We can go where we want to

A place where they will never find

We can act like we come from out of this world

Leave the real one far behind

--Men Without Hats

Another thrust to record lows for Treasury yields this am.

10 yr rates now below 1.6%.

position in BOND

Thursday, May 31, 2012

Wednesday, May 30, 2012

Gimme Shelter

Oh, a storm is threatening

My very life today

If I don't get some shelter

Lord, I'm gonna fade away

--Rolling Stones

Standout action this am in Treasuries. EU flames have both Treasuries and Bunds catching big bids.

10 yr yields have broken below 1.7%. Record low.

In retrospect, seemingly ugly headfake on bond bears two months back...

position in BOND, SPX

My very life today

If I don't get some shelter

Lord, I'm gonna fade away

--Rolling Stones

Standout action this am in Treasuries. EU flames have both Treasuries and Bunds catching big bids.

10 yr yields have broken below 1.7%. Record low.

In retrospect, seemingly ugly headfake on bond bears two months back...

position in BOND, SPX

Tuesday, May 29, 2012

Wisdom of Warrenbonds

"I heard that about you. You like to work alone."

--Ice Man (Top Gun)

John Hussman once again reinforces his message of overvalued, overleveraged markets that must 'clear' before real progress can be made. He thinks that perhaps that will occur in 2012. Implied, I think, is that stock prices would need to significantly decline.

I also like his analogy of Eurobonds to 'Warrenbonds." Suppose 9 broke people approached Warren Buffett that they would all get together and issue Warrenbonds to fund the activities of the ten. The activities would be backed by the assets of the consortium which, in this case, would be WB's assets. 90% of the 'group' would agree on the wisdom of this idea, and WB would be criticized as the lone, selfish holdout.

WB would never agree to such a plan unless he could impose strict controls over the activities of the others. Of course, the 9 broke people would be unlikely to consent to such loss of sovereignty, so the Warrenbond idea never gets off the ground.

Same for Eurobonds.

I might add that this analogy bears some resemblance to modern democracy and class warfare arguments.

position in SPX

--Ice Man (Top Gun)

John Hussman once again reinforces his message of overvalued, overleveraged markets that must 'clear' before real progress can be made. He thinks that perhaps that will occur in 2012. Implied, I think, is that stock prices would need to significantly decline.

I also like his analogy of Eurobonds to 'Warrenbonds." Suppose 9 broke people approached Warren Buffett that they would all get together and issue Warrenbonds to fund the activities of the ten. The activities would be backed by the assets of the consortium which, in this case, would be WB's assets. 90% of the 'group' would agree on the wisdom of this idea, and WB would be criticized as the lone, selfish holdout.

WB would never agree to such a plan unless he could impose strict controls over the activities of the others. Of course, the 9 broke people would be unlikely to consent to such loss of sovereignty, so the Warrenbond idea never gets off the ground.

Same for Eurobonds.

I might add that this analogy bears some resemblance to modern democracy and class warfare arguments.

position in SPX

Monday, May 28, 2012

Adding Some Equities

Give me a chance

Give me a sign

I'll show her anytime

Su-Sussudio

--Phil Collins

While my macro outlook remains decidedly bearish, I have been buying some equities over the past months. Nothing crazy. Currently, my net stock exposure is about 4% of total liquid assets (19% long minus 15% index short). If we should happen to sell off hard over the next few months, I may take that exposure up to ~25%.

Various factors are making me more sanguine toward equities, including:

Financial repression. This is the label being assigned to global policies that are forcing interest rates toward zero for the foreseeable future. Suppressed interest rates discourage traditional forms of saving. As such, dividend paying stocks, particularly those of large cap low beta names such as Johnson & Johnson (JNJ) and Procter & Gamble (PG), look increasingly attractive. Many of these stocks yield 3% or more, which easily beats the payout on multi-year CDs. Moreover, they tend to hold their value pretty well in general stock downdrafts. Yes, principal is still at risk, but I'm increasingly comfortable holding a few of my favorite divendend payers here as income generators.

Inflation hedge. If you review this site's archives, you'll find many posts discussing inflation vs deflation. I've generally favored a 'deflation before big inflation' sequence. It is becoming increasingly apparent to me, however, that I might have it backwards. Tendency of central banks to print aggressively to avoid any economic pain suggests that Big Inflation may precede the ultimate deflationary bust. Think Weimar. While stocks may not keep up with real assets like gold in such a scenario, they will likely hold up better than cash.

Decent value. I'm actually seeing decent value in a few of my favorite names (i.e., well branded, cash rich, high margin, strong competitive position stalwarts). JNJ seems reasonably priced. In tech, Cisco (CSCO) and Applied Materials (AMAT) look interesting. After the recent downdraft in the miners, Pan American Silver (PAAS) popped up on my radar as well. I don't have to torture my discounted cash flow models to find value here. One limitation, however, is that the basis for my cash flow modeling is the last 3-4 years of financial performance--a period that has been generous to US corporations. As John Hussman has frequently stressed, using the past few years of historical performance to forecast future performance is likely to over-estimate future cash flow generating capacities. While I'm in full agreement, my valuation models are pretty conservative in their assumptions, making me comfortable with taking initial positions in some of my favorite names.

Yes, there is downside risk here, which is why I'm only 4% net long stock at present. Because lower prices reduce that risk, I'll likely use price weakness (if/when) to add to my fave names.

positions in AMAT, CSCO, JNJ, PAAS, PG, SPX, gold

Give me a sign

I'll show her anytime

Su-Sussudio

--Phil Collins

While my macro outlook remains decidedly bearish, I have been buying some equities over the past months. Nothing crazy. Currently, my net stock exposure is about 4% of total liquid assets (19% long minus 15% index short). If we should happen to sell off hard over the next few months, I may take that exposure up to ~25%.

Various factors are making me more sanguine toward equities, including:

Financial repression. This is the label being assigned to global policies that are forcing interest rates toward zero for the foreseeable future. Suppressed interest rates discourage traditional forms of saving. As such, dividend paying stocks, particularly those of large cap low beta names such as Johnson & Johnson (JNJ) and Procter & Gamble (PG), look increasingly attractive. Many of these stocks yield 3% or more, which easily beats the payout on multi-year CDs. Moreover, they tend to hold their value pretty well in general stock downdrafts. Yes, principal is still at risk, but I'm increasingly comfortable holding a few of my favorite divendend payers here as income generators.

Inflation hedge. If you review this site's archives, you'll find many posts discussing inflation vs deflation. I've generally favored a 'deflation before big inflation' sequence. It is becoming increasingly apparent to me, however, that I might have it backwards. Tendency of central banks to print aggressively to avoid any economic pain suggests that Big Inflation may precede the ultimate deflationary bust. Think Weimar. While stocks may not keep up with real assets like gold in such a scenario, they will likely hold up better than cash.

Decent value. I'm actually seeing decent value in a few of my favorite names (i.e., well branded, cash rich, high margin, strong competitive position stalwarts). JNJ seems reasonably priced. In tech, Cisco (CSCO) and Applied Materials (AMAT) look interesting. After the recent downdraft in the miners, Pan American Silver (PAAS) popped up on my radar as well. I don't have to torture my discounted cash flow models to find value here. One limitation, however, is that the basis for my cash flow modeling is the last 3-4 years of financial performance--a period that has been generous to US corporations. As John Hussman has frequently stressed, using the past few years of historical performance to forecast future performance is likely to over-estimate future cash flow generating capacities. While I'm in full agreement, my valuation models are pretty conservative in their assumptions, making me comfortable with taking initial positions in some of my favorite names.

Yes, there is downside risk here, which is why I'm only 4% net long stock at present. Because lower prices reduce that risk, I'll likely use price weakness (if/when) to add to my fave names.

positions in AMAT, CSCO, JNJ, PAAS, PG, SPX, gold

Labels:

asset allocation,

central banks,

deflation,

EU,

inflation,

risk,

saving,

time horizon,

valuation,

Weimar,

yields

Sunday, May 27, 2012

EU Discounting Mechanism

I don't want to wait for our lives to be over

I want to know right now what will it be

--Paula Cole

There is some belief that the European situation has been so broadly reported that markets have factored in most of the outcomes. Thus, when some 'resolution' actually occurs, it may largely be a nonevent for the markets.

Perhaps, but efficient discounting requires certain conditions to be present. One is that the information available can be interpreted as to its meaning. Stated differently, available information must permit various possible outcomes and their values to be forecast. Not sure this condition is present for the EU. Each day I read new interpretations of the Greek crisis alone. The leveraged, interconnected nature of global economies and financial systems make it difficult to grasp what will happen.

Another condition that must be present is the understanding of risk and reward associated with the decision. Market partipants must understand the penalties associated with being wrong, and the benefits associated with being right.

Through their past interventions, policymakers have skewed the risk/reward relationship far away from the one present in free markets. Poor decisions have largely been bailed out.

To the extent that market participants expect another round of bailouts, then they may be prone to take on more risk than they would in unhampered markets.

Stated differently, moral hazard may be impairing the discounting mechanism, causing unwise decisions to be made in front pending EU outcomes.

I want to know right now what will it be

--Paula Cole

There is some belief that the European situation has been so broadly reported that markets have factored in most of the outcomes. Thus, when some 'resolution' actually occurs, it may largely be a nonevent for the markets.

Perhaps, but efficient discounting requires certain conditions to be present. One is that the information available can be interpreted as to its meaning. Stated differently, available information must permit various possible outcomes and their values to be forecast. Not sure this condition is present for the EU. Each day I read new interpretations of the Greek crisis alone. The leveraged, interconnected nature of global economies and financial systems make it difficult to grasp what will happen.

Another condition that must be present is the understanding of risk and reward associated with the decision. Market partipants must understand the penalties associated with being wrong, and the benefits associated with being right.

Through their past interventions, policymakers have skewed the risk/reward relationship far away from the one present in free markets. Poor decisions have largely been bailed out.

To the extent that market participants expect another round of bailouts, then they may be prone to take on more risk than they would in unhampered markets.

Stated differently, moral hazard may be impairing the discounting mechanism, causing unwise decisions to be made in front pending EU outcomes.

Friday, May 25, 2012

Government is Force

"So why didn't you break his thumb like I told you? When you don't do what I tell you to do, you make me look bad."

--Gazzo (Rocky)

Rose Wilder Lane reminds us that government is force, pure and simple. It is interesting to ponder why this truth is not put forth in the earliest of class studies concerning government.

In a free society, limited government (i.e., a small amount of institutional force) is necessary in order to protect property rights. Specialists in the use of force are hired to help individuals protect their property, broadly construed to include life and wherewithal to produce as well as accumulated property, against assault.

Were this limited government not in place, then there would be anarchy. Under conditions of anarchy, individuals are less free because they must spend lots of time merely defending their property.

The Framers understood that, given the axiomatic human tendency to seek satisfaction using less effort, government would be seen by many as a mechanism for acquiring wealth without having to engage in productive work. The Constitution was therefore established to limit the powers of government so that people could not use government as tool for expropriation.

Today, the Constitution is broadly ignored as special interest groups (SIGs) of all shapes and sizes engage in the behavior that the Framers sought to prohibit--the use of government as a wealth appropriation tool.

It therefore follows that proponents of modern government are proponents of force. No different, really, from crime bosses that enlist strong armed muscle to do their dirty work.

--Gazzo (Rocky)

Rose Wilder Lane reminds us that government is force, pure and simple. It is interesting to ponder why this truth is not put forth in the earliest of class studies concerning government.

In a free society, limited government (i.e., a small amount of institutional force) is necessary in order to protect property rights. Specialists in the use of force are hired to help individuals protect their property, broadly construed to include life and wherewithal to produce as well as accumulated property, against assault.

Were this limited government not in place, then there would be anarchy. Under conditions of anarchy, individuals are less free because they must spend lots of time merely defending their property.

The Framers understood that, given the axiomatic human tendency to seek satisfaction using less effort, government would be seen by many as a mechanism for acquiring wealth without having to engage in productive work. The Constitution was therefore established to limit the powers of government so that people could not use government as tool for expropriation.

Today, the Constitution is broadly ignored as special interest groups (SIGs) of all shapes and sizes engage in the behavior that the Framers sought to prohibit--the use of government as a wealth appropriation tool.

It therefore follows that proponents of modern government are proponents of force. No different, really, from crime bosses that enlist strong armed muscle to do their dirty work.

Labels:

agency problem,

Constitution,

founders,

property,

war

Thursday, May 24, 2012

Questions of Fairness

It ain't no use, we're headed for disaster

Our minds say 'no,' but our hearts are talking faster

--Donnie Iris

A favorite word of the Left is fairness. People need to pay their fair share. People need a fair shot. Naturally, in all such rhetorical contexts, fairness implies gains for Leftist interests.

It should come as no surprise that hearing the word fairness drives reflexive reactions in some folks to protect their wallets.

To justify governmental policies driven by fairness arguments, people on the Left have several questions to answer, including:

a) How do you define fairness?

b) Are there other definitions of fairness?

c) Why should your definition of fairness be accepted over others?

d) How do you justify the use of force to impose your definition of fairness on others?

Framing answers in the context of the Constitution would also be insightful.

Our minds say 'no,' but our hearts are talking faster

--Donnie Iris

A favorite word of the Left is fairness. People need to pay their fair share. People need a fair shot. Naturally, in all such rhetorical contexts, fairness implies gains for Leftist interests.

It should come as no surprise that hearing the word fairness drives reflexive reactions in some folks to protect their wallets.

To justify governmental policies driven by fairness arguments, people on the Left have several questions to answer, including:

a) How do you define fairness?

b) Are there other definitions of fairness?

c) Why should your definition of fairness be accepted over others?

d) How do you justify the use of force to impose your definition of fairness on others?

Framing answers in the context of the Constitution would also be insightful.

Labels:

Constitution,

democracy,

government,

media,

rhetoric

Wednesday, May 23, 2012

Saving Despite Zero Yield

Maybe some day

Saved by zero

I'll be more together

--The Fixx

Although the unhampered free market ideal seemingly grows more distant by the day, forces that government free markets are still at work. This is because free market forces are grounded in natural laws that cannot be eliminated by edict.

Recent behavior of individuals to save more in the face of near zero interest rates provides an example. Policymakers have driven down rates in hopes that people will seek more risk and borrow. But multi-decade orgies of borrowing and spending facilitated by past low interest rate regimes have saddled many individuals with excessive debt and low savings.

As such, people are now feeling the urge (market forces) to spend less and save more despite low yields on savings instruments. Indeed, the above graph shows that savings rates have ticked up since the onset of the recession--which perplexes some policymakers to no end because they have been pressing interest rates lower during this period. Falling money velocities, at multi-decade lows, corroborate greater propensity to hoard cash.

When people feel the need to save more resources for a rainy day, there is perhaps no minimum interest rate that deters individuals from doing things that improve their capacities to survive and prosper (the law of purposeful self-interested behavior).

Markets perpetually seek proper balance between risk and reward. When policymakers detour this journey off its natural path, market forces intensify to move the relationship back into natural balance. The more extreme the excursion, the greater the influence of market forces to rebalance the system.

Saved by zero

I'll be more together

--The Fixx

Although the unhampered free market ideal seemingly grows more distant by the day, forces that government free markets are still at work. This is because free market forces are grounded in natural laws that cannot be eliminated by edict.

Recent behavior of individuals to save more in the face of near zero interest rates provides an example. Policymakers have driven down rates in hopes that people will seek more risk and borrow. But multi-decade orgies of borrowing and spending facilitated by past low interest rate regimes have saddled many individuals with excessive debt and low savings.

As such, people are now feeling the urge (market forces) to spend less and save more despite low yields on savings instruments. Indeed, the above graph shows that savings rates have ticked up since the onset of the recession--which perplexes some policymakers to no end because they have been pressing interest rates lower during this period. Falling money velocities, at multi-decade lows, corroborate greater propensity to hoard cash.

When people feel the need to save more resources for a rainy day, there is perhaps no minimum interest rate that deters individuals from doing things that improve their capacities to survive and prosper (the law of purposeful self-interested behavior).

Markets perpetually seek proper balance between risk and reward. When policymakers detour this journey off its natural path, market forces intensify to move the relationship back into natural balance. The more extreme the excursion, the greater the influence of market forces to rebalance the system.

Labels:

debt,

intervention,

markets,

natural law,

risk,

saving,

yields

Tuesday, May 22, 2012

Private Equity Goes Public

"The new law of evolution in corporate America seems to be survival of the unfittest. Well, in my book you either do it right, or you get eliminated."

--Gordon Gekko (Wall Street)

'Private equity' has been thrust into the forefront because Republican presidential hopeful Mitt Romney used to head Bain Capital, a large private equity firm. Private equity firms amass capital (which may be equity or debt financed) and take ownership stakes in businesses. Usually, although not always, these ownership stakes result in the companies going private if they were not already so.

While they sometimes invest in nascent industries and enterprises, private equity firms are more prone to scour mature industries for under-performing companies with commensurately low valuations. By purchasing controlling ownership stakes, private equity firms then act to make operations more productive. If the productivity improvements are successful, then profits are likely to rise. With rising profits come rising valuations. The benefits of higher valuation may then be realized by selling part or all of the company to another private owner, taking the company public (IPO), or operating the company as an ongoing concern.

Of course, it is also possible that the investment does not work out, in which case the private equity firm may either sell the company at a loss, file for bankruptcy, or operate the company as an ongoing concern.

From an investment perspective, private equity is considered an 'alternative asset class.' Alternative investments are asset classes with potential to produce returns that are uncorrelated to conventional stock and bond returns. Other alternative asset classes include commodities, venture capital, and hedge funds. As investors have become more sophisticated, alternative assets have become a popular way to diversify portfolios, particularly among institutional investors (e.g., pension funds, endowments). Portfolio managers have thus poured oceans of capital into private equity funds. Private equity funds under management are estimated at $2+ trillion dollars.

Thus, many Americans, particularly those with defined benefit plans, have ownership stakes in private equity.

There is good reason for this. The social value of private equity operations is that they improve efficiency of scarce economic resources. Unproductive operations squander economic resources, which drags down general standard of living. Reconfiguring under-performing operations toward more productive ends creates more output per unit of input. Inputs such as labor or materials that are no longer needed in the streamlined operations can subsequently seek more productive uses. Society is better off. This missive includes a partial review of research confirming the benefits of private equity operations.

Unfortunately, what captures the attention of many are the layoffs that often occur during productivity improvement efforts. Predictably, the Obama administration has jumped on this bandwagon, painting candidate Romney as a heartless soul who shuts down factories in pursuit of profits. With notable exceptions, the media happily play along.

Hazlitt has eloquently explained the error (a chronic one at that) of this line of thought.

To be sure, there are problems with the private equity model as currently practiced. Artificially cheap credit offered by central banks provides a level of funding for private equity projects unavailable if borrowing were based market-determined interest rates. Moreover, suppressed yields on more conservative investment vehicles has more portfolio managers seeking riskier positions, thereby showering private equity projects with far more funds than they otherwise would. Finally, the gigantic degree of leverage in the credit-induced financial system shrinks investment time horizon, making private equity operators and their investors more sensitive to short term outcomes than they would be in a less leveraged world.

In short, government intervention has surely inflated private equity projects far beyond their 'natural' reach. It has also made private equity investors less patient--i.e., more prone to prematurely pull the plug on projects might produce better results if given more time.

Of course, few government officials or mainstream media outlets are likely to take on this facet of private equity...

I do wonder whether the president may be unwittingly digging a hole for himself by attacking the idea of private equity operations. If Romney counters correctly, then the debate could morph into the merits of unhampered markets seeking the best use of scarce resources vs socialized markets that shelter and encourage under-performance.

American most desperately needs a full-throated debate on this issue. Perhaps private equity has 'funded' such a debate.

--Gordon Gekko (Wall Street)

'Private equity' has been thrust into the forefront because Republican presidential hopeful Mitt Romney used to head Bain Capital, a large private equity firm. Private equity firms amass capital (which may be equity or debt financed) and take ownership stakes in businesses. Usually, although not always, these ownership stakes result in the companies going private if they were not already so.

While they sometimes invest in nascent industries and enterprises, private equity firms are more prone to scour mature industries for under-performing companies with commensurately low valuations. By purchasing controlling ownership stakes, private equity firms then act to make operations more productive. If the productivity improvements are successful, then profits are likely to rise. With rising profits come rising valuations. The benefits of higher valuation may then be realized by selling part or all of the company to another private owner, taking the company public (IPO), or operating the company as an ongoing concern.

Of course, it is also possible that the investment does not work out, in which case the private equity firm may either sell the company at a loss, file for bankruptcy, or operate the company as an ongoing concern.

From an investment perspective, private equity is considered an 'alternative asset class.' Alternative investments are asset classes with potential to produce returns that are uncorrelated to conventional stock and bond returns. Other alternative asset classes include commodities, venture capital, and hedge funds. As investors have become more sophisticated, alternative assets have become a popular way to diversify portfolios, particularly among institutional investors (e.g., pension funds, endowments). Portfolio managers have thus poured oceans of capital into private equity funds. Private equity funds under management are estimated at $2+ trillion dollars.

Thus, many Americans, particularly those with defined benefit plans, have ownership stakes in private equity.

There is good reason for this. The social value of private equity operations is that they improve efficiency of scarce economic resources. Unproductive operations squander economic resources, which drags down general standard of living. Reconfiguring under-performing operations toward more productive ends creates more output per unit of input. Inputs such as labor or materials that are no longer needed in the streamlined operations can subsequently seek more productive uses. Society is better off. This missive includes a partial review of research confirming the benefits of private equity operations.

Unfortunately, what captures the attention of many are the layoffs that often occur during productivity improvement efforts. Predictably, the Obama administration has jumped on this bandwagon, painting candidate Romney as a heartless soul who shuts down factories in pursuit of profits. With notable exceptions, the media happily play along.

Hazlitt has eloquently explained the error (a chronic one at that) of this line of thought.

To be sure, there are problems with the private equity model as currently practiced. Artificially cheap credit offered by central banks provides a level of funding for private equity projects unavailable if borrowing were based market-determined interest rates. Moreover, suppressed yields on more conservative investment vehicles has more portfolio managers seeking riskier positions, thereby showering private equity projects with far more funds than they otherwise would. Finally, the gigantic degree of leverage in the credit-induced financial system shrinks investment time horizon, making private equity operators and their investors more sensitive to short term outcomes than they would be in a less leveraged world.

In short, government intervention has surely inflated private equity projects far beyond their 'natural' reach. It has also made private equity investors less patient--i.e., more prone to prematurely pull the plug on projects might produce better results if given more time.

Of course, few government officials or mainstream media outlets are likely to take on this facet of private equity...

I do wonder whether the president may be unwittingly digging a hole for himself by attacking the idea of private equity operations. If Romney counters correctly, then the debate could morph into the merits of unhampered markets seeking the best use of scarce resources vs socialized markets that shelter and encourage under-performance.

American most desperately needs a full-throated debate on this issue. Perhaps private equity has 'funded' such a debate.

Labels:

central banks,

commodities,

credit,

debt,

intervention,

leverage,

markets,

media,

natural law,

Obama,

productivity,

risk,

socialism,

valuation

Monday, May 21, 2012

Reversal of Fortune

So take that look out of here, it doesn't fit you

Because it's happened doesn't mean you've been discarded

--Big Country

Mining bulls may have gotten their 'blowoff low' signal that a low may be in. Many stocks reversed hard last week on good volume.

Nice follow thru in many of the shares today. For example, NEM pierced its multi-week downtrend, suggesting a change of course.

This action was all the more impressive in that the precious metals themselves did not do much today.

position in NEM

Sunday, May 20, 2012

Adding Fibo to the Diet

We can go where we want to

A place where they will never find

--Men Without Hats

Another look at the SPX using Fibonacci analysis. We use the March 2009 lows and the recent highs as the frame of reference.

Fibo retracement levels show a pretty good fit. The 'logical' landing zone using this perspective is 1135ish, which would represent a 38% retracement from the recent highs. 1135 happens to constitute the front lines of the battle waged last year.

position in SPX

A place where they will never find

--Men Without Hats

Another look at the SPX using Fibonacci analysis. We use the March 2009 lows and the recent highs as the frame of reference.

Fibo retracement levels show a pretty good fit. The 'logical' landing zone using this perspective is 1135ish, which would represent a 38% retracement from the recent highs. 1135 happens to constitute the front lines of the battle waged last year.

position in SPX

Saturday, May 19, 2012

You Don't Do It Yourself

There's a room where the light won't find you

Holding hands while

The wall come tumbling down

When they do, I'll be right behind you

--Tears for Fears

I have now heard several renditions of a curious argument by people on the Left. It goes something like this. No one goes it alone on the road to success. Public institutions play a significant role. If you are a successful businessperson, for example, then your employees were students at public schools, and your supply chain is supported by public roads.

Without such public works, you would be less successful. Therefore, you are obligated to pay your fair share to support government works.

This argument appears to be nothing more than a rationalization for Big Government. Anyone holding up this claim as truth would need to address several issues in order to be convincing, including:

Pre-paid usage. Those who are economically well off pay the majority of taxes in the US. As such, these people have largely funded the public institutions that they are said to be exploiting. In fact, they could be seen as majority owners of public works who are reaping dividends from past 'investments.' If the argument is that successful people benefit from public institutions, haven't they already paid for that privilege?

Forced participation. In protection rackets, people are 'asked' to pay gangsters to protect property from destruction from those same gangsters. Pay up and be secure. This is a form of slavery.

Imagine Southern plantation owners in the early/mid 1800s telling slaves, "The roof over your heads and the food on your tables comes is a benefit of the institution of slavery. Be thankful. You owe us slave owners your continued support."

Currently, society (a.k.a. The State) forces the surrender of wealth. Some of the booty is deployed to keep those who are robbed productive enough so that they may be robbed again down the road.

Why isn't the you-don't-do-it-yourself argument a pro-slavery argument?

Ex post contract changes. People voluntarily engage in trade to better their situations. Trade is governed by contract law. If an employer and worker reach a wage agreement made in good faith, for instance, that agreement must be honored unless both sides voluntarily renegotiate.

The you-don't-do-it-yourself argument implies that contracts governing past trades are invalid and that new rules can be made ex post--by one side of the trade. In the present context, if a person becomes 'successful,' then the entity on the other side of the trade can hit the successful person up for more than the original agreement.

The moral and economic implications of such an arrangement are obvious. Anyone who feels slighted in past exchanges can approach past trading partners and claim, "You owe me more."

Why, then, is it reasonable to ignore contract law governing exchange?

Absent sound responses to these issues, you-don't-do-it-yourself is just another slogan chanted by Statists and their mindless followers.

Holding hands while

The wall come tumbling down

When they do, I'll be right behind you

--Tears for Fears

I have now heard several renditions of a curious argument by people on the Left. It goes something like this. No one goes it alone on the road to success. Public institutions play a significant role. If you are a successful businessperson, for example, then your employees were students at public schools, and your supply chain is supported by public roads.

Without such public works, you would be less successful. Therefore, you are obligated to pay your fair share to support government works.

This argument appears to be nothing more than a rationalization for Big Government. Anyone holding up this claim as truth would need to address several issues in order to be convincing, including:

Pre-paid usage. Those who are economically well off pay the majority of taxes in the US. As such, these people have largely funded the public institutions that they are said to be exploiting. In fact, they could be seen as majority owners of public works who are reaping dividends from past 'investments.' If the argument is that successful people benefit from public institutions, haven't they already paid for that privilege?

Forced participation. In protection rackets, people are 'asked' to pay gangsters to protect property from destruction from those same gangsters. Pay up and be secure. This is a form of slavery.

Imagine Southern plantation owners in the early/mid 1800s telling slaves, "The roof over your heads and the food on your tables comes is a benefit of the institution of slavery. Be thankful. You owe us slave owners your continued support."

Currently, society (a.k.a. The State) forces the surrender of wealth. Some of the booty is deployed to keep those who are robbed productive enough so that they may be robbed again down the road.

Why isn't the you-don't-do-it-yourself argument a pro-slavery argument?

Ex post contract changes. People voluntarily engage in trade to better their situations. Trade is governed by contract law. If an employer and worker reach a wage agreement made in good faith, for instance, that agreement must be honored unless both sides voluntarily renegotiate.

The you-don't-do-it-yourself argument implies that contracts governing past trades are invalid and that new rules can be made ex post--by one side of the trade. In the present context, if a person becomes 'successful,' then the entity on the other side of the trade can hit the successful person up for more than the original agreement.

The moral and economic implications of such an arrangement are obvious. Anyone who feels slighted in past exchanges can approach past trading partners and claim, "You owe me more."

Why, then, is it reasonable to ignore contract law governing exchange?

Absent sound responses to these issues, you-don't-do-it-yourself is just another slogan chanted by Statists and their mindless followers.

Labels:

markets,

productivity,

property,

reason,

socialism,

specialization,

taxes

Friday, May 18, 2012

Facebook's Faceplant

It's easy to deceive

It's easy to tease

But hard to get release

--Billy Idol

The much acclaimed Facebook (FB) IPO occurred today. Approx 2.7 billion shares were priced in the primary market at $38 giving FB a mkt cap $100+ billion. Shares started trading on the NASDAQ before noon today at an opening price of about $42.

In the salad days of the tech bubble, shares would explode higher from there. Indeed, some pundits were predicting $100 FB stock by end of day.

It wasn't to be. Prices leaked all day, landing at the $38 IPO price with an hour to spare in the session. Fortunately, there was a buyer with insatiable appetite @ exactly $38.00--likely the syndicate of banks that brought this puppy public.

But these shares cannot be propped up forever. Soon, FB will have to trade on its own merits.

As an indicator of speculative risk appetite, FB's direction in the next few sessions may be an interesting tell for the tape.

no positions

It's easy to tease

But hard to get release

--Billy Idol

The much acclaimed Facebook (FB) IPO occurred today. Approx 2.7 billion shares were priced in the primary market at $38 giving FB a mkt cap $100+ billion. Shares started trading on the NASDAQ before noon today at an opening price of about $42.

In the salad days of the tech bubble, shares would explode higher from there. Indeed, some pundits were predicting $100 FB stock by end of day.

It wasn't to be. Prices leaked all day, landing at the $38 IPO price with an hour to spare in the session. Fortunately, there was a buyer with insatiable appetite @ exactly $38.00--likely the syndicate of banks that brought this puppy public.

But these shares cannot be propped up forever. Soon, FB will have to trade on its own merits.

As an indicator of speculative risk appetite, FB's direction in the next few sessions may be an interesting tell for the tape.

no positions

Regulating Banks

I said, hey, the time is right

For palace revolution

But where I live the game

To play is compromise solution

--Rolling Stones

Frank Shostak argues that, if you're opposed to banks creating credit out of thin air, then tighter regs on banks make sense. Nice point.

Banking as we know it today is not a market-oriented industry. Instead, it can be seen as one huge monopoly bank controlled by central banks. A most undesirable feature of this arrangement is fractional reserve banking, which essentially permits the creation of fraudulent contracts that are impossible to honor. It is fractional reserve banking that permits the creation of money out of thin air.

If banking were a market-oriented industry, then fractional reserve banking would not be possible to a large, sustainable degree because of the risk of going bust--which would govern the behavior of both bank managers and bank depositors.

Regulations that curtail banks' capacity for credit creation should therefore be a good thing, says Shostak. I hadn't thought about it quite this way but it is an interesting point.

On the other hand, regulations tend to give consumers a false sense of security, and are likely to encourage excessive risk taking. In other words, regs seem likely to perpetuate the bogus system currently in place, when perhaps the only hope of ever obtaining monetary freedom if the current system fractures.

position in SPX

For palace revolution

But where I live the game

To play is compromise solution

--Rolling Stones

Frank Shostak argues that, if you're opposed to banks creating credit out of thin air, then tighter regs on banks make sense. Nice point.

Banking as we know it today is not a market-oriented industry. Instead, it can be seen as one huge monopoly bank controlled by central banks. A most undesirable feature of this arrangement is fractional reserve banking, which essentially permits the creation of fraudulent contracts that are impossible to honor. It is fractional reserve banking that permits the creation of money out of thin air.

If banking were a market-oriented industry, then fractional reserve banking would not be possible to a large, sustainable degree because of the risk of going bust--which would govern the behavior of both bank managers and bank depositors.

Regulations that curtail banks' capacity for credit creation should therefore be a good thing, says Shostak. I hadn't thought about it quite this way but it is an interesting point.

On the other hand, regulations tend to give consumers a false sense of security, and are likely to encourage excessive risk taking. In other words, regs seem likely to perpetuate the bogus system currently in place, when perhaps the only hope of ever obtaining monetary freedom if the current system fractures.

position in SPX

Labels:

central banks,

credit,

inflation,

intervention,

markets,

moral hazard,

risk,

security

Thursday, May 17, 2012

Levels of Lore

So now for restless mind

I could go either way

--ELO

If the downside in fact continues, then where are the technical support levels?

First up is the SPX 1280ish area which happens to correspond to the 200 day moving average. Then comes 1250 which enjoys some horizontal support support. It also marks the uptrend line from the Spring 2009 lows.

1200 is next as it marks a multi-year uptrend line with various 'touches'.

Below that are the 1100s probed last year, most notably 1135 which constitutes the 200 day moving average and the closing lows reached late last summer.

position in SPX

I could go either way

--ELO

If the downside in fact continues, then where are the technical support levels?

First up is the SPX 1280ish area which happens to correspond to the 200 day moving average. Then comes 1250 which enjoys some horizontal support support. It also marks the uptrend line from the Spring 2009 lows.

1200 is next as it marks a multi-year uptrend line with various 'touches'.

Below that are the 1100s probed last year, most notably 1135 which constitutes the 200 day moving average and the closing lows reached late last summer.

position in SPX

Scared Short

"It's just that you get to do all the dangerous stuff, and I get to parallel park."

--Danny Costanzo (Running Scared)

Is it easier to be long or short here? Am carrying a two sided book right now and the short side feels much more precarious than the long side. Why? We're just one central bank announcement away from another printfest higher.

If this feeling is widespread, then it is bearish on the margin.

position in SPX

--Danny Costanzo (Running Scared)

Is it easier to be long or short here? Am carrying a two sided book right now and the short side feels much more precarious than the long side. Why? We're just one central bank announcement away from another printfest higher.

If this feeling is widespread, then it is bearish on the margin.

position in SPX

Wednesday, May 16, 2012

Bank Shot

"And you can take that to the bank!"

--Senator Vernon Trent (Hard to Kill)

Chart gazing today revealed a number of interesting data points. High yield bonds got smacked, while high grade corp and Treasuries well bid (implication: widening HY spreads). Dollar jumping to highs for the move.

Correlations among risk assets once again going up as prices going down. This is what leverage does.

But perhaps the most striking were charts of big US money center banks. Most are just about back to where they started last Fall.

Quite the round trip. One with potentially ominous implications.

position in SPX

--Senator Vernon Trent (Hard to Kill)

Chart gazing today revealed a number of interesting data points. High yield bonds got smacked, while high grade corp and Treasuries well bid (implication: widening HY spreads). Dollar jumping to highs for the move.

Correlations among risk assets once again going up as prices going down. This is what leverage does.

But perhaps the most striking were charts of big US money center banks. Most are just about back to where they started last Fall.

Quite the round trip. One with potentially ominous implications.

position in SPX

Lack of Selling Pressure

It's ok if you must go

'Cause I'll understand if you don't

You say goodbye somehow, I'll still survive somehow

Why should we let this drag on?

--Tom Petty

Author here suggests that this downleg has yet to see significant selling pressure. Sure feels that way to me too. Most down days over the past two weeks have seen intraday 'buy the dip' rallies.

Stochastics on weekly chart do not indicate oversold conditions.

Do we need to see some 'straight down' days before this leg is done?

position in SPX

'Cause I'll understand if you don't

You say goodbye somehow, I'll still survive somehow

Why should we let this drag on?

--Tom Petty

Author here suggests that this downleg has yet to see significant selling pressure. Sure feels that way to me too. Most down days over the past two weeks have seen intraday 'buy the dip' rallies.

Stochastics on weekly chart do not indicate oversold conditions.

Do we need to see some 'straight down' days before this leg is done?

position in SPX

Tuesday, May 15, 2012

Commodity Redux

Dr Alexander Denny: You know you don't have to do this.

Doug Carlin: What if I already have?

--Deja Vu

Adding to many commodity-oriented positions today. Also started a new one: Pan American Silver (PAAS). Compelling enterprise value here at ~$2B. Solid balance sheet--signif more cash than debt (rare for miners). Currently trading in the low-mid $15 range--closer to 2008 low of $10 than to 2011 high of $43. Almost 1% yield.

While a new current holding, PAAS is an 'old friend' from the run up in miners a few years back. Feels good to slot it in again.

position in PAAS

Doug Carlin: What if I already have?

--Deja Vu

Adding to many commodity-oriented positions today. Also started a new one: Pan American Silver (PAAS). Compelling enterprise value here at ~$2B. Solid balance sheet--signif more cash than debt (rare for miners). Currently trading in the low-mid $15 range--closer to 2008 low of $10 than to 2011 high of $43. Almost 1% yield.

While a new current holding, PAAS is an 'old friend' from the run up in miners a few years back. Feels good to slot it in again.

position in PAAS

Monday, May 14, 2012

EU Cesspool

Clark Griswold: There's the Left Bank, kids. Russ, bet you can't guess which bank is on the right.

Rusty Griswold: The Bank of America

--European Vacation

Hard not to see a growing cesspool of Ponzi and moral hazard when looking at the EU situation. Germany's resolve on austerity/no inflation appears to be weakening. All other countries seem all in on money printing strategy.

If a confetti fest is pending, then why is gold not reacting violently to the upside? The yellow metal continues to mark new lows daily.

position in gold

Rusty Griswold: The Bank of America

--European Vacation

Hard not to see a growing cesspool of Ponzi and moral hazard when looking at the EU situation. Germany's resolve on austerity/no inflation appears to be weakening. All other countries seem all in on money printing strategy.

If a confetti fest is pending, then why is gold not reacting violently to the upside? The yellow metal continues to mark new lows daily.

position in gold

Sunday, May 13, 2012

CDS Self-Regulation

I tried to call you before but I lost my nerve

I tried my imagination, but I was disturbed

--Tommy Tutone

Rick Santelli chats with a derivatives guy about the causes behind last week's JPM blowup. The proposed solution to 'regulating' CDSs is 'to put them on exchange.' That seems reasonable. But markets will do that on their own if it truly makes sense in the calculation of risk and reward.

However, if the risk/reward calculation has been impaired by background intervention that encourages moral hazard, then markets are likely to opt for riskier configurations--because they are factoring in the likelihood that their bad decisions will get bailed out.

That calculation has largely been correct when framed over the past 4-5 years.

The real solution is for non-market insurers to leave the market, thereby leveling the economic consequences of decisions on the shoulders of those making the decisions.

Absent that, why should people be surprised when JPM-like events occur?

position in SPX

I tried my imagination, but I was disturbed

--Tommy Tutone

Rick Santelli chats with a derivatives guy about the causes behind last week's JPM blowup. The proposed solution to 'regulating' CDSs is 'to put them on exchange.' That seems reasonable. But markets will do that on their own if it truly makes sense in the calculation of risk and reward.

However, if the risk/reward calculation has been impaired by background intervention that encourages moral hazard, then markets are likely to opt for riskier configurations--because they are factoring in the likelihood that their bad decisions will get bailed out.

That calculation has largely been correct when framed over the past 4-5 years.

The real solution is for non-market insurers to leave the market, thereby leveling the economic consequences of decisions on the shoulders of those making the decisions.

Absent that, why should people be surprised when JPM-like events occur?

position in SPX

Friday, May 11, 2012

Conference Room Time?

"I told you. Good day, I'm ok. Bad day, I'm ok. Stop bugging me about my feelings. They're irrelevant."

--Lewis Zabel (Wall Street: Money Never Sleeps)

Last nite JP Morgan (JPM) CEO Jamie Dimon called an impromptu press conference to announce that his firm had lost $2 billion in ill conceived and executed 'hedging strategies.'

The trade gone bad looks to have involved credit default swaps (CDS). JPM was apparently short a ton of high yield CDS (or HYs). Against them, JPM was long a bunch of investment grade CDS (IGs). One puts on a hedge when two asset classes are presumed negatively correlated to the extend necessary to manage potential loss (a.k.a. risk). Hedges don't work when those presumptions don't hold.

Alas, that is what has been happening. As markets rallied over the past couple of months, IGs strengthened with stocks. This drove JPM to sell more HYs to maintain the hedge. The sheer size of JPMs trade attracted the interest of other traders, however, who saw rich the divergences between these CDSs and their fair value. As they acted to capture those riches, those traders were essentially shooting against JPM's trade to magnify the divergence in 'vicious cycle' character.

Losses have been piling quickly. As observed here, $2 billion represents less than one percent of JPM's assets and usually would not be worthy of a press conference. However, Dimon is likely signalling that losses could be much higher before this trade is unwound--particularly now that the cat has been fully let of the bag.

I wonder whether that mahogany conference room at the NY Fed might be busy today...

position in SPX

--Lewis Zabel (Wall Street: Money Never Sleeps)

Last nite JP Morgan (JPM) CEO Jamie Dimon called an impromptu press conference to announce that his firm had lost $2 billion in ill conceived and executed 'hedging strategies.'

The trade gone bad looks to have involved credit default swaps (CDS). JPM was apparently short a ton of high yield CDS (or HYs). Against them, JPM was long a bunch of investment grade CDS (IGs). One puts on a hedge when two asset classes are presumed negatively correlated to the extend necessary to manage potential loss (a.k.a. risk). Hedges don't work when those presumptions don't hold.

Alas, that is what has been happening. As markets rallied over the past couple of months, IGs strengthened with stocks. This drove JPM to sell more HYs to maintain the hedge. The sheer size of JPMs trade attracted the interest of other traders, however, who saw rich the divergences between these CDSs and their fair value. As they acted to capture those riches, those traders were essentially shooting against JPM's trade to magnify the divergence in 'vicious cycle' character.

Losses have been piling quickly. As observed here, $2 billion represents less than one percent of JPM's assets and usually would not be worthy of a press conference. However, Dimon is likely signalling that losses could be much higher before this trade is unwound--particularly now that the cat has been fully let of the bag.

I wonder whether that mahogany conference room at the NY Fed might be busy today...

position in SPX

Labels:

derivatives,

Fed,

leverage,

media,

moral hazard,

risk

Moral Hazard Training

"I am not leaving my wingman."

--Maverick (Top Gun)

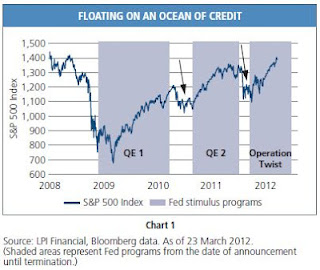

Dave Rosenberg notes that markets are getting trained to put money to work (read: take risk) when they get liquidity (read: money) from central banks. This is consummate moral hazard--taking more risk than you otherwise would because you think someone else has your back.

Markets cannot be accurately assessed unless the moral hazard factor is appropriately considered.

position in SPX

--Maverick (Top Gun)

Dave Rosenberg notes that markets are getting trained to put money to work (read: take risk) when they get liquidity (read: money) from central banks. This is consummate moral hazard--taking more risk than you otherwise would because you think someone else has your back.

Markets cannot be accurately assessed unless the moral hazard factor is appropriately considered.

position in SPX

Labels:

central banks,

inflation,

moral hazard,

risk,

sentiment

Thursday, May 10, 2012

Oversold Hard Sell

For the words of the prophets were written on the studio wall

Concert hall

And echoes with the sounds of salemen

Of salesmen, of salesmen

--Rush

Domestic markets have been weakened by the ongoing saga that is the EU. On each of the first three days this weak, markets were off more than a percent in the mornings followed by brave face ramps that cut the losses by day's end.

Today we're seeing a 'relief rally' of sorts to take some pressure off 6-7 consecutive days of negative closes. Many are calling the markets oversold, but that condition exists only when viewing the tape with a short horizon.

On a weekly basis (above), stochastics have just started lower after twisting high for months. Support at SPX 1360ish has yet to be decisively pierced.

If that level breaks, then more downside seems in the offing.

position in SPX

Concert hall

And echoes with the sounds of salemen

Of salesmen, of salesmen

--Rush

Domestic markets have been weakened by the ongoing saga that is the EU. On each of the first three days this weak, markets were off more than a percent in the mornings followed by brave face ramps that cut the losses by day's end.

Today we're seeing a 'relief rally' of sorts to take some pressure off 6-7 consecutive days of negative closes. Many are calling the markets oversold, but that condition exists only when viewing the tape with a short horizon.

On a weekly basis (above), stochastics have just started lower after twisting high for months. Support at SPX 1360ish has yet to be decisively pierced.

If that level breaks, then more downside seems in the offing.

position in SPX

Wednesday, May 9, 2012

Basic Economic Understanding

It's not that hard

If you just turn the key

--Madonna

Part of the problem is people generally lack understanding of axiomatic principles that provide the foundation for economic decision making at the individual, organizational, and national levels. Lacking a solid foundation, it should be of little surprise that we consistently make questionable financial decisions.

Toward the end of this missive, the author notes a few of the axioms essential to fundamental literacy of markets (emphasis mine):

"Of course, dividing the stock of goods and services by a larger quantity of money does not create wealth. One of the most important lessons of economic theory is that the only way for a society to generate economic growth is to consume less than it produces. The surplus (real savings) can be invested in the production of capital goods (and innovation) that allows for greater production in the future.

"Conversely, one of the oldest economic fallacies is the idea that the economy sometimes gets 'stuck' with low production and high unemployment due to a shortage of money, and that the way to get it unstuck is to print more money to increase 'total spending' - to consume more than the economy produces. Some 60 years ago Ludwig von Mises ridiculed this as the 'spurious grocer philosophy' (the merchant's view that his products aren't selling because his buyers lack enough currency), noting that this fallacy is essentially the philosophy of Lord Keynes, the 20th century apostle of central banking and macroeconomic stabilization policy."

If only students could grasp these simple axioms, then financial literacy would improve dramatically in the US.

Labels:

central banks,

education,

inflation,

natural law,

productivity,

saving

Sunday, May 6, 2012

Election Fixation

What'll you do when you get lonely

And nobody's waiting by your side?

You've been running and hiding much too long

You know it's just your foolish pride

--Derek & the Dominos

Weekend elections in France and Greece are tilting toward new regimes that appear even more socialist than the current regimes. The world is fixated on the results here. Why? Because of the overleveraged, cross linked nature of the global financial system. Dominoes start falling.

Any event that might reduce intensity of market intervention attracts global attention. Laughably sad, really.

position in SPX

And nobody's waiting by your side?

You've been running and hiding much too long

You know it's just your foolish pride

--Derek & the Dominos

Weekend elections in France and Greece are tilting toward new regimes that appear even more socialist than the current regimes. The world is fixated on the results here. Why? Because of the overleveraged, cross linked nature of the global financial system. Dominoes start falling.

Any event that might reduce intensity of market intervention attracts global attention. Laughably sad, really.

position in SPX

Saturday, May 5, 2012

Jelly Donuts

"You guys can...keep the donuts."

--Terry McCaleb (Blood Work)

I've read (and written) my fair share of critiques about Fed policy, but I found this column by David Einhorn among the more thought provoking that I've come across. Thought provoking because he makes a number of points that I found counter-intuitive or particularly insightful. I plan to chew thru this missive a few more times, and to reflect on some salient points on this blog. Here's one of them.

Einhorn first observes what many of us know. The Fed is engaged in policies that it hopes will energize the economy after a credit bust. Unfortunately, the policies are like jelly donuts, junk food that has little lasting nutritional value. After a brief sugar high, the economy heads back to the doldrums. The Fed's misguided belief is that an ever increasing diet of jelly donuts will do the trick.

Personally, I prefer the drug analogy a bit better because of the dependence and moral hazard fostered by consuming narcotics. But metaphorical choice is not the primary issue here. Instead, Einhorn's real insight comes via his explanation of why such policies are prone to produce undesirable outcomes.

Central to current Fed actions is the lowering of short term lending rates to essentially zero (a.k.a. zero interest rate policy or ZIRP), buying non-performing assets from leveraged financial entities (a.k.a. Troubled Asset Relief Program or TARP, and Quantitative Easing Part One or QE1), and buying longer dated Treasuries to lower longer term borrowing rates (a.k.a. QE2 and Operation Twist). The Fed has also telegraphed that these sorts of policies are likely to be in place thru at least 2014!

The Fed hopes that these policies will a) increase borrowing, and b) force people out of low risk assets (cash, bonds) and into higher risk assets like stocks and real estate.

Neither is happening to a great degree. And while many believe these policies essentially put a floor under the stock markets (a.k.a. 'the Bernanke put'), Einhorn thinks that the real Fed put is under the bond market.

The average person is already carrying significant debt and little real savings. Incrementally lowering interest rates long past the threshold that would have governed behavior in a free market design, is unlikely to to generate significantly more borrowing. As Einhorn observes, if projects don't make sense at 2%, they are unlikely to make sense at 1% or even 0%. This helps explain behavior in the housing market.

Meanwhile, folks invested in stocks over the past ten years have experienced at least two big declines, and many may be out of this asset class for good or at least a long time (I'm reminded of the Great Depression Generation). Not only that, but many of these folks were short on savings to begin with and are now more focused on saving for the future. This intensity may supercede low rates. In other words, people are becoming more interested in return of capital rather than return on capital.

And what asset class is perceived as being ultra safe? Why, Treasuries of course. And, as Einhorn observes, all of the Fed's interventionary policies signal to savers that Treasury prices will not go down.

It should be no surprise, then, that we are seeing huge inflows into Treasuries despite their low rates.

Moreover, Einhorn argues that by telegraphing its long term committment to ZIRP, the Fed has essentially devalued time. Instead of encouraging borrowing and spending in the present, signaling ZIRP thru at least 2014 destroys sense of urgency. Why make a decision to take on risk now if low-cost financing is available thru 2014?

The italicized phrases are the real thought provokers. They run counter to common (read: Fed) wisdom and explain why on-the-ground economic behavior appears to be 'undermining' Bernanke's best laid plains. Fed policies can be seen as promoting saving rather than spending, longer rather than short time horizon, and preference for bonds over stocks.

Not sure you'll find better examples of the law of unintended consequences that torments central planners.

--Terry McCaleb (Blood Work)

I've read (and written) my fair share of critiques about Fed policy, but I found this column by David Einhorn among the more thought provoking that I've come across. Thought provoking because he makes a number of points that I found counter-intuitive or particularly insightful. I plan to chew thru this missive a few more times, and to reflect on some salient points on this blog. Here's one of them.

Einhorn first observes what many of us know. The Fed is engaged in policies that it hopes will energize the economy after a credit bust. Unfortunately, the policies are like jelly donuts, junk food that has little lasting nutritional value. After a brief sugar high, the economy heads back to the doldrums. The Fed's misguided belief is that an ever increasing diet of jelly donuts will do the trick.

Personally, I prefer the drug analogy a bit better because of the dependence and moral hazard fostered by consuming narcotics. But metaphorical choice is not the primary issue here. Instead, Einhorn's real insight comes via his explanation of why such policies are prone to produce undesirable outcomes.

Central to current Fed actions is the lowering of short term lending rates to essentially zero (a.k.a. zero interest rate policy or ZIRP), buying non-performing assets from leveraged financial entities (a.k.a. Troubled Asset Relief Program or TARP, and Quantitative Easing Part One or QE1), and buying longer dated Treasuries to lower longer term borrowing rates (a.k.a. QE2 and Operation Twist). The Fed has also telegraphed that these sorts of policies are likely to be in place thru at least 2014!

The Fed hopes that these policies will a) increase borrowing, and b) force people out of low risk assets (cash, bonds) and into higher risk assets like stocks and real estate.

Neither is happening to a great degree. And while many believe these policies essentially put a floor under the stock markets (a.k.a. 'the Bernanke put'), Einhorn thinks that the real Fed put is under the bond market.

The average person is already carrying significant debt and little real savings. Incrementally lowering interest rates long past the threshold that would have governed behavior in a free market design, is unlikely to to generate significantly more borrowing. As Einhorn observes, if projects don't make sense at 2%, they are unlikely to make sense at 1% or even 0%. This helps explain behavior in the housing market.

Meanwhile, folks invested in stocks over the past ten years have experienced at least two big declines, and many may be out of this asset class for good or at least a long time (I'm reminded of the Great Depression Generation). Not only that, but many of these folks were short on savings to begin with and are now more focused on saving for the future. This intensity may supercede low rates. In other words, people are becoming more interested in return of capital rather than return on capital.

And what asset class is perceived as being ultra safe? Why, Treasuries of course. And, as Einhorn observes, all of the Fed's interventionary policies signal to savers that Treasury prices will not go down.

It should be no surprise, then, that we are seeing huge inflows into Treasuries despite their low rates.

Moreover, Einhorn argues that by telegraphing its long term committment to ZIRP, the Fed has essentially devalued time. Instead of encouraging borrowing and spending in the present, signaling ZIRP thru at least 2014 destroys sense of urgency. Why make a decision to take on risk now if low-cost financing is available thru 2014?

The italicized phrases are the real thought provokers. They run counter to common (read: Fed) wisdom and explain why on-the-ground economic behavior appears to be 'undermining' Bernanke's best laid plains. Fed policies can be seen as promoting saving rather than spending, longer rather than short time horizon, and preference for bonds over stocks.

Not sure you'll find better examples of the law of unintended consequences that torments central planners.

Labels:

credit,

Fed,

intervention,

moral hazard,

mortgage,

natural law,

real estate,

risk,

saving,

socialism,

socionomics,

time horizon,

yields

Friday, May 4, 2012

Head & Shoulders Still in Play

"You can't hold your mud. You're a bleeder, and I like blood."

--Brian Shute (Vision Quest)

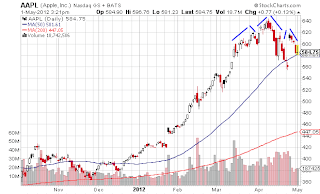

Early in the week US stock markets were working hard to negate head and shoulders patterns that have been tracing across major indexes for the past 2-3 months. A surprise ISM number on Tues found the Dow rallying to marginal intraday 4 yr highs. AAPL's heaviness proved a useful tell, as by end of day much of that rally had been erased.

Since then it has been the bears' turn, punctuated by ~1.5% decline following a weaker than expected payroll number this morning. As the chart shows, bulls were able to contain the damage in early March and early April. However, head and shoulders patterns are likely construed as bearish because it's difficult to defend a third time.

Should the line of defense fail here, then technically the downside appears to have room to SPX 1280ish.

position in SPX

--Brian Shute (Vision Quest)

Early in the week US stock markets were working hard to negate head and shoulders patterns that have been tracing across major indexes for the past 2-3 months. A surprise ISM number on Tues found the Dow rallying to marginal intraday 4 yr highs. AAPL's heaviness proved a useful tell, as by end of day much of that rally had been erased.

Since then it has been the bears' turn, punctuated by ~1.5% decline following a weaker than expected payroll number this morning. As the chart shows, bulls were able to contain the damage in early March and early April. However, head and shoulders patterns are likely construed as bearish because it's difficult to defend a third time.

Should the line of defense fail here, then technically the downside appears to have room to SPX 1280ish.

position in SPX

Crude Attitude

Words, playing me deja vu

Like a radio tune, I swear I've heard before

--Duran Duran

While many are focused on the weak payroll number this am, the eyebrow raising action is in oil. Crude has been hammered over the past few days and now sits at a 3 month low.

Old trader's tale is that big directional moves in commodities lead stocks...

no positions

Like a radio tune, I swear I've heard before

--Duran Duran

While many are focused on the weak payroll number this am, the eyebrow raising action is in oil. Crude has been hammered over the past few days and now sits at a 3 month low.

Old trader's tale is that big directional moves in commodities lead stocks...

no positions

Thursday, May 3, 2012

Pollution and Free Markets

When it all was over

We had to find another place

But Swiss time was running out

It seemed that we would lose the race

--Deep Purple

Rothbard discusses pollution in the context of free markets. People commonly associate pollution with capitalism. Because people act in their own self interest, then negative by-products of their actions that impact other people, such as pollution, are likely to occur. As such, pollution is presumed an unpleasant externality of markets that must be addressed by government.

At the outset, Rothbard astutely observes that government ownership and/or control has not been a proven solution to pollution problems. Two areas of society where private property has not been permitted to function, air and waterways, constitute primary grounds for pollution.

Waterways such as rivers have gone 'unowned,' which permits their corruption and pollution. Moreover, government has been among the most active polluters through the operation of municipal wastewater facilities with capacity to dump sewage into rivers and streams.

Because public waterways are unowned, there are no owners with legal standing to sue polluters for aggression against private property. Owners of small lakes and ponds, of which there are many, would surely exercise their rights to protect their property from such aggression.

Since government permits pollution of water, industrial technology has become a water polluting technology. Regulation stunts, rather than promotes, innovation in water pollution-free production technologies.

Property rights pertain to air pollution as well. Here, the issue is not ownership of air but ownership of one's person and property. The vital fact of air pollution is that the polluter sends unwanted pollutants through the air and into the lungs of innocent victims, and onto their property. Air pollution is an act of aggression against an individual and his/her property.

In free markets, it is the responsibility of government to stop this aggression.

Unfortunately, government has failed at this task. Early in the Industrial Revoluion, injurious air pollution was in fact considered a tort in many communities. Victims could sue for damages and obtain injunctions for polluters to cease and desist further invasions of private property.

In the 19th century, however, courts systematically altered the laws of nuisance and negligence to permit air pollution that was no more extensive than customary practice of fellow polluters. As such, the objective shifted from protecting individuals to the public sphere--i.e., the 'common good.' The common good decreed that pollution and progress were good things, and that property rights were to be overridden on behalf of the general welfare.

It should be evident that pollution is not a by-product of free markets that must be dealt with by government. Instead, pollution is the result of failure to uphold the free market principle of property rights. Indeed, markets can not be free until/unless property rights are upheld.

Until property rights are protected, expect continued pollution and hampered markets for innovations that reduce pollution.

We had to find another place

But Swiss time was running out

It seemed that we would lose the race

--Deep Purple

Rothbard discusses pollution in the context of free markets. People commonly associate pollution with capitalism. Because people act in their own self interest, then negative by-products of their actions that impact other people, such as pollution, are likely to occur. As such, pollution is presumed an unpleasant externality of markets that must be addressed by government.

At the outset, Rothbard astutely observes that government ownership and/or control has not been a proven solution to pollution problems. Two areas of society where private property has not been permitted to function, air and waterways, constitute primary grounds for pollution.

Waterways such as rivers have gone 'unowned,' which permits their corruption and pollution. Moreover, government has been among the most active polluters through the operation of municipal wastewater facilities with capacity to dump sewage into rivers and streams.

Because public waterways are unowned, there are no owners with legal standing to sue polluters for aggression against private property. Owners of small lakes and ponds, of which there are many, would surely exercise their rights to protect their property from such aggression.

Since government permits pollution of water, industrial technology has become a water polluting technology. Regulation stunts, rather than promotes, innovation in water pollution-free production technologies.

Property rights pertain to air pollution as well. Here, the issue is not ownership of air but ownership of one's person and property. The vital fact of air pollution is that the polluter sends unwanted pollutants through the air and into the lungs of innocent victims, and onto their property. Air pollution is an act of aggression against an individual and his/her property.

In free markets, it is the responsibility of government to stop this aggression.

Unfortunately, government has failed at this task. Early in the Industrial Revoluion, injurious air pollution was in fact considered a tort in many communities. Victims could sue for damages and obtain injunctions for polluters to cease and desist further invasions of private property.