off the rails we already are.

Of course, policymakers have been proceeding as if MMT was already in force. Federal debt is now close to $22 trillion. Central banks around the world have been monetizing debt for years with trillion$ created out of thin air to buy government bonds and related obligations.

The author raises the specter of hyperinflation springing from these policies but wonders why big inflation has yet to arise from all of the money printing so far. One reason is that most of the trillion$ created by central banks have remained within the financial system. Look at long term price charts of stocks, for example, for pictures of what big time inflation looks like.

Once these dollars make their way out of financial system containment and spread into goods and service economic systems, then the inflationary horse put in motion by MMT will really start to gallop.

Labels:

bonds,

central banks,

debt,

Depression,

Fed,

inflation,

manipulation,

money,

theory

Saturday, February 2, 2019

Quick to Condemn

"We do not train to be merciful here. Mercy is for the weak. Here, in the streets, in competition. A man confronts you; he is the enemy. An enemy deserves no mercy."

--John Kreese (The Karate Kid)

Another call today for a public figure to resign because of something done decades ago. These episodes continue to suggest several things about our present circumstance.

One is the utter incapability of people to cope with situations that they deem 'offensive' no matter how distant and removed from the present. Better to strip the person of any prominence or connection with the in-group as a means to deal with painful cognitive dissonance.

Another is the escalating political division to be expected in a democratic state that increasingly motivates members of one faction to scrutinize past behavior of members of the opposing faction for any flaws that can be exploited. All political enemies must be destroyed.

Finally, it speaks to our growing intolerance of behavior that we may personally deem as unbecoming. Quick to condemn, slow to have mercy. Of course, we hope that our Creator acts just the opposite when we stand before Him on Judgment Day.

--John Kreese (The Karate Kid)

Another call today for a public figure to resign because of something done decades ago. These episodes continue to suggest several things about our present circumstance.

One is the utter incapability of people to cope with situations that they deem 'offensive' no matter how distant and removed from the present. Better to strip the person of any prominence or connection with the in-group as a means to deal with painful cognitive dissonance.

Another is the escalating political division to be expected in a democratic state that increasingly motivates members of one faction to scrutinize past behavior of members of the opposing faction for any flaws that can be exploited. All political enemies must be destroyed.

Finally, it speaks to our growing intolerance of behavior that we may personally deem as unbecoming. Quick to condemn, slow to have mercy. Of course, we hope that our Creator acts just the opposite when we stand before Him on Judgment Day.

Friday, February 1, 2019

Sniffing It Out

The news is blue

Has its own way to get to you

--Sniff 'n' the Tears

The Fed's walk back on rates et al has not been lost on gold. Gold is a bet on disorder, whether that disorder be grounded in the monetary system or in broader social systems.

By taking its foot of the monetary brakes, the Fed greatly increases the probability of Big Inflation which, of course, can create disorder of great magnitude (and duration).

Gold is sniffing it out.

position in gold

Has its own way to get to you

--Sniff 'n' the Tears

The Fed's walk back on rates et al has not been lost on gold. Gold is a bet on disorder, whether that disorder be grounded in the monetary system or in broader social systems.

By taking its foot of the monetary brakes, the Fed greatly increases the probability of Big Inflation which, of course, can create disorder of great magnitude (and duration).

Gold is sniffing it out.

position in gold

Subscribe to:

Posts (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)