I've been in my mind

It's such a fine line

That keeps searching for a heart of gold

--Neil Young

Daily gold chart looks cup-and-handlish.

Potentially bullish.

position in gold

Sunday, January 31, 2016

Saturday, January 30, 2016

Presidents and Regulation

I lie awake

Burning inside

Nowhere to run

Nowhere to hide

--Roger Daltrey

Article discusses rate of increase in regulatory restrictions under each presidential administration since Carter. Results suggest that there has been little difference in rate of regulatory increase among administrations save the second terms of both Reagan and Clinton.

"Over the last 20 years, the regulatory budget has more than doubled in real terms, while the total number of restrictions has grown by about 220,000 - a 25 percent increase.

Restricting freedom has been a bi-partisan activity.

Burning inside

Nowhere to run

Nowhere to hide

--Roger Daltrey

Article discusses rate of increase in regulatory restrictions under each presidential administration since Carter. Results suggest that there has been little difference in rate of regulatory increase among administrations save the second terms of both Reagan and Clinton.

"Over the last 20 years, the regulatory budget has more than doubled in real terms, while the total number of restrictions has grown by about 220,000 - a 25 percent increase.

Restricting freedom has been a bi-partisan activity.

Labels:

Bush,

Clinton,

freedom,

intervention,

liberty,

Obama,

regulation,

socialism

Friday, January 29, 2016

Tumbling Yields

I close my eyes

Oh God, I think I'm falling

--Madonna

Japan's announcement last night that it is joining the negative interest rate policy (NIRP) club finds sovereign yields tumbling lower this morning. That few economists saw this coming demonstrates how clueless this group as a whole is.

T-note yields have gapped below 2%.

Leverage chasing lower yields. A mighty dangerous thing.

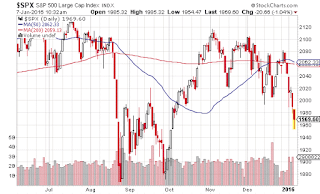

position in SPX

Oh God, I think I'm falling

--Madonna

Japan's announcement last night that it is joining the negative interest rate policy (NIRP) club finds sovereign yields tumbling lower this morning. That few economists saw this coming demonstrates how clueless this group as a whole is.

T-note yields have gapped below 2%.

Leverage chasing lower yields. A mighty dangerous thing.

position in SPX

Thursday, January 28, 2016

Criminal Indifference

"Two words, Mr President: plausible deniability."

--Secretary of Defense Albert Nimziki (Independence Day)

Building on previous comments, Judge Nap remains on the case of Hillary Clinton, namely that the FBI is currently and aggressively building cases against Hillary Clinton for failure to safeguard state secrets and for using her position as secretary of state to advance the financial position of the Clinton Foundation. He believes that the FBI will recommend that the Department of Justice convene a grand jury seek an indictment against Ms Clinton for espionage.

He suspects, based on recent remarks from Clinton, that if an indictment does come that she might plead that she was so technologically inept that she did not know what she was doing when she worked with top secret emails on non-secure platforms. Her case essentially becomes one of plausible deniability.

However, the Judge argues that plausible deniability is not a valid defense in Clinton's situation. Failure to safeguard state secrets is a crime for which the government does not need to prove intent. Whether negligence is involved is inconsequential. Plausible deniability in this case would be an admission of negligence and of guilt.

Moreover, when she first become secretary of state, Clinton signed an oath, under penalty of perjury, that she was fully briefed by the FBI on the lawful requirements of keeping state secrets. The obligation to safeguard state secrets is absolute and cannot be avoided or evaded by acts of negligence. Such negligence can bring prosecution.

Claims of plausible deniability amounts to a case of criminal indifference here.

As the Judge observes, we will soon learn whether the rule of law still commands some respect in this country.

--Secretary of Defense Albert Nimziki (Independence Day)

Building on previous comments, Judge Nap remains on the case of Hillary Clinton, namely that the FBI is currently and aggressively building cases against Hillary Clinton for failure to safeguard state secrets and for using her position as secretary of state to advance the financial position of the Clinton Foundation. He believes that the FBI will recommend that the Department of Justice convene a grand jury seek an indictment against Ms Clinton for espionage.

He suspects, based on recent remarks from Clinton, that if an indictment does come that she might plead that she was so technologically inept that she did not know what she was doing when she worked with top secret emails on non-secure platforms. Her case essentially becomes one of plausible deniability.

However, the Judge argues that plausible deniability is not a valid defense in Clinton's situation. Failure to safeguard state secrets is a crime for which the government does not need to prove intent. Whether negligence is involved is inconsequential. Plausible deniability in this case would be an admission of negligence and of guilt.

Moreover, when she first become secretary of state, Clinton signed an oath, under penalty of perjury, that she was fully briefed by the FBI on the lawful requirements of keeping state secrets. The obligation to safeguard state secrets is absolute and cannot be avoided or evaded by acts of negligence. Such negligence can bring prosecution.

Claims of plausible deniability amounts to a case of criminal indifference here.

As the Judge observes, we will soon learn whether the rule of law still commands some respect in this country.

Wednesday, January 27, 2016

Bureaucratic Forest

It's too easy to live like clockwork

Tick tock watchin' the world go by

Any change would take too long

So dry your eyes

--Genesis

Related to the last post, this article puts into perspective just how enormous the Code of Federal Regulations is. Reading the 2012 version on a full time basis would take about...three years.

Bureaucratic red tape? More like the bureaucratic forest.

Tick tock watchin' the world go by

Any change would take too long

So dry your eyes

--Genesis

Related to the last post, this article puts into perspective just how enormous the Code of Federal Regulations is. Reading the 2012 version on a full time basis would take about...three years.

Bureaucratic red tape? More like the bureaucratic forest.

Labels:

bureaucracy,

entrepreneurship,

government,

intervention,

lifestyle,

media,

regulation

Tuesday, January 26, 2016

Newspaper Decline

"It's not enough anymore to give 'em just news. They want comics, contests, puzzles. They want to know how to bake a cake, win friends, and influence the future. Ergo horoscopes, tips on the horses, interpretations of dreams so they can win on the numbers lottery. And, if they accidently stumble on the front page, news!"

--Ed Hucheson (Deadline U.S.A.)

Interesting data here on newspaper trends. Was frankly surprised that the downtrends were not more severe--particularly w.r.t. number since the Internet era. Eyeballing it, it appears that number of daily newspapers is down by about 35% since 1920 and perhaps about 5% since 2000.

Circulation seems to show a more pronounced Internet Effect. After increasing more than doubling from 1920 to the 1970s and then holding steady for about twenty years, daily circulation has fallen by about 40%, with the downtrend getting steeper since 2000.

The article suggests the influence of regulation in insulating and hamstringing newspapers against competition and building capacity for adaptation. For example, FCC rules prohibit local newspapers from diversifying into local television markets, while permitting large media conglomerates to acquire local TV properties.

Stated differently, the decline of printed news has not been entirely self-imposed.

--Ed Hucheson (Deadline U.S.A.)

Interesting data here on newspaper trends. Was frankly surprised that the downtrends were not more severe--particularly w.r.t. number since the Internet era. Eyeballing it, it appears that number of daily newspapers is down by about 35% since 1920 and perhaps about 5% since 2000.

Circulation seems to show a more pronounced Internet Effect. After increasing more than doubling from 1920 to the 1970s and then holding steady for about twenty years, daily circulation has fallen by about 40%, with the downtrend getting steeper since 2000.

The article suggests the influence of regulation in insulating and hamstringing newspapers against competition and building capacity for adaptation. For example, FCC rules prohibit local newspapers from diversifying into local television markets, while permitting large media conglomerates to acquire local TV properties.

Stated differently, the decline of printed news has not been entirely self-imposed.

Monday, January 25, 2016

Founding Mother

Benjamin Martin: May I sit with you.

Charlotte Selton: It's a free country. Or at least it will be.

--The Patriot

Nice background on Mercy Otis Warren, who may well be considered the Founding Mother of the United States. An accomplished writer and historian, she is viewed by many as the 'conscience of the revolution.'

Warren's 1772 anonymously written play, The Adulateur, foretold the coming revolution and enjoyed enthusiastic reception among liberty-hungry colonists. Producing much of her work anonymously, she gained traction as the patriots' secret pen.

Post revolution, she took a decidedly Anti-Federalist view of the Constitution as drafted from the 1787 convention. Warren wrote that the Constitution as written would "betray the people of the United States into an acceptance of a most complicated system of government" that, without explicit guarantees of individual rights, the Constitution would undermine the liberty that Americans had fought for. She proposed the addition of "a bill of rights to guard against the dangerous encroachments of power."

Through her influence and that of other Anti-Federalists, the Bill of Rights was amended to the Constitution.

In her later years Warren worried that future generations would give their liberty away through apathy, lies, and unprincipled compromise. She wrote,

"The characters of nations have been disgraced by their weak partialities, until their freedom has been irretrievably lost in that vortex of folly which throws a lethargy over the mind, till awakened by the fatal consequences which result from arbitrary power, disguised by specious pretexts amidst a general relaxation of manners [personal character]."

Lethargy of the mind, rise of arbitrary power, decline in personal character.

Mercy Otis Warren foresaw many of today's threats to liberty.

Charlotte Selton: It's a free country. Or at least it will be.

--The Patriot

Nice background on Mercy Otis Warren, who may well be considered the Founding Mother of the United States. An accomplished writer and historian, she is viewed by many as the 'conscience of the revolution.'

Warren's 1772 anonymously written play, The Adulateur, foretold the coming revolution and enjoyed enthusiastic reception among liberty-hungry colonists. Producing much of her work anonymously, she gained traction as the patriots' secret pen.

Post revolution, she took a decidedly Anti-Federalist view of the Constitution as drafted from the 1787 convention. Warren wrote that the Constitution as written would "betray the people of the United States into an acceptance of a most complicated system of government" that, without explicit guarantees of individual rights, the Constitution would undermine the liberty that Americans had fought for. She proposed the addition of "a bill of rights to guard against the dangerous encroachments of power."

Through her influence and that of other Anti-Federalists, the Bill of Rights was amended to the Constitution.

In her later years Warren worried that future generations would give their liberty away through apathy, lies, and unprincipled compromise. She wrote,

"The characters of nations have been disgraced by their weak partialities, until their freedom has been irretrievably lost in that vortex of folly which throws a lethargy over the mind, till awakened by the fatal consequences which result from arbitrary power, disguised by specious pretexts amidst a general relaxation of manners [personal character]."

Lethargy of the mind, rise of arbitrary power, decline in personal character.

Mercy Otis Warren foresaw many of today's threats to liberty.

Labels:

antifederalists,

Constitution,

founders,

freedom,

liberty,

self defense,

war

Sunday, January 24, 2016

Disarming Government

The war machine springs to life

Opens up one eager eye

--Nena

Imagine a world where all governments were disarmed. No guns, bullets, tanks, missiles, fighter planes, et al in the hands of government agents.

Not only would the global peace quotient move much higher, but it would essentially end government as we know it . Government as we know it is authoritarian and requires force in order to enact its policies. Without capacity for force, government would lose its power to collect resources via taxes and other mechanisms. Without those resources, the government leviathan would starve.

Next time you hear gun grabbers cry for the elimination of firearms, rest assured that they do not mean to completely eliminate guns. They need guns in their agent's hands in order to enact policies that require force to implement.

Opens up one eager eye

--Nena

Imagine a world where all governments were disarmed. No guns, bullets, tanks, missiles, fighter planes, et al in the hands of government agents.

Not only would the global peace quotient move much higher, but it would essentially end government as we know it . Government as we know it is authoritarian and requires force in order to enact its policies. Without capacity for force, government would lose its power to collect resources via taxes and other mechanisms. Without those resources, the government leviathan would starve.

Next time you hear gun grabbers cry for the elimination of firearms, rest assured that they do not mean to completely eliminate guns. They need guns in their agent's hands in order to enact policies that require force to implement.

Labels:

agency problem,

capacity,

government,

self defense,

socialism,

taxes,

war

Saturday, January 23, 2016

Crossing Teas

Senator Joseph Paine: He can raise public opinion against us. If any part of this sticks...

James Taylor: Aah, he'll never get started. I'll make public opinion out there in five hours! I've done it all my life. I'll blacken this punk so that he'll--you just leave public opinion to me. Now, Joe, I think you'd better go back into the Senate and keep those senators lined up.

--Mr Smith Goes to Washington

During the early days of the Tea Party movement these pages observed that establishment Republicans would ride the coat tails of Tea Party types only so long. The Tea Party's core values of fiscal responsibility, limited government, and free markets share little in common with the mainstream GOP. Indeed, the big government roots of the Republican Party can be traced back to the American System platform upon which the party was built.

On the political landscape, Republicans are much closer to Democrats in their political actions.

Although mainstream Republicans have been distancing themselves from Tea Party types for a few years, we're now seeing a good example of true 'enemy of my enemy is my friend' strategy with respect to presidential candidates.

While neither Ted Cruz nor Donald Trump can be considered perfect reflections of Tea Party values (particularly Trump), their platforms certainly qualify as 'anti-establishment.' By definition, then, they are a threat to mainstream Republicans, who are speaking out in droves against Trump and Cruz. This is particularly the case with Cruz, who mainliners claim would be less likely to 'deal' and therefore to strike compromises compared to Trump. This assessment seems accurate to me.

That some establishment GOPers have said that they'd rather vote for a Democrat than Ted Cruz reveals much about how close the two political parties are in ideological terms. Mainline Republican repulsion to Cruz also suggests him as closest to the Tea Party concept among top polling presidential candidates to date.

James Taylor: Aah, he'll never get started. I'll make public opinion out there in five hours! I've done it all my life. I'll blacken this punk so that he'll--you just leave public opinion to me. Now, Joe, I think you'd better go back into the Senate and keep those senators lined up.

--Mr Smith Goes to Washington

During the early days of the Tea Party movement these pages observed that establishment Republicans would ride the coat tails of Tea Party types only so long. The Tea Party's core values of fiscal responsibility, limited government, and free markets share little in common with the mainstream GOP. Indeed, the big government roots of the Republican Party can be traced back to the American System platform upon which the party was built.

On the political landscape, Republicans are much closer to Democrats in their political actions.

Although mainstream Republicans have been distancing themselves from Tea Party types for a few years, we're now seeing a good example of true 'enemy of my enemy is my friend' strategy with respect to presidential candidates.

While neither Ted Cruz nor Donald Trump can be considered perfect reflections of Tea Party values (particularly Trump), their platforms certainly qualify as 'anti-establishment.' By definition, then, they are a threat to mainstream Republicans, who are speaking out in droves against Trump and Cruz. This is particularly the case with Cruz, who mainliners claim would be less likely to 'deal' and therefore to strike compromises compared to Trump. This assessment seems accurate to me.

That some establishment GOPers have said that they'd rather vote for a Democrat than Ted Cruz reveals much about how close the two political parties are in ideological terms. Mainline Republican repulsion to Cruz also suggests him as closest to the Tea Party concept among top polling presidential candidates to date.

Labels:

government,

liberty,

manipulation,

markets,

media,

socialism,

Tea Party

Friday, January 22, 2016

Bank Shot

You can make or break

You can win or lose

That's a chance you take

When the heat's on you

And the heat is on

--Glenn Frey

Todd Harrison just Tweeted the following:

Indeed, there's a lot of room between up here and down there.

position in SPX

You can win or lose

That's a chance you take

When the heat's on you

And the heat is on

--Glenn Frey

Todd Harrison just Tweeted the following:

Boy that $BKX chart makes me wanna sell rallies...and there's *some* room to do that.

— Todd Harrison (@todd_harrison) January 22, 2016

Using a horizon similar to what we just showed for the SPX, a case can be made that the banks are suggesting lower general prices as the BKX has already decisively broken its key support line (BKX 66ish) and is currently chewing thru its 200 day moving avg.Indeed, there's a lot of room between up here and down there.

position in SPX

Means of Support

See it in the headlines

You hear it every day

They say they're gonna stop it

But it doesn't go away

--Glenn Frey

This end of week rally was somewhat intuitive given the selling of late. And, as of Friday morning, the SPX has reclaimed the 1880 level. This will likely draw bulls in under the presumption that, as in the past, this strength following a nasty sell-down signals the all clear for higher prices.

I'm certainly not slurping that Kool Aid, although I did cover the majority of my short exposure into the -500+ intraday Dow melt a couple days back. Rather than buy 'em, however, I'm to looking for opportunities to reload on the short side.

Pulling back the time frame indicates lack of support between that 1880 level and...1100 (not to mention that head and shoulders topping pattern).

That's what one way moves do, cookie. They leave support behind.

position in SPX

You hear it every day

They say they're gonna stop it

But it doesn't go away

--Glenn Frey

This end of week rally was somewhat intuitive given the selling of late. And, as of Friday morning, the SPX has reclaimed the 1880 level. This will likely draw bulls in under the presumption that, as in the past, this strength following a nasty sell-down signals the all clear for higher prices.

I'm certainly not slurping that Kool Aid, although I did cover the majority of my short exposure into the -500+ intraday Dow melt a couple days back. Rather than buy 'em, however, I'm to looking for opportunities to reload on the short side.

Pulling back the time frame indicates lack of support between that 1880 level and...1100 (not to mention that head and shoulders topping pattern).

That's what one way moves do, cookie. They leave support behind.

position in SPX

Thursday, January 21, 2016

Depression Market Analog

The shadow's high on the darker side

Behind those doors, it's a wilder ride

--Glenn Frey

Few realize that after their infamous 'crash' in the late 1920s and early 1930s, stock spent some years of the Great Depression rallying higher until FDR's New Deal stimulus began running out of gas in 1936-37.

Interesting analog here raises the spectre of a similar phenomenon unfolding now.

As the saying goes, history rarely repeats but often rhymes.

Behind those doors, it's a wilder ride

--Glenn Frey

Few realize that after their infamous 'crash' in the late 1920s and early 1930s, stock spent some years of the Great Depression rallying higher until FDR's New Deal stimulus began running out of gas in 1936-37.

Interesting analog here raises the spectre of a similar phenomenon unfolding now.

As the saying goes, history rarely repeats but often rhymes.

Labels:

Depression,

intervention,

measurement,

technical analysis

Wednesday, January 20, 2016

Ranking Rights

Benjamin Martin: May I sit with you?

Charlotte Selton: It's a free country. Or at least it will be.

--The Patriot

Gun control advocates claim that the Second Amendment should not 'trump all else' and that the right to self defense needs to be 'balanced' alongside other rights.

These claims are misguided. The framers did not enumerate rights with weightings or rankings. All carry the same weight--that of being completely secured. They are equally protected under the law and not subject to compromise or infringement.

More of one right cannot be negotiated at the expense of another because each individual is born with them in their totality.

The spectre of horsetrading rights is a construct of the statist mind meant to dupe people into believing that the natural rights granted to them by their Creator or by their humanity (not by government) are limited and subject to negotiation.

Charlotte Selton: It's a free country. Or at least it will be.

--The Patriot

Gun control advocates claim that the Second Amendment should not 'trump all else' and that the right to self defense needs to be 'balanced' alongside other rights.

These claims are misguided. The framers did not enumerate rights with weightings or rankings. All carry the same weight--that of being completely secured. They are equally protected under the law and not subject to compromise or infringement.

More of one right cannot be negotiated at the expense of another because each individual is born with them in their totality.

The spectre of horsetrading rights is a construct of the statist mind meant to dupe people into believing that the natural rights granted to them by their Creator or by their humanity (not by government) are limited and subject to negotiation.

Labels:

Bible,

Constitution,

founders,

freedom,

government,

liberty,

natural law,

self defense,

socialism,

war

Tuesday, January 19, 2016

World Market Cap

The traffic roars

And the sirens scream

You look at the faces

It's just like a dream

--Glenn Frey

What's the market cap of world equity markets? About $30 trillion according to a B of A analyst. The US represents about half of that.

The article notes that currently market values are generally not close to the size of the respective country land masses.

Interesting to ponder whether that might change in the future.

position in SPX

And the sirens scream

You look at the faces

It's just like a dream

--Glenn Frey

What's the market cap of world equity markets? About $30 trillion according to a B of A analyst. The US represents about half of that.

The article notes that currently market values are generally not close to the size of the respective country land masses.

Interesting to ponder whether that might change in the future.

position in SPX

Monday, January 18, 2016

Unmarked Energy

Here I am in silence

Looking round without a clue

I find myself alone again

All alone with you

--Information Society

Many believe that the key to stemming the credit market meltdown in early 2009 was not TARP, ZIRP, QE or any other acronym spooned into the monetary policy alphabet soup. Instead, it was Fed-led efforts to suspend FASB market-to-market requirements which permitted banks et al to avoid accurately pricing illiquid, depreciated mortgage backed securities and other assets--thereby steering clear of having to report conditions of insolvency.

It appears that the Fed is at it again--this time in the energy patch. ZeroHedge reports that the Dallas Fed has quietly suspended requirements for its area banks to mark distressed energy sector bonds to market. As such, banks are not reporting impairments or writing down losses from investments in energy industry debt. Using Wells Fargo (WFC) as an example, it is easy to posit that banks are lugging hundreds of billions of energy sector junk bonds. It is also easy to postulate contagion potential.

Stated differently, banks are once again bailed out by the Fed for excessive risk taking. Last time around the theme was mortgage backed securities. This time around it is junk bonds linked to energy companies.

no positions

Looking round without a clue

I find myself alone again

All alone with you

--Information Society

Many believe that the key to stemming the credit market meltdown in early 2009 was not TARP, ZIRP, QE or any other acronym spooned into the monetary policy alphabet soup. Instead, it was Fed-led efforts to suspend FASB market-to-market requirements which permitted banks et al to avoid accurately pricing illiquid, depreciated mortgage backed securities and other assets--thereby steering clear of having to report conditions of insolvency.

It appears that the Fed is at it again--this time in the energy patch. ZeroHedge reports that the Dallas Fed has quietly suspended requirements for its area banks to mark distressed energy sector bonds to market. As such, banks are not reporting impairments or writing down losses from investments in energy industry debt. Using Wells Fargo (WFC) as an example, it is easy to posit that banks are lugging hundreds of billions of energy sector junk bonds. It is also easy to postulate contagion potential.

Stated differently, banks are once again bailed out by the Fed for excessive risk taking. Last time around the theme was mortgage backed securities. This time around it is junk bonds linked to energy companies.

no positions

Labels:

balance sheet,

bonds,

credit,

debt,

derivatives,

energy,

Fed,

intervention,

leverage,

moral hazard,

risk

Sunday, January 17, 2016

Regulation and the Status Quo

It's down to me, yes it is

The way she does just what she's told

Down to me, the change has come

She's under my thumb

--The Rolling Stones

Nice point made by Jeffrey Tucker. He observes that government-imposed regulations "freeze the status quo in place and make it permanent."

Not sure I would go quite that far. Innovations can still happen in regulated environments, as Tucker's own incandescent light bulb example demonstrates. Whether due to man's innate desire to improve, or merely to satisfy demand in black markets erected by regulation, progress is still likely to occur over time.

But regulation in all of its forms certainly slows it down. Regulation is harmful. It hurts people and can cost lives directly or via opportunity costs.

Ironically, people who champion regulation are often self-identify as 'progressives.' In reality the regulatory actions of these people restrain progress and preserve the status quo.

The way she does just what she's told

Down to me, the change has come

She's under my thumb

--The Rolling Stones

Nice point made by Jeffrey Tucker. He observes that government-imposed regulations "freeze the status quo in place and make it permanent."

Not sure I would go quite that far. Innovations can still happen in regulated environments, as Tucker's own incandescent light bulb example demonstrates. Whether due to man's innate desire to improve, or merely to satisfy demand in black markets erected by regulation, progress is still likely to occur over time.

But regulation in all of its forms certainly slows it down. Regulation is harmful. It hurts people and can cost lives directly or via opportunity costs.

Ironically, people who champion regulation are often self-identify as 'progressives.' In reality the regulatory actions of these people restrain progress and preserve the status quo.

Labels:

entrepreneurship,

regulation,

socialism,

time horizon

Saturday, January 16, 2016

Avoiding the Abyss

"It's a bottomless pit, baby. Two and a half miles straight down."

--Catfish De Vries (The Abyss)

After an intraday melt saw the Dow down more than 500 pts, bulls were able to pull the indexes back from the abyss to salvage a close that held onto the August lows. The SPX closed at, yep, 1880.

May be talking my book here but angst does not feel that high here. Sure, folks are talking about the rough start to the year and recognition of the August lows seems nearly universal here. But, as Fleck recently mentioned, it is one thing to be bearish in mind and another thing entirely to be bearish in action here. The past few years have seen many face ripping rallies that have likely conditioned the actions of bulls (take more risk) and bears (take less risk) alike.

In my view, that's bearish on the margin.

position in SPX

--Catfish De Vries (The Abyss)

After an intraday melt saw the Dow down more than 500 pts, bulls were able to pull the indexes back from the abyss to salvage a close that held onto the August lows. The SPX closed at, yep, 1880.

May be talking my book here but angst does not feel that high here. Sure, folks are talking about the rough start to the year and recognition of the August lows seems nearly universal here. But, as Fleck recently mentioned, it is one thing to be bearish in mind and another thing entirely to be bearish in action here. The past few years have seen many face ripping rallies that have likely conditioned the actions of bulls (take more risk) and bears (take less risk) alike.

In my view, that's bearish on the margin.

position in SPX

Labels:

media,

moral hazard,

risk,

sentiment,

technical analysis

Friday, January 15, 2016

Of Fish and Bait

As sure as night is dark and day is light

I keep you on my mind both day and night

--Johnny Cash

With another 2% down morning, we're here at the Aug lows. Some technical support evident in the SPX 1850-1880 zone. After that, not much till 1700ish.

Note also the head-and-shoulders look...

Took some exposure off (INTC puts with stock down on an 8% whoosh). Will let other short exposure (SH, JPM puts) ride for now.

position in SH, JPM

I keep you on my mind both day and night

--Johnny Cash

With another 2% down morning, we're here at the Aug lows. Some technical support evident in the SPX 1850-1880 zone. After that, not much till 1700ish.

Note also the head-and-shoulders look...

Took some exposure off (INTC puts with stock down on an 8% whoosh). Will let other short exposure (SH, JPM puts) ride for now.

position in SH, JPM

Labels:

asset allocation,

derivatives,

sentiment,

technical analysis

Thursday, January 14, 2016

Hillary's Problem

Robert Ritter: Jack, computer theft is a serious crime.

Jack Ryan: So are crimes against the Constitution.

--Clear and Present Danger

Consistent with previous comments, Judge Nap continues to build the espionage case against Hillary Clinton. He notes that there are now over 100 FBI agents investigating Ms Clinton for various violations of the law. The most recent thread involves whether she made decisions as secretary of state that would benefit her family foundation or her husband's speaking engagements.

The judge believes that this investigation will lead the FBI to recommend indictment. That recommendation, of course, would go to the attorney general who belongs to the same political party as Clinton, which increases the likelihood that justice will not be immediately served--particularly given Clinton's position as the leading presidential candidate for the party.

It certainly does not seem like people are generally taking prospects for indictment seriously here. The judge, on the other hand, suspects that Hillary's problem is not going away.

Jack Ryan: So are crimes against the Constitution.

--Clear and Present Danger

Consistent with previous comments, Judge Nap continues to build the espionage case against Hillary Clinton. He notes that there are now over 100 FBI agents investigating Ms Clinton for various violations of the law. The most recent thread involves whether she made decisions as secretary of state that would benefit her family foundation or her husband's speaking engagements.

The judge believes that this investigation will lead the FBI to recommend indictment. That recommendation, of course, would go to the attorney general who belongs to the same political party as Clinton, which increases the likelihood that justice will not be immediately served--particularly given Clinton's position as the leading presidential candidate for the party.

It certainly does not seem like people are generally taking prospects for indictment seriously here. The judge, on the other hand, suspects that Hillary's problem is not going away.

Labels:

Clinton,

Constitution,

manipulation,

media,

natural law,

socialism,

socionomics,

war

Wednesday, January 13, 2016

Deleveraging?

"It's all just the same thing over and over. We can't help ourselves. And you and I can't control it, stop it, or even slow it. Or even ever so slightly alter it."

--John Tuld (Margin Call)

The period since 2007-08 has often been labeled the time of 'great deleveraging.' This post points out the falsehood of that label.

Leverage has gone up in almost a straight line since 2000. Barely a blip can be observed as part of the 07-08 credit crisis.

This period is better termed the time of continued leveraging.

--John Tuld (Margin Call)

The period since 2007-08 has often been labeled the time of 'great deleveraging.' This post points out the falsehood of that label.

Leverage has gone up in almost a straight line since 2000. Barely a blip can be observed as part of the 07-08 credit crisis.

This period is better termed the time of continued leveraging.

Tuesday, January 12, 2016

Ugly Reversal

Turn around

Every now and then

I get a little bit nervous

That the best of all the years have gone by

--Bonnie Tyler

Ugly 200+ pt reversal in DJIA this am.

Seems to me that bulls have to stay composed here or a stampede toward the exits may be on.

position in SPX

Every now and then

I get a little bit nervous

That the best of all the years have gone by

--Bonnie Tyler

Ugly 200+ pt reversal in DJIA this am.

Seems to me that bulls have to stay composed here or a stampede toward the exits may be on.

position in SPX

Monday, January 11, 2016

Obamagun

I must've dreamed a thousand dreams

Been haunted by a million screams

I can hear the marching feet

They're moving into the street

--Genesis

Amusing graphical follow-up to previous post.

I think fingerprint ID is already being explored.

Been haunted by a million screams

I can hear the marching feet

They're moving into the street

--Genesis

Amusing graphical follow-up to previous post.

I think fingerprint ID is already being explored.

Chief Executive Warlord

"While the biggest arms dealer in the world is your boss, the President of the United States, who ships more merchandise in a day that I do in a year, sometimes it's embarrassing to have his fingerprints on the guns. Sometimes he needs a freelancer like me to supply forces he can't be seen supplying."

--Yuri Orlov (Lord of War)

Once again, President Obama is seeking to further regulate gun ownership--this time thru use of executive orders. Judge Nap explains why the president has little legal authority to do so.

Jacob Hornberger adds that President Obama, while trying to regulate gun ownership of the US citizenry, presides over the largest arms dealer on the planet--that being the federal government. In 2014 US government sales of weaponry topped $36 billion, up 35% from the previous year.

As these pages have noted, statists are not against guns. They need guns in order to enforce their policies. To increase their forceful advantage, statists need to disarm those who oppose them.

President Obama is merely seeking to strengthen his position as Chief Executive Warlord.

--Yuri Orlov (Lord of War)

Once again, President Obama is seeking to further regulate gun ownership--this time thru use of executive orders. Judge Nap explains why the president has little legal authority to do so.

Jacob Hornberger adds that President Obama, while trying to regulate gun ownership of the US citizenry, presides over the largest arms dealer on the planet--that being the federal government. In 2014 US government sales of weaponry topped $36 billion, up 35% from the previous year.

As these pages have noted, statists are not against guns. They need guns in order to enforce their policies. To increase their forceful advantage, statists need to disarm those who oppose them.

President Obama is merely seeking to strengthen his position as Chief Executive Warlord.

Labels:

Constitution,

media,

Obama,

property,

self defense

Sunday, January 10, 2016

Sleepless in Cincinnati

Nickerson: Where are you going?

Stefen Djordjevic: Where am I going? No place, man.

--All the Right Moves

Am certain that many Cincinnati Bengal players and fans found it difficult to sleep last night after a late game meltdown that can only be described as 'epic.' Truly, fiction could not have told a greater tale of self-destruction.

The play calling and execution were certainly questionable and will be subject of close hindsight-oriented scrutiny for some time.

To me, however, the larger issue was complete lack of emotional control that escalated as the game progressed and hit a crescendo in that last 1:36. Regardless of what others might say to you, you choose your response. You do not have to take it personally. You can remain calm. You can simply walk away.

This is a lesson that should be taught at a young age. Bengals players, coaches, and, frankly, fans in attendance generally behaved like juveniles. An organization (and its supporters) that displays, condones, or tolerates such behavior is destined to face consequences similar to those experienced by the Bengals last night.

Stefen Djordjevic: Where am I going? No place, man.

--All the Right Moves

Am certain that many Cincinnati Bengal players and fans found it difficult to sleep last night after a late game meltdown that can only be described as 'epic.' Truly, fiction could not have told a greater tale of self-destruction.

The play calling and execution were certainly questionable and will be subject of close hindsight-oriented scrutiny for some time.

To me, however, the larger issue was complete lack of emotional control that escalated as the game progressed and hit a crescendo in that last 1:36. Regardless of what others might say to you, you choose your response. You do not have to take it personally. You can remain calm. You can simply walk away.

This is a lesson that should be taught at a young age. Bengals players, coaches, and, frankly, fans in attendance generally behaved like juveniles. An organization (and its supporters) that displays, condones, or tolerates such behavior is destined to face consequences similar to those experienced by the Bengals last night.

Labels:

football,

lifestyle,

natural law,

self defense,

sentiment

Saturday, January 9, 2016

Hunt for Red January

"Give me a ping, Vasily. One ping only, please."

--Captain Marko Ramius (The Hunt for Red October)

Equity markets completed one of their worst opening weeks in history with another weak day on Friday. Most major equity indexes lost at least 5%, with China's Shanghai Composite down about 10%.

With Friday's -1% showing, the SPX is within pinging distance of the August lows of 1880ish. While short term oscillators are 'getting there,' they are by no means deeply oversold, and longer term oscillators are just beginning to turn down.

Plus, while a rally to relieve some selling pressure could certainly happen at any time, bears have been burned so many times before that many are underexposed here--meaning that there is less liquidity to sop up downside selling pressure.

Stated differently, one can't rule out an 'elevator shaft' type drop from here, particularly after market participants who increasingly feel trapped have the weekend to think about it.

position in SPX

--Captain Marko Ramius (The Hunt for Red October)

Equity markets completed one of their worst opening weeks in history with another weak day on Friday. Most major equity indexes lost at least 5%, with China's Shanghai Composite down about 10%.

With Friday's -1% showing, the SPX is within pinging distance of the August lows of 1880ish. While short term oscillators are 'getting there,' they are by no means deeply oversold, and longer term oscillators are just beginning to turn down.

Plus, while a rally to relieve some selling pressure could certainly happen at any time, bears have been burned so many times before that many are underexposed here--meaning that there is less liquidity to sop up downside selling pressure.

Stated differently, one can't rule out an 'elevator shaft' type drop from here, particularly after market participants who increasingly feel trapped have the weekend to think about it.

position in SPX

Friday, January 8, 2016

Trapped Longs

I'm sick and tired of you setting me up

Setting me up just to

Knock-a, knock-a, knock-a me down

--Bruce Springsteen

Ugly close yesterday as dip buyers were slammed rather than rewarded and markets closed near the low tick. Heavy action continues to be attributed to China--little understanding or at least admission of slowing economy, other probs domestically.

This morning, early strength has been sold. Smells like trapped longs to me. Not much support between here and SPX 1880ish--about 70 handles lower. Looking for short side entry points on any strength.

position in SPX

Setting me up just to

Knock-a, knock-a, knock-a me down

--Bruce Springsteen

Ugly close yesterday as dip buyers were slammed rather than rewarded and markets closed near the low tick. Heavy action continues to be attributed to China--little understanding or at least admission of slowing economy, other probs domestically.

This morning, early strength has been sold. Smells like trapped longs to me. Not much support between here and SPX 1880ish--about 70 handles lower. Looking for short side entry points on any strength.

position in SPX

Thursday, January 7, 2016

Down Again

Here comes the rain again

Raining in my head like a tragedy

Tearing me apart like a new emotion

--Eurythmics

Stock down again this am but once again dip buyers materializing to cut losses. SPX 2000 Maginot has been trampled underfoot.

Can't shake feeling that dip buyers are of non-economic variety.

position in SPX

Raining in my head like a tragedy

Tearing me apart like a new emotion

--Eurythmics

Stock down again this am but once again dip buyers materializing to cut losses. SPX 2000 Maginot has been trampled underfoot.

Can't shake feeling that dip buyers are of non-economic variety.

position in SPX

Labels:

central banks,

manipulation,

sentiment,

technical analysis

Wednesday, January 6, 2016

Ways to Spend Money

Money, get back

I'm all right Jack

Keep your hands off of my stack

--Pink Floyd

Milton Friedman proposed that there are four ways to spend money:

1) Spend your own money on yourself. When spending money on yourself, you are very careful to both economize (not spend too much) and seek highest value (get as much utility from the purchase as possible).

2) Spend your own money on somebody else. Buying a Christmas gift for someone else or donating to charity, for instance, you generally spend far less energy worrying about the value the other person gets from the purchase than you would spend on yourself. You do worry, however, about how much you pay out.

3) Spend someone else's money on yourself. When dining out on a corporate expense account, for instance, you will pay more attention about the benefits that your meal will provide than on what it will cost.

4) Spend someone else's money on someone else. If you are a welfare administrator, for example, then you will exert relatively little effort worrying about how much is spent or whether the purchases maximize value for the welfare client.

Stated differently, 1) provides the most 'bang for the buck' while 4) provides the least.

I'm all right Jack

Keep your hands off of my stack

--Pink Floyd

Milton Friedman proposed that there are four ways to spend money:

2) Spend your own money on somebody else. Buying a Christmas gift for someone else or donating to charity, for instance, you generally spend far less energy worrying about the value the other person gets from the purchase than you would spend on yourself. You do worry, however, about how much you pay out.

3) Spend someone else's money on yourself. When dining out on a corporate expense account, for instance, you will pay more attention about the benefits that your meal will provide than on what it will cost.

4) Spend someone else's money on someone else. If you are a welfare administrator, for example, then you will exert relatively little effort worrying about how much is spent or whether the purchases maximize value for the welfare client.

Stated differently, 1) provides the most 'bang for the buck' while 4) provides the least.

Tuesday, January 5, 2016

Line Dance

I bought a ticket to the world

But now I've come back again

Why do I find it hard to write the next line?

Oh I want the truth to be said

--Spandau Ballet

Thanks to a late day rally that lifted major indexes nearly 1% off the lows, Hoofy's Heroes were indeed able to keep prices on the right side of the tracks yesterday.

This morning, early day green has flipped to red. Meanwhile, the Trannies continue to frown as they mark fresh lows for the move.

Feels like we haven't seen the last of SPX 2000.

position in SPX

But now I've come back again

Why do I find it hard to write the next line?

Oh I want the truth to be said

--Spandau Ballet

Thanks to a late day rally that lifted major indexes nearly 1% off the lows, Hoofy's Heroes were indeed able to keep prices on the right side of the tracks yesterday.

This morning, early day green has flipped to red. Meanwhile, the Trannies continue to frown as they mark fresh lows for the move.

Feels like we haven't seen the last of SPX 2000.

position in SPX

Monday, January 4, 2016

Gappy New Year

It's not in the way that you hold me

It's not in the way you say you care

--Toto

Gap down sell off on first trading day of new year with domestic markets down over 2% earlier today. Motivation? Perhaps partly due to big declines in Chinese stocks overnight that resulted in market halts.

SPX has probed below the 2000 Maginot once again and regained it for now. Let's see if Hoofy's Heroes can keep 'em on the right side of the tracks.

position in SPX

It's not in the way you say you care

--Toto

Gap down sell off on first trading day of new year with domestic markets down over 2% earlier today. Motivation? Perhaps partly due to big declines in Chinese stocks overnight that resulted in market halts.

SPX has probed below the 2000 Maginot once again and regained it for now. Let's see if Hoofy's Heroes can keep 'em on the right side of the tracks.

position in SPX

Sunday, January 3, 2016

End of an Era

Who's gonna tell you when

Things aren't so great

Who's gonna tell you things

Aren't so great

--The Cars

Said goodbye to my 2000 BMW 323i yesterday. And with it marked the end of an era. After using stick shifts for 30 years, I've swapped the road car feel for the space, luxury, convenience of the SUV.

Will I miss the stick? Oh yeah. I've already found my hand reaching for a ghostly gear shift knob and my foot pressing on a missing clutch pedal.

The new ride, a BMW X3, is no slouch on the road. Plus, it is loaded with comfort and luxurious doodads that made the old wheels seem cramped and arcane. And, admittedly, it kind of feels good to step sideways to up into the driver's seat rather than to crouch down into the old 'cockpit.'

Nonetheless, I felt pangs of regret when I turned my old keys over to the sales guy. For almost 13 years, I was fortunate to drive, truly, the Ultimate Driving Machine.

Things aren't so great

Who's gonna tell you things

Aren't so great

--The Cars

Said goodbye to my 2000 BMW 323i yesterday. And with it marked the end of an era. After using stick shifts for 30 years, I've swapped the road car feel for the space, luxury, convenience of the SUV.

Will I miss the stick? Oh yeah. I've already found my hand reaching for a ghostly gear shift knob and my foot pressing on a missing clutch pedal.

The new ride, a BMW X3, is no slouch on the road. Plus, it is loaded with comfort and luxurious doodads that made the old wheels seem cramped and arcane. And, admittedly, it kind of feels good to step sideways to up into the driver's seat rather than to crouch down into the old 'cockpit.'

Nonetheless, I felt pangs of regret when I turned my old keys over to the sales guy. For almost 13 years, I was fortunate to drive, truly, the Ultimate Driving Machine.

Saturday, January 2, 2016

Big and Bad

Bad company

Always on the run

Destiny is the rising sun

--Bad Company

Recent Gallup results continue to indicate growing concerns about Big Government. When choosing between government, business, and labor, about 70% of survey respondents indicate Big Government as the biggest threat to the country in the future. This is up from about 50% of respondents (still a high percentage) fifty years ago.

Concerns about threats from Big Business have also increased somewhat over the past few decades.

These two Bigs are related, of course.

Always on the run

Destiny is the rising sun

--Bad Company

Recent Gallup results continue to indicate growing concerns about Big Government. When choosing between government, business, and labor, about 70% of survey respondents indicate Big Government as the biggest threat to the country in the future. This is up from about 50% of respondents (still a high percentage) fifty years ago.

Concerns about threats from Big Business have also increased somewhat over the past few decades.

These two Bigs are related, of course.

Friday, January 1, 2016

Rebalancing

Daniel Larusso: When do I learn how to punch?

Miyagi: Better to learn balance. Balance is key. Balance good, karate good. Everything good. Balance bad, better pack up, go home. Understand?

--The Karate Kid

A primary objective of nature is balance. Ebbs and flows mark natural cycles of action and rest, exertion and revitalization. The greater the stretch in one direction, the larger the movement in the opposite direction to flush extremes.

Will the new year be one where nature exerts major forces in the name of rebalancing?

Miyagi: Better to learn balance. Balance is key. Balance good, karate good. Everything good. Balance bad, better pack up, go home. Understand?

--The Karate Kid

A primary objective of nature is balance. Ebbs and flows mark natural cycles of action and rest, exertion and revitalization. The greater the stretch in one direction, the larger the movement in the opposite direction to flush extremes.

Will the new year be one where nature exerts major forces in the name of rebalancing?

Subscribe to:

Posts (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)