I am unwritten

Can't read my mind

I'm undefined

--Natasha Beddingfield

Interesting discussion of copyright laws, including some relevant Supreme Court decisions, in the context of the Constitution. The main argument is that the federal government has expanded the scope of copyright laws far beyond what was originally intended, and that copyright terms should be shortened.

While this is likely true, the author's central argument is grounded in the assumptions that so called intellectual property (IP) of any type, including copyrights, is legitimate property, and that the framers were correct in specifying the power to grant legal IP-related monopolies as within the proper scope of central government.

These assumptions are contestable.

It can be argued that IP is not property at all. It is not scarce. Unlike tangible property, where taking it away from the owner denies use of property to the owner, intangible ideas can be infinitely reproduced without denying use to the purported owner or originator. Moreover, clean title cannot be shown for an idea. It is impossible to demonstrate that the ideas of one person have not been significantly influenced by the thoughts and ideas of other people.

The framers justified IP protection as a way to encourage new ideas and innovation through the establishment of a statutorily created property right. Without a way to reap the fruits of their intellectual labor, it was supposed, then individuals would be less prone to create.

However, there is little evidence that this is the case. It seems equally if not more likely that grant of monopolistic privilege creates barriers to entry that impair competition. As famously noted by Schumpeter, it is unhampered competition, not protection from competition, that drives innovation and creativity over time.

Laws that grant monopoly power over ideas and their expression limit progress, and can be seen as a form of censorship--in conflict with the First Amendment.

Copyright protection is one of a few areas that the framers got wrong.

Wednesday, April 30, 2014

Tuesday, April 29, 2014

Investing Isn't Saving

Substition

Mass confusion

Clouds inside your head

--The Cars

Pundits constantly confuse saving and investing. Saving is setting economic resources aside for future consumption. Risk, defined as potential for loss of those resources set aside, is low.

Investing is allocating economic resources toward projects speculated to yield a return. Risk necessarily accompanies prospective return. Generally, the higher the possible return, the higher risk of losing some or all of the invested resources.

To be sure, saving and investing are related. There can be no investment if there is no pool of saved economic resources from which to draw. Investment capital necessarily comes from savings.

However, once economic resources have been invested, they are no longer saved. Instead, they are employed by the people involved in investment project. For example, while they are building productivity enhancing tools and techniques, workers consume savings in the form of food and drink. If these resources were not saved elsewhere, workers could not survive while working on projects aimed at improving productivity.

In projects yielding a positive return on investment, more output is ultimately created than input is consumed. In that happy case, then investors get back their original resource investment plus more.

In the unhappy event that the project consumes more input than it generates in output, then investors get back less than their original resource amount. In fact, they could lose all of their original investment.

When entrepreneurs invest in a new venture, few would suggest that these individuals are "saving for retirement."

When people allocate funds to equity and other risky investment positions, why, then, do we often view this as "saving for retirement" rather than "speculating for retirement?"

Mass confusion

Clouds inside your head

--The Cars

Pundits constantly confuse saving and investing. Saving is setting economic resources aside for future consumption. Risk, defined as potential for loss of those resources set aside, is low.

Investing is allocating economic resources toward projects speculated to yield a return. Risk necessarily accompanies prospective return. Generally, the higher the possible return, the higher risk of losing some or all of the invested resources.

To be sure, saving and investing are related. There can be no investment if there is no pool of saved economic resources from which to draw. Investment capital necessarily comes from savings.

However, once economic resources have been invested, they are no longer saved. Instead, they are employed by the people involved in investment project. For example, while they are building productivity enhancing tools and techniques, workers consume savings in the form of food and drink. If these resources were not saved elsewhere, workers could not survive while working on projects aimed at improving productivity.

In projects yielding a positive return on investment, more output is ultimately created than input is consumed. In that happy case, then investors get back their original resource investment plus more.

In the unhappy event that the project consumes more input than it generates in output, then investors get back less than their original resource amount. In fact, they could lose all of their original investment.

When entrepreneurs invest in a new venture, few would suggest that these individuals are "saving for retirement."

When people allocate funds to equity and other risky investment positions, why, then, do we often view this as "saving for retirement" rather than "speculating for retirement?"

Labels:

capital,

entrepreneurship,

productivity,

risk,

saving

Monday, April 28, 2014

Preferential Treatment and Cronyism

In violent times

You shouldn't have to sell your soul

In black and white

They really, really ought to know

--Tears for Fears

Recently, General Electric (GE) informed the city of Cincinnati that it was considering a new office facility in the area--one that would be filled with 2,000 well paid employees. City officials have since been wheeling and dealing to arrange a prime downtown real estate location for the GE facility.

Such activity points out the preferential treatment afforded to big business by government. Tax incentives, subsidies, bailouts, trade negotiators, and regulatory representation are some of the services that government offers to big business.

These privileges benefit the franchises of large operators at the expense of small entrepreneurs. Competition, and therefore standard of living, falters.

Preferential treatment of big business by government is central to cronyism. Cronyism is central to the facsist flavor of socialism.

You shouldn't have to sell your soul

In black and white

They really, really ought to know

--Tears for Fears

Recently, General Electric (GE) informed the city of Cincinnati that it was considering a new office facility in the area--one that would be filled with 2,000 well paid employees. City officials have since been wheeling and dealing to arrange a prime downtown real estate location for the GE facility.

Such activity points out the preferential treatment afforded to big business by government. Tax incentives, subsidies, bailouts, trade negotiators, and regulatory representation are some of the services that government offers to big business.

These privileges benefit the franchises of large operators at the expense of small entrepreneurs. Competition, and therefore standard of living, falters.

Preferential treatment of big business by government is central to cronyism. Cronyism is central to the facsist flavor of socialism.

Labels:

competition,

government,

intervention,

regulation,

socialism,

taxes,

urban planning

Sunday, April 27, 2014

Viable Health Care System Alternatives

"You don't need to be helped any longer. You've always had the power to go back to Kansas."

--Glinda (The Wizard of Oz)

At the end of this piece, Richard Epstein observes that the Obama administration regularly derides critics for not coming up with viable alternatives to the Affordable Care Act. Of course, when the president says 'viable,' he means compliant with his view of the world.

The alternative that has always been available is the natural, peaceful one. Withdraw aggression from the system. Allow people to produce and trade freely among themselves. For example, why not remove regulation that bars interstate insurance trade? Competition will increase, which will drive gains in efficiency and improvements in care. Health care prices will go down and quality will go up.

Further, remove costly regulatory and licensing requirements that raise barriers to entrepreneurial entry. Typically, major innovation comes from new entrants into an industry rather than from incumbents. Any impediment to entry reduces the likelihood of major medical breakthrough.

Such alternatives carry the added economic and moral benefit of being aggression-free. No guns are pointed at people to force them into things that they do not want to do.

Indeed, 'viable' alternatives are right there in front of you, Mr President. As an old sage used to tell me, "If you have eyes, see. If you have ears, listen."

I would add, "If you have a brain, engage it and think."

--Glinda (The Wizard of Oz)

At the end of this piece, Richard Epstein observes that the Obama administration regularly derides critics for not coming up with viable alternatives to the Affordable Care Act. Of course, when the president says 'viable,' he means compliant with his view of the world.

The alternative that has always been available is the natural, peaceful one. Withdraw aggression from the system. Allow people to produce and trade freely among themselves. For example, why not remove regulation that bars interstate insurance trade? Competition will increase, which will drive gains in efficiency and improvements in care. Health care prices will go down and quality will go up.

Further, remove costly regulatory and licensing requirements that raise barriers to entrepreneurial entry. Typically, major innovation comes from new entrants into an industry rather than from incumbents. Any impediment to entry reduces the likelihood of major medical breakthrough.

Such alternatives carry the added economic and moral benefit of being aggression-free. No guns are pointed at people to force them into things that they do not want to do.

Indeed, 'viable' alternatives are right there in front of you, Mr President. As an old sage used to tell me, "If you have eyes, see. If you have ears, listen."

I would add, "If you have a brain, engage it and think."

Labels:

competition,

entrepreneurship,

freedom,

health care,

intervention,

markets,

natural law,

Obama,

regulation,

socialism

Saturday, April 26, 2014

Hedge Fund Irrelevance

It's better to burn out

Than to fade away

--Neil Young

A decade ago, contributors at Minyanville regularly observed the self-destructive nature of hedge funds. My friend Todd Harrison was fond of saying that it was like 9,000 fund managers in a circle shooting each other.

Fast forward to today. The war of attrition has driven many shops from the market. Hedge fund superstars have been displaced by high frequency trading black boxes.

With the onset of algorithmic alchemy, hedge fund unique impact on the tape is dwindling. For example, data suggest that the performance of equity hedge funds and the S&P 500 (SPX) is increasingly correlated.

Ironically, the original purpose behind hedge funds was to reduce correlation to general markets. The greater degrees of freedom taken by hedge funds (e.g., taking short as well as long positions, investing in alternative asset classes deemed not to move in sync with popular investments, etc.) provided a vehicle for hedging portfolio risk.

It appears, however, that hedge funds are increasingly choosing to follow trends rather than to fade them.

As they do so, hedgies render themselves less relevant.

position in SPX

Than to fade away

--Neil Young

A decade ago, contributors at Minyanville regularly observed the self-destructive nature of hedge funds. My friend Todd Harrison was fond of saying that it was like 9,000 fund managers in a circle shooting each other.

Fast forward to today. The war of attrition has driven many shops from the market. Hedge fund superstars have been displaced by high frequency trading black boxes.

With the onset of algorithmic alchemy, hedge fund unique impact on the tape is dwindling. For example, data suggest that the performance of equity hedge funds and the S&P 500 (SPX) is increasingly correlated.

Ironically, the original purpose behind hedge funds was to reduce correlation to general markets. The greater degrees of freedom taken by hedge funds (e.g., taking short as well as long positions, investing in alternative asset classes deemed not to move in sync with popular investments, etc.) provided a vehicle for hedging portfolio risk.

It appears, however, that hedge funds are increasingly choosing to follow trends rather than to fade them.

As they do so, hedgies render themselves less relevant.

position in SPX

Labels:

asset allocation,

fund management,

markets,

measurement,

risk

Friday, April 25, 2014

Institutions of Economic Squalor

Maybe someday

Saved by zero

I'll be more together

--The Fixx

Jacob Hornberger taps the root cause of economic stagnation and decline: lack of savings. Savings represent the fraction of production that is put aside for future consumption. Savings provide for capital accumulation. Capital accumulation fosters investment that increases productivity.

Without savings, productivity cannot improve and standard of living cannot rise.

Lack of savings explains why third world countries remain that way. It also explains long term economic decline in the US.

JH highlights two institutions that are robbing the US of savings. Income taxes take approximately one third of all economic income from producers for redistribution to non-producers. A good portion of these resources would have been saved.

Savings are also dimished via currency debasement (a.k.a. inflation). Because currency represents a claim on production, printing more of it gives government and its special interests claims on other people's production. When economic resources produced by others are claimed by those holding newly minted cash, the amount of economic resources set aside and saved declines.

Instead of facilitating capital accumulation and prosperity, institutions of income taxes and inflation reduce savings and foster capital consumption and squalor.

Saved by zero

I'll be more together

--The Fixx

Jacob Hornberger taps the root cause of economic stagnation and decline: lack of savings. Savings represent the fraction of production that is put aside for future consumption. Savings provide for capital accumulation. Capital accumulation fosters investment that increases productivity.

Without savings, productivity cannot improve and standard of living cannot rise.

Lack of savings explains why third world countries remain that way. It also explains long term economic decline in the US.

JH highlights two institutions that are robbing the US of savings. Income taxes take approximately one third of all economic income from producers for redistribution to non-producers. A good portion of these resources would have been saved.

Savings are also dimished via currency debasement (a.k.a. inflation). Because currency represents a claim on production, printing more of it gives government and its special interests claims on other people's production. When economic resources produced by others are claimed by those holding newly minted cash, the amount of economic resources set aside and saved declines.

Instead of facilitating capital accumulation and prosperity, institutions of income taxes and inflation reduce savings and foster capital consumption and squalor.

Labels:

capital,

cash,

Fed,

inflation,

institution theory,

money,

natural law,

productivity,

saving,

socialism,

taxes

Thursday, April 24, 2014

Moral Hazard and Food

"How do the machines know what Tasty Wheat tasted like? Maybe they got it wrong. Maybe what I think Tasty Wheat tasted like actually tasted like oatmeal, or tuna fish."

--Mouse (The Matrix)

Suppose it is decided that it is within the scope of the federal government to regulate the quality and safety of food. An agency is formed. The agency certifies producers and agency stamps appear on food products.

Are consumers likely to engage in more or less upfront study of alternatives before making food purchases when the government claims to have their backs when it comes to safety and quality?

Moral hazard colors people's decisions about what they eat.

--Mouse (The Matrix)

Suppose it is decided that it is within the scope of the federal government to regulate the quality and safety of food. An agency is formed. The agency certifies producers and agency stamps appear on food products.

Are consumers likely to engage in more or less upfront study of alternatives before making food purchases when the government claims to have their backs when it comes to safety and quality?

Moral hazard colors people's decisions about what they eat.

Labels:

lifestyle,

moral hazard,

regulation,

security,

socialism

Wednesday, April 23, 2014

Guilt and Envy

My friends and I, we've cracked the code

We count our dollars on the train to the party

And everyone who knows us knows

That we're fine with this

We didn't come for money

--Lorde

Progressive politics depends on tapping feelings of guilt and envy. If you are wealthier than someone else, then you are 'privileged' rather than productive or resourceful. You should feel guilty for your privileges and be willing to surrender production to strong armed government agents for redistribution to others who are less privileged.

If someone has more than you, then that is unfair. It is ok to covet what others have in the name of 'social justice' and 'equality.' You are encouraged to back efforts of strong armed government agents to take production from others for your benefit. Conditions of collective envy create a pathology of resentment.

Guilt and envy are institutions of progressivism.

We count our dollars on the train to the party

And everyone who knows us knows

That we're fine with this

We didn't come for money

--Lorde

Progressive politics depends on tapping feelings of guilt and envy. If you are wealthier than someone else, then you are 'privileged' rather than productive or resourceful. You should feel guilty for your privileges and be willing to surrender production to strong armed government agents for redistribution to others who are less privileged.

If someone has more than you, then that is unfair. It is ok to covet what others have in the name of 'social justice' and 'equality.' You are encouraged to back efforts of strong armed government agents to take production from others for your benefit. Conditions of collective envy create a pathology of resentment.

Guilt and envy are institutions of progressivism.

Labels:

agency problem,

government,

institution theory,

intervention,

productivity,

socialism,

war

Tuesday, April 22, 2014

Smart Money Flow Index

Don't make sense not to live for fun

Your brain gets smart but your head gets dumb

--Smash Mouth

My friend Todd Harrison examines the Smart Money Flow Index (SMFI). The SMFI is calculated by taking the 10 am Dow Jones Industrial Average (DJIA) value - previous day close DJIA + next day closing DJIA.

Because the first 30 minutes of market action are viewed as associated with emotional, unsophisticated 'dumb money' and end-of-day action is often seen as driven by 'smart money,' significant divergences between the DJIA and the SMFI suggest that dumb money has taken control of the tape temporarily and is due for a comeuppance.

Current SMFI readings suggest comeuppance pending...

position in SPX

Your brain gets smart but your head gets dumb

--Smash Mouth

My friend Todd Harrison examines the Smart Money Flow Index (SMFI). The SMFI is calculated by taking the 10 am Dow Jones Industrial Average (DJIA) value - previous day close DJIA + next day closing DJIA.

Because the first 30 minutes of market action are viewed as associated with emotional, unsophisticated 'dumb money' and end-of-day action is often seen as driven by 'smart money,' significant divergences between the DJIA and the SMFI suggest that dumb money has taken control of the tape temporarily and is due for a comeuppance.

Current SMFI readings suggest comeuppance pending...

position in SPX

Monday, April 21, 2014

Nevada and Federal Land

"Gentlemen, whenever you have a group of individuals who are beyond any investigation, who can manipulate the press, judges, members of our Congress, you are always going to have in our government those who are above the law."

--Nico Toscani (Above the Law)

Previously we observed the large amounts of land claimed by the federal government in Western states. This bids the obvious question: How did the feds manage to accumulate so much land in these states?

In the case of Nevada, the answer is associated with the election of 1864. Republicans, anxious to acquire the necessary votes to re-elect Lincoln and to bolster majorities in Congress, pushed through a Statehood Act in March, 1864 in order to bring the GOP-friendly state into the fold.

The statute violated standing law that required territories to have at least 60,000 people in order to become a state. At the time, Nevada's population was about 40,000. Of course, by 1864 the federal government had positioned itself well above the law.

In return for statehood that was against the law, Nevada surrendered rights, title, claim to unappropriated land within state borders.

In 1980, President Reagan argued for return of this land to the state. Legal precedents also suggest the unconstitutionality of this statute.

Hopefully, current events will open the eyes of the public to this situation.

--Nico Toscani (Above the Law)

Previously we observed the large amounts of land claimed by the federal government in Western states. This bids the obvious question: How did the feds manage to accumulate so much land in these states?

In the case of Nevada, the answer is associated with the election of 1864. Republicans, anxious to acquire the necessary votes to re-elect Lincoln and to bolster majorities in Congress, pushed through a Statehood Act in March, 1864 in order to bring the GOP-friendly state into the fold.

The statute violated standing law that required territories to have at least 60,000 people in order to become a state. At the time, Nevada's population was about 40,000. Of course, by 1864 the federal government had positioned itself well above the law.

In return for statehood that was against the law, Nevada surrendered rights, title, claim to unappropriated land within state borders.

In 1980, President Reagan argued for return of this land to the state. Legal precedents also suggest the unconstitutionality of this statute.

Hopefully, current events will open the eyes of the public to this situation.

Labels:

Constitution,

contracts,

government,

Lincoln,

media,

property,

real estate,

war

Sunday, April 20, 2014

Resurrecting Freedom

"Their prophet says 'submit.' Jesus says, 'decide.'"

--Sibylla (Kingdom of Heaven)

We are again at the holiest of days, remembering that freedom triumphs over force as Jesus rises from the dead to redeem us all. He urges us to follow Him--to do what is right even in the face of the worst aggression imaginable.

He shows us that, no matter how difficult the path, the end is sweet when we choose what is right.

Now, the ball is our court. Each of us must decide what to do.

--Sibylla (Kingdom of Heaven)

We are again at the holiest of days, remembering that freedom triumphs over force as Jesus rises from the dead to redeem us all. He urges us to follow Him--to do what is right even in the face of the worst aggression imaginable.

He shows us that, no matter how difficult the path, the end is sweet when we choose what is right.

Now, the ball is our court. Each of us must decide what to do.

Saturday, April 19, 2014

What's Important

"It changed my life. In time it will change the world."

--Marcellus Gallio (The Robe)

Once again this weekend we are reminded of what is truly important. The trick is listening.

Then acting..

--Marcellus Gallio (The Robe)

Once again this weekend we are reminded of what is truly important. The trick is listening.

Then acting..

Friday, April 18, 2014

Measuring Economic Inequality II

Every summer we can rent a cottage

In the Isle of Wright

If it's not too dear

We shall scrimp and save

--The Beatles

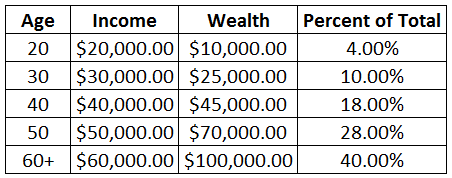

In a previous post, we highlighted a common problem in studies of economic inequality--the commingling of income and wealth data. Another issue involves income and wealth differences by age.

Suppose that all people entered the workforce at age 20 s making $20,000/yr. Each decade, they get a $10,000/yr raise. They also save 5% of their income annually and get no return on their savings. Assuming the same number of people in each ten year age bracket, the distribution of income and end-of-age-bracket wealth would resemble the following:

Those aged 50 or older own more than 2/3 of the wealth.

The above model assumes equal work skills, similar saving habits, and no returns on savings. Sprinkle more reality into the example and the distribution skews more.

Age alone creates economic inequality.

In the Isle of Wright

If it's not too dear

We shall scrimp and save

--The Beatles

In a previous post, we highlighted a common problem in studies of economic inequality--the commingling of income and wealth data. Another issue involves income and wealth differences by age.

Suppose that all people entered the workforce at age 20 s making $20,000/yr. Each decade, they get a $10,000/yr raise. They also save 5% of their income annually and get no return on their savings. Assuming the same number of people in each ten year age bracket, the distribution of income and end-of-age-bracket wealth would resemble the following:

Those aged 50 or older own more than 2/3 of the wealth.

The above model assumes equal work skills, similar saving habits, and no returns on savings. Sprinkle more reality into the example and the distribution skews more.

Age alone creates economic inequality.

Labels:

measurement,

productivity,

saving,

socialism,

yields

Thursday, April 17, 2014

Gender Pay Differences

"You're the first woman I've seen at one of these things that dresses like a woman--not like a woman thinks a man would dress if he was a woman."

--Jack Trainer (Working Girl)

Pandering to its voter base, the Obama administration has turned to a well-worn page in the Progressive playbook--the one claiming that women are victims of workplace discrimination because they are paid less than men. Such a tactic appeals particularly well to today's 'War On Women' crowd.

Thomas Sowell cites the work of Diana Furchtgott-Roth of the Manhattan Institute and Prof Claudia Goldin of Harvard as among the research that has demonstrated that when controlled for factors such as occupation, skills, education, hours of works, and years of consecutive work experience, income differences between men and women virtually disappear and in some cases favor women.

Univ of Michigan Prof Mark Perry summarized similar empirical research findings in a recent WSJ piece. He also discusses the issue with Tom Woods here.

Sowell suggests that in his own research on gender pay differences, actual hours worked is often the dominant factor in predicting pay levels--although accurately capturing hours worked statistics can be difficult in professions such as doctors and lawyers.

Beyond the empirical evidence, Progressives also have reasoning issues to overcome. If gender pay bias was real, then employers would be overpaying each time they hired a man to do work that a woman could do equally well. Why would employers be such fools with their own money?

Moreover, bigoted actions are penalized in the marketplace. Should a chauvinist operator underpay female workers relative to their productivity, then rivals can improve their economic position by hiring that female talent away at wages commensurate with worker productivity. Unbigoted rivals become more productive at the bigot's expense.

Because they weaken competitive position, discriminatory pay practices are unlikely to persist.

--Jack Trainer (Working Girl)

Pandering to its voter base, the Obama administration has turned to a well-worn page in the Progressive playbook--the one claiming that women are victims of workplace discrimination because they are paid less than men. Such a tactic appeals particularly well to today's 'War On Women' crowd.

Thomas Sowell cites the work of Diana Furchtgott-Roth of the Manhattan Institute and Prof Claudia Goldin of Harvard as among the research that has demonstrated that when controlled for factors such as occupation, skills, education, hours of works, and years of consecutive work experience, income differences between men and women virtually disappear and in some cases favor women.

Univ of Michigan Prof Mark Perry summarized similar empirical research findings in a recent WSJ piece. He also discusses the issue with Tom Woods here.

Sowell suggests that in his own research on gender pay differences, actual hours worked is often the dominant factor in predicting pay levels--although accurately capturing hours worked statistics can be difficult in professions such as doctors and lawyers.

Beyond the empirical evidence, Progressives also have reasoning issues to overcome. If gender pay bias was real, then employers would be overpaying each time they hired a man to do work that a woman could do equally well. Why would employers be such fools with their own money?

Moreover, bigoted actions are penalized in the marketplace. Should a chauvinist operator underpay female workers relative to their productivity, then rivals can improve their economic position by hiring that female talent away at wages commensurate with worker productivity. Unbigoted rivals become more productive at the bigot's expense.

Because they weaken competitive position, discriminatory pay practices are unlikely to persist.

Labels:

competition,

entrepreneurship,

manipulation,

measurement,

Obama,

productivity,

property,

reason,

socialism

Wednesday, April 16, 2014

Federal Land Ownership

"Why, land is the only thing in the world worth workin' for, worth fightin' for, worth dyin' for, because it's the only thing that lasts."

--Gerald O'Hara (Gone With The Wind)

Map showing the fraction of state land that is owned by the federal government. Fed land ownership is concentrated in the west.

Professor Williams has suggested that the federal government could give this land away to citizens in exchange for making good on entitlement promises that otherwise cannot be kept.

Interesting idea. Another idea is to simply sell it and use the proceeds to pay down federal debt.

--Gerald O'Hara (Gone With The Wind)

Map showing the fraction of state land that is owned by the federal government. Fed land ownership is concentrated in the west.

Professor Williams has suggested that the federal government could give this land away to citizens in exchange for making good on entitlement promises that otherwise cannot be kept.

Interesting idea. Another idea is to simply sell it and use the proceeds to pay down federal debt.

Labels:

balance sheet,

debt,

measurement,

mortgage,

real estate,

socialism

Tuesday, April 15, 2014

One Third Slave

Should five percent appear too small

Be thankful I don't take it all

--The Beatles

On average, Americans must generate about four month's worth of wages in order to pay federal and state taxes. This makes the average American 1/3 slave.

Taxpayers are today's fractional slaves.

Be thankful I don't take it all

--The Beatles

On average, Americans must generate about four month's worth of wages in order to pay federal and state taxes. This makes the average American 1/3 slave.

Taxpayers are today's fractional slaves.

Labels:

freedom,

liberty,

Lincoln,

measurement,

natural law,

taxes,

war

Monday, April 14, 2014

Liberty Preference

"So, here's to the men who did what was considered wrong, in order to do what they knew was right...what they KNEW was right."

--Benjamin Franklin Gates (National Treasure)

As Jefferson elequently wrote, each of us has been endowed with the inalienable right to liberty. Liberty is defined as the freedom to pursue one's interests absent forcible intrusion by government.

Although each of us is equally endowed with the right to liberty, we are unequal in preference for liberty. Stated differently, some people value liberty more than others.

Those who value freedom highly will protest whenever liberty is impaired. They will naturally be unwilling to surrender or compromise, as they are sensitive to the slippery slope that carves this path. As suggested by Patrick Henry, those who value liberty highly are willing to die for it.

Those with lower liberty preference cannot understand the protestations of those with high liberty preference--at least in the early stages of escalation of state power. People with low liberty preference may be willing to cede liberty in favor of security--however temporary that concession might be. This group is likely to label those with high liberty preference as radicals, and publicly ridicule their dissident behavior.

Perhaps there is some merit to this situation. Without some degree of social restraint, liberty-minded people would likely be in a constant state of revolution in order to regain even small amounts of liberty lost.

As despotic government grows, however, the liberty preference of more people is engaged. When Jefferson' (Locke's) train of abuses gets long enough, then liberty preference reaches critical mass and revolution is put in motion to throw off the tyranny.

Once again, it seems, our Creator demonstrates the wisdom of axiomatic diversity. By endowing individuals with different preferences for liberty, God creates a balance between stability and change. Those with lower liberty preference keep the system from flying out of kilter every time government takes liberty from individuals.

Those with high liberty preference are the canaries in the coal mine of sorts, as they are the first to recognize tyranny and voice early warnings of growing despotism that others cannot sense. The louder this group chirps, the closer the system is to revolutionary change.

--Benjamin Franklin Gates (National Treasure)

As Jefferson elequently wrote, each of us has been endowed with the inalienable right to liberty. Liberty is defined as the freedom to pursue one's interests absent forcible intrusion by government.

Although each of us is equally endowed with the right to liberty, we are unequal in preference for liberty. Stated differently, some people value liberty more than others.

Those who value freedom highly will protest whenever liberty is impaired. They will naturally be unwilling to surrender or compromise, as they are sensitive to the slippery slope that carves this path. As suggested by Patrick Henry, those who value liberty highly are willing to die for it.

Those with lower liberty preference cannot understand the protestations of those with high liberty preference--at least in the early stages of escalation of state power. People with low liberty preference may be willing to cede liberty in favor of security--however temporary that concession might be. This group is likely to label those with high liberty preference as radicals, and publicly ridicule their dissident behavior.

Perhaps there is some merit to this situation. Without some degree of social restraint, liberty-minded people would likely be in a constant state of revolution in order to regain even small amounts of liberty lost.

As despotic government grows, however, the liberty preference of more people is engaged. When Jefferson' (Locke's) train of abuses gets long enough, then liberty preference reaches critical mass and revolution is put in motion to throw off the tyranny.

Once again, it seems, our Creator demonstrates the wisdom of axiomatic diversity. By endowing individuals with different preferences for liberty, God creates a balance between stability and change. Those with lower liberty preference keep the system from flying out of kilter every time government takes liberty from individuals.

Those with high liberty preference are the canaries in the coal mine of sorts, as they are the first to recognize tyranny and voice early warnings of growing despotism that others cannot sense. The louder this group chirps, the closer the system is to revolutionary change.

Sunday, April 13, 2014

Captain and The Cutch

City lights and business nights

When you require a streetcar

Desire for higher heights

--Sade

Easing back into the game over the past few years, I've naturally been on the lookout for the top talent. Because I'm particularly drawn toward hitters with style, it's hard not to admire the sweet lefty strokes of the two Gonzales--Adrian of the Dodgers and Carlos of the Rockies.

But in terms of all 'round ability including off-the-field composure, two players have stood out. Mets third baseman David Wright is one of them. In his 10+ major league seasons, Wright has put up numbers that project toward the HOF. His demeanor on and off the field makes him the classic role model type. They call him Captain America for a reason...

The other is Andrew McCutchen. The Pirates centerfielder won the NL MVP last year although this seemed in arrears as he put up impressive numbers in 2012 as well. McCutchen is the consummate five tool player. It's a joy to watch The Cutch chase down fly balls in the alleys and round second in pursuit of a triple. Off the field, he's super active in the community and enjoys engaging the fan base.

These are the players that I'd point out to youngsters and say, "Watch how these guys do it."

When you require a streetcar

Desire for higher heights

--Sade

Easing back into the game over the past few years, I've naturally been on the lookout for the top talent. Because I'm particularly drawn toward hitters with style, it's hard not to admire the sweet lefty strokes of the two Gonzales--Adrian of the Dodgers and Carlos of the Rockies.

But in terms of all 'round ability including off-the-field composure, two players have stood out. Mets third baseman David Wright is one of them. In his 10+ major league seasons, Wright has put up numbers that project toward the HOF. His demeanor on and off the field makes him the classic role model type. They call him Captain America for a reason...

The other is Andrew McCutchen. The Pirates centerfielder won the NL MVP last year although this seemed in arrears as he put up impressive numbers in 2012 as well. McCutchen is the consummate five tool player. It's a joy to watch The Cutch chase down fly balls in the alleys and round second in pursuit of a triple. Off the field, he's super active in the community and enjoys engaging the fan base.

These are the players that I'd point out to youngsters and say, "Watch how these guys do it."

Saturday, April 12, 2014

50 Years of Federal Spending by Category

All last night sat on the levee and moaned

Thinkin' about my baby and my happy home

--Led Zeppelin

Nice little review of the last 50 years of federal spending by select category. The elephant in the room is entitlement spending which now consumes nearly 15% of GDP compared to less than 5% in 1964.

Also noteworthy is military spending. When I ask my students what fraction of GDP is currently spent on military, they typically guess 20% or more. However, even during the Cold War and Vietnam, US military spending did not top 10% of GDP. Now it is under 5%.

The other series worth mentioning is interest expense--which has actually declined during the last couple of decades. How can that be when we're borrowing more than we ever have? It's because interest rates have been suppressed by central bank actions.

Such suppression only lasts until the Fed loses control of the bond market. When the Fed can no longer manipulate bond prices, then Treasury yields will explode higher.

And before you know it, the federal government will have money for little else than funding interest payments on our debt...

Thinkin' about my baby and my happy home

--Led Zeppelin

Nice little review of the last 50 years of federal spending by select category. The elephant in the room is entitlement spending which now consumes nearly 15% of GDP compared to less than 5% in 1964.

Also noteworthy is military spending. When I ask my students what fraction of GDP is currently spent on military, they typically guess 20% or more. However, even during the Cold War and Vietnam, US military spending did not top 10% of GDP. Now it is under 5%.

The other series worth mentioning is interest expense--which has actually declined during the last couple of decades. How can that be when we're borrowing more than we ever have? It's because interest rates have been suppressed by central bank actions.

Such suppression only lasts until the Fed loses control of the bond market. When the Fed can no longer manipulate bond prices, then Treasury yields will explode higher.

And before you know it, the federal government will have money for little else than funding interest payments on our debt...

Labels:

debt,

government,

manipulation,

measurement,

security,

socialism,

war,

yields

Friday, April 11, 2014

Fibo's Voices

Don't look back

Yesterday's gone

Don't turn away

You can take it on

--Russ Ballard

The bulls gave it the college try today, twice trying to push 'em higher toward recapturing the 1840 flag intraday. Both times, however, those rallies fell apart, and the indexes closed near the lows.

Let's invite our buddy Fibonacci to voice his two cents on the tape. Using last October's lows and the recent all time highs as reference points, we are approaching a 38% retracement at SPX 1800ish. This area constituted resistance back in Nov/Dec before it was taken out pre-Xmas. Because resistance, once pierced, generally offers price support, the bulls may be able to find a branch or two to grab onto to stop their slide right around here.

If not, then it's hard for the technician's eye not to gravitate to 1740. This level corresponds not only to a 62% Fibo retracement, but also to the early Feb lows.

Below that is basically a 80 handle drop straight down to SPX 1680.

position in SPX

Yesterday's gone

Don't turn away

You can take it on

--Russ Ballard

The bulls gave it the college try today, twice trying to push 'em higher toward recapturing the 1840 flag intraday. Both times, however, those rallies fell apart, and the indexes closed near the lows.

Let's invite our buddy Fibonacci to voice his two cents on the tape. Using last October's lows and the recent all time highs as reference points, we are approaching a 38% retracement at SPX 1800ish. This area constituted resistance back in Nov/Dec before it was taken out pre-Xmas. Because resistance, once pierced, generally offers price support, the bulls may be able to find a branch or two to grab onto to stop their slide right around here.

If not, then it's hard for the technician's eye not to gravitate to 1740. This level corresponds not only to a 62% Fibo retracement, but also to the early Feb lows.

Below that is basically a 80 handle drop straight down to SPX 1680.

position in SPX

Volatility Picking Up

You're beggin' me to go

You're makin' me stay

Why do you hurt me so bad?

--Pat Benatar

After it appeared that the bulls successfully defended SPX 1840 with a 1% up day on Wednesday, the bears blitzed back yesterday with a 2% down day, and easily broke through the 1840 maginot.

The action also consituted an 'outside day' to the downside (technically bearish).

This morning, bears pressed their bets and have now surrendered much of their early gains to obstinate bulls.

Volatility is picking up as bulls and bears slug it out in a battle for control of the tape.

position in SPX

You're makin' me stay

Why do you hurt me so bad?

--Pat Benatar

After it appeared that the bulls successfully defended SPX 1840 with a 1% up day on Wednesday, the bears blitzed back yesterday with a 2% down day, and easily broke through the 1840 maginot.

The action also consituted an 'outside day' to the downside (technically bearish).

This morning, bears pressed their bets and have now surrendered much of their early gains to obstinate bulls.

Volatility is picking up as bulls and bears slug it out in a battle for control of the tape.

position in SPX

Thursday, April 10, 2014

Legislating Leisure

If you ever get annoyed

Look at me I'm self-employed

I love to work at nothing all day

--Bachman-Turner Overdrive

New labor agreement obliges French workers to ignore work-related emails once the work day is officially over. This is on top of other government-imposed restrictions that includes a 35 hour work week cap.

What employers in their right minds would want to operate in such a hostile environment? Well, some might do so out of patriotism. Others, having been institutionalized in an environment where people are not free to make their own decisions, might simply continue to comply with governmental mandates. Still others may perceive market opportunities that outweigh the negatives of operating in such a hampered system.

Beyond such groups, we can be sure that capacity will leave the system--or never enter to begin with in the case of entrepreneurs who decide to look elsewhere for opportunities.

Workers willing to work outside of government mandated parameters are also hurt. Like minimum wage laws, rules that force workers to do something that they would not freely do serve as forms of compulsory unemployment.

Those who applaud laws that mandate leisure reveal themselves as fools. Although people generally prefer leisure over labor, leisure is generally enjoyable to the extent that goods and services are available to consume while at rest.

Someone must produce those goods and services. If that production is impaired, then the quality of leisure declines.

When leisure is legislated, standard of living falls.

Look at me I'm self-employed

I love to work at nothing all day

--Bachman-Turner Overdrive

New labor agreement obliges French workers to ignore work-related emails once the work day is officially over. This is on top of other government-imposed restrictions that includes a 35 hour work week cap.

What employers in their right minds would want to operate in such a hostile environment? Well, some might do so out of patriotism. Others, having been institutionalized in an environment where people are not free to make their own decisions, might simply continue to comply with governmental mandates. Still others may perceive market opportunities that outweigh the negatives of operating in such a hampered system.

Beyond such groups, we can be sure that capacity will leave the system--or never enter to begin with in the case of entrepreneurs who decide to look elsewhere for opportunities.

Workers willing to work outside of government mandated parameters are also hurt. Like minimum wage laws, rules that force workers to do something that they would not freely do serve as forms of compulsory unemployment.

Those who applaud laws that mandate leisure reveal themselves as fools. Although people generally prefer leisure over labor, leisure is generally enjoyable to the extent that goods and services are available to consume while at rest.

Someone must produce those goods and services. If that production is impaired, then the quality of leisure declines.

When leisure is legislated, standard of living falls.

Labels:

capacity,

competition,

entrepreneurship,

government,

institution theory,

socialism

Wednesday, April 9, 2014

Bond Chart Taper

I've been looking so long at these pictures of you

That I almost believe that they're real

I've been living so long with my pictures of you

That I almost believe that the pictures are all I can feel

--The Cure

Rather than the QE-related bond taper, I'm eyeing the taper pattern in 10 yr bond yields.

Not perfect, but similar to a 'flag' or 'pennant' pattern of technical lore. Textbook technical analysis posits that these patterns typically resolve in the direction of the primary trend--which in this case suggests higher bond yields.

Shouldn't be long before we learn how this one turns out.

no positions

That I almost believe that they're real

I've been living so long with my pictures of you

That I almost believe that the pictures are all I can feel

--The Cure

Rather than the QE-related bond taper, I'm eyeing the taper pattern in 10 yr bond yields.

Not perfect, but similar to a 'flag' or 'pennant' pattern of technical lore. Textbook technical analysis posits that these patterns typically resolve in the direction of the primary trend--which in this case suggests higher bond yields.

Shouldn't be long before we learn how this one turns out.

no positions

Labels:

bonds,

Fed,

intervention,

technical analysis,

yields

Tuesday, April 8, 2014

715

Move over Babe

Hank 's hit another

He'll break that 714

--Bill Slayback

Forty years ago I sat in front of our first gen color TV and watched my favorite baseball player, Hank Aaron, break Babe Ruth's home run record. Aaron had tied the record four days earlier in Cincinnati on Opening Day.

The replay today looks exactly the same. Downing's 1-0 pitch. The classic, almost magical, Aaron swing. Buckner climbing the fence in left. Tom House catching the ball on the fly in the Brave's bullpen.

Hank 's hit another

He'll break that 714

--Bill Slayback

Forty years ago I sat in front of our first gen color TV and watched my favorite baseball player, Hank Aaron, break Babe Ruth's home run record. Aaron had tied the record four days earlier in Cincinnati on Opening Day.

The replay today looks exactly the same. Downing's 1-0 pitch. The classic, almost magical, Aaron swing. Buckner climbing the fence in left. Tom House catching the ball on the fly in the Brave's bullpen.

Some memories get better with age. Others stay the same, because they're already the best.

Battle of SPX 1840

It's not in the way that you hold me

It's not in the way you say you care

--Toto

Bulls and bears are battling over SPX 1840. The bulls held back a morning charge by the bears.

Wondering whether another rush is pending...

position in SPX

It's not in the way you say you care

--Toto

Bulls and bears are battling over SPX 1840. The bulls held back a morning charge by the bears.

Wondering whether another rush is pending...

position in SPX

Monday, April 7, 2014

HFT Overview

"Look at these people. Wandering around with absolutely no idea of what's about to happen."

--Peter Sullivan (Margin Call)

Nice overview of high frequency trading (HFT) that includes some historical color as well as comparisons of trading supply chains and categorizations of HFT types and strategies.

At the end of the article, it is concluded that, although regulators, investors, interested observers might huff and puff about the negatives of HFT, nothing will be done. This is because HFT is so woven into the current system that any attempt to extract will be perceived as catastrophic. And any attempt to actually remove HFT trading from the system, which is estimated to account for approx. 70% of stock exchange volume, will result in a gigantic 'flash crash.'

Similar to the big banks, the HFT franchise will be viewed as Too Big To Fail.

Of course, the HFT model may also be precisely what central banks and other policymakers need to express non-economic agendas.

Personally, I suspect that flash crashes may be inevitable even with the black boxes going full tilt. In fact, we have already seen hints of this. If the general market trend changes from up to down, then pattern seeking algos could very well create 'elevator shaft' conditions for sudden, steep price declines.

position in SPX

--Peter Sullivan (Margin Call)

Nice overview of high frequency trading (HFT) that includes some historical color as well as comparisons of trading supply chains and categorizations of HFT types and strategies.

At the end of the article, it is concluded that, although regulators, investors, interested observers might huff and puff about the negatives of HFT, nothing will be done. This is because HFT is so woven into the current system that any attempt to extract will be perceived as catastrophic. And any attempt to actually remove HFT trading from the system, which is estimated to account for approx. 70% of stock exchange volume, will result in a gigantic 'flash crash.'

Similar to the big banks, the HFT franchise will be viewed as Too Big To Fail.

Of course, the HFT model may also be precisely what central banks and other policymakers need to express non-economic agendas.

Personally, I suspect that flash crashes may be inevitable even with the black boxes going full tilt. In fact, we have already seen hints of this. If the general market trend changes from up to down, then pattern seeking algos could very well create 'elevator shaft' conditions for sudden, steep price declines.

position in SPX

Labels:

central banks,

institution theory,

manipulation,

markets,

measurement,

risk

Sunday, April 6, 2014

Money is Speech

"This paper will fight for progress and reform. We'll never be satisfied merely with printing the news. We'll never be afraid to attack wrong, whether by predatory wealth or predatory poverty."

--Ed Hutcheson (Deadline U.S.A.)

In its McCutcheon v Federal Election Commission ruling last week, the Supreme Court struck down aggregate contribution limits to political campaigns.

The majority opinion authored by Chief Justice John Roberts viewed federal law that prevented donors from giving a maximum contribution to more than 10 candidates as an unconstitutional violation of First Amendment rights. Roberts wrote:

"Congress may not regulate contributions simply to reduce the amount of money in politics, or to restrict the political participation of some in order to enhance the relative influence of others."

Roberts correctly observed that influence is a "central feature of democracy" because constituents support candidates who "share their beliefs and interests."

Stated differently, influence drives political systems where majority vote rules.

The logical question to those who favor restrictions on campaign contributions is why should only monetary contributions be regulated? There are other ways to buy political favor.

For instance, why not regulate the editorial contributions made by media companies and other entities toward political campaigns? After all, large media efforts that favor certain candidates drown out the voice of the little guy on blogs and elsewhere. Surely a slanted piece presented by journalists at large media outlets possess political value for particular candidates. Because of their potential for outsized influence on democratic process, why shouldn't such journalistic contributions be regulated?

As this piece smartly observes, "How can anyone say - as people do say, as if this settles the issue - that 'Money isn't speech' and then, in the same breath, ask for money to spread the word about the danger to democracy posed by [big campaign contributors]? Money spent trying to spread a political message is speech, whether you like the message or not. More money is louder speech, that more people can hear."

As we have frequently observed on these pages, the way to reduce the impact of political influence is to cut off the resource stream available to government. If government had no power to take resources from some for the benefit of others, then the market for political favor withers.

--Ed Hutcheson (Deadline U.S.A.)

In its McCutcheon v Federal Election Commission ruling last week, the Supreme Court struck down aggregate contribution limits to political campaigns.

The majority opinion authored by Chief Justice John Roberts viewed federal law that prevented donors from giving a maximum contribution to more than 10 candidates as an unconstitutional violation of First Amendment rights. Roberts wrote:

"Congress may not regulate contributions simply to reduce the amount of money in politics, or to restrict the political participation of some in order to enhance the relative influence of others."

Roberts correctly observed that influence is a "central feature of democracy" because constituents support candidates who "share their beliefs and interests."

Stated differently, influence drives political systems where majority vote rules.

The logical question to those who favor restrictions on campaign contributions is why should only monetary contributions be regulated? There are other ways to buy political favor.

For instance, why not regulate the editorial contributions made by media companies and other entities toward political campaigns? After all, large media efforts that favor certain candidates drown out the voice of the little guy on blogs and elsewhere. Surely a slanted piece presented by journalists at large media outlets possess political value for particular candidates. Because of their potential for outsized influence on democratic process, why shouldn't such journalistic contributions be regulated?

As this piece smartly observes, "How can anyone say - as people do say, as if this settles the issue - that 'Money isn't speech' and then, in the same breath, ask for money to spread the word about the danger to democracy posed by [big campaign contributors]? Money spent trying to spread a political message is speech, whether you like the message or not. More money is louder speech, that more people can hear."

As we have frequently observed on these pages, the way to reduce the impact of political influence is to cut off the resource stream available to government. If government had no power to take resources from some for the benefit of others, then the market for political favor withers.

Labels:

Constitution,

democracy,

freedom,

judicial,

liberty,

manipulation,

media,

regulation,

socialism

Saturday, April 5, 2014

HFT as Enabler

Docter please

Some more of these

Outside the door

She took four more

--The Rolling Stones

In his always interesting market commentary, Minyanville's Jeff Cooper wonders whether the Fed's QE program has been facilitated by high frequency trading.

"Few market participants have suggested that if the Fed has a mandate to keep the market buoyant, it may be enabled by high freduency trading (HFT)."

Have been thinking precisely the same thing.

Black box algos are opaque. The confusion that they create in markets could easily disguise the actions of non-economic buyers with alternative agendas.

At the very least, trend-following algorithms can perpetuate market movement in one direction. Until they don't, of course...

Much of the sudden public outrage over HFT might be muted if it was revealed that HFT has been a mechanism for higher asset prices over the past few years.

Some more of these

Outside the door

She took four more

--The Rolling Stones

In his always interesting market commentary, Minyanville's Jeff Cooper wonders whether the Fed's QE program has been facilitated by high frequency trading.

"Few market participants have suggested that if the Fed has a mandate to keep the market buoyant, it may be enabled by high freduency trading (HFT)."

Have been thinking precisely the same thing.

Black box algos are opaque. The confusion that they create in markets could easily disguise the actions of non-economic buyers with alternative agendas.

At the very least, trend-following algorithms can perpetuate market movement in one direction. Until they don't, of course...

Much of the sudden public outrage over HFT might be muted if it was revealed that HFT has been a mechanism for higher asset prices over the past few years.

Friday, April 4, 2014

Minimum Wage Laws and ECON 101

I'm ten years burning down that road

Nowhere to run and nowhere to go

--Bruce Springsteen

In an open letter the Obama administration, George Reisman provides a simple ECON 101-based explanation of the negative effects of minimum wage laws. As we have observed many times on these pages, minimum wage laws are forms of compulsory unemployment.

As such, and as Prof Reisman observes, minimum wage laws are anti-labor and anti-poor. They force marginal workers to the sidelines.

If the goal is to raise standard of living of marginal workers, then the correct policy is to abolish the minimum wage and other policies (e.g., forced union pay scales, licensing) that block the path to economic improvement for poor people.

Money printing must also be stopped, as inflation disproportionately destroys the purchasing power of lower wage earners.

Nowhere to run and nowhere to go

--Bruce Springsteen

In an open letter the Obama administration, George Reisman provides a simple ECON 101-based explanation of the negative effects of minimum wage laws. As we have observed many times on these pages, minimum wage laws are forms of compulsory unemployment.

As such, and as Prof Reisman observes, minimum wage laws are anti-labor and anti-poor. They force marginal workers to the sidelines.

If the goal is to raise standard of living of marginal workers, then the correct policy is to abolish the minimum wage and other policies (e.g., forced union pay scales, licensing) that block the path to economic improvement for poor people.

Money printing must also be stopped, as inflation disproportionately destroys the purchasing power of lower wage earners.

Thursday, April 3, 2014

High Frequency Trading (HFT)

"You stop sending me information, and you start getting me some."

--Gordon Gekko (Wall Street)

A new book by Michael Lewis, Flash Boys, along with a 60 Minutes interview with Lewis last Sunday, has suddenly elevated public awareness of high frequency trading. As usual, the public is behind the curve. HFT is not exactly new.

We have discussed HFT (a.k.a. 'algos,' 'black boxes') several times on these pages, including this missive that considers the central problem at hand: the commingling of market making and prop trading on for-profit exchanges that count HFTs among their largest revenue producers.

It is tempting to reach for regulatory solutions. Some have proposed banning the fragmented for-profit exchange network in favor of the old model of a few mutually-owned public exchanges. Charles Schwab and others favor laws that penalize quote stuffing, ban exchange selling of preferential data feeds, and eliminate order types that promote front running.

Another solution is for investors to vote with their feet. If you do not like exchange practices that put you at a disadvantage, then don't play in that arena. Pull your business from exchanges that tilt the playing field.

Entrepreneurs will be motivated to meet the needs of those investors by developing alternative exchanges--ones that are free of biases that currently infect the system.

Instead of force, try freedom. Lower the guns, and encourage people to peacefully decide how they want to trade.

--Gordon Gekko (Wall Street)

A new book by Michael Lewis, Flash Boys, along with a 60 Minutes interview with Lewis last Sunday, has suddenly elevated public awareness of high frequency trading. As usual, the public is behind the curve. HFT is not exactly new.

We have discussed HFT (a.k.a. 'algos,' 'black boxes') several times on these pages, including this missive that considers the central problem at hand: the commingling of market making and prop trading on for-profit exchanges that count HFTs among their largest revenue producers.

It is tempting to reach for regulatory solutions. Some have proposed banning the fragmented for-profit exchange network in favor of the old model of a few mutually-owned public exchanges. Charles Schwab and others favor laws that penalize quote stuffing, ban exchange selling of preferential data feeds, and eliminate order types that promote front running.

Another solution is for investors to vote with their feet. If you do not like exchange practices that put you at a disadvantage, then don't play in that arena. Pull your business from exchanges that tilt the playing field.

Entrepreneurs will be motivated to meet the needs of those investors by developing alternative exchanges--ones that are free of biases that currently infect the system.

Instead of force, try freedom. Lower the guns, and encourage people to peacefully decide how they want to trade.

Labels:

entrepreneurship,

freedom,

fund management,

intervention,

markets,

media,

regulation,

taxes,

war

Wednesday, April 2, 2014

Slavery and Free Markets

"If you men will take no pay, then none of us will."

--Col Robert Gould Shaw (Glory)

Robert Murphy posits that in a society with strict property rights, market forces would dismantle slavery even if society perversely began with a law that enabled one human being to own another.

The primary reason is that slavery becomes uncompetitive as entrepreneurs innovate and improve productivity.

Mises claimed that "if one treats men as cattle, one cannot squeeze out of them more than cattle-like performances." To compete with other producers that employ free labor who are incented to improve productivity, slave owners must free their labor or lose ground in the marketplace.

It is the spectre of economic pain, argued Mises, that "has made all systems of compulsory labor ultimately disappear."

Murphy observes that slaves have no motivation to produce above bare minimum standards that avoid punishment. As competition grows from free labor, slaveholders may be tempted to raise the minimum standard and punish workers who do not meet it. But as the bar goes up more slaves will be punished and at some point physical punishments will hurt the health of slaves, thereby impairing slaveholders' primary 'assets.'

Market forces will compel slaveholders to offer workplace incentives to boost productivity and competitiveness. As incentives increase, so does freedom. Over time, slavery dissolves in favor of self-ownership that promotes voluntary cooperation and exchange.

Aside from moral considerations, market forces are likely to transform slaves into self-owners because self-ownership enables the most efficient economic outcome.

--Col Robert Gould Shaw (Glory)

Robert Murphy posits that in a society with strict property rights, market forces would dismantle slavery even if society perversely began with a law that enabled one human being to own another.

The primary reason is that slavery becomes uncompetitive as entrepreneurs innovate and improve productivity.

Mises claimed that "if one treats men as cattle, one cannot squeeze out of them more than cattle-like performances." To compete with other producers that employ free labor who are incented to improve productivity, slave owners must free their labor or lose ground in the marketplace.

It is the spectre of economic pain, argued Mises, that "has made all systems of compulsory labor ultimately disappear."

Murphy observes that slaves have no motivation to produce above bare minimum standards that avoid punishment. As competition grows from free labor, slaveholders may be tempted to raise the minimum standard and punish workers who do not meet it. But as the bar goes up more slaves will be punished and at some point physical punishments will hurt the health of slaves, thereby impairing slaveholders' primary 'assets.'

Market forces will compel slaveholders to offer workplace incentives to boost productivity and competitiveness. As incentives increase, so does freedom. Over time, slavery dissolves in favor of self-ownership that promotes voluntary cooperation and exchange.

Aside from moral considerations, market forces are likely to transform slaves into self-owners because self-ownership enables the most efficient economic outcome.

Labels:

competition,

entrepreneurship,

freedom,

Lincoln,

markets,

productivity,

property,

war

Tuesday, April 1, 2014

Measuring Economic Inequality I

Drawn into the stream

Of undefined illusion

Those diamond dreams

They can't disguise the truth

--Level 42

Nice review of common mistakes when measuring economic inequality. A whopper, using a 2011 paper by Norton and Ariely as an example, is the commingling of income and wealth inequality measures. Norton and Ariely asked survey participants to indicate their preference between pie charts depicting wealth distribution in the US and income distribution in Sweden--while framing both as wealth distributions.

In fact, wealth distributions of the US and Sweden are much closer than presented by the researchers. Ariely has since admitted that it is difficult to find a country that has a relatively equitable distribtution of wealth.

Finding such an example is likely to prove more than difficult. It is probably impossible. Concentrated wealth has been a condition of society since the beginning, with observers such as Pareto considering the phenomenon along the way. Even countries positioned far toward the socialism end of the economic spectrum are likely to reflect large quantitities of wealth concentrated in small fractions of their populations.

An important but usually unaddressed issue is the extent to which wealth distributions are skewed by force.

Returning to Norton and Ariely's paper, add the fact that the authors did not merely present two hypothetical distributions (e.g., A and B) to reduce respondent bias related to particular countries and you get results that are highly contestable at best and severely slanted at worst. It is easy to construe this paper as more propaganda than research.

That this study appeared in a peer reviewed outlet demonstrates that any paper can pass editorial muster if the review board is sympathetic to a particular ideological viewpoint.

There are several other good points made by this author concerning the (mis)measurement of economic inequality. We will consider some of them in future posts.

Of undefined illusion

Those diamond dreams

They can't disguise the truth

--Level 42

Nice review of common mistakes when measuring economic inequality. A whopper, using a 2011 paper by Norton and Ariely as an example, is the commingling of income and wealth inequality measures. Norton and Ariely asked survey participants to indicate their preference between pie charts depicting wealth distribution in the US and income distribution in Sweden--while framing both as wealth distributions.

In fact, wealth distributions of the US and Sweden are much closer than presented by the researchers. Ariely has since admitted that it is difficult to find a country that has a relatively equitable distribtution of wealth.

Finding such an example is likely to prove more than difficult. It is probably impossible. Concentrated wealth has been a condition of society since the beginning, with observers such as Pareto considering the phenomenon along the way. Even countries positioned far toward the socialism end of the economic spectrum are likely to reflect large quantitities of wealth concentrated in small fractions of their populations.

An important but usually unaddressed issue is the extent to which wealth distributions are skewed by force.

Returning to Norton and Ariely's paper, add the fact that the authors did not merely present two hypothetical distributions (e.g., A and B) to reduce respondent bias related to particular countries and you get results that are highly contestable at best and severely slanted at worst. It is easy to construe this paper as more propaganda than research.

That this study appeared in a peer reviewed outlet demonstrates that any paper can pass editorial muster if the review board is sympathetic to a particular ideological viewpoint.

There are several other good points made by this author concerning the (mis)measurement of economic inequality. We will consider some of them in future posts.

Labels:

EU,

manipulation,

measurement,

media,

natural law,

socialism,

war

Subscribe to:

Posts (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)