Hey now, hey now

Don't dream it's over

Hey now, hey now

When the world comes in

--Crowded House

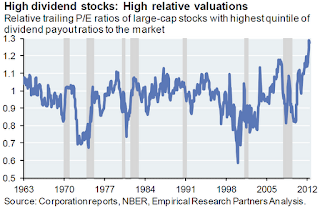

Drawn from this missive, the chart below indicates the premium being paid for 'blue chip' dividend paying equities. Blue chip in this case means those companies with high payout ratios, implying that the dividends are relatively safe.

Investors are paying up for yield. The chart indicates that PEs for blue chip dividend payers are at 50 year highs.

The driver of this behavior is 'financial repression,' the term being assigned to the zero interest rate policies (ZIRP) by central banks world wide. Before the current state of financial repression, investors in need of income had various fixed income alternatives to choose from that provided a stream of cash at low or moderate risk.

In the face of ZIRP, those fixed income instruments have been bid thru the roof, driving down their effective yields. As such, income-starved investors have been pouring into dividend paying stocks to get income. Sectors that typically pay high dividends such as utilities, health care, and consumer staples have been hitting new price highs for months.

I must confess that I have been partial to some dividend paying stocks myself, but have been trimming my exposure in these names into the recent buying euphoria. It's becoming increasing hard for me to hold 'em in the current environment...

Future historians will surely highlight this ZIRP period as a textbook case of central planning gone wrong. By suppressing interest rates below market, central bankers are forcing capital into investment choices with risk/reward profiles that have altogether been distorted. In the case of dividend paying stocks, investors are paying ever higher prices for ever smaller streams of cash--a recipe for disaster for instruments that have relatively uncertain cash streams and principals.

What central planners really seem to be planning is an epic capital wipeout.

position in SPX

Thursday, August 2, 2012

Dividend Stock Euphoria

Labels:

asset allocation,

bonds,

central banks,

intervention,

risk,

sentiment,

valuation,

yields

Subscribe to:

Post Comments (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

1 comment:

Your article is very impressive. Companies can pay dividends in cash or stock. Shareholders can choose how to receive a cash dividend.

ex dividend date

Post a Comment