The moon looks mean

And the crew ain't stayin'

There's gonna be some blood

They're all sayin'

--Jay Ferguson

Increasingly, people seem to be convincing themselves that as long as 'risk free' interest rates are suppressed low, then risky asset classes will move higher. If the yield on a security is greater than zero, then it is worth buying, the basic rationale goes. Even more so because central banks seem willing to backstop such investment policy.

This rationale is grounds for financial suicide. How much will you pay for a dollar of annual yield? As people are willing to pay more and more for less and less, they are walking further out on the risk plank.

A whole lot of people will be wondering what they were thinking when the plank drops away.

Monday, June 30, 2014

Sunday, June 29, 2014

Intervention is Aggression

Here comes the rain again

Raining in my head like a tragedy

Tearing me apart like a new emotion

--Eurythmics

Market intervention, whether it be via monetary policy, regulation, subsidies, taxes, price ceilings/floors, et al., is aggression. It forcibly interferes with voluntary cooperation among individuals engaged in production and trade.

This aggression is marshalled by special interest principals who employ strong-armed government agents to get their way. The intent is to benefit thru the use of force on others--rather than thru one's own productive effort or peaceful influence.

Market intervention disturbs the peace. It offends natural forces that push prosperity higher over time.

By interfering with free will and reasoned judgment, intervention compromises God's gift for alleviating impoverishment in the world.

Raining in my head like a tragedy

Tearing me apart like a new emotion

--Eurythmics

Market intervention, whether it be via monetary policy, regulation, subsidies, taxes, price ceilings/floors, et al., is aggression. It forcibly interferes with voluntary cooperation among individuals engaged in production and trade.

This aggression is marshalled by special interest principals who employ strong-armed government agents to get their way. The intent is to benefit thru the use of force on others--rather than thru one's own productive effort or peaceful influence.

Market intervention disturbs the peace. It offends natural forces that push prosperity higher over time.

By interfering with free will and reasoned judgment, intervention compromises God's gift for alleviating impoverishment in the world.

Labels:

agency problem,

Bible,

intervention,

markets,

natural law,

productivity,

reason,

regulation,

taxes,

war

Saturday, June 28, 2014

Secular Decline in GDP Growth

There's a place where the light won't find you

Holding hands while the walls come tumbling down

When they do, I'll be right behind you

--Tears for Fears

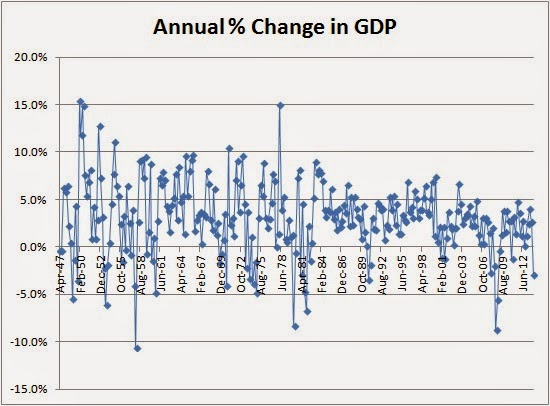

The 'final' revision' of Q1 GDP found that the US economy contracted at a 2.9% annual rate. In other words, output shrank. Back in January, 'consensus' estimates were for a gain of 2.6%. The government, just like corporations, blame the miss on 'weather.'

While the large near term drop in output is disturbing, the bigger picture problem is secular decline in US GDP growth.

The graph below plots annual percentage change in GDP using quarterly real GDP since 1947. It is clear that GDP growth has been slowing for decades.

From 1950-1969, GDP growth averaged 4.2%. From 1970-1999 growth slowed to 3.2% (two sample t-test for difference in means p = .084). Since 2000, mean GDP growth has slipped to 1.7% (p = .003).

Because 'real' GDP over-reports output because it under-reports CPI-based inflation, actual decline in GDP growth is likely much worse.

Why is GDP growth slowing or perhaps contracting? Markets are becoming less free, and savings--the basis for investment and productivity improvement--is evaporating in favor of debt.

Because output and prosperity go hand in hand, we're tracing a decline of prosperity.

Holding hands while the walls come tumbling down

When they do, I'll be right behind you

--Tears for Fears

The 'final' revision' of Q1 GDP found that the US economy contracted at a 2.9% annual rate. In other words, output shrank. Back in January, 'consensus' estimates were for a gain of 2.6%. The government, just like corporations, blame the miss on 'weather.'

While the large near term drop in output is disturbing, the bigger picture problem is secular decline in US GDP growth.

The graph below plots annual percentage change in GDP using quarterly real GDP since 1947. It is clear that GDP growth has been slowing for decades.

From 1950-1969, GDP growth averaged 4.2%. From 1970-1999 growth slowed to 3.2% (two sample t-test for difference in means p = .084). Since 2000, mean GDP growth has slipped to 1.7% (p = .003).

Because 'real' GDP over-reports output because it under-reports CPI-based inflation, actual decline in GDP growth is likely much worse.

Why is GDP growth slowing or perhaps contracting? Markets are becoming less free, and savings--the basis for investment and productivity improvement--is evaporating in favor of debt.

Because output and prosperity go hand in hand, we're tracing a decline of prosperity.

Labels:

capital,

debt,

manipulation,

markets,

measurement,

media,

productivity,

saving

Friday, June 27, 2014

Social Opposition to the Fed

It's time we stop

Hey, what's that sound?

Everybody look what's going down

--Buffalo Springfield

Is it possible that the Fed's radical inflationary actions will be hamstrung by public opinion? Thru its actions, the Fed is facilitating the greatest wealth transfer in the history of the world. What if the public catches on? What if the public demands a stop to polices that skew wealth in an unnatural manner?

Many statists face a dilemma. They endorse government force to 'fix' problems. Yet they see wealth skewing more to the rich as a result of government policy. Moreover, prices are rising in many categories as purchasing power is destroyed. Yet, to demand an end to inflationary Fed policy would be to admit that government force is making things worse instead of better.

Such a thought is surely difficult for many statists to process.

However, as $trillions are printed and supplied to the privileged--who in turn exchange that cash for real economic resources produced by others--perhaps the cognitive dissonance grows to the point where the public mind breaks thru its mental block and recognizes the truth.

If it did, then the Fed's current policies and perhaps the institution itself would be history.

Hey, what's that sound?

Everybody look what's going down

--Buffalo Springfield

Is it possible that the Fed's radical inflationary actions will be hamstrung by public opinion? Thru its actions, the Fed is facilitating the greatest wealth transfer in the history of the world. What if the public catches on? What if the public demands a stop to polices that skew wealth in an unnatural manner?

Many statists face a dilemma. They endorse government force to 'fix' problems. Yet they see wealth skewing more to the rich as a result of government policy. Moreover, prices are rising in many categories as purchasing power is destroyed. Yet, to demand an end to inflationary Fed policy would be to admit that government force is making things worse instead of better.

Such a thought is surely difficult for many statists to process.

However, as $trillions are printed and supplied to the privileged--who in turn exchange that cash for real economic resources produced by others--perhaps the cognitive dissonance grows to the point where the public mind breaks thru its mental block and recognizes the truth.

If it did, then the Fed's current policies and perhaps the institution itself would be history.

Labels:

agency problem,

Fed,

government,

inflation,

institution theory,

measurement,

media,

reason,

sentiment,

socionomics

Thursday, June 26, 2014

The Simon Trade

"I'm here for one reason and one reason only. I'm here to guess what the music might do in a week, a month, a year from now. That's it. Nothing more. And standing here tonight, I'm afraid that I don't...here...a think. Just...silence."

--John Tuld (Margin Call)

Nose bleed stock prices and uber low vols found me revisiting the Minyanville classic about Simon. John Succo tells the tale of a trading desk friend who bought cheap out-of-the-money S&P index puts in the summer of 1987 and rode them down the subsequent October crash.

What makes the story so interesting is not just that Simon got the timing right on trading a market meltdown, but that he was able to express his trade in a vehicle that was extraordinarily priced.

Option selling had been in vogue for years. Market makers had been making a killing selling puts in a rising market, collecting the premium, then watching the puts go to zero. The popularity of 'portfolio insurance' added to The Street's 'short vol' position.

Somewhat like today's situation where investors are overreaching for yield in an era of interest rate repression, put sellers in 1987 were willing to sell puts at very low prices because they figured that the premium, however low, was like free money. Not only was this creating a dangerous macro environment due to the increased leveraged wrought from massive put selling, but it was suppressing put premiums to extraordinary lows.

John notes that Simon was able to buy six month 10% out-of-the-money puts for less than 0.05% of the index. This enabled Simon to control more than 20 times the underlying stock compared to today, where similar puts typically cost ~1% of the index price.

Stated differently, Simon was able to secure far more leverage per trading dollar than a trader could purchase in today's environment.

As markets weakened and his puts grabbed delta, Simon's P/L exploded higher. When Simon closed his project on the day of the crash, the result was...early retirement. By my calcs, Simon's $12,500 investment (2000 puts @ $.0625) grew to $11.8 million (2000 puts @ $59).

So, with current volatility indexes tickling record lows, does this mean that a bearish market participant can leg into a trade similar to Simon's?

Nope.

Although low implied vols mean that many at-the-money options are cheaper than usual, there is still demand for out-of-the-money puts. Currently, a 10% out-of-the-money put on the SPY costs about 1.1%, and there is chunky open interest at strikes down option chain. The condition where volatilities implied by prices paid for out-of-the-money options are high compared to implied volatilities for at-the-money options is sometimes referred to as 'skew.'

In short, despite the decline in implied volatility in general, prices of out-of-the-money puts have not come down much. Skew is high.

This does not mean that buying index puts to express a bearish view is necessarily a bad idea. A six month 10% out-of-the-money SPY put currently costs about $2. If the SPX drops 20% between now and December expiry then that option will be worth $20+.

A ten bagger would surely be a great trade. However, it requires a large decline in the SPX over the next six months. The probabilities of such an event, coupled with relatively high prices for the speculative instrument, do not match the risk:reward profile of The Simon Trade.

position in SPX

--John Tuld (Margin Call)

Nose bleed stock prices and uber low vols found me revisiting the Minyanville classic about Simon. John Succo tells the tale of a trading desk friend who bought cheap out-of-the-money S&P index puts in the summer of 1987 and rode them down the subsequent October crash.

What makes the story so interesting is not just that Simon got the timing right on trading a market meltdown, but that he was able to express his trade in a vehicle that was extraordinarily priced.

Option selling had been in vogue for years. Market makers had been making a killing selling puts in a rising market, collecting the premium, then watching the puts go to zero. The popularity of 'portfolio insurance' added to The Street's 'short vol' position.

Somewhat like today's situation where investors are overreaching for yield in an era of interest rate repression, put sellers in 1987 were willing to sell puts at very low prices because they figured that the premium, however low, was like free money. Not only was this creating a dangerous macro environment due to the increased leveraged wrought from massive put selling, but it was suppressing put premiums to extraordinary lows.

John notes that Simon was able to buy six month 10% out-of-the-money puts for less than 0.05% of the index. This enabled Simon to control more than 20 times the underlying stock compared to today, where similar puts typically cost ~1% of the index price.

Stated differently, Simon was able to secure far more leverage per trading dollar than a trader could purchase in today's environment.

As markets weakened and his puts grabbed delta, Simon's P/L exploded higher. When Simon closed his project on the day of the crash, the result was...early retirement. By my calcs, Simon's $12,500 investment (2000 puts @ $.0625) grew to $11.8 million (2000 puts @ $59).

So, with current volatility indexes tickling record lows, does this mean that a bearish market participant can leg into a trade similar to Simon's?

Nope.

Although low implied vols mean that many at-the-money options are cheaper than usual, there is still demand for out-of-the-money puts. Currently, a 10% out-of-the-money put on the SPY costs about 1.1%, and there is chunky open interest at strikes down option chain. The condition where volatilities implied by prices paid for out-of-the-money options are high compared to implied volatilities for at-the-money options is sometimes referred to as 'skew.'

In short, despite the decline in implied volatility in general, prices of out-of-the-money puts have not come down much. Skew is high.

This does not mean that buying index puts to express a bearish view is necessarily a bad idea. A six month 10% out-of-the-money SPY put currently costs about $2. If the SPX drops 20% between now and December expiry then that option will be worth $20+.

A ten bagger would surely be a great trade. However, it requires a large decline in the SPX over the next six months. The probabilities of such an event, coupled with relatively high prices for the speculative instrument, do not match the risk:reward profile of The Simon Trade.

position in SPX

Labels:

asset allocation,

derivatives,

leverage,

risk,

sentiment,

technical analysis

Wednesday, June 25, 2014

Population Center of Gravity

And after all the violence and the double talk

There's just a song in all the trouble and the strife

You do the walk, yeah, you do the walk of life

You do the walk of life

--Dire Straits

Interesting center of gravity analysis of US population since 1790 (interactive version here).

Center of gravity has consistently shifted west with every census. And since the 1930 census, pop center has been shifting south as well.

In 1880, COG was close to Cincinnati. Current center of gravity is Texas County, Missouri.

There's just a song in all the trouble and the strife

You do the walk, yeah, you do the walk of life

You do the walk of life

--Dire Straits

Interesting center of gravity analysis of US population since 1790 (interactive version here).

Center of gravity has consistently shifted west with every census. And since the 1930 census, pop center has been shifting south as well.

In 1880, COG was close to Cincinnati. Current center of gravity is Texas County, Missouri.

Tuesday, June 24, 2014

Losing IRS Emails

Illusion never changed

Into something real

--Natalie Imbruglia

The Obama administration is pushing its lawlessness to new levels with recent announcements that emails from key bureaucrats involved in the IRS scandal have been...lost.

This administration continues to operate is if it believes that the citizenry is either apathetic or stupid.

Into something real

--Natalie Imbruglia

The Obama administration is pushing its lawlessness to new levels with recent announcements that emails from key bureaucrats involved in the IRS scandal have been...lost.

This administration continues to operate is if it believes that the citizenry is either apathetic or stupid.

Monday, June 23, 2014

Democracy and Minority Rights

Kreese: What's the matter? The boy can't take care of his own problems?

Miyagi: One to one problem, yes. FIVE to one problem, too much ask anyone.

--Karate Kid

Laughable statement uttered this morning on the radio by a well known political analyst (paraphrased): The definition of democracy is not majority rule but respect for minority rights.

This person is either delusional or hopes that listeners are stupid.

Democracy is in fact majority rule--the process of putting majority opinion into law. It is an expression of positivism. If a group can conjure the majority of votes, then what this group says, goes. Why? Because they control the government agents who tote the guns.

By definition, minority rights are subservient to the whims of the majority in a democracy. In fact, the majority is likely to rationalize aggression on minorities to no end.

Because it grants privilege rather than preserves rights, democracy discriminates against minority interests.

Respect for minority rights requires rule of law. Democracy facilitates rule by discretion--unequal treatment under the law.

Miyagi: One to one problem, yes. FIVE to one problem, too much ask anyone.

--Karate Kid

Laughable statement uttered this morning on the radio by a well known political analyst (paraphrased): The definition of democracy is not majority rule but respect for minority rights.

This person is either delusional or hopes that listeners are stupid.

Democracy is in fact majority rule--the process of putting majority opinion into law. It is an expression of positivism. If a group can conjure the majority of votes, then what this group says, goes. Why? Because they control the government agents who tote the guns.

By definition, minority rights are subservient to the whims of the majority in a democracy. In fact, the majority is likely to rationalize aggression on minorities to no end.

Because it grants privilege rather than preserves rights, democracy discriminates against minority interests.

Respect for minority rights requires rule of law. Democracy facilitates rule by discretion--unequal treatment under the law.

Labels:

agency problem,

democracy,

government,

media,

natural law,

socialism,

war

Sunday, June 22, 2014

Patriotism

"Why should I trade one tyrant three thousand miles away for three thousand tyrants one mile away? An elected legislature can trample a man's rights as easily as a king can."

--Benjamin Martin (The Patriot)

Patriotism is often framed as devotion to nation over self. It is not just 'loving one's country,' but doing things in the name of country that one might not do otherwise.

Military contexts often foster patriotic accolades. Fighting for one's country' is commonly deemed patriotic. Military veterans are often labeled as patriots.

The thing about patriotism is that it is usually employed by a group seeking to influence the behavior of others. A person is patriotic if he/she acts in favor of the group and unpatriotic otherwise.

As such, patriotism is a form of social control--a potent and dangerous one at that. The most powerful nation states in world history bathed in patriotism. Citizens acting in the name of country have committed the worst of human atrocities.

Can there be a 'good' form of patriotism. Perhaps. Perhaps good patriotism consists of individuals who see their government going on the offensive, and act to restrain the scope of government to its natural limits.

Many actions of our founding ancestors reflected this notion of patriotism.

--Benjamin Martin (The Patriot)

Patriotism is often framed as devotion to nation over self. It is not just 'loving one's country,' but doing things in the name of country that one might not do otherwise.

Military contexts often foster patriotic accolades. Fighting for one's country' is commonly deemed patriotic. Military veterans are often labeled as patriots.

The thing about patriotism is that it is usually employed by a group seeking to influence the behavior of others. A person is patriotic if he/she acts in favor of the group and unpatriotic otherwise.

As such, patriotism is a form of social control--a potent and dangerous one at that. The most powerful nation states in world history bathed in patriotism. Citizens acting in the name of country have committed the worst of human atrocities.

Can there be a 'good' form of patriotism. Perhaps. Perhaps good patriotism consists of individuals who see their government going on the offensive, and act to restrain the scope of government to its natural limits.

Many actions of our founding ancestors reflected this notion of patriotism.

Labels:

founders,

government,

institution theory,

natural law,

rhetoric,

socialism,

war

Saturday, June 21, 2014

Fed Funds and Instability

If you leave

Don't look back

I'll be running the other way

--OMD

Many things to ponder when viewing this chart.

Fed funds rate has declined from ~18% in 1980 to effectively zero today. A secular decline. The distortions wrought by this policy over the past 30 yrs are mind boggling.

GDP growth has slowed with Fed funds rate decline. This is no spurious correlation.

Not shown here, but lay stock, bond, real estate prices on top of this graph and see what you get. Again, the correlation is not spurious.

The Fed intervenes with easy credit at every 'crisis' point. Can there be more fertile ground for moral hazard?

The secular decline in Fed funds rate indicates that the Fed never fully takes the punch bowl away. Residual stimulus is left in the system after each 'crisis.' There is no 'neutral' funds rate. This is a recipe for addiction.

With Fed funds rate at zero, the Fed has reached the notorious 'zero bound.' Does that mean that they are out of gas? Hardly. There are negative fed funds rates. There is outright asset purchase (a.k.a. 'quantitative easing'). There is straight money printing (e.g., sending people 'stimulus checks').

The tilt to the graph suggests diminishing returns to each unit of Fed intervention. It also suggests that natural market forces are building. At some point that potential energy will turn kinetic--and the Fed will have less counterforce to cope.

Declining Fed funds is a reflection of growing instability.

Don't look back

I'll be running the other way

--OMD

Many things to ponder when viewing this chart.

Fed funds rate has declined from ~18% in 1980 to effectively zero today. A secular decline. The distortions wrought by this policy over the past 30 yrs are mind boggling.

GDP growth has slowed with Fed funds rate decline. This is no spurious correlation.

Not shown here, but lay stock, bond, real estate prices on top of this graph and see what you get. Again, the correlation is not spurious.

The Fed intervenes with easy credit at every 'crisis' point. Can there be more fertile ground for moral hazard?

The secular decline in Fed funds rate indicates that the Fed never fully takes the punch bowl away. Residual stimulus is left in the system after each 'crisis.' There is no 'neutral' funds rate. This is a recipe for addiction.

With Fed funds rate at zero, the Fed has reached the notorious 'zero bound.' Does that mean that they are out of gas? Hardly. There are negative fed funds rates. There is outright asset purchase (a.k.a. 'quantitative easing'). There is straight money printing (e.g., sending people 'stimulus checks').

The tilt to the graph suggests diminishing returns to each unit of Fed intervention. It also suggests that natural market forces are building. At some point that potential energy will turn kinetic--and the Fed will have less counterforce to cope.

Declining Fed funds is a reflection of growing instability.

Labels:

credit,

Fed,

inflation,

intervention,

measurement,

moral hazard,

natural law,

productivity,

risk,

technical analysis,

yields

Friday, June 20, 2014

Measuring Regulation

Cylinder dreams passing in stages

Lethargic grins left to bare

Broadway window, cubical cages

Where escape is fairly rare

--Ric Ocasek

Academic study provides empirical evidence of negative relationship between regulation and industry productivity. Such results should not be surprising, and we have discussed this relationship many times on these pages.

The paper might serve as a good reference for its conceptual development of the regulation:productivity argument as well as for its examples of behavior in regulated industries.

The paper is also interesting in how it measured extent of regulation. Simply counting the number of regulations that restrain industry behavior is problematic since some regulations have much greater inhibiting effect than others.

For example, Federal Register page counts, while providing some sense of general regulatory trends, ignores the extent to which some regulations might influence behavior. Applied to the regulatory context, the Pareto Principle suggests that relatively few regulations are likely to have outsized impact.

A better measure is to use counts of binding words, such as "shall," "must," and "prohibited" that appear in regulatory text. Binding word counts are appealing because they better reflect the constraints imposed by regulations rather than wordiness.

The authors used a binding word count index developed by RegData for 96 industries. They split the industries into three groups--high, medium, low regulated--and then compared them using various measures of productivity obtained from the BLS. Their data set was longitudinal, covering 1997-2010.

Comparison of means and regression analysis were straightforward. Results demonstrating the negative effects of regulation on productivity are clear.

Lethargic grins left to bare

Broadway window, cubical cages

Where escape is fairly rare

--Ric Ocasek

Academic study provides empirical evidence of negative relationship between regulation and industry productivity. Such results should not be surprising, and we have discussed this relationship many times on these pages.

The paper might serve as a good reference for its conceptual development of the regulation:productivity argument as well as for its examples of behavior in regulated industries.

The paper is also interesting in how it measured extent of regulation. Simply counting the number of regulations that restrain industry behavior is problematic since some regulations have much greater inhibiting effect than others.

For example, Federal Register page counts, while providing some sense of general regulatory trends, ignores the extent to which some regulations might influence behavior. Applied to the regulatory context, the Pareto Principle suggests that relatively few regulations are likely to have outsized impact.

A better measure is to use counts of binding words, such as "shall," "must," and "prohibited" that appear in regulatory text. Binding word counts are appealing because they better reflect the constraints imposed by regulations rather than wordiness.

The authors used a binding word count index developed by RegData for 96 industries. They split the industries into three groups--high, medium, low regulated--and then compared them using various measures of productivity obtained from the BLS. Their data set was longitudinal, covering 1997-2010.

Comparison of means and regression analysis were straightforward. Results demonstrating the negative effects of regulation on productivity are clear.

Thursday, June 19, 2014

Rationales for Military Aggression

"We seem to spend more time training for seizure than for prevention--like the Commies already had the stuff and we had to get it back."

--Col William "Mutt" Henderson (Seven Days In May)

At least one of three reasons is usually offered when it is desired to apply military force in a foreign land:

1) Protecting national interests. The foreign land has resources (e.g., oil) that the invader needs or desires.

2) Nation building. The invader seeks to 'spread democracy' or some other characteristic to a foreign land.

3) National security. The foreign land contains a perceived threat that, it is thought, must be neutralized in a preemptive manner.

The problem with each of these is that they condone the use of offensive rather than defensive force. Each is an excuse, a rationalization, for aggression.

--Col William "Mutt" Henderson (Seven Days In May)

At least one of three reasons is usually offered when it is desired to apply military force in a foreign land:

1) Protecting national interests. The foreign land has resources (e.g., oil) that the invader needs or desires.

2) Nation building. The invader seeks to 'spread democracy' or some other characteristic to a foreign land.

3) National security. The foreign land contains a perceived threat that, it is thought, must be neutralized in a preemptive manner.

The problem with each of these is that they condone the use of offensive rather than defensive force. Each is an excuse, a rationalization, for aggression.

Wednesday, June 18, 2014

Tony Gwynn

"Good judgment comes from experience and a lot of that comes from bad judgment."

--Arthur Bishop (The Mechanic)

Tony Gwynn passed away on Monday. He had mouth cancer--attributed to chewing snuff (as in 'just a pinch between the cheek and gum') during his career. He had just turned 54 in May.

Using batting average as the yardstick, Gwynn was among the best pure hitters of all time, and certainly the best of the past 30 years. His lifetime average was .338 and he led the league in hitting 8 times. He was also a 15 time All Star who earned 5 Gold Gloves in the outfield. Gwynn was inducted into the Hall of Fame in 2007.

Gwynn was a mechanic, the consummate technician of hitting a baseball. Studying the craft like few others, he was among the first to routinely view video of himself at the plate and then put what he learned to work.

The most amazing of Gwynn's stats, to me, are his strikeout stats. In 9288 at bats, Gwynn struck out 434 times. That's striking out less than once in every 20 at bats. Spread across his 20 year career, he averaged about 22 K's per year. In his career, he struck out 3 times in a game...once. He said that he hated to strike out--that he would rather bounce feebly to the pitcher rather than whiff.

That attitude is long gone today.

RIP TG.

--Arthur Bishop (The Mechanic)

Tony Gwynn passed away on Monday. He had mouth cancer--attributed to chewing snuff (as in 'just a pinch between the cheek and gum') during his career. He had just turned 54 in May.

Using batting average as the yardstick, Gwynn was among the best pure hitters of all time, and certainly the best of the past 30 years. His lifetime average was .338 and he led the league in hitting 8 times. He was also a 15 time All Star who earned 5 Gold Gloves in the outfield. Gwynn was inducted into the Hall of Fame in 2007.

Gwynn was a mechanic, the consummate technician of hitting a baseball. Studying the craft like few others, he was among the first to routinely view video of himself at the plate and then put what he learned to work.

The most amazing of Gwynn's stats, to me, are his strikeout stats. In 9288 at bats, Gwynn struck out 434 times. That's striking out less than once in every 20 at bats. Spread across his 20 year career, he averaged about 22 K's per year. In his career, he struck out 3 times in a game...once. He said that he hated to strike out--that he would rather bounce feebly to the pitcher rather than whiff.

That attitude is long gone today.

RIP TG.

Tuesday, June 17, 2014

Human Rights = Property Rights

Come on baby dry your eyes

Wipe your tears

Never like to see you cry

--Human League

I have seen this quote from former Supreme Court Justice George Sutherland before and thought I had it recorded in these pages--but apparently not. Currently I am unable to find the original source but pretty sure I will run across it (again).

Justice Sutherland well captures the inseparabililty of human rights and property rights:

"It is not the right of property which is protected, but the right to property. Property, per se, has no rights; but the individual--the man--has three great rights, equally sacred from arbitrary interference: the right to his life, the right to his liberty, the right to his property...The three rights are so bound together to be essentially one right. To give a man his life but deny him his liberty, is to take from him all that is worth living. To give him his liberty but take from him the property which is the fruit and badge of his liberty, is to still leave him a slave."

These pages have concluded similarly (e.g., here, here). Rothbard also offers perspective.

Wipe your tears

Never like to see you cry

--Human League

I have seen this quote from former Supreme Court Justice George Sutherland before and thought I had it recorded in these pages--but apparently not. Currently I am unable to find the original source but pretty sure I will run across it (again).

Justice Sutherland well captures the inseparabililty of human rights and property rights:

"It is not the right of property which is protected, but the right to property. Property, per se, has no rights; but the individual--the man--has three great rights, equally sacred from arbitrary interference: the right to his life, the right to his liberty, the right to his property...The three rights are so bound together to be essentially one right. To give a man his life but deny him his liberty, is to take from him all that is worth living. To give him his liberty but take from him the property which is the fruit and badge of his liberty, is to still leave him a slave."

These pages have concluded similarly (e.g., here, here). Rothbard also offers perspective.

Labels:

Depression,

freedom,

judicial,

liberty,

Lincoln,

natural law,

property,

taxes

Monday, June 16, 2014

Firming Commodities

Riders on the storm

Riders on the storm

Into this house we're born

Into this world we're thrown

--The Doors

Commodity baskets appear to be firming. Yes, geopolitical tensions in Iraq and elsewhere are boosting the oil complex, but many other commodities, such as gold and silver, appear to be gathering technical strength as well.

Am keeping my eye on some commodity ETFs as proxies. Many are challenging multi-year downtrends. If they break through with authority, then commodity bulls will be riding point.

position in DBC

Riders on the storm

Into this house we're born

Into this world we're thrown

--The Doors

Commodity baskets appear to be firming. Yes, geopolitical tensions in Iraq and elsewhere are boosting the oil complex, but many other commodities, such as gold and silver, appear to be gathering technical strength as well.

Am keeping my eye on some commodity ETFs as proxies. Many are challenging multi-year downtrends. If they break through with authority, then commodity bulls will be riding point.

position in DBC

Labels:

commodities,

energy,

inflation,

Iran,

oil,

technical analysis,

war

Sunday, June 15, 2014

War and Economic Growth

Guy de Lusignan: Give me a war.

Reynald de Chatillon: That is what I do.

--Kingdom of Heaven

Few venues publish more absurd pieces than the NYT. This one, however, is among the most absurd. The proposition is that lack of war is hurting global growth.

The author, an economist from George Mason University (who by his affiliation should know better), suggests that "greater peacefulness of the world may make the attainment of higher rates of economic growth less likely." Further, "the very possibility of war focuses the attention of governments on getting some basic decisions right--whether investing in science or simply liberalizing the economy. Such focus ends up improving a nation's longer run prospects."

This is a laughable proposition and merely another variation of the Bastiat's Broken Window Fallacy.

War, or any destructive violence for that matter, destroys productive assets. Efforts to rebuild them merely get the capital stock back towards even. All the while, society is hurt because those efforts could have gone toward advancing prosperity rather than rebuilding it.

Taking this 'logic' to completion suggests bulldozing houses and killing people in the name of progress.

The author's argument does differ a bit. He posits that war allows government to force advancements that it cannot do in peacetime. But the author does not explain how government force during war, or anytime for that matter, 'liberalizes' economies and is superior to voluntary interactions among people always interested in improving their positions in life. He never explains how advancement occurs in the context of broken assets, lost lives, and all of the energy diverted to unproductive killing and conquest rather than to peaceful cooperation.

In the context of war, a more plausible argument for today's slowing growth is that savings and debt used to finance wars or capacity for war in the past have resulted in capital consumption, leaving us less capable of investing in projects that improve productivity in the future.

Sadly, history suggests policymakers derive just the sort of foolish lesson suggested by this article: that war can be an effective way to bolster an economy--assuming that you win the war, of course.

Reynald de Chatillon: That is what I do.

--Kingdom of Heaven

Few venues publish more absurd pieces than the NYT. This one, however, is among the most absurd. The proposition is that lack of war is hurting global growth.

The author, an economist from George Mason University (who by his affiliation should know better), suggests that "greater peacefulness of the world may make the attainment of higher rates of economic growth less likely." Further, "the very possibility of war focuses the attention of governments on getting some basic decisions right--whether investing in science or simply liberalizing the economy. Such focus ends up improving a nation's longer run prospects."

This is a laughable proposition and merely another variation of the Bastiat's Broken Window Fallacy.

War, or any destructive violence for that matter, destroys productive assets. Efforts to rebuild them merely get the capital stock back towards even. All the while, society is hurt because those efforts could have gone toward advancing prosperity rather than rebuilding it.

Taking this 'logic' to completion suggests bulldozing houses and killing people in the name of progress.

The author's argument does differ a bit. He posits that war allows government to force advancements that it cannot do in peacetime. But the author does not explain how government force during war, or anytime for that matter, 'liberalizes' economies and is superior to voluntary interactions among people always interested in improving their positions in life. He never explains how advancement occurs in the context of broken assets, lost lives, and all of the energy diverted to unproductive killing and conquest rather than to peaceful cooperation.

In the context of war, a more plausible argument for today's slowing growth is that savings and debt used to finance wars or capacity for war in the past have resulted in capital consumption, leaving us less capable of investing in projects that improve productivity in the future.

Sadly, history suggests policymakers derive just the sort of foolish lesson suggested by this article: that war can be an effective way to bolster an economy--assuming that you win the war, of course.

Labels:

capacity,

capital,

debt,

Depression,

government,

intervention,

measurement,

media,

productivity,

saving,

self defense,

socialism,

war

Saturday, June 14, 2014

Palladium Closed

I get up

And nothing gets me down

You got it tough

Well, I've seen the toughest around

--Van Halen

Had the good fortune to take my small palladium trade earlier in the week before the classic 'Wesson 45' trend break.

Rolled proceeds into gold and silver. Not only are these my precious metals of choice, but the complex appears to be gathering technical strength.

position in CEF

And nothing gets me down

You got it tough

Well, I've seen the toughest around

--Van Halen

Had the good fortune to take my small palladium trade earlier in the week before the classic 'Wesson 45' trend break.

Rolled proceeds into gold and silver. Not only are these my precious metals of choice, but the complex appears to be gathering technical strength.

position in CEF

Labels:

asset allocation,

commodities,

gold,

Russia,

sentiment,

silver,

technical analysis

Drying Up

Hands across the water

Heads across the sky

--Paul McCartney

As reported by ZeroHedge, the Baltic Dry Index (BDI) continues to bounce along the bottom hit after crashing in 2008. Currently it is on pace to deliver close to its worst annual performance in measured history.

Bulls continue to drink all BDI numbers pretty. When the index rebounded in 2009-10, bulls hailed the rise as an indicator of global growth following the credit market meltdown.

When the BDI sank back to crisis levels, bulls dismissed the decline, claiming that it was a case of overcapacity in the shipping business rather than weak demand.

Now, nearly four years after this supposed situation arose, bulls want to believe that supply has yet to balance with demand despite tales of global growth.

An alternative interpretation, one that seems increasingly plausible, is that shipping prices remain soft because global demand is weak.

Heads across the sky

--Paul McCartney

As reported by ZeroHedge, the Baltic Dry Index (BDI) continues to bounce along the bottom hit after crashing in 2008. Currently it is on pace to deliver close to its worst annual performance in measured history.

Bulls continue to drink all BDI numbers pretty. When the index rebounded in 2009-10, bulls hailed the rise as an indicator of global growth following the credit market meltdown.

When the BDI sank back to crisis levels, bulls dismissed the decline, claiming that it was a case of overcapacity in the shipping business rather than weak demand.

Now, nearly four years after this supposed situation arose, bulls want to believe that supply has yet to balance with demand despite tales of global growth.

An alternative interpretation, one that seems increasingly plausible, is that shipping prices remain soft because global demand is weak.

Labels:

capacity,

credit,

measurement,

reason,

sentiment,

technical analysis

Friday, June 13, 2014

Optional Licensing

"Cyn! Guess where I am."

--Tess McGill (Working Girl)

It appears more people are waking up to the downside of mandatory occupational licensing. Far more workers require some form of occupational license today compared to a few decades ago.

As the post observes, this forcible intervention raises cost to consumers. It also serves as a barrier to entry in many fields, which hits low income workers particularly hard.

The merits of optional, rather than mandatory, licensing is discussed. Individuals could legally practice in a profession such as medicine, law, or finance without a license. However, some might choose to achieve certification to signal quality and commitment to the profession. Those without licenses would provide services to those who are less prices sensitive (assuming certified individuals would charge premiums).

Consumers might also be attracted to unlicensed individuals because they may be sources of novel services. Because they are less subject to constraints that may be imposed by licensing institutions, unlicensed providers are more likely to think entrepreneurially and to innovate.

Because mandatory licensing limits the quantity of goods and services available to consumers, relaxing licensing requirements improves standard of living.

--Tess McGill (Working Girl)

It appears more people are waking up to the downside of mandatory occupational licensing. Far more workers require some form of occupational license today compared to a few decades ago.

As the post observes, this forcible intervention raises cost to consumers. It also serves as a barrier to entry in many fields, which hits low income workers particularly hard.

The merits of optional, rather than mandatory, licensing is discussed. Individuals could legally practice in a profession such as medicine, law, or finance without a license. However, some might choose to achieve certification to signal quality and commitment to the profession. Those without licenses would provide services to those who are less prices sensitive (assuming certified individuals would charge premiums).

Consumers might also be attracted to unlicensed individuals because they may be sources of novel services. Because they are less subject to constraints that may be imposed by licensing institutions, unlicensed providers are more likely to think entrepreneurially and to innovate.

Because mandatory licensing limits the quantity of goods and services available to consumers, relaxing licensing requirements improves standard of living.

Thursday, June 12, 2014

Blinded by Conceit

"How dare you come into this office and bark at me like some little junkyard dog. I am the President of the United States!"

--President Bennett (Clear and Present Danger)

Judge Nap argues that the modern presidency, and particularly the Obama administration, is "blinded by a conceit that says it can do no wrong." This has been a function of a process that has shifted power from states to the federal government before a permissive Congress. It is also a function of a president who thinks that he knows better than others about how those others should live.

The judge ends by quoting James Madison, who warned liberty is most threatened under the ruse of government beneficence:

"Experience should teach us to be most on guard to protect liberty when the government's purposes are beneficent. Men born to freedom are naturally alert to repel invasion of their liberty by evil-minded rulers. The greatest dangers to liberty lurk in insidious encroachment by men of zeal, well-meaning but without understanding."

--President Bennett (Clear and Present Danger)

Judge Nap argues that the modern presidency, and particularly the Obama administration, is "blinded by a conceit that says it can do no wrong." This has been a function of a process that has shifted power from states to the federal government before a permissive Congress. It is also a function of a president who thinks that he knows better than others about how those others should live.

The judge ends by quoting James Madison, who warned liberty is most threatened under the ruse of government beneficence:

"Experience should teach us to be most on guard to protect liberty when the government's purposes are beneficent. Men born to freedom are naturally alert to repel invasion of their liberty by evil-minded rulers. The greatest dangers to liberty lurk in insidious encroachment by men of zeal, well-meaning but without understanding."

Labels:

Constitution,

founders,

government,

institution theory,

intervention,

liberty,

Obama,

self defense,

socialism

Wednesday, June 11, 2014

Radical Extremists

"You can beat a man's skull. You can arrest him. You can throw him into a dungeon. But how do you control what's up here? How do you control an idea?"

--Sextus (Ben-Hur)

It has become all-too-common for the status quo to label folks who disagree with them as radicals and extremists. The status quo's assumption is that those labels will serve a derogatory purpose, ultimately quelling the threat posed by someone willing to break away from the pack and attack rigid, unproductive institutions.

This is because the status quo values compliance and conformity. Thus, accusing others of being non-compliant and non-conforming seems appropriately derogatory.

It does not dawn on the status quo that people who break from the status quo view the radical and extremist labels as complimentary. They know that significant positive change, by definition, requires radical departure from the status quo.

Radicals and extremists, not the status quo, have paved the way for human advancement since the beginning. The Catholic church and the United States were founded on such radicalism.

When this is no longer the case, then perhaps we will have reached the end of time.

--Sextus (Ben-Hur)

It has become all-too-common for the status quo to label folks who disagree with them as radicals and extremists. The status quo's assumption is that those labels will serve a derogatory purpose, ultimately quelling the threat posed by someone willing to break away from the pack and attack rigid, unproductive institutions.

This is because the status quo values compliance and conformity. Thus, accusing others of being non-compliant and non-conforming seems appropriately derogatory.

It does not dawn on the status quo that people who break from the status quo view the radical and extremist labels as complimentary. They know that significant positive change, by definition, requires radical departure from the status quo.

Radicals and extremists, not the status quo, have paved the way for human advancement since the beginning. The Catholic church and the United States were founded on such radicalism.

When this is no longer the case, then perhaps we will have reached the end of time.

Labels:

Bible,

entrepreneurship,

founders,

freedom,

institution theory,

productivity,

rhetoric,

self defense,

sentiment,

socialism,

socionomics,

war

Tuesday, June 10, 2014

Student Loan Bailout

All in all it's just

Another brick in the wall

--Pink Floyd

President Obama is taking unilateral actions with the stated purpose of easing the burden of college student loans. The primary move is to cap loan repayments at 10% of monthly income.

Meanwhile, proposals for loan refinancing and loan forgiveness continue to circulate.

Such actions fit the general mold of bubble blowing followed by bailout. In this case: Make cheap student loans easier to get-->increase supply of college grads vs what markets will bear-->decrease salary per graduate-->make it tougher for college grads to pay back loans-->ease pain by loosening payback terms.

In 2013 student loan debt surpassed credit card debt, and crossed the $1 trillion mark. Delinquencies have been rising even faster than student loan growth over the past year or so.

The higher ed bubble continues to grow--and moral hazard along with it.

Another brick in the wall

--Pink Floyd

President Obama is taking unilateral actions with the stated purpose of easing the burden of college student loans. The primary move is to cap loan repayments at 10% of monthly income.

Meanwhile, proposals for loan refinancing and loan forgiveness continue to circulate.

Such actions fit the general mold of bubble blowing followed by bailout. In this case: Make cheap student loans easier to get-->increase supply of college grads vs what markets will bear-->decrease salary per graduate-->make it tougher for college grads to pay back loans-->ease pain by loosening payback terms.

In 2013 student loan debt surpassed credit card debt, and crossed the $1 trillion mark. Delinquencies have been rising even faster than student loan growth over the past year or so.

The higher ed bubble continues to grow--and moral hazard along with it.

Monday, June 9, 2014

Battlefield Conscience

"A king may move a man. A father may claim a son. But remember that, even when those who move you be kings or men of great power, your soul is in your keeping alone. When you stand before God you cannot say 'But I was told by others to do thus,' or that 'Virtue was not convenient at the time.' This will not suffice. Remember that."

--King Baldwin IV (Kingdom of Heaven)

Wonderful essay by Leonard Read originally written in 1951. The essay finds a critically wounded soldier on the battlefield conversing with his conscience about the legitimacy of his worldly actions--particularly as they pertained to engaging in war.

The banter draws out a number of points previously considered on these pages, such as the "I was just following orders" excuse to rationalize acts of aggression.

I would put this essay in front of all young adults--particularly those considering military service.

His points that I wanted to highlight here are a more general ones. One is that "not knowing" is no excuse if people fail to engage their power to reason--a gift granted by God to help us test what we experience against what is correct and erroneous. It is our responsibility to engage our reasoning capacity to the best of our ability in pursuit of truth.

The other, related, point is made by Read's Conscience toward the end. Conscience states that although it is subject to error, "I am as close to God as you can get on this earth."

That statement left its mark on me.

--King Baldwin IV (Kingdom of Heaven)

Wonderful essay by Leonard Read originally written in 1951. The essay finds a critically wounded soldier on the battlefield conversing with his conscience about the legitimacy of his worldly actions--particularly as they pertained to engaging in war.

The banter draws out a number of points previously considered on these pages, such as the "I was just following orders" excuse to rationalize acts of aggression.

I would put this essay in front of all young adults--particularly those considering military service.

His points that I wanted to highlight here are a more general ones. One is that "not knowing" is no excuse if people fail to engage their power to reason--a gift granted by God to help us test what we experience against what is correct and erroneous. It is our responsibility to engage our reasoning capacity to the best of our ability in pursuit of truth.

The other, related, point is made by Read's Conscience toward the end. Conscience states that although it is subject to error, "I am as close to God as you can get on this earth."

That statement left its mark on me.

Sunday, June 8, 2014

Confidence Key

"You know, most people would kill to be treated like a god, just for a few moments."

--Norman Dale (Hoosiers)

The correlation between stock prices and quantitative easing (QE) is unmistakeable. Increasingly, the SPX has been in lockstep with Fed balance sheet expansion:

In the rare periods where the Fed has not been intervening in markets over the past 5 years, stock prices have floundered:

Because the Fed views the same charts that we do, we know that it will be reluctant to remove any degree of stimulus that materially hurts stock prices.

This situation raises a couple of interesting questions. What will ever cause the Fed to retract QE? And, if the Fed does not retract QE, then what will ever cause stock prices to go down?

Some believe that the answer to the first question is: nothing--at least nothing that will cause the Fed to retract QE voluntarily. Institutional hubris grows by the day at the Fed--each day that stock prices levitate and there is no hyperinflation from printing $trillions increases conviction that policymakers have stumbled upon an economic elixer of magnanimous strength. To those who own stocks, the Fed is god-like. The Fed has bestowed unto them huge amounts of paper wealth. Humans who think themselves godlike rarely relinquish their iconic pedastals willingly.

Of course, removal of QE may not be of the Fed's volition. Instead, bond markets may tank, or signs of Big Inflation may become evident to the masses. Perhaps awareness will grow that what the Fed is doing amounts to the greatest wealth transfer in the history of the world--and people wake up to the robbery in progress.

Short of such forced withdrawal, however, many investors sense a QE Forever situation--and a concommitant high stock prices forever situation. If the Fed has our backs with eternal QE, they ask, then how can such a situation ever take stock prices down?

The answer to this question first requires thought about the correlation reflected by the first graph above. On the surface, strong correlation between the Fed's balance sheet and stock prices suggests a high degree of causality--i.e., the more money the Fed prints by buying securities, the higher stock prices will go.

It is true that a necessary condition for stock prices to fly higher here is presence of massive Fed credit creation and securities buying. But it is not a sufficient condition. What is also required is confidence--confidence that the Fed knows what it is doing, and that the interventions will work.

Such confidence has been in place so far. But the real issue involves whether such confidence will persist going forward. What would cause confidence in the Fed and its actions to decline? How likely are such causes?

If you answer "Nothing" and "Near zero," then you have nothing to worry about.

However, if you sense that the mother of all bubbles is an expanding bubble in confidence--in confidence in the competence of monetary bureaucrats, then it is easy to see how at some point, the relationship between Fed balance sheet size and stock prices reflected by the first graph above begins to diverge and break down.

Stated differently, the correlation evident in the first graph can be seen as a spurious one. If confidence in the Fed breaks down, then the correlation goes away or perhaps even turns negative.

position in SPX

--Norman Dale (Hoosiers)

The correlation between stock prices and quantitative easing (QE) is unmistakeable. Increasingly, the SPX has been in lockstep with Fed balance sheet expansion:

In the rare periods where the Fed has not been intervening in markets over the past 5 years, stock prices have floundered:

Because the Fed views the same charts that we do, we know that it will be reluctant to remove any degree of stimulus that materially hurts stock prices.

This situation raises a couple of interesting questions. What will ever cause the Fed to retract QE? And, if the Fed does not retract QE, then what will ever cause stock prices to go down?

Some believe that the answer to the first question is: nothing--at least nothing that will cause the Fed to retract QE voluntarily. Institutional hubris grows by the day at the Fed--each day that stock prices levitate and there is no hyperinflation from printing $trillions increases conviction that policymakers have stumbled upon an economic elixer of magnanimous strength. To those who own stocks, the Fed is god-like. The Fed has bestowed unto them huge amounts of paper wealth. Humans who think themselves godlike rarely relinquish their iconic pedastals willingly.

Of course, removal of QE may not be of the Fed's volition. Instead, bond markets may tank, or signs of Big Inflation may become evident to the masses. Perhaps awareness will grow that what the Fed is doing amounts to the greatest wealth transfer in the history of the world--and people wake up to the robbery in progress.

Short of such forced withdrawal, however, many investors sense a QE Forever situation--and a concommitant high stock prices forever situation. If the Fed has our backs with eternal QE, they ask, then how can such a situation ever take stock prices down?

The answer to this question first requires thought about the correlation reflected by the first graph above. On the surface, strong correlation between the Fed's balance sheet and stock prices suggests a high degree of causality--i.e., the more money the Fed prints by buying securities, the higher stock prices will go.

It is true that a necessary condition for stock prices to fly higher here is presence of massive Fed credit creation and securities buying. But it is not a sufficient condition. What is also required is confidence--confidence that the Fed knows what it is doing, and that the interventions will work.

Such confidence has been in place so far. But the real issue involves whether such confidence will persist going forward. What would cause confidence in the Fed and its actions to decline? How likely are such causes?

If you answer "Nothing" and "Near zero," then you have nothing to worry about.

However, if you sense that the mother of all bubbles is an expanding bubble in confidence--in confidence in the competence of monetary bureaucrats, then it is easy to see how at some point, the relationship between Fed balance sheet size and stock prices reflected by the first graph above begins to diverge and break down.

Stated differently, the correlation evident in the first graph can be seen as a spurious one. If confidence in the Fed breaks down, then the correlation goes away or perhaps even turns negative.

position in SPX

Saturday, June 7, 2014

Arguments Against Secession

Welcome said the nightman

We are programmed to receive

You can check out any time you like

But you can never leave

--Eagles

Why have states throughout the world, and throughout history, not allowed secession to occur within their territories? Various reasons are offered here.

States typically argue that secession is not legal. But claims to legality do not necessarily align with what is lawful or right. A group of people cannot be held in thrall to a government to which it does not consent.

A second argument is that secession destroys unity within the state. But unity is not a requirement for prosperity. In fact, diversity, discomfort, and disputes with the status quo are vital for progress. Moreover, if others cannot persuade those wanting to secede, then 'unity' becomes a construct of force rather than volition.

A third argument is that secession makes the remaining state weaker to defend. But how can a state be strongly defended when people inside its various territories do not wish to be there? Moreover, federations of states are capable of forming defensive coalitions while remaining independent.

The likely reason for government opposition to secession is that the state loses control over people and resources when some fraction of the governed decide to break away. Because it does not want to give up its 'property,' the state is likely to fight secession with maximum force.

We are programmed to receive

You can check out any time you like

But you can never leave

--Eagles

Why have states throughout the world, and throughout history, not allowed secession to occur within their territories? Various reasons are offered here.

States typically argue that secession is not legal. But claims to legality do not necessarily align with what is lawful or right. A group of people cannot be held in thrall to a government to which it does not consent.

A second argument is that secession destroys unity within the state. But unity is not a requirement for prosperity. In fact, diversity, discomfort, and disputes with the status quo are vital for progress. Moreover, if others cannot persuade those wanting to secede, then 'unity' becomes a construct of force rather than volition.

A third argument is that secession makes the remaining state weaker to defend. But how can a state be strongly defended when people inside its various territories do not wish to be there? Moreover, federations of states are capable of forming defensive coalitions while remaining independent.

The likely reason for government opposition to secession is that the state loses control over people and resources when some fraction of the governed decide to break away. Because it does not want to give up its 'property,' the state is likely to fight secession with maximum force.

Labels:

entrepreneurship,

government,

intervention,

liberty,

Lincoln,

property,

self defense,

war

Friday, June 6, 2014

We're Not Free

"You think you're free. You're not."

--Diamond Dog (Con Air)

Jacob Hornberger observes that, during their school years, US citizens are inculcated into believing that they are free. But just because we are able to move about, talk to others, surf the Internet, et al with little restraint, that does not mean that we are free.

JH highlights three restraints on liberty that prohibit us from living truly free lives:

1) Government wields control over income. Practically speaking, the current tax system puts government in control of all income; it decides how much each person is permitted to keep. Until we are free to work and dispose of our production and property as we see fit, then we are not free.

2) Government wields control over peaceful behavior. In addition to economic activity, government controls what we do in our leisure time. Drugs, prostitution, gambling, and other activities are regulated by the government. Until we are allowed to make choices, even bad ones, concerning our own well-being, then we are not free.

3) Government wields control over the war machine. Government justifies much of its actions in the name of 'national security.' By and large, however, these actions are aggressive rather than defensive in nature. People can be spied upon and taken into custody if they are deemed threats to national security. Until we throw off totalitarian methods of the warfare state, then we are not free.

--Diamond Dog (Con Air)

Jacob Hornberger observes that, during their school years, US citizens are inculcated into believing that they are free. But just because we are able to move about, talk to others, surf the Internet, et al with little restraint, that does not mean that we are free.

JH highlights three restraints on liberty that prohibit us from living truly free lives:

1) Government wields control over income. Practically speaking, the current tax system puts government in control of all income; it decides how much each person is permitted to keep. Until we are free to work and dispose of our production and property as we see fit, then we are not free.

2) Government wields control over peaceful behavior. In addition to economic activity, government controls what we do in our leisure time. Drugs, prostitution, gambling, and other activities are regulated by the government. Until we are allowed to make choices, even bad ones, concerning our own well-being, then we are not free.

3) Government wields control over the war machine. Government justifies much of its actions in the name of 'national security.' By and large, however, these actions are aggressive rather than defensive in nature. People can be spied upon and taken into custody if they are deemed threats to national security. Until we throw off totalitarian methods of the warfare state, then we are not free.

Labels:

education,

freedom,

intervention,

liberty,

manipulation,

media,

productivity,

property,

regulation,

self defense,

taxes,

war

Thursday, June 5, 2014

Negative Interest Rates

So I went to the bank to see what they could do

They said, 'Son, look like bad luck got a hold on you'

--Simply Red

As part of its newest package to 'combat deflation,' the ECB announced a charge for banks that want to deposit funds with the ECB. Modern banks typically pay interest, rather than charge fees, for the privilege of holding depositor funds (and trading them in their own personal accounts).

Negative interest rates have long been discussed by central bankers as a possible extreme measure in extreme situations. The idea is to penalize savings in favor of consumption.

It can be argued of course that real interest rates have negative for some time in this era of financial repression.

We are now seeing the even more misguided policy of negative nominal rates come to life.

They said, 'Son, look like bad luck got a hold on you'

--Simply Red

As part of its newest package to 'combat deflation,' the ECB announced a charge for banks that want to deposit funds with the ECB. Modern banks typically pay interest, rather than charge fees, for the privilege of holding depositor funds (and trading them in their own personal accounts).

Negative interest rates have long been discussed by central bankers as a possible extreme measure in extreme situations. The idea is to penalize savings in favor of consumption.

It can be argued of course that real interest rates have negative for some time in this era of financial repression.

We are now seeing the even more misguided policy of negative nominal rates come to life.

Wednesday, June 4, 2014

Universal Code

It's coming any day now said the captain

It's coming any day now cried the priest

--Bruce Hornsby & the Range

Many people respond with some variation of, "Don't impose your morality on me!" when someone else seeks to use strong arm of government to enact some normative code. These normative codes are based on religious or secular beliefs of what is right and wrong.

Because diversity and variation are axiomatic, it should be expected that some object when others seek to impose beliefs by use of force.

However, there is one code that seems universal--that transcends any particular belief system. This is the code of natural rights. People have the right to dispose of their lives, wherewithal to produce, and their property as they see fit.

Not only are natural rights inalienable as Jefferson observed, but this is the universal code that transcends belief systems and 'social contracts.'

How do we know this? From a humanitarian perspective, this code prohibits the use of offensive force. Force can be used for self-defense purposes only.

From a utilitarian perspective, absent this code, people are busy defending their lives, liberty, and property against attack. While they are doing so, they are not producing. When they are not producing, standard of living does not advance. In fact, standard of living will fall, even collapse, if invasion becomes pervasive enough.

If people want to prosper and do so peacefully, then natural law becomes the one standard that all races, nationalities, religions, generations, et al. should be amenable to. It forms the basis of durable law.

It's coming any day now cried the priest

--Bruce Hornsby & the Range

Many people respond with some variation of, "Don't impose your morality on me!" when someone else seeks to use strong arm of government to enact some normative code. These normative codes are based on religious or secular beliefs of what is right and wrong.

Because diversity and variation are axiomatic, it should be expected that some object when others seek to impose beliefs by use of force.

However, there is one code that seems universal--that transcends any particular belief system. This is the code of natural rights. People have the right to dispose of their lives, wherewithal to produce, and their property as they see fit.

Not only are natural rights inalienable as Jefferson observed, but this is the universal code that transcends belief systems and 'social contracts.'

How do we know this? From a humanitarian perspective, this code prohibits the use of offensive force. Force can be used for self-defense purposes only.

From a utilitarian perspective, absent this code, people are busy defending their lives, liberty, and property against attack. While they are doing so, they are not producing. When they are not producing, standard of living does not advance. In fact, standard of living will fall, even collapse, if invasion becomes pervasive enough.

If people want to prosper and do so peacefully, then natural law becomes the one standard that all races, nationalities, religions, generations, et al. should be amenable to. It forms the basis of durable law.

Labels:

Bible,

contracts,

Jefferson,

liberty,

natural law,

property,

self defense,

socialism,

war

Tuesday, June 3, 2014

Mental Health Screening

They can see no reasons

'Cause there are no reasons

What reason do you need to die?

--Boomtown Rats

Whenever a mentally ill person does something that hurts someone else, it is tempting to propose some form of mental health screening administered by the federal government. We need preemptive screening, goes the rationale, in order to protect people.

Ron Paul discusses why mental health screening is a bad idea. The primary issue is that such screening violates individuals' Fourth Amendment right to be secure in their person and papers. Any mental health screening databases would be subject to confidentiality concerns as well as identity theft.

Giving government power to determine an individual's degree of mental fitness ahead of some sort of licensing or permitting, such as gun ownership, could lead to major abuse. Any citizen deemed to hold negative opinions of a particular regime could be deemed 'mentally ill,' as that tag is socially constructed and arbitrary.

Stated differently, government sponsored mental health screening compromises liberty.

A counterargument is that mental health screening, while reducing liberty, keeps people safer. But it is not government's responsibility to keep people safe. The role of government is to help people guard their freedom.

Moreover, research suggests that it is difficult to predict that people deemed 'mentally ill' will act in a violent manner.

One way to limit the effect of violent behavior, such as mass shootings, by mentally ill people is to make sure that people are capable of defending themselves as they see fit. Gun control laws that disarm law abiding citizens make them bigger targets.

If we feel that government needs to be involved in the mental health-crime link in some way, then perhaps it can scrutinize the relationship between SSRI drugs and violent crime.

Otherwise, a culture that encourages self responsibility and respect for the rights of others is the best defense against aggression.

'Cause there are no reasons

What reason do you need to die?

--Boomtown Rats

Whenever a mentally ill person does something that hurts someone else, it is tempting to propose some form of mental health screening administered by the federal government. We need preemptive screening, goes the rationale, in order to protect people.

Ron Paul discusses why mental health screening is a bad idea. The primary issue is that such screening violates individuals' Fourth Amendment right to be secure in their person and papers. Any mental health screening databases would be subject to confidentiality concerns as well as identity theft.

Giving government power to determine an individual's degree of mental fitness ahead of some sort of licensing or permitting, such as gun ownership, could lead to major abuse. Any citizen deemed to hold negative opinions of a particular regime could be deemed 'mentally ill,' as that tag is socially constructed and arbitrary.

Stated differently, government sponsored mental health screening compromises liberty.

A counterargument is that mental health screening, while reducing liberty, keeps people safer. But it is not government's responsibility to keep people safe. The role of government is to help people guard their freedom.

Moreover, research suggests that it is difficult to predict that people deemed 'mentally ill' will act in a violent manner.

One way to limit the effect of violent behavior, such as mass shootings, by mentally ill people is to make sure that people are capable of defending themselves as they see fit. Gun control laws that disarm law abiding citizens make them bigger targets.

If we feel that government needs to be involved in the mental health-crime link in some way, then perhaps it can scrutinize the relationship between SSRI drugs and violent crime.

Otherwise, a culture that encourages self responsibility and respect for the rights of others is the best defense against aggression.

Labels:

Constitution,

freedom,

intervention,

liberty,

measurement,

natural law,

pharma,

security,

self defense,

Tea Party

Monday, June 2, 2014

Hampered Healthcare Markets

Rain keeps falling

Rain keeps falling

Down, down, down, down

--Simple Minds

Nice review of some ways that healthcare markets have become hampered over the years. Author highlights 1960s implementation of Medicare and Medicaid as an important inflection point, as healthcare prices really started taking off at this point.