We thought just for an instant

That we could see the future

We thought for once we knew

What really was important

--Til Tuesday

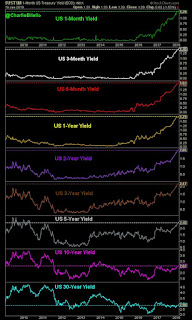

A year ago bond maven Bill Gross argued that 2.6% represented the Maginot line of resistance for 10 yr Treasury yields. Over the past couple of days, 10 yr yields broke thru that level.

In fact, yields are marking multi-year highs across the Treasury spectrum.

To review, higher yields are bearish for stocks because a) fixed income alternatives appear increasingly more attractive to income-oriented investors and b) higher interest rates are deadly for leveraged economies (like ours).

When this begins to matter to stocks in a big way is anyone's guess. That higher yields will matter is not a guess, however.

Friday, January 19, 2018

Failure to Yield

Labels:

balance sheet,

bonds,

leverage,

risk,

sentiment,

technical analysis,

time horizon,

yields

Subscribe to:

Post Comments (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

No comments:

Post a Comment