"Someone reminded me the other evening that I once said, 'Greed is good.' Now it seems it's legal. But, folks, it's greed that makes my bartender buy three houses he can't afford with no money down. And it's greed that makes your parents refinance their two hundred thousand dollar house for two fifty. And then they take that extra fifty and they go down to the mall. And they buy a plasma TV, cell phones, computers, an SUV, and, hey, why not a second home while we're at it because, gee whiz, we all know that prices of houses in America always go up, right?"

--Gordon Gekko (Wall Street: Money Never Sleeps)

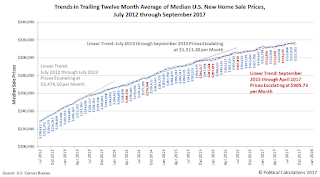

Nearly a year ago, US home price passed thru their previous highs set before the mortgage-backed credit collapse. In fact, over the past few years, home prices have been increasing at a breathtaking pace. The below graph indicates that since summer of 2012, the median price of a new home has increased about 38%.

This is a good example of the Cantillon Effect. First users of cheap mortgage credit have bid up the housing category in a classic compartmentalized inflation.

So what's a little housing inflation matter? Well, for one, home prices are rising faster than incomes, making housing less affordable.

For another, people are more leveraged as they borrow more against less equity. Another economic downturn will once again stress cash flows and mortgage payments, leading to the familiar sound of jingle mail.

Stated differently, rising housing prices are a mirage. Like a decade ago, they are an artifact of cheap credit money bidding up assets ahead of an inevitable tumble.

Subscribe to:

Post Comments (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

No comments:

Post a Comment