"And I hate to tell you this, but it's a bankrupt business model. It won't work. It's systemic, malignant, and it's global...like cancer."

--Gordon Gekko (Wall Street: Money Never Sleeps)

The muted market response to the DB situation demonstrates just how entrenched moral hazard is in the minds of investors. I've heard people ranging from professional investors to students this week uttering the same thing:

"There's no way that they will let it fail."

There seems to be near universal comfort in the 'authorities' and their capacity to bail out risky behavior.

Capitalism? No way. What we have here is the antithesis of capitalism.

Friday, September 30, 2016

Entrenched Moral Hazard

Labels:

capital,

intervention,

leverage,

markets,

moral hazard,

risk,

socialism

Thursday, September 29, 2016

Why We Get Deplorable Candidates

"What difference does it make if a few political extremists lose their rights? What difference does it make if a few racial minorities lose their rights? It is only a passing phase. It is only a stage we are going through. It will be discarded sooner or later. Hitler himself will be discarded--sooner or later. The country is in danger. We will march out of the shadows. We will go foward. FORWARD is the great password."

--Ernst Janning (Judgment at Nuremberg)

Jacob Hornberger reminds us that having nothing but 'deplorable' candidates run for top political office is no accident in a democratic state where authoritarianism is on the rise. The people (voters) create a system that values deplorables in office.

JH cites the work of Hayek, who discussed this phenomenon in his seminal The Road to Serfdom. In the book, Chapter 10 was entitled 'Why The Worst Get On Top.' Hayek refutes the argument that there can be a 'good' totalitarian regime with a benevolent dictator. Moreover, people who think that they are just one good leader away from filling a totalitarian seat in a benevolent manner are delusional.

Because authoritarian regimes require, by definition, force to enact, they attract people who are willing to employ aggression to accomplish state, and by extension personal, objectives. Those with high moral and ethical standards naturally find such conditions repulsive.

As Hayek observes:

"Yet while there is little that is likely to induce men who are good by our standards to aspire to leading positions in the totalitarian machine, and much to deter them, there will be special opportunities for the ruthless and unscrupulous. There will be jobs to be done about the badness of which taken by themselves nobody has any doubt, but which have to be done in the service of some higher end, and which have to be executed with the same expertness and efficiency as others. And as there will be need for actions which are bad in themselves, and which all those still influenced by traditional morals will be reluctant to perform, the readiness to do bad things becomes a path to promotion and power. [emphasis mine] The positions in a totalitarian society in which it is necessary to practice cruelty and intimidation, deliberate deception and spying, are numerous."

Per Hayek, "the readiness to do bad things" as a "path to promotion and power" aptly describes the primary job qualification that we have institutionalized for senior political positions.

--Ernst Janning (Judgment at Nuremberg)

Jacob Hornberger reminds us that having nothing but 'deplorable' candidates run for top political office is no accident in a democratic state where authoritarianism is on the rise. The people (voters) create a system that values deplorables in office.

JH cites the work of Hayek, who discussed this phenomenon in his seminal The Road to Serfdom. In the book, Chapter 10 was entitled 'Why The Worst Get On Top.' Hayek refutes the argument that there can be a 'good' totalitarian regime with a benevolent dictator. Moreover, people who think that they are just one good leader away from filling a totalitarian seat in a benevolent manner are delusional.

Because authoritarian regimes require, by definition, force to enact, they attract people who are willing to employ aggression to accomplish state, and by extension personal, objectives. Those with high moral and ethical standards naturally find such conditions repulsive.

As Hayek observes:

"Yet while there is little that is likely to induce men who are good by our standards to aspire to leading positions in the totalitarian machine, and much to deter them, there will be special opportunities for the ruthless and unscrupulous. There will be jobs to be done about the badness of which taken by themselves nobody has any doubt, but which have to be done in the service of some higher end, and which have to be executed with the same expertness and efficiency as others. And as there will be need for actions which are bad in themselves, and which all those still influenced by traditional morals will be reluctant to perform, the readiness to do bad things becomes a path to promotion and power. [emphasis mine] The positions in a totalitarian society in which it is necessary to practice cruelty and intimidation, deliberate deception and spying, are numerous."

Per Hayek, "the readiness to do bad things" as a "path to promotion and power" aptly describes the primary job qualification that we have institutionalized for senior political positions.

Labels:

Clinton,

democracy,

institution theory,

media,

natural law,

Obama,

socialism,

Tea Party,

war

Wednesday, September 28, 2016

Filling Gaps

"Now what?"

--John Finnegan (Deep Rising)

In technical analysis, it is said that all gaps are meant to be filled. Nice example here with...Gap (GPS).

Three gaps (2 down, 1 up) in last six months. recent price action filled the gap up in early July.

Now what?

no positions

--John Finnegan (Deep Rising)

In technical analysis, it is said that all gaps are meant to be filled. Nice example here with...Gap (GPS).

Three gaps (2 down, 1 up) in last six months. recent price action filled the gap up in early July.

Now what?

no positions

Tuesday, September 27, 2016

Global Container Volume

It was thirty days around the horn

The captain says it's thirty five more

The moon looks mean

The crew ain't stayin'

There's gonna be some blood

Is what they're all sayin'

--Jay Ferguson

Global container volume is down, as are associated shipping rates. The benchmark price is shipment of a 20 ft container from Shanghai to Northern Europe.

Since July, rates have fallen from $1200 to below $800. YOY % change in global container volume is near zero.

Another data point pointing to slower global growth. Also suggests problem ahead for leveraged shippers and their financiers.

The captain says it's thirty five more

The moon looks mean

The crew ain't stayin'

There's gonna be some blood

Is what they're all sayin'

--Jay Ferguson

Global container volume is down, as are associated shipping rates. The benchmark price is shipment of a 20 ft container from Shanghai to Northern Europe.

Since July, rates have fallen from $1200 to below $800. YOY % change in global container volume is near zero.

Another data point pointing to slower global growth. Also suggests problem ahead for leveraged shippers and their financiers.

Derivative Deja Vu

"Well, you can be wrong a million times. You only gotta be right once."

--Doug Carlin (Deja Vu)

On the back of yesterday's DB post, ponder this graphic:

Discussions about derivatives may soon become popular once again.

--Doug Carlin (Deja Vu)

On the back of yesterday's DB post, ponder this graphic:

Discussions about derivatives may soon become popular once again.

Monday, September 26, 2016

DB and the Lehman Analog

"The mother of all evil is speculation--leveraged debt."

--Gordon Gekko (Wall Street: Money Never Sleeps)

Deutsche Bank (DB) is in the spotlight as shares hit 20 yr lows on the back of concerns about adequate capital.

DB has been the target of US probes into the 2008 credit collapse Moreover, it has seen money-making opportunities decline as interest rates have declined.

Equity is shrinking, but market cap still stands at ~$15 billion which, given DB's leverage, suggests to me that it can still fall a long way.

The Lehman analog still seems appropriate, particularly given that it was 8 yrs ago this month that LEH disappeared.

--Gordon Gekko (Wall Street: Money Never Sleeps)

Deutsche Bank (DB) is in the spotlight as shares hit 20 yr lows on the back of concerns about adequate capital.

DB has been the target of US probes into the 2008 credit collapse Moreover, it has seen money-making opportunities decline as interest rates have declined.

Equity is shrinking, but market cap still stands at ~$15 billion which, given DB's leverage, suggests to me that it can still fall a long way.

The Lehman analog still seems appropriate, particularly given that it was 8 yrs ago this month that LEH disappeared.

Labels:

balance sheet,

credit,

leverage,

risk,

technical analysis

Plausible Reasons for Trump's Popularity

Alice Russell: As someone sooner or later is bound to say, "Politics makes strange bedfellows."

William Russell: I was hoping it wouldn't be you.

--The Best Man

A popular progressive narrative is that Donald Trump is where he is in the polls primarily because of a 'white riot.' White supremecist racists who do not want to lose their positions of social dominance are banding together and elevating Trump into competitive position in the polls.

Although there may be a group of Trump supporters that fit this demographic, is this the primary reason for Trump's surge? Let's list, as is done here, some plausible rival hypotheses for Trump's popularity:

By doing so, of course, they risk upsetting the narrative. As such, they are likely to avoid honestly pursuing the truth.

William Russell: I was hoping it wouldn't be you.

--The Best Man

A popular progressive narrative is that Donald Trump is where he is in the polls primarily because of a 'white riot.' White supremecist racists who do not want to lose their positions of social dominance are banding together and elevating Trump into competitive position in the polls.

Although there may be a group of Trump supporters that fit this demographic, is this the primary reason for Trump's surge? Let's list, as is done here, some plausible rival hypotheses for Trump's popularity:

- Trump is self-funding his campaign and thus is less subject to manipulation by buyers of political influence.

- Trump possesses business acumen which many Americans admire. They also suspect it could helpful in the Oval Office.

- Instead of carefully following a script developed by a group of political handlers, Trump often shoots from the hip. Many people find this refreshing and human.

- Many Americans see the economy as weakening and want an administration unaffiliated with the party that has governed during this period of economic malaise.

- Many see Obamacare as deeply flawed and getting worse. Trump has stated that he will fix it, which is attractive to many people.

- Many Americans are appalled by the degree of media bias in the coverage of the presidential candidates and are causing some to throw their support toward Trump as an expression of procedural justice.

- Trump is a celebrity in a celebrity culture.

- Trump's campaign rhetoric has become more inclusive which is attracting a broader group of supporters.

- People are concerned about safety and are drawn to the candidate with an aggressive position on national security.

By doing so, of course, they risk upsetting the narrative. As such, they are likely to avoid honestly pursuing the truth.

Labels:

Clinton,

competition,

Depression,

entrepreneurship,

health care,

manipulation,

media,

Obama,

reason,

rhetoric,

risk,

security,

socialism,

Tea Party,

war

Sunday, September 25, 2016

Harvard and Yale Endowments

"Ever wonder why fund managers can't beat the S&P 500? 'Cause they're sheep. And sheep get slaughtered."

--Gordon Gekko (Wall Street)

Because fiscal years for university endowments often end in the summer (consistent with the academic calendar), year end results are just now making their way to the news. Two of the largest endowments are Harvard ($35.7 billion) and Yale ($25.4 billion).

This year, Yale reported a 3.4% annual gain vs Harvard's -2% performance. This marks the sixth straight year that Yale has outperformed Harvard. It also marks Harvard's worst annual performance since 2009. Both schools outperformed the average school endowment which reported a -2.7% net return.

Although both schools were among the first to add alternative investments to their portfolios, they manage their funds in different ways. Yale, managed by veteran David Swensen, outsources most individual investment decisions to dozens of investment managers. This is similar to individual investors who invest in plethoras of mutual funds. Those individuals put their faith in the investment prowess of the money managers in charge of those mutual funds.

Harvard, on the other hand, has relied on the 'old fashioned' approach of managing some of its assets in-house. It is also searching for a new chief executive for the endowment.

Also interesting was Yale's forecast parameters for 2017 asset allocations. Private equity and venture capital will might comprise up to 53.5% of the portfolio. Domestic stocks won't be higher than 4%, and cash and bonds won't exceed 7.5%.

It appears that David Swensen's well known 'equity bias' is still manifest in Yale's asset allocation.

--Gordon Gekko (Wall Street)

Because fiscal years for university endowments often end in the summer (consistent with the academic calendar), year end results are just now making their way to the news. Two of the largest endowments are Harvard ($35.7 billion) and Yale ($25.4 billion).

This year, Yale reported a 3.4% annual gain vs Harvard's -2% performance. This marks the sixth straight year that Yale has outperformed Harvard. It also marks Harvard's worst annual performance since 2009. Both schools outperformed the average school endowment which reported a -2.7% net return.

Although both schools were among the first to add alternative investments to their portfolios, they manage their funds in different ways. Yale, managed by veteran David Swensen, outsources most individual investment decisions to dozens of investment managers. This is similar to individual investors who invest in plethoras of mutual funds. Those individuals put their faith in the investment prowess of the money managers in charge of those mutual funds.

Harvard, on the other hand, has relied on the 'old fashioned' approach of managing some of its assets in-house. It is also searching for a new chief executive for the endowment.

Also interesting was Yale's forecast parameters for 2017 asset allocations. Private equity and venture capital will might comprise up to 53.5% of the portfolio. Domestic stocks won't be higher than 4%, and cash and bonds won't exceed 7.5%.

It appears that David Swensen's well known 'equity bias' is still manifest in Yale's asset allocation.

Labels:

asset allocation,

bonds,

cash,

endowments,

fund management,

risk,

supply chain management

Saturday, September 24, 2016

Easy to Create, Hard to Stop

Oh, a storm is threatening

My very life today

If I don't get some shelter

Oh yeah, I'm gonna fade away

--The Rolling Stones

Great point made by Fleck last nite. Monetary policymakers currently base their actions on the belief that inflation is hard to create and easy to stop.

This is a false belief, as Fleck observes. Properly defined, inflation is easy to create and hard to stop. Witness the gargantuan growth in global money supply under the tenure of central bankers.

When inflation spills over into the prices of goods and services in a big way, the toothpaste is out of the tube. Witness Weimar, Zimbabwe, et al.

People continue to ignore the insane nature of policies currently being put forth by central bankers. These bankers seem determined to ignite a cataclysm that cannot be stopped.

My very life today

If I don't get some shelter

Oh yeah, I'm gonna fade away

--The Rolling Stones

Great point made by Fleck last nite. Monetary policymakers currently base their actions on the belief that inflation is hard to create and easy to stop.

This is a false belief, as Fleck observes. Properly defined, inflation is easy to create and hard to stop. Witness the gargantuan growth in global money supply under the tenure of central bankers.

When inflation spills over into the prices of goods and services in a big way, the toothpaste is out of the tube. Witness Weimar, Zimbabwe, et al.

People continue to ignore the insane nature of policies currently being put forth by central bankers. These bankers seem determined to ignite a cataclysm that cannot be stopped.

Labels:

central banks,

Depression,

inflation,

money,

rhetoric,

Weimar

Friday, September 23, 2016

Staging News

"This is really wonderful. If we go along with you and lie our asses off, the world of truth and ideals is, er, protected. But if we don't want to take part in some giant rip-off of yours then somehow or other we're managing to ruin the country. You're pretty good, Jim. I'll give you that."

--Charles Brubaker (Capricorn One)

One thing that is becoming increasingly clear is that events reported as 'news' are often staged. Recent race riots in Ferguson, Baltimore, and now Charlotte are good cases in point. Evidence suggests that much of the rioting and damage is being done by paid protesters who are being bused in from the outside.

Most staging largely goes unreported by the mainstream media. Indeed, their lack of due diligence supports the proposition that the mainstream media are complicit in creating the illusion.

Fortunately, people now have more choices from which they can select information sources that they can trust.

Find those trusted sources, lest you wind up viewing theater events rather than becoming informed.

--Charles Brubaker (Capricorn One)

One thing that is becoming increasingly clear is that events reported as 'news' are often staged. Recent race riots in Ferguson, Baltimore, and now Charlotte are good cases in point. Evidence suggests that much of the rioting and damage is being done by paid protesters who are being bused in from the outside.

Most staging largely goes unreported by the mainstream media. Indeed, their lack of due diligence supports the proposition that the mainstream media are complicit in creating the illusion.

Fortunately, people now have more choices from which they can select information sources that they can trust.

Find those trusted sources, lest you wind up viewing theater events rather than becoming informed.

Thursday, September 22, 2016

Euphemized Spending

You fell and cried as our people were starving

Now you know that we blame you

You tried to walk on the trail we were carving

Now you know that we framed you

--The Who

Politicians love to create euphemisms for spending. 'Investing' is the current favorite.

This is nothing new. For example, the American System platform advanced by the Whigs in the 1800s promoted the value of 'internal improvement' projects initiated by the federal government.

Such euphemisms fool only the most gullible. Or soothe the most partisan.

Now you know that we blame you

You tried to walk on the trail we were carving

Now you know that we framed you

--The Who

Politicians love to create euphemisms for spending. 'Investing' is the current favorite.

This is nothing new. For example, the American System platform advanced by the Whigs in the 1800s promoted the value of 'internal improvement' projects initiated by the federal government.

Such euphemisms fool only the most gullible. Or soothe the most partisan.

Wednesday, September 21, 2016

Pier 1 Imports

Hand across the water

Heads across the sky

--Paul McCartney & Wings

Have been buying a bit of Pier 1 Imports (PIR) recently. Owned it a long time ago. The stock has gone through several major up/down cycles since then and, as indicated by the chart, is on the 'down' side of things after having retraced most of the move since the 2009 lows that made it a $20+ stock a couple years ago.

I see this as a 'special situation/value play. PIR's $340 million market cap, or about $400 million enterprise value when net debt is considered, puts the stock in the smaller market cap bucket that I'm interested in. The company seems more than capable of generating at least that much in free cash flow currently. It also sports a dividend yield near 7%.

Fundamentally, have always loved the stores and their eclectic specialty merchandise mix. Current issues such as recent CEO resignation and concerns with declining bricks and mortar traffic (something all retail is coping with) seems largely factored into the price.

Can price go lower? Oh yeah. And given my view of the world, upcoming environmental forces should prove a wind in the face of PIR and other retailers. I wish the company had maintained its nearly debt free balance sheet of two years ago, but its current cash:debt of $128/$200 million suggests a manageable degree of leverage given its cash flow dynamics.

If/when prices do head lower, I plan to increase my position here to something more meaningful--assuming of course that my analysis remains bullish.

position in PIR

Heads across the sky

--Paul McCartney & Wings

Have been buying a bit of Pier 1 Imports (PIR) recently. Owned it a long time ago. The stock has gone through several major up/down cycles since then and, as indicated by the chart, is on the 'down' side of things after having retraced most of the move since the 2009 lows that made it a $20+ stock a couple years ago.

I see this as a 'special situation/value play. PIR's $340 million market cap, or about $400 million enterprise value when net debt is considered, puts the stock in the smaller market cap bucket that I'm interested in. The company seems more than capable of generating at least that much in free cash flow currently. It also sports a dividend yield near 7%.

Fundamentally, have always loved the stores and their eclectic specialty merchandise mix. Current issues such as recent CEO resignation and concerns with declining bricks and mortar traffic (something all retail is coping with) seems largely factored into the price.

Can price go lower? Oh yeah. And given my view of the world, upcoming environmental forces should prove a wind in the face of PIR and other retailers. I wish the company had maintained its nearly debt free balance sheet of two years ago, but its current cash:debt of $128/$200 million suggests a manageable degree of leverage given its cash flow dynamics.

If/when prices do head lower, I plan to increase my position here to something more meaningful--assuming of course that my analysis remains bullish.

position in PIR

Tuesday, September 20, 2016

Regulation and Prices

Be running up that road

Be running up that hill

Be running up that building

--Kate Bush

What effect does regulation have on prices? In industries that are highly regulated, prices tend to increase over time. In relatively unregulated industries, prices tend to fall?

Regulations increase the cost of doing business for producers. Where possible, producers will pass those cost increases on to consumers in the form of higher prices.

Moreover, regulation raises entry barriers for new firms. Entrepreneurs, recognizing higher costs of entry posed by regulation, avoid pursuing opportunities that may exist in highly regulated industries. This removes a major source of innovation and productivity improvement from the economy.

It also protects the franchises of established firms that are prone to favor the status quo over competition and improvement.

Be running up that hill

Be running up that building

--Kate Bush

What effect does regulation have on prices? In industries that are highly regulated, prices tend to increase over time. In relatively unregulated industries, prices tend to fall?

Regulations increase the cost of doing business for producers. Where possible, producers will pass those cost increases on to consumers in the form of higher prices.

Moreover, regulation raises entry barriers for new firms. Entrepreneurs, recognizing higher costs of entry posed by regulation, avoid pursuing opportunities that may exist in highly regulated industries. This removes a major source of innovation and productivity improvement from the economy.

It also protects the franchises of established firms that are prone to favor the status quo over competition and improvement.

Labels:

competition,

entrepreneurship,

inflation,

productivity,

regulation

Monday, September 19, 2016

Upsetting the Narrative

No one knows

How I feel

Or what I say

Unless you read between my lines

--Stevie Nicks

Nice example of narrative society provided by the current administration and its media cronies. There are certain words they simply refuse to use until/unless they are completely backed into a corner.

Why not call it as it is upfront? Because it would spoil the narrative.

How I feel

Or what I say

Unless you read between my lines

--Stevie Nicks

Nice example of narrative society provided by the current administration and its media cronies. There are certain words they simply refuse to use until/unless they are completely backed into a corner.

Why not call it as it is upfront? Because it would spoil the narrative.

Sunday, September 18, 2016

Strength In Numbers

Guy de Lusignan: Give me a war.

Reynald de Chatillon: That is what I do.

--Kingdom of Heaven

Years ago, when people act 'uncivilized,' they used force to get what they want. Collectively, force was dependent on size--the number of people behind the force. "There's strength in numbers," as the saying goes.

Today, when people act 'civilized,' they still use force to get what they want. Through democratic process, they amass a majority that contracts with strong armed agents to do their bidding. Minorities must comply or risk bodily harm.

There is still strength in numbers. What has changed is that, unlike times past, people now live under the pretense that they no longer behave like their ancestral barbarians.

Reynald de Chatillon: That is what I do.

--Kingdom of Heaven

Years ago, when people act 'uncivilized,' they used force to get what they want. Collectively, force was dependent on size--the number of people behind the force. "There's strength in numbers," as the saying goes.

Today, when people act 'civilized,' they still use force to get what they want. Through democratic process, they amass a majority that contracts with strong armed agents to do their bidding. Minorities must comply or risk bodily harm.

There is still strength in numbers. What has changed is that, unlike times past, people now live under the pretense that they no longer behave like their ancestral barbarians.

Labels:

agency problem,

contracts,

democracy,

government,

self defense,

socialism,

war

Saturday, September 17, 2016

Politics and the Fed

It happened one summer

It happened one time

It happened forever

For a short time

--The Motel

One of the greatest farces of modern economics and finance is that the central bank of the United States, the Federal Reserve, is apolitical. That is why recent comments by presidential candidate Donald Trump, despite his many shortcomings, are so refreshing. It also explains the reaction to his comments from all supporters of the State (here and here for example).

Rival presidential candidate Hillary Clinton had this to say about Trump's remarks:

"You should not be commenting on Fed actions when you are either running for president or you are president."

Completely consistent with the narrative, i.e., the charade of independence, promulgated by statists.

Trump, of course, may not be serious. Moreover, I see no way that a President Trump could enact his seriously troubled economic policies without the Fed being his 'partner in government' has it has been for nearly every president in the past century.

But his comments, genuine or not, are spot on. Hopefully, they have opened a few more eyes and motivated a few more questions in the past week.

It happened one time

It happened forever

For a short time

--The Motel

One of the greatest farces of modern economics and finance is that the central bank of the United States, the Federal Reserve, is apolitical. That is why recent comments by presidential candidate Donald Trump, despite his many shortcomings, are so refreshing. It also explains the reaction to his comments from all supporters of the State (here and here for example).

Rival presidential candidate Hillary Clinton had this to say about Trump's remarks:

"You should not be commenting on Fed actions when you are either running for president or you are president."

Completely consistent with the narrative, i.e., the charade of independence, promulgated by statists.

Trump, of course, may not be serious. Moreover, I see no way that a President Trump could enact his seriously troubled economic policies without the Fed being his 'partner in government' has it has been for nearly every president in the past century.

But his comments, genuine or not, are spot on. Hopefully, they have opened a few more eyes and motivated a few more questions in the past week.

Labels:

central banks,

Clinton,

Fed,

institution theory,

Obama,

rhetoric

Friday, September 16, 2016

Narrative Society

"Have you ever had a dream, Neo, that you were so sure was real? What if you were unable to wake from that dream? How would you know the difference between the dream world and the real world?"

--Morpheus (The Matrix)

Increasingly, we live in a narrative society. People act not according to what is known to be true. Rather, they act according to a narrative script--a script that has usually been shaped by others. Narratives are stories. In a narrative society, these stories are shared between people. They can be fact or fiction.

People do not seem to care if they ground their actions in factual or fictional narratives. This leaves a significant fraction of the population living in fantasy land as they cling to fictional narratives. Fictional narratives lend to cognitive dissonance--excursions in thought and behavior from what the mind knows to be true.

Any attempt by external actors to pop the narrative bubble steering people's minds is met with resistance and often finds those ruled by narratives scurrying from 'trigger warnings' and running for the cover of 'safe spaces.,'

Coping with reality and seeking truth is not the primary goal of a narrative society. Institutionalizing the narrative is.

--Morpheus (The Matrix)

Increasingly, we live in a narrative society. People act not according to what is known to be true. Rather, they act according to a narrative script--a script that has usually been shaped by others. Narratives are stories. In a narrative society, these stories are shared between people. They can be fact or fiction.

People do not seem to care if they ground their actions in factual or fictional narratives. This leaves a significant fraction of the population living in fantasy land as they cling to fictional narratives. Fictional narratives lend to cognitive dissonance--excursions in thought and behavior from what the mind knows to be true.

Any attempt by external actors to pop the narrative bubble steering people's minds is met with resistance and often finds those ruled by narratives scurrying from 'trigger warnings' and running for the cover of 'safe spaces.,'

Coping with reality and seeking truth is not the primary goal of a narrative society. Institutionalizing the narrative is.

Thursday, September 15, 2016

Wages and Productivity

Some days won't end ever

And some days pass on by

I'll be working here forever

At least until I die

--Huey Lewis & The News

As workers becomes more productive, they earn higher wages. It works in reverse as well. Lower productivities lead to wage declines.

It should come as no surprise, then, that reports indicate broadly declining wages. Productivity has been falling, which by definition means that fewer economic resources are being generated as income.

And some days pass on by

I'll be working here forever

At least until I die

--Huey Lewis & The News

As workers becomes more productive, they earn higher wages. It works in reverse as well. Lower productivities lead to wage declines.

It should come as no surprise, then, that reports indicate broadly declining wages. Productivity has been falling, which by definition means that fewer economic resources are being generated as income.

Labels:

capital,

Depression,

measurement,

productivity,

saving

Wednesday, September 14, 2016

Authoritarianism and Organizational Size

All for freedom and of pleasure

Nothing ever lasts forever

Everybody wants to rule the world

--Tears for Fears

Authoritarian regimes prefer large organizations. A few large organizations are easier to influence and control that are many small organizations.

Stated differently, there are fewer control points.

Free markets promote the opposite. Decisions are decentralized among millions of people voluntarily engaging in cooperative exchange.

Such fragmentation is impossible for bureaucrats to manage. That is why authoritarians despise distributed government designs in which they must share or cede power to many small organizations.

Nothing ever lasts forever

Everybody wants to rule the world

--Tears for Fears

Authoritarian regimes prefer large organizations. A few large organizations are easier to influence and control that are many small organizations.

Stated differently, there are fewer control points.

Free markets promote the opposite. Decisions are decentralized among millions of people voluntarily engaging in cooperative exchange.

Such fragmentation is impossible for bureaucrats to manage. That is why authoritarians despise distributed government designs in which they must share or cede power to many small organizations.

Tuesday, September 13, 2016

Uncovering the FBI

If you think that I don't know about the little tricks you've played

And never see you when deliberately you put things in my way

--The Who

Yesterday, the House Oversight Committee Chairman issued a subpoena to the FBI for the full case file in the Hillary Clinton email investigation. Remarkably, the subpoena was issued in the middle of a congressional hearing with the FBI on the matter.

As Judge Nap recounts, insiders are saying that the Bureau is attempting to create a false impression of what happened by selectively releasing portions of the investigation. If all of it is released, then people can form more informed opinions about the thoroughness of the investigation and the Bureau's decision not to prosecute Clinton.

Anything that challenges the blatant lawlessness of this administration and of the Clintons is refreshing.

And never see you when deliberately you put things in my way

--The Who

Yesterday, the House Oversight Committee Chairman issued a subpoena to the FBI for the full case file in the Hillary Clinton email investigation. Remarkably, the subpoena was issued in the middle of a congressional hearing with the FBI on the matter.

As Judge Nap recounts, insiders are saying that the Bureau is attempting to create a false impression of what happened by selectively releasing portions of the investigation. If all of it is released, then people can form more informed opinions about the thoroughness of the investigation and the Bureau's decision not to prosecute Clinton.

Anything that challenges the blatant lawlessness of this administration and of the Clintons is refreshing.

Labels:

Clinton,

institution theory,

judicial,

Obama,

security

Monday, September 12, 2016

Compression Begets Decompression

"It's a bottomless pit, baby. Two and a half miles straight down."

--Catfish DeVries (The Abyss)

First big down day since Brexit sticks out like a sore thumb amidst the recent quiet.

Of course, one day does not a market trend make. But will be watching to see if compression begets decompression.

Technically, support from the multi-month uptrend line is another heavy day away at just under SPX 2100.

position in SPX

--Catfish DeVries (The Abyss)

First big down day since Brexit sticks out like a sore thumb amidst the recent quiet.

Of course, one day does not a market trend make. But will be watching to see if compression begets decompression.

Technically, support from the multi-month uptrend line is another heavy day away at just under SPX 2100.

position in SPX

Sunday, September 11, 2016

Fifteen

When my teeth bite down I can see the blood

Of a thousand men who have come and gone

Now we grieve 'cause now it's gone

Things were good when we were young

--Von Bondies

As I stepped outside early this morning, it looked the same. Sun rising into a deep blue sky. Clean, crisp air with a hint of fall in it. Quiet.

But I need no reminders. Although I don't care to think about the particulars of that day much anymore, when I do, my worst nightmare dutifully reappears in full color and detail. Seared into memory for ready retrieval.

The space between then and now closes. And fifteen years ago becomes fifteen seconds ago.

Of a thousand men who have come and gone

Now we grieve 'cause now it's gone

Things were good when we were young

--Von Bondies

As I stepped outside early this morning, it looked the same. Sun rising into a deep blue sky. Clean, crisp air with a hint of fall in it. Quiet.

But I need no reminders. Although I don't care to think about the particulars of that day much anymore, when I do, my worst nightmare dutifully reappears in full color and detail. Seared into memory for ready retrieval.

The space between then and now closes. And fifteen years ago becomes fifteen seconds ago.

Saturday, September 10, 2016

Hierarchy of Disagreement

Secrets stolen

From deep inside

The drum beats out of time

--Cyndi Lauper

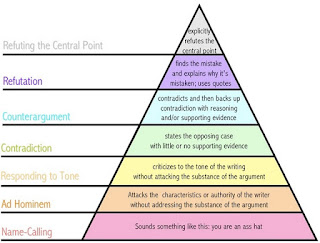

Not a bad framework for categorizing arguments.

Toward the bottom of the pyramid is name calling. This is the emotional argument of the juvenile mind that is common on playgrounds. Unfortunately, most adults never graduate from the playground as ad hominem responses dominate the rhetoric of disagreement among 'grown ups.' Witness the rhetoric of identity politics and popular responses to any behavior that rubs people the wrong way as 'racist,' 'xenophobic,' 'misogynistic,' et al.

Name calling is characteristic of fast thinking.

Toward the top of the pyramid is refutation of the central point made by the other party. Reasons obtained from reasoning. Carefully considered arguments that prove opposing arguments false.

The slow, deliberate thought process required to operate at the top of the pyramid is consummate System Two territory. It is also why arguments of this type have always been rare in the world.

From deep inside

The drum beats out of time

--Cyndi Lauper

Not a bad framework for categorizing arguments.

Toward the bottom of the pyramid is name calling. This is the emotional argument of the juvenile mind that is common on playgrounds. Unfortunately, most adults never graduate from the playground as ad hominem responses dominate the rhetoric of disagreement among 'grown ups.' Witness the rhetoric of identity politics and popular responses to any behavior that rubs people the wrong way as 'racist,' 'xenophobic,' 'misogynistic,' et al.

Name calling is characteristic of fast thinking.

Toward the top of the pyramid is refutation of the central point made by the other party. Reasons obtained from reasoning. Carefully considered arguments that prove opposing arguments false.

The slow, deliberate thought process required to operate at the top of the pyramid is consummate System Two territory. It is also why arguments of this type have always been rare in the world.

Friday, September 9, 2016

Cooper's Road

"Insanity is just a state of mind."

--Captain Benjamin Franklin 'Hawkeye' Pierce (M*A*S*H)

Interesting note that James Fenimore Cooper. Cooper, one of America's novelists, lived during the early populist movement in American history. Cooper was quick to recognize the dangers of majority rule. He also understood the proper definition of equality in the political context.

Many of his thoughts appeared in the American Democrat, Cooper's political essay first published in 1838. In it, Cooper noted that democracy defined as majority rule threatened the unalienable rights recognized by our founding ancestors unless strict limitations were placed on what majorities were permitted to decide. That, of course, was a primary purpose of the Constitution.

He also correctly saw equality in the political sense: equal treatment under the law. All men are created equal in that they are all born with rights to life, liberty, and property. No one is legally permitted to forcibly interfere with those interests as long as they are peacefully pursued.

Force is not legitimate when applied to achieve equality of condition. Government's role is to help people protect themselves against offensive force. Government is not the Great Redistributor.

James Fenimore Cooper joins William Faulkner on these pages as American writers who got it.

--Captain Benjamin Franklin 'Hawkeye' Pierce (M*A*S*H)

Interesting note that James Fenimore Cooper. Cooper, one of America's novelists, lived during the early populist movement in American history. Cooper was quick to recognize the dangers of majority rule. He also understood the proper definition of equality in the political context.

Many of his thoughts appeared in the American Democrat, Cooper's political essay first published in 1838. In it, Cooper noted that democracy defined as majority rule threatened the unalienable rights recognized by our founding ancestors unless strict limitations were placed on what majorities were permitted to decide. That, of course, was a primary purpose of the Constitution.

He also correctly saw equality in the political sense: equal treatment under the law. All men are created equal in that they are all born with rights to life, liberty, and property. No one is legally permitted to forcibly interfere with those interests as long as they are peacefully pursued.

Force is not legitimate when applied to achieve equality of condition. Government's role is to help people protect themselves against offensive force. Government is not the Great Redistributor.

James Fenimore Cooper joins William Faulkner on these pages as American writers who got it.

Labels:

Constitution,

democracy,

founders,

liberty,

natural law,

property,

rhetoric,

socialism

Thursday, September 8, 2016

Quiet Markets

Hello darkness, my old friend

I've come to talk with you again

--Simon & Garfunkel

Can't recall a two month period when markets have traded in such a narrow range both inter- and intra-day.

There is a theory, of course, that systems get noticeably quiet before periods of extreme volatility.

position in SPX

I've come to talk with you again

--Simon & Garfunkel

Can't recall a two month period when markets have traded in such a narrow range both inter- and intra-day.

There is a theory, of course, that systems get noticeably quiet before periods of extreme volatility.

position in SPX

Wednesday, September 7, 2016

When Bias Backfires

You got altered information

You were told to not take chances

--The Who

In the run up to the 2004 presidential election, the media's slant toward Kerry and away from Bush intensified. The negative Bush ads and failure to portray Kerry as anything other than qualified revealed a bias that was blatantly obvious to anyone but the most partisan Kerry supporter.

On election day, many polls (and all of the odds-making sites) had Kerry in the lead. But then early election night results found Bush taking several swing states by surprise, and the tables quickly turned.

I remember thinking that one factor working in Bush's favor may have been the heavily biased tone of the media. Their output was so slanted that large groups of voters in the middle may have said "enough" and pulled the lever for Bush as an expression of protest or of balancing the situation.

I wonder whether the same phenomenon may be at work again.

Media coverage of the two presidential candidates this time around has been so slanted that some outlets have confessed that they must compromise journalistic integrity in order to keep Trump from winning. Thus, Clinton gets a free pass on criminal behavior while Trump is put under the microscope for issues that appear trivial in comparison.

Onlookers with a sense of procedural fairness perceive this situation as out of balance and, although they might not see eye to eye with Trump, begin to root for the guy.

And if the bias becomes slanted enough, people who had no original intent to do so may vote for him.

You were told to not take chances

--The Who

In the run up to the 2004 presidential election, the media's slant toward Kerry and away from Bush intensified. The negative Bush ads and failure to portray Kerry as anything other than qualified revealed a bias that was blatantly obvious to anyone but the most partisan Kerry supporter.

On election day, many polls (and all of the odds-making sites) had Kerry in the lead. But then early election night results found Bush taking several swing states by surprise, and the tables quickly turned.

I remember thinking that one factor working in Bush's favor may have been the heavily biased tone of the media. Their output was so slanted that large groups of voters in the middle may have said "enough" and pulled the lever for Bush as an expression of protest or of balancing the situation.

I wonder whether the same phenomenon may be at work again.

Media coverage of the two presidential candidates this time around has been so slanted that some outlets have confessed that they must compromise journalistic integrity in order to keep Trump from winning. Thus, Clinton gets a free pass on criminal behavior while Trump is put under the microscope for issues that appear trivial in comparison.

Onlookers with a sense of procedural fairness perceive this situation as out of balance and, although they might not see eye to eye with Trump, begin to root for the guy.

And if the bias becomes slanted enough, people who had no original intent to do so may vote for him.

Tuesday, September 6, 2016

Labor Lost

Standing in line marking time

Waiting for the welfare dime

'Cause they can't buy a job

--Bruce Hornsby & the Range

Cheerleaders of the positive trend in BLS unemployment numbers ignore serious measurement problems with the series. One of them is it treats a job as a job regardless of quality.

Part time employment as a bartender counts the same as full time employment as an engineer.

Since the so-called 'recovery,' national employment trends that this administration loves to boast about have been goosed by rising underemployment.

Waiting for the welfare dime

'Cause they can't buy a job

--Bruce Hornsby & the Range

Cheerleaders of the positive trend in BLS unemployment numbers ignore serious measurement problems with the series. One of them is it treats a job as a job regardless of quality.

Part time employment as a bartender counts the same as full time employment as an engineer.

Since the so-called 'recovery,' national employment trends that this administration loves to boast about have been goosed by rising underemployment.

Labels:

Depression,

manipulation,

measurement,

Obama,

productivity

Monday, September 5, 2016

Capital Day

"I work hard all day, too, and what do I get? A lot of yak from you. You at least get out everyday, see things, talk to people. I never get out of this cave."

--Wilma Flintstone (The Flintstones)

Nice reminder that labor alone is not sufficient to advance prosperity. People working with their hands alone are destined to live their lives in Bedrock.

Rather, it is capital, i.e., production that has not been consumed or 'savings,' that creates the tools that advance productivity toward Orbit City.

As the author notes, a 'Capital Day' might go a long way to stir awareness in what seems like an ignored axiom.

Unfortunately, this ignorance foster the opposite of capital creation: capital consumption. Plus its direct consequence: declining productivity.

--Wilma Flintstone (The Flintstones)

Nice reminder that labor alone is not sufficient to advance prosperity. People working with their hands alone are destined to live their lives in Bedrock.

Rather, it is capital, i.e., production that has not been consumed or 'savings,' that creates the tools that advance productivity toward Orbit City.

As the author notes, a 'Capital Day' might go a long way to stir awareness in what seems like an ignored axiom.

Unfortunately, this ignorance foster the opposite of capital creation: capital consumption. Plus its direct consequence: declining productivity.

Labels:

capital,

intervention,

natural law,

productivity,

saving,

socialism

Sunday, September 4, 2016

Trading Places

"You're all committin' suicide!"

--Lewis Zabel (Wall Street: Money Never Sleeps)

Interesting then-and-now of the UBS trading floor in Stamford CT. Pre-financial crisis in 2008 when it was one of the largest trading floors in the world:

Today:

Of course, perhaps some capacity has merely been shifted elsewhere. More probably, trading capacity has been retired due to overbuilding during previous cycles.

Plus, increasing share of daily trading volume on many exchanges is being executed by robots.

--Lewis Zabel (Wall Street: Money Never Sleeps)

Interesting then-and-now of the UBS trading floor in Stamford CT. Pre-financial crisis in 2008 when it was one of the largest trading floors in the world:

Today:

Of course, perhaps some capacity has merely been shifted elsewhere. More probably, trading capacity has been retired due to overbuilding during previous cycles.

Plus, increasing share of daily trading volume on many exchanges is being executed by robots.

Saturday, September 3, 2016

Declining Productivity

I'm ten years burning down the road

Nowhere to run

Ain't got nowhere to go

--Bruce Springsteen

Productivity has been making headlines recently. Specifically, there have been concerns about the data coming out of the Bureau of Labor Statistics (the BLS is the 'gatekeeper' of national productivity data) that indicates slowing productivity growth and perhaps even productivity decline. Several commentators, such as Bill Gross, have been commenting on the corrosive effects of productivity decline and why it is occurring.

I track the BLS productivity series for use in my operations management class. I recently updated my spreadsheet with an eye on recent trends. The graph below shows manufacturing and nonfarm business (essentially manufacturing + service sectors together). The nonfarm business series goes back further because, well, the BLS mysteriously truncated all years in the manufacturing series prior to 1987 a couple of years back. Why it did this I do not know.

The data points represent annual percentage changes in productivity from the year prior. Positive numbers reflect increasing productivity; negative numbers indicate productivity decline. Focusing on the non-farm business series for which we have more data (and likely to be more representative of the overall economy), note that, with few exceptions, productivity has increased each year since 1950 with the average being about 2.1%.

Until recently, there has been no noticeable trend in the data. While there have been short term excursions downward, they were followed by movement higher that made the entire series appear stationary from a statistical standpoint.

That has been changing, however. The eye is drawn to a more persistent downtrend that commenced in 2000. The graph below focuses on this period. It is difficult to ignore the series of lower highs and lower lows that define the downtrend pattern. The most recent five year period (2011-2016) is particularly noteworthy, as never in the history of this BLS series has there been a period of five successive years of productivity increases of 1% or less.

What about statistical tests of significance? Well, if we split the nonfarm business series into essentially two halves--a 1950-1980 period and a 1981-present period-- the averages for the two periods are 2.41 and 1.84 respectively. Although the average in the second half is lower, a t-test suggest that those differences are not statistically significant (p = .146). More lower data points ahead will obviously change that, of course.

I also broke the 2000-2016 period into 2000-2010 bucket and a 2011-2016 bucket. The average productivity changes of 2.62 and 0.40 in these two recent periods were, as the eye suggests, highly significant (p = .000).

Conclusion: evidence suggests that US productivity is in fact trending lower in a manner that we haven't seen in nearly 70 years.

Nowhere to run

Ain't got nowhere to go

--Bruce Springsteen

Productivity has been making headlines recently. Specifically, there have been concerns about the data coming out of the Bureau of Labor Statistics (the BLS is the 'gatekeeper' of national productivity data) that indicates slowing productivity growth and perhaps even productivity decline. Several commentators, such as Bill Gross, have been commenting on the corrosive effects of productivity decline and why it is occurring.

I track the BLS productivity series for use in my operations management class. I recently updated my spreadsheet with an eye on recent trends. The graph below shows manufacturing and nonfarm business (essentially manufacturing + service sectors together). The nonfarm business series goes back further because, well, the BLS mysteriously truncated all years in the manufacturing series prior to 1987 a couple of years back. Why it did this I do not know.

The data points represent annual percentage changes in productivity from the year prior. Positive numbers reflect increasing productivity; negative numbers indicate productivity decline. Focusing on the non-farm business series for which we have more data (and likely to be more representative of the overall economy), note that, with few exceptions, productivity has increased each year since 1950 with the average being about 2.1%.

Until recently, there has been no noticeable trend in the data. While there have been short term excursions downward, they were followed by movement higher that made the entire series appear stationary from a statistical standpoint.

That has been changing, however. The eye is drawn to a more persistent downtrend that commenced in 2000. The graph below focuses on this period. It is difficult to ignore the series of lower highs and lower lows that define the downtrend pattern. The most recent five year period (2011-2016) is particularly noteworthy, as never in the history of this BLS series has there been a period of five successive years of productivity increases of 1% or less.

What about statistical tests of significance? Well, if we split the nonfarm business series into essentially two halves--a 1950-1980 period and a 1981-present period-- the averages for the two periods are 2.41 and 1.84 respectively. Although the average in the second half is lower, a t-test suggest that those differences are not statistically significant (p = .146). More lower data points ahead will obviously change that, of course.

I also broke the 2000-2016 period into 2000-2010 bucket and a 2011-2016 bucket. The average productivity changes of 2.62 and 0.40 in these two recent periods were, as the eye suggests, highly significant (p = .000).

Conclusion: evidence suggests that US productivity is in fact trending lower in a manner that we haven't seen in nearly 70 years.

Labels:

capital,

Fed,

intervention,

manipulation,

measurement,

productivity

Friday, September 2, 2016

Supply Chain Disruption

To the heart and mind

Ignorance is kind

There's no comfort in the truth

Pain is all you'll find

--Wham

The other example involves Korean shipping giant Hanjin which filed for bankruptcy protection on Wednesday. Hanjin, a major shipping container carrier, stopped taking new cargo and US ports have begun turning away Hanjin ships. It is estimated that nearly 500,000 containers full of goods could be stuck in the mud while supply chains sort this disruption out. Moreover, many expect shipping rates to go up as Hanjin's capacity leaves the market.

no positions

Ignorance is kind

There's no comfort in the truth

Pain is all you'll find

--Wham

Two good examples of supply chain disruption in the news this week. One is the fire at Gap's distribution center (DC) in New York. The DC represents about 10% of the company's nationwide warehouse capacity that supplies Gap and Banana Republic merchandise to online and store customers primarily in the northeast. Disruption from the fire creates a bottleneck for replenishing store inventories and filling online business during the back-to-school and upcoming holiday seasons. It appears that Gap supply chain managers are looking at company DCs in Tennessee and Ohio to pick up the slack.

The other example involves Korean shipping giant Hanjin which filed for bankruptcy protection on Wednesday. Hanjin, a major shipping container carrier, stopped taking new cargo and US ports have begun turning away Hanjin ships. It is estimated that nearly 500,000 containers full of goods could be stuck in the mud while supply chains sort this disruption out. Moreover, many expect shipping rates to go up as Hanjin's capacity leaves the market.

no positions

Thursday, September 1, 2016

Voting Rights

In violent times

You shouldn't have to sell your soul

Those one track minds

They really, really ought to know

--Tears for Fears

Just as government has no legitimate authority to take resources from individuals to fund welfare or warfare programs, no individual has the right to vote for government agents that will forcibly take those resources. When elections involve advance auctions on stolen goods, no one has a legitimate right to vote.

You shouldn't have to sell your soul

Those one track minds

They really, really ought to know

--Tears for Fears

Just as government has no legitimate authority to take resources from individuals to fund welfare or warfare programs, no individual has the right to vote for government agents that will forcibly take those resources. When elections involve advance auctions on stolen goods, no one has a legitimate right to vote.

Labels:

agency problem,

Depression,

government,

health care,

intervention,

natural law,

security,

self defense,

socialism,

war

Subscribe to:

Posts (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)