And feelings we'll never find

It's taken so long to see it

'Cause we never seemed to have the time

--Phil Collins

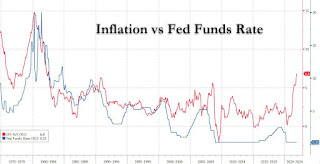

The CPI printed above expectations once again. The annualized 7.5% increase is the highest since March 1982. Yes, the era of 15% APR certificates of deposit.

Interest rate markets are discounting more hawkish Fed policy in the near term but more dovish a couple yrs out.

Two interpretations being floated. 1) the Fed quickly gets inflation under control and engineers a soft landing. 2) The Fed makes a 'policy error' by raising rates and crashing the economy, which subsequently forces them to lower rates in attempt to pull the economy out of the abyss.

These pages have been pondering a scenario that fits door number 2 pretty well.

Despite rocketing prices, the Fed is behind the curve when it comes to 'fighting inflation' like the Paul Volcker-led Fed did in the early 1980s. Compare now vs then in the above graph.

It may be a while before we see those 15% CDs again.

No comments:

Post a Comment