"Knights, the gift of freedom is yours by right."

--Arthur Castus (King Arthur)

As we approach Independence Day, Paul's words from today's second reading (Galatians 5:1) resonate:

"For freedom Christ set us free. So stand firm and do not submit again to the yoke of slavery."

Freedom is not a privilege granted with discretion by some worldly entity. It is a gift to all from God.

Indeed, next to life itself, freedom may be God's greatest gift.

It falls to each of us to make the most of this holy gift of freedom. Not to squander it, nor let others take it away.

Sunday, June 30, 2019

Saturday, June 29, 2019

Treaty of Versailles

"You offer terms. I ask none."

--Balian of Ibelin (Kingdom of Heaven)

Yesterday marked the 100th anniversary of the Treaty of Versailles. Although conventional wisdom is that the treaty marked the end of war and the institution of peace, the reality is that it motivated a period of unprecedented statism and war.

The Treaty of Versailles was actually a collection of treaties signed by individual countries in a series of settlements. In January, 1919, delegates from Britain, France, Italy, and the US convened in Paris for a preliminary conference to decide amongst themselves the terms to offer Germany. Germany was not summoned to Paris until May, and it was not permitted to negotiate terms. Because this violated precedent for resolving post-war differences, the fact that treaty terms were dictated was bound to breed contempt in Germany.

Germany signed the treaty forced on them on June 28, 1919.

The several clauses of the treaty, heavily influenced btw by British economist John Maynard Keynes, intensified the bad taste in German mouths. The military clause disarmed Germany. However, German disarmament was supposed to be part of a general European disarmament sponsored by the League of Nations. But the Allies did not fulfill their promise to disarm, and this broken promise infuriated German public opinion.

The reparations clause, upon Keynes's recommendation, did not fix the amount of reparations that Germany was to pay for wartime damages. Instead, Germany was forced to sign a blank check, which permitted the country to complain that its citizens had been condemned to indefinite slave labor. Moreover, the reparation sums demanded by Britain and France subsequently indebted Germany to the point of the Weimar hyperinflation and country's economic collapse in the early 1920s.

The reparations clause also included Article 231. Article 231 required that Germany accept sole responsibility for starting the war. This was folly, of course, because all major European powers shared responsibility for starting the war. Sadly the charade of Article 231 has been perpetuated in most history books.

The territories clause caused Germany to lose 13% of its land and 10% of its population. Alsace-Loraine went to France, territory in the east (along with Russian and Austro-Hungarian land) went to recreate Poland, the Polish Corridor to the sea cut off East Prussia from the Germany, the Austro Hungarian empire was shattered to create the new nation of Czechoslovakia, and the unification of Germany and Austria was prohibited. Not only did these moves deny the people in these territories the right to self determination--a self-determination that was promised by the Allies prior to the treaty conference--but it festered ill feelings inside Germany about surrounding locales that had been created by force rather than by freedom.

The German people thought the treaty unfair, and they wanted someone to oppose it. The platform for Hitler's rise to power was built on the Treaty of Versailles.

The scope of the treaty also facilitated land deals in Italy, Asia, and the Middle East--all motivated by imperialistic impulses of the Allies. These deals were forced, and violated principles of self-determination for the peoples involved. Negative outcomes subsequently followed, including Italy's fascism and proclivity to side with the Axis in WWII, extremism in the Middle East, communism in Russian, China, Korea, and Vietnam, and militarism in Japan.

It is difficult for the reasoned mind not to conclude that many if not most of the major social and economic problems faced by the world today were set in motion one hundred years ago from yesterday.

--Balian of Ibelin (Kingdom of Heaven)

Yesterday marked the 100th anniversary of the Treaty of Versailles. Although conventional wisdom is that the treaty marked the end of war and the institution of peace, the reality is that it motivated a period of unprecedented statism and war.

The Treaty of Versailles was actually a collection of treaties signed by individual countries in a series of settlements. In January, 1919, delegates from Britain, France, Italy, and the US convened in Paris for a preliminary conference to decide amongst themselves the terms to offer Germany. Germany was not summoned to Paris until May, and it was not permitted to negotiate terms. Because this violated precedent for resolving post-war differences, the fact that treaty terms were dictated was bound to breed contempt in Germany.

Germany signed the treaty forced on them on June 28, 1919.

The several clauses of the treaty, heavily influenced btw by British economist John Maynard Keynes, intensified the bad taste in German mouths. The military clause disarmed Germany. However, German disarmament was supposed to be part of a general European disarmament sponsored by the League of Nations. But the Allies did not fulfill their promise to disarm, and this broken promise infuriated German public opinion.

The reparations clause, upon Keynes's recommendation, did not fix the amount of reparations that Germany was to pay for wartime damages. Instead, Germany was forced to sign a blank check, which permitted the country to complain that its citizens had been condemned to indefinite slave labor. Moreover, the reparation sums demanded by Britain and France subsequently indebted Germany to the point of the Weimar hyperinflation and country's economic collapse in the early 1920s.

The reparations clause also included Article 231. Article 231 required that Germany accept sole responsibility for starting the war. This was folly, of course, because all major European powers shared responsibility for starting the war. Sadly the charade of Article 231 has been perpetuated in most history books.

The territories clause caused Germany to lose 13% of its land and 10% of its population. Alsace-Loraine went to France, territory in the east (along with Russian and Austro-Hungarian land) went to recreate Poland, the Polish Corridor to the sea cut off East Prussia from the Germany, the Austro Hungarian empire was shattered to create the new nation of Czechoslovakia, and the unification of Germany and Austria was prohibited. Not only did these moves deny the people in these territories the right to self determination--a self-determination that was promised by the Allies prior to the treaty conference--but it festered ill feelings inside Germany about surrounding locales that had been created by force rather than by freedom.

The German people thought the treaty unfair, and they wanted someone to oppose it. The platform for Hitler's rise to power was built on the Treaty of Versailles.

The scope of the treaty also facilitated land deals in Italy, Asia, and the Middle East--all motivated by imperialistic impulses of the Allies. These deals were forced, and violated principles of self-determination for the peoples involved. Negative outcomes subsequently followed, including Italy's fascism and proclivity to side with the Axis in WWII, extremism in the Middle East, communism in Russian, China, Korea, and Vietnam, and militarism in Japan.

It is difficult for the reasoned mind not to conclude that many if not most of the major social and economic problems faced by the world today were set in motion one hundred years ago from yesterday.

Labels:

China,

debt,

EU,

freedom,

inflation,

intervention,

natural law,

North Korea,

Russia,

socialism,

terrorism,

war,

Weimar

Friday, June 28, 2019

When Silver Leads

Good times and faces that remind me

I'm trying to forget your name

And leave it all behind me

You're coming back to find me

--Boston

A comparison of silver:gold shows the ratio at 20 year lows. Silver, being the most volatile one, should perform worse during precious metal bear markets.

But true to the risk:reward axiom, silver should perform better than gold when precious metal markets turn bullish. And historically it has.

The metals markets are turning bullish. If historical patterns hold true, then we should expect silver to re-exert upside leadership shortly.

position in gold, silver

I'm trying to forget your name

And leave it all behind me

You're coming back to find me

--Boston

A comparison of silver:gold shows the ratio at 20 year lows. Silver, being the most volatile one, should perform worse during precious metal bear markets.

But true to the risk:reward axiom, silver should perform better than gold when precious metal markets turn bullish. And historically it has.

The metals markets are turning bullish. If historical patterns hold true, then we should expect silver to re-exert upside leadership shortly.

position in gold, silver

Thursday, June 27, 2019

Downside Surprise

"What time is my surprise party?"--Tess McGill (Working Girl)

The Pomboy girl notes the negative position of Citigroup Economic Surprise Index. The Economic Surprise Index measures deviations in economic data series results compared to forecasts.

Pomboy observes that the index, after bouncing off mult-year lows, has made a quick round trip back to the bottom of the channel.

Certainly reflective of a downside economic surprise.

The Pomboy girl notes the negative position of Citigroup Economic Surprise Index. The Economic Surprise Index measures deviations in economic data series results compared to forecasts.

When the result 'beats' to the upside, the index goes positive. When it 'disappoints' to the downside, the index goes negative.After hitting levels from which it has always bounced materially, the Citigroup Surprise Index has officially round-tripped from -68 to -29 to -68. The deadcat thud is deafening. pic.twitter.com/00yArNUkvQ— steph pomboy (@spomboy) June 26, 2019

Pomboy observes that the index, after bouncing off mult-year lows, has made a quick round trip back to the bottom of the channel.

Certainly reflective of a downside economic surprise.

Wednesday, June 26, 2019

Student Loan Arson

"Alderman, I have an uncomplicated job: To determine if a fire is arson or not, and, if so, to catch the son of a bitch doing it. And if my investigative methods happen to muck up the campaign of certain mayor wannabes, I gotta tell you...I'm not gonna lose any sleep over it."

--Donald Rimgale (Backdraft)

With presidential election campaigns underway, candidates are, as always, dangling various proposals for free stuff in order to capture a goodly share of prospective voters. One such proposal is 'forgiving' college student loan debt.

Bailing out student debtors is an idea that has been under development since the Obama administration. It is certain to appeal to a sizable block of students or former students (read: voters) lugging what amounts to a collective $1.5 trillion in college loans.

Naturally, some will shun the proposal out of a sense of self-responsiblity...

Of course, most politicians currently proposing student loan forgiveness don't want to go there, because they know that it was their (or their party's) previous promises of free stuff that suppressed interest rates for student loans far below market and resulted in students borrowing far more than they should to go to school.

And so it goes. The fires created by politicians in old election cycles open opportunities for riding to the political rescue on fire trucks in new election cycles.

Seems like a case of student loan arson to me.

--Donald Rimgale (Backdraft)

With presidential election campaigns underway, candidates are, as always, dangling various proposals for free stuff in order to capture a goodly share of prospective voters. One such proposal is 'forgiving' college student loan debt.

Bailing out student debtors is an idea that has been under development since the Obama administration. It is certain to appeal to a sizable block of students or former students (read: voters) lugging what amounts to a collective $1.5 trillion in college loans.

Naturally, some will shun the proposal out of a sense of self-responsiblity...

...or in the spirit of honoring contracts.I chose to go to a private university.— Autumn Johnson (@AutumnDPJohnson) June 24, 2019

I chose to go to grad school.

I chose to go to law school.

They were all my choices. I made them freely. The debt that has come with those choices is MY responsibility. Not the responsibility of the taxpayers.#CancelStudentDebt

— Larry Elder (@larryelder) June 26, 2019But the central issue that demands attention is how student loans reached 'crisis' proportions to begin with.

Of course, most politicians currently proposing student loan forgiveness don't want to go there, because they know that it was their (or their party's) previous promises of free stuff that suppressed interest rates for student loans far below market and resulted in students borrowing far more than they should to go to school.

And so it goes. The fires created by politicians in old election cycles open opportunities for riding to the political rescue on fire trucks in new election cycles.

Seems like a case of student loan arson to me.

Tuesday, June 25, 2019

Cash Flow Statements

Joan Dickinson: Well, I don't understand. If you're studying to be a lawyer why that kind of of job? Toughening up the muscles for the football field?

Anthony Judson Lawrence: No.

Joan Dickinson: There must be some reason.

Anthony Judson Lawrence: Hh-hhm.

Joan Dickinson: Well, give me a hint.

Anthony Judson Lawrence: Alright, it begins with a 'K.'

Joan Dickinson: Kick the can.

Anthony Judson Lawrence: No. Kold cash.

--The Young Philadelphians

Last time we reviewed income statements--the first of the financial statement trilogy. Today we'll take a look at cash flow statements.

It is often said that cash is the lifeblood of business. Because of vagaries in accounting procedure, it is quite possible for companies to report large profits on their income statements while being cash poor (why this is so is a topic for another day). The cash flow statement basically strips out expenses and accounting adjustments to provide a better sense of the cash economics of a business.

The essential metric to determine here is called 'free cash flow.' Free cash flow (FCF) represents the cash that is left over after a company pays for operating expenses and capital projects. It is calculated by taking operating cash flow (OCF) and subtracting capital expenditures (CapEx). Using the symbology:

FCF = OCF - CapEx

Let's stick with our Intel (INTC) example from last time. Referencing Intel's cash flow statement at the end of fiscal year 2018, observe that the company reported OCF of $29.4 billion and CapEx of $15.2 billion. INTC's free cash flow, then, amounts to $29.4 - $15.2 = $14.2 billion. That's good sized free cash flow.

I also like to look for trends in free cash flow. Ideally, FCF should be increasing over time. We can see that has been the case with Intel. The company's FCF has grown from about $12 billion in 2015 to about $14 billion in 2018.

Sizable and growing free cash flow. Those are signs of a business with strong cash economics--capable of supporting future business (and dividend) growth.

That's what we can learn from quick review of cash flow statements. Next time we'll examine the last of the financial statement trilogy: balance sheets.

position in INTC

Anthony Judson Lawrence: No.

Joan Dickinson: There must be some reason.

Anthony Judson Lawrence: Hh-hhm.

Joan Dickinson: Well, give me a hint.

Anthony Judson Lawrence: Alright, it begins with a 'K.'

Joan Dickinson: Kick the can.

Anthony Judson Lawrence: No. Kold cash.

--The Young Philadelphians

Last time we reviewed income statements--the first of the financial statement trilogy. Today we'll take a look at cash flow statements.

It is often said that cash is the lifeblood of business. Because of vagaries in accounting procedure, it is quite possible for companies to report large profits on their income statements while being cash poor (why this is so is a topic for another day). The cash flow statement basically strips out expenses and accounting adjustments to provide a better sense of the cash economics of a business.

The essential metric to determine here is called 'free cash flow.' Free cash flow (FCF) represents the cash that is left over after a company pays for operating expenses and capital projects. It is calculated by taking operating cash flow (OCF) and subtracting capital expenditures (CapEx). Using the symbology:

FCF = OCF - CapEx

Let's stick with our Intel (INTC) example from last time. Referencing Intel's cash flow statement at the end of fiscal year 2018, observe that the company reported OCF of $29.4 billion and CapEx of $15.2 billion. INTC's free cash flow, then, amounts to $29.4 - $15.2 = $14.2 billion. That's good sized free cash flow.

I also like to look for trends in free cash flow. Ideally, FCF should be increasing over time. We can see that has been the case with Intel. The company's FCF has grown from about $12 billion in 2015 to about $14 billion in 2018.

Sizable and growing free cash flow. Those are signs of a business with strong cash economics--capable of supporting future business (and dividend) growth.

That's what we can learn from quick review of cash flow statements. Next time we'll examine the last of the financial statement trilogy: balance sheets.

position in INTC

Labels:

capital,

cash,

fund management,

manipulation,

measurement,

time horizon

Monday, June 24, 2019

Crossing $1400

Get up on your feet, yeah

Step to the beat

Boy, what will it be?

--Madonna

Gold touched $1410 overnight before backing off a few bucks this am. Last Friday the SPDR Gold Trust (GLD) added more ounces than any day in the past 10 yrs.

position in gold

Step to the beat

Boy, what will it be?

--Madonna

Gold touched $1410 overnight before backing off a few bucks this am. Last Friday the SPDR Gold Trust (GLD) added more ounces than any day in the past 10 yrs.

Market participants are beginning to take notice. Let's see how the metal behaves now that gold has crossed the 1400 mark.SPDR Gold Trust (GLD) adds 1.12 million ounces (35 tonnes) today. Biggest 1-day inflow since Feb. 2009... pic.twitter.com/B65bugMykC— Eric Pomboy (@epomboy) June 22, 2019

position in gold

Sunday, June 23, 2019

Negative Rates Impair Prosperity

"Negative, negative!"

--Lt Chris Burnett (Behind Enemy Lines)

Daniel Lacalle is correct. Negative interest rates are not a gift that enables prosperity. They amount to enormous wealth transfers from savers and the efficient to debtors and the inefficient.

--Lt Chris Burnett (Behind Enemy Lines)

Daniel Lacalle is correct. Negative interest rates are not a gift that enables prosperity. They amount to enormous wealth transfers from savers and the efficient to debtors and the inefficient.

In prolonged negative rate environments, productivity and prosperity are destined to fall.Financial repression is not a gift. It is a huge transfer of wealth from savers and the efficient to the indebted and inefficient. You' may think it's great that countries are financed at negative rates... Until you see your deposits and pension fund disappear. pic.twitter.com/8KaQLb0eZE— Daniel Lacalle (@dlacalle_IA) June 22, 2019

Labels:

capital,

central banks,

Fed,

fund management,

productivity,

saving,

yields

Saturday, June 22, 2019

Laffer Curve

Should five percent appear to small

Be thankful I don't take it all

--The Beatles

Although economist Art Laffer is associated with advancing the relationship pictured in what today is known as the 'Laffer curve,' the concept far precedes him. In fact, any reasoning mind can derive the theory.

The theoretical issue involves the relationship between revenue raised by government and tax rates employed to raise that revenue. At the extremes we know that government gets no revenue. If it does not tax at all, then government gets nothing. If the tax rate is 100%, then the government gets nothing on this end as well because no one will voluntarily produce if they cannot keep a fraction of their spoils.

Somewhere in between there is a tax rate where government can maximize its revenue. However, the point of maximum revenue does not correspond to the best social welfare. Because government is an inefficient resource allocator, economic growth will be impaired when government takes control of economic resources.

As such, the tax rate associated with the point of maximum economic growth will be less than the tax rate associated with point of maximum government revenue.

The only real questions involve at what tax rates do these two points reside. Or, stated differently, how much less is the growth maximizing tax rate than the revenue maximizing tax rate?

Although these seem like empirical questions, their answers are well approximated by good theory.

Be thankful I don't take it all

--The Beatles

Although economist Art Laffer is associated with advancing the relationship pictured in what today is known as the 'Laffer curve,' the concept far precedes him. In fact, any reasoning mind can derive the theory.

The theoretical issue involves the relationship between revenue raised by government and tax rates employed to raise that revenue. At the extremes we know that government gets no revenue. If it does not tax at all, then government gets nothing. If the tax rate is 100%, then the government gets nothing on this end as well because no one will voluntarily produce if they cannot keep a fraction of their spoils.

Somewhere in between there is a tax rate where government can maximize its revenue. However, the point of maximum revenue does not correspond to the best social welfare. Because government is an inefficient resource allocator, economic growth will be impaired when government takes control of economic resources.

As such, the tax rate associated with the point of maximum economic growth will be less than the tax rate associated with point of maximum government revenue.

The only real questions involve at what tax rates do these two points reside. Or, stated differently, how much less is the growth maximizing tax rate than the revenue maximizing tax rate?

Although these seem like empirical questions, their answers are well approximated by good theory.

Labels:

capital,

government,

measurement,

productivity,

reason,

socialism,

taxes,

theory

Friday, June 21, 2019

Gold Running

She's got a heart of gold

She'd never let me down

But you're the one that always turns me on

You keep me coming 'round

--Bryan Adams

Gold running toward $1400. Dots being connected post FOMC.

As previously noted, a decisive break higher projects a couple hundred higher.

position in gold

She'd never let me down

But you're the one that always turns me on

You keep me coming 'round

--Bryan Adams

Gold running toward $1400. Dots being connected post FOMC.

As previously noted, a decisive break higher projects a couple hundred higher.

position in gold

Thursday, June 20, 2019

Imaging Inflation

"Magic mirror on the wall, who is the fairest one of all?"

--The Queen (Snow White and the Seven Dwarfs)

Futures up big this am after markets digested the FOMC's dovish statement yesterday. In his post-session press conference, Fed chair Jerome Powell emphasized the we-need-more-inflation' rationalization. He stated that the Fed doesn't want to be "seen as weak on inflation."

The reasoned economic mind would take that statement to mean that the central bank would be vigilant about creating too much inflation. Powell means precisely the opposite, of course. It wants to be seen as powering inflation higher.

A question followed from the crowd. Why not set the Fed's inflation target even higher--from its current arbitrary level of 2% price increases annually to, say, double that...4%? Powell replied that, given the Fed's inability to hit its 2% target, "I wonder how credible that would be."

Think about it. The Fed chair doesn't seem bothered by the idea of a 4% inflation target (despite the economic havoc that 4% annual price increases would wreak). Instead, he is more concerned about the Fed's institutional image.

History will surely look back on this moment and shake its head.

Gold, btw, may finally be catching on. After moving up about $10 yesterday afternoon, the yellow metal is up about $22 overnight. Now at $1382, gold is chewing thru latent supply in an important zone of technical resistance.

position in gold

--The Queen (Snow White and the Seven Dwarfs)

Futures up big this am after markets digested the FOMC's dovish statement yesterday. In his post-session press conference, Fed chair Jerome Powell emphasized the we-need-more-inflation' rationalization. He stated that the Fed doesn't want to be "seen as weak on inflation."

The reasoned economic mind would take that statement to mean that the central bank would be vigilant about creating too much inflation. Powell means precisely the opposite, of course. It wants to be seen as powering inflation higher.

A question followed from the crowd. Why not set the Fed's inflation target even higher--from its current arbitrary level of 2% price increases annually to, say, double that...4%? Powell replied that, given the Fed's inability to hit its 2% target, "I wonder how credible that would be."

Think about it. The Fed chair doesn't seem bothered by the idea of a 4% inflation target (despite the economic havoc that 4% annual price increases would wreak). Instead, he is more concerned about the Fed's institutional image.

History will surely look back on this moment and shake its head.

Gold, btw, may finally be catching on. After moving up about $10 yesterday afternoon, the yellow metal is up about $22 overnight. Now at $1382, gold is chewing thru latent supply in an important zone of technical resistance.

position in gold

Labels:

central banks,

Fed,

inflation,

institution theory,

media,

yields

Wednesday, June 19, 2019

Fortune 500

"I once saw an office like this in Fortune magazine at my dentist's."

--Sabrina Fairchild (Sabrina)

As a brief follow-on on yesterday's post, if you're studying a company's annual revenue on its income statement and wondering how it compares to other companies, then you might find the Fortune 500 to be a useful frame of reference. The Fortune 500, initiated by Fortune magazine in the late 1940s, ranks the top 500 US-based companies based on annual revenue from their most recent fiscal year.

The list comes out every spring. Here is this year's list.

Keep in mind that revenues are only one possible measure of organizational size. Size could also be measured by number of employees, market value, profitability, etc. But the Fortune 500 is the grand daddy of them all and offers a convenient and widely recognized listing of large company revenues.

Quick quiz per the most recent Fortune 500 list:

1) Currently, what is the largest US company based on revenue?

2) We were studying Intel's (INTC) revenues yesterday. Can you find Intel on the list? Where does it stand?

3) Currently, there are two companies with their world headquarters in Cincinnati in the top 50. Who are they and what are their respective rankings?

position in INTC

--Sabrina Fairchild (Sabrina)

As a brief follow-on on yesterday's post, if you're studying a company's annual revenue on its income statement and wondering how it compares to other companies, then you might find the Fortune 500 to be a useful frame of reference. The Fortune 500, initiated by Fortune magazine in the late 1940s, ranks the top 500 US-based companies based on annual revenue from their most recent fiscal year.

The list comes out every spring. Here is this year's list.

Keep in mind that revenues are only one possible measure of organizational size. Size could also be measured by number of employees, market value, profitability, etc. But the Fortune 500 is the grand daddy of them all and offers a convenient and widely recognized listing of large company revenues.

Quick quiz per the most recent Fortune 500 list:

1) Currently, what is the largest US company based on revenue?

2) We were studying Intel's (INTC) revenues yesterday. Can you find Intel on the list? Where does it stand?

3) Currently, there are two companies with their world headquarters in Cincinnati in the top 50. Who are they and what are their respective rankings?

position in INTC

Tuesday, June 18, 2019

Income Statements

"Things are bad around here but you're making big money. What's the bottom line?"

--Marv (Wall Street)

To be a successful investor, you must be comfortable with examining a company's financial statements. Publicly traded companies release three primary financial statements: income statement, cash flow statement, balance sheet. These statements express what a business has done, and offer some insight into what it can do in the future.

You don't need to be an accounting genius to make sense of financial statements. Here is a summary of the things I tend to look for in income statements (we'll cover cash flow statements and balance sheets in future missives). Let's use the income statement of Intel Corp (INTC) for reference. You can find all of Intel's financial statements on the Schwab site as well.

Although much attention is often paid to income statements, I tend to view them with less scrutiny. Investors often focus on 'net income' near the bottom of the income statement. This is the infamous 'bottom line' measure of profits. For its most recent fiscal year (ended 12/29/18), INTC reported net income of about $21 billion.

Here's the thing about net income. Because it is influenced by many accounting 'tricks,' net income is often more construct than reality. It frequently does not reflect the true cash profitability of a company.

Rather than focusing on the 'bottom line,' I usually pay more attention to the 'top line,' or total revenue. Revenue captures the dollar value of all goods and services sold by the company. Revenues are much harder to 'fudge' from an accounting standpoint; they provide a good measure of total stuff sold in the marketplace.

From Intel's income statement, we can see that the company realized total revenue of $70.8 billion in its most recent fiscal year. Note also that revenues have been rising steadily over the past four years. Sales growth is almost always a good thing.

Sometimes I also check out profit margins. There's gross profit margin and net profit margin. Using INTC:

gross profit margin = gross profit/total revenue = $43.7 billion/$70.8 billion = 61.7%

net profit margin = net income/total revenue = $21.0 billion/$70.8 billion = 29.7%

Anything over 50% gross and 10% net is good (and rare), which makes Intel's profit margins uncommonly good.

Next time we'll examine the cash flow statement.

position in INTC

--Marv (Wall Street)

To be a successful investor, you must be comfortable with examining a company's financial statements. Publicly traded companies release three primary financial statements: income statement, cash flow statement, balance sheet. These statements express what a business has done, and offer some insight into what it can do in the future.

You don't need to be an accounting genius to make sense of financial statements. Here is a summary of the things I tend to look for in income statements (we'll cover cash flow statements and balance sheets in future missives). Let's use the income statement of Intel Corp (INTC) for reference. You can find all of Intel's financial statements on the Schwab site as well.

Although much attention is often paid to income statements, I tend to view them with less scrutiny. Investors often focus on 'net income' near the bottom of the income statement. This is the infamous 'bottom line' measure of profits. For its most recent fiscal year (ended 12/29/18), INTC reported net income of about $21 billion.

Here's the thing about net income. Because it is influenced by many accounting 'tricks,' net income is often more construct than reality. It frequently does not reflect the true cash profitability of a company.

Rather than focusing on the 'bottom line,' I usually pay more attention to the 'top line,' or total revenue. Revenue captures the dollar value of all goods and services sold by the company. Revenues are much harder to 'fudge' from an accounting standpoint; they provide a good measure of total stuff sold in the marketplace.

From Intel's income statement, we can see that the company realized total revenue of $70.8 billion in its most recent fiscal year. Note also that revenues have been rising steadily over the past four years. Sales growth is almost always a good thing.

Sometimes I also check out profit margins. There's gross profit margin and net profit margin. Using INTC:

gross profit margin = gross profit/total revenue = $43.7 billion/$70.8 billion = 61.7%

net profit margin = net income/total revenue = $21.0 billion/$70.8 billion = 29.7%

Anything over 50% gross and 10% net is good (and rare), which makes Intel's profit margins uncommonly good.

Next time we'll examine the cash flow statement.

position in INTC

Labels:

balance sheet,

cash,

debt,

freedom,

fund management,

leverage,

manipulation,

measurement,

risk,

valuation

Monday, June 17, 2019

Devouring the US Economy

A pretty face

Don't make no pretty heart

I learned that buddy

Right from the start

--Robert Palmer

To conclude our thread on the history of health insurance in the US, we focus on recent events beginning in the 1960s. By this time, the flawed private health care financing system was firmly in place. To make problems considerably worse, government entered the market with public healthcare programs called Medicare and Medicaid. Interestingly enough, both doctors and hospitals opposed this attempt at socialized medicine. Consequently, bureaucrats structured both programs to resemble Blue Cross and Blue Shield in order to assure providers that the status quo would not be upset.

Of course, when they realized that Medicare and Medicaid were a actually financial bonanza for them, healthcare providers quickly turned their hats around and become champions of these programs--a position that endures to this day. Subsequently, the incomes of medical professionals soared, roughly doubling in the 1960s and increasing many multiples since then.

An important consequence of these programs was the power that they gave state governments over hospitals. Because they became the largest source of funds for nearly every major hospital in the country, state governments could throw their weight around to influence hospital policy decisions. Not surprisingly, operating decisions began to assume political rather economic rationale. For example, closing surplus hospitals or converting them into more specialized operations became much more difficult. Although local neighborhoods and hospital workers unions gained from these decisions, society as a whole did not.

Finally came the explosion in medical malpractice litigation. For every malpractice suit filed in 1969, 300 were filed in 1990. Naturally, because lawsuits drive up the cost of malpractice insurance, these costs are passed onto patients and their insurance companies. Today, a neurosurgeon with an excellent record can expect to pay as much as $300,000/yr in coverage. Doctors in less lawsuit-prone specialties also pay higher premiums and are forced to order batteries of unnecessary tests and perform unnecessary procedures to avoid being second-guessed in court.

Like night follows day, it follows that medical costs have risen far above and beyond general prices, population growth, and medical productivity advances. As a fraction of GDP, the trend in healthcare spending looks like this:

1930 3.5%

1950 4.5%

1970 7.3%

1990 12.2%

2010 15.0%

Yes, medical advances have saved millions of lives and average life expectancy is much higher today than a century ago. But productivity improvements are generally supposed to lower costs rather than raise them.

Unfortunately, hampered US medical markets generate inefficiencies and costs that are devouring the American economy.

Don't make no pretty heart

I learned that buddy

Right from the start

--Robert Palmer

To conclude our thread on the history of health insurance in the US, we focus on recent events beginning in the 1960s. By this time, the flawed private health care financing system was firmly in place. To make problems considerably worse, government entered the market with public healthcare programs called Medicare and Medicaid. Interestingly enough, both doctors and hospitals opposed this attempt at socialized medicine. Consequently, bureaucrats structured both programs to resemble Blue Cross and Blue Shield in order to assure providers that the status quo would not be upset.

Of course, when they realized that Medicare and Medicaid were a actually financial bonanza for them, healthcare providers quickly turned their hats around and become champions of these programs--a position that endures to this day. Subsequently, the incomes of medical professionals soared, roughly doubling in the 1960s and increasing many multiples since then.

An important consequence of these programs was the power that they gave state governments over hospitals. Because they became the largest source of funds for nearly every major hospital in the country, state governments could throw their weight around to influence hospital policy decisions. Not surprisingly, operating decisions began to assume political rather economic rationale. For example, closing surplus hospitals or converting them into more specialized operations became much more difficult. Although local neighborhoods and hospital workers unions gained from these decisions, society as a whole did not.

Finally came the explosion in medical malpractice litigation. For every malpractice suit filed in 1969, 300 were filed in 1990. Naturally, because lawsuits drive up the cost of malpractice insurance, these costs are passed onto patients and their insurance companies. Today, a neurosurgeon with an excellent record can expect to pay as much as $300,000/yr in coverage. Doctors in less lawsuit-prone specialties also pay higher premiums and are forced to order batteries of unnecessary tests and perform unnecessary procedures to avoid being second-guessed in court.

Like night follows day, it follows that medical costs have risen far above and beyond general prices, population growth, and medical productivity advances. As a fraction of GDP, the trend in healthcare spending looks like this:

1930 3.5%

1950 4.5%

1970 7.3%

1990 12.2%

2010 15.0%

Yes, medical advances have saved millions of lives and average life expectancy is much higher today than a century ago. But productivity improvements are generally supposed to lower costs rather than raise them.

Unfortunately, hampered US medical markets generate inefficiencies and costs that are devouring the American economy.

Labels:

bureaucracy,

capacity,

competition,

government,

health care,

judicial,

markets,

measurement,

productivity,

socialism,

specialization

Sunday, June 16, 2019

Tax Absurdity

And if you knew how much I need you

Oh and I need you like the air

If someone should take you from me

I would run, run, run, runaway

--Jefferson Starship

Amusing post by Dan Mitchell on two absurd statements about taxes made by political officials. One comes from the governor of Illinois who claims that higher income taxes are needed to keep people from leaving the state (!). Theory and data show the opposite of course. As Illinois has raised its taxes, people are voting with their feet--as they are doing in other high tax regimes like New York and California.

The other statement comes from a German bureaucrat. He claims that, while he respects the sovereign rights of states to set their own tax rates, sovereignty of some states depends on being able to impose taxes on the people of other states. Mitchell suggests this is like having the right to own a house while neighbors have the right to set it on fire.

In fact, the situation is more akin to what we actually have. People 'own' houses, but other people can vote to tax that property. If people can forcibly take your property by law, then do you really own it?

The scary thing is that people actually believe these statements of tax absurdity.

Oh and I need you like the air

If someone should take you from me

I would run, run, run, runaway

--Jefferson Starship

Amusing post by Dan Mitchell on two absurd statements about taxes made by political officials. One comes from the governor of Illinois who claims that higher income taxes are needed to keep people from leaving the state (!). Theory and data show the opposite of course. As Illinois has raised its taxes, people are voting with their feet--as they are doing in other high tax regimes like New York and California.

The other statement comes from a German bureaucrat. He claims that, while he respects the sovereign rights of states to set their own tax rates, sovereignty of some states depends on being able to impose taxes on the people of other states. Mitchell suggests this is like having the right to own a house while neighbors have the right to set it on fire.

In fact, the situation is more akin to what we actually have. People 'own' houses, but other people can vote to tax that property. If people can forcibly take your property by law, then do you really own it?

The scary thing is that people actually believe these statements of tax absurdity.

Labels:

bureaucracy,

contracts,

democracy,

EU,

property,

real estate,

rhetoric,

taxes

Saturday, June 15, 2019

Hard to Resist

"How can you resist? I'm like candy."

--Paula Porifki (An Officer and a Gentleman)

After peeking above $1350 yesterday, gold decided it wasn't quite ready to assault long term resistance in the $1350-$1400 area.

It is easy to see why some technicians see this juncture as important. Should gold decisively poke thru these levels, the technical picture suggests little subsequent resistance until $1600ish.

It is no coincidence that the technical drama corresponds to growing anticipation of accomodative monetary policy coming from the Fed.

position in gold

--Paula Porifki (An Officer and a Gentleman)

After peeking above $1350 yesterday, gold decided it wasn't quite ready to assault long term resistance in the $1350-$1400 area.

It is easy to see why some technicians see this juncture as important. Should gold decisively poke thru these levels, the technical picture suggests little subsequent resistance until $1600ish.

It is no coincidence that the technical drama corresponds to growing anticipation of accomodative monetary policy coming from the Fed.

position in gold

Friday, June 14, 2019

Indomitable Spirit

Went the distance

Now I'm not gonna stop

Just a man

And his will to survive

--Survivor

After being gunned down on a practice field two years ago and enduring months of hospital time and physical therapy, Steve Scalise is back to work--and on the diamond once again.

Now I'm not gonna stop

Just a man

And his will to survive

--Survivor

After being gunned down on a practice field two years ago and enduring months of hospital time and physical therapy, Steve Scalise is back to work--and on the diamond once again.

This is what indomitable spirit looks like.Two years ago, my colleagues and I were attacked while practicing for a charity baseball game, simply because we’re Republicans. Thanks to countless heroes, miracles, and prayers, I’m still here today getting to do the job I love in Congress—and play a little baseball. pic.twitter.com/4DWeeFrc76— Steve Scalise (@SteveScalise) June 14, 2019

Labels:

baseball,

lifestyle,

security,

self defense,

terrorism

Thursday, June 13, 2019

"I Wish I Had a Gun"

There's a storm on the loose

Sirens in my head

Wrapped up in silence

All circuits are dead

--Golden Earring

Reports indicate that one of the people killed in the recent Virginia Beach shooting pondered taking a gun to work to protect herself from the very man who would murder her the next day. The municipal worker decided against it because of city policy that prevented employees from carrying on the job.

When defenseless people face a person pointing a gun at them, myriad thoughts are likely to pass thru racing minds facing extinction. If we were somehow able to capture those thoughts and categorize them, it is a good bet that one of the leading categories would relate to this theme:

"I wish I had a gun."

It is also a good bet that this very thought was one of the last things to go thru the head of woman in Virginia Beach who was prohibited from defending herself against a lethal attack.

Sirens in my head

Wrapped up in silence

All circuits are dead

--Golden Earring

Reports indicate that one of the people killed in the recent Virginia Beach shooting pondered taking a gun to work to protect herself from the very man who would murder her the next day. The municipal worker decided against it because of city policy that prevented employees from carrying on the job.

When defenseless people face a person pointing a gun at them, myriad thoughts are likely to pass thru racing minds facing extinction. If we were somehow able to capture those thoughts and categorize them, it is a good bet that one of the leading categories would relate to this theme:

"I wish I had a gun."

It is also a good bet that this very thought was one of the last things to go thru the head of woman in Virginia Beach who was prohibited from defending herself against a lethal attack.

Labels:

bureaucracy,

Constitution,

natural law,

security,

self defense

Wednesday, June 12, 2019

Staples Sticking Out

I say, we can act if we want to

If we don't nobody will

--Men Without Hats

Lots of consumer staple names such as Colgate (CL), Coca-Cola (KO), and Procter & Gamble (PG) marking highs this am.

As these are usually regarded as 'safety' names, not sure this is what bulls want to see right here.

position in CL, KO, PG

If we don't nobody will

--Men Without Hats

Lots of consumer staple names such as Colgate (CL), Coca-Cola (KO), and Procter & Gamble (PG) marking highs this am.

As these are usually regarded as 'safety' names, not sure this is what bulls want to see right here.

position in CL, KO, PG

Tuesday, June 11, 2019

Moats

"Knights, the gift of freedom is yours by right. But the home we seek resides not in some distant land. It's in us, and in our actions on this day! If this be our destiny, then so be it. But let history remember, we chose to make it so!"

--Arthur Castus (King Arthur)

Years ago economist Joseph Schumpeter (1942) famously described capitalistic markets as processes of 'creative destruction' where entrepreneurial innovation continuously obsoletes the status quo in favor of more valuable forms of output that please customers. Thriving in such a dynamic environment requires businesses to develop sources of 'sustainable competitive advantage' to keep distance between them and rivals. A business may be wildly successful today, but absent a durable edge against competition, those gains are likely to be short-lived.

Stated differently, businesses need a moat in order to realize long-term success. In medieval times, castles would surround themselves with trenches of water called moats. The wider and deeper the moat--perhaps with extra obstacles like crocodiles tossed in--the greater the barrier against unwanted intruders.

In the context of business and markets, moats can take many forms. Proven, reputable brands. Valuable libraries of intellectual property such as patents, trademarks, copyrights. Great location for assets. Large economies of scale. Network effects from large, loyal customer/user bases. Unique capability for quick learning and adaptation. Hard-to-copy production techniques.

The best moats are unique and hard-to-copy. The larger and more impenetrable the moat, the more sustainable a business's competitive advantage.

Investors with long-term horizons need to develop skills at analyzing moats that surround businesses. What factors comprise a particular company's moat? Is the moat getting bigger, or is it shrinking? Stocks of companies with large and growing moats are more likely to appreciate over time. Stock dividends paid by these companies are likely to grow over time as well.

Stock research reports can sometimes offer valuable moat-related insights. In fact, research firm Morningstar (available thru Schwab accounts), conducts an explicit moat analysis for all companies that it follows. You might find useful.

If you are looking for stock investments to hold for many years, then accumulating skill at analyzing business moats is imperative.

--Arthur Castus (King Arthur)

Years ago economist Joseph Schumpeter (1942) famously described capitalistic markets as processes of 'creative destruction' where entrepreneurial innovation continuously obsoletes the status quo in favor of more valuable forms of output that please customers. Thriving in such a dynamic environment requires businesses to develop sources of 'sustainable competitive advantage' to keep distance between them and rivals. A business may be wildly successful today, but absent a durable edge against competition, those gains are likely to be short-lived.

Stated differently, businesses need a moat in order to realize long-term success. In medieval times, castles would surround themselves with trenches of water called moats. The wider and deeper the moat--perhaps with extra obstacles like crocodiles tossed in--the greater the barrier against unwanted intruders.

In the context of business and markets, moats can take many forms. Proven, reputable brands. Valuable libraries of intellectual property such as patents, trademarks, copyrights. Great location for assets. Large economies of scale. Network effects from large, loyal customer/user bases. Unique capability for quick learning and adaptation. Hard-to-copy production techniques.

The best moats are unique and hard-to-copy. The larger and more impenetrable the moat, the more sustainable a business's competitive advantage.

Investors with long-term horizons need to develop skills at analyzing moats that surround businesses. What factors comprise a particular company's moat? Is the moat getting bigger, or is it shrinking? Stocks of companies with large and growing moats are more likely to appreciate over time. Stock dividends paid by these companies are likely to grow over time as well.

Stock research reports can sometimes offer valuable moat-related insights. In fact, research firm Morningstar (available thru Schwab accounts), conducts an explicit moat analysis for all companies that it follows. You might find useful.

If you are looking for stock investments to hold for many years, then accumulating skill at analyzing business moats is imperative.

References

Schempeter, J.A. (1942). Capitalism, socialism, and democracy. New York: Harper & Brothers.

Labels:

capital,

competition,

entrepreneurship,

fund management,

markets,

property,

time horizon

Monday, June 10, 2019

Hotel California Monetary Policy

Relax, said the nightman

We are programmed to receive

You can check out any time you like

But you can never leave

--The Eagles

Early in his recent CNBC interview, Stan Druckenmiller confesses (at around the 7:40 mark), "I don't understand the Fed's monetary framework at all." He goes on to say that he grew up in an era where the Fed used monetary policy to 'lean against' extreme highs and lows in economic cycles, and that Fed policymakers under Janet Yellen missed their opportunity a few years back to return the Fed Fund Rate back more 'neutral' levels during periods of economic strength.

However, evidence suggests the Fed has rarely behaved as Druck suggests--at least for the past three decades. As indicated in the above graph of historical Fed Funds Rates (source here), the Fed never returns rates to levels that match previous cycles. New high water marks in Fed rates are always lower than previous iterations. Consequently, rates have been stair-stepping lower since their peak in the early 1980s.

With the Fed's recent walk back in its tightening policy, the central bank is signaling that it will once again repeat the pattern. The current Fed Funds Rate of almost 2.5% will almost surely mark another lower high in the series.

What drives the Fed to be secularly dovish in its monetary policy? One reason is that the Fed is a political animal. It succumbs to institutional pressures to keep money and credit flowing easily. Fed bureaucrats do not want to be seen as the party poopers that take the punch bowl away. They would surely face political, economic, and social consequences for doing so.

Another explanation is that the Fed simply realizes that it can't return rates to previous levels without imploding the financial system. Each time the Fed forces interest rates lower than true market rates, more credit is created than unhampered markets would deem prudent. Consequently, each cycle of Fed easing results in more debt and leverage than the previous one.

An axiomatic principle of leverage is this: the greater the leverage in the system, the more sensitive the system becomese to any uptick in interest rates. Higher rates increase debt servicing rates. Moreover, higher rates reduce demand (and thus prices) for assets purchased on margin. For leveraged asset owners this is bad news from a balance sheet perspective. Asset values are declining while liabilities remain constant, thereby increasing the likelihood of insolvency.

The Fed knows by lowering interest rates, it creates a more leveraged financial system. If it were to subsequently raise rates back to previous levels, the Fed also knows that it runs the risk locking the system up in the throes of a deflationary spiral.

The Fed's monetary framework that Stan Druckenmiller claims to not understand can be seen as resting on a Hotel California-like paradox. Although it is headed toward a bad destination, Fed interest rate policy can't be reversed without untenable consequences--at least in the eyes of bureacrats.

We are programmed to receive

You can check out any time you like

But you can never leave

--The Eagles

Early in his recent CNBC interview, Stan Druckenmiller confesses (at around the 7:40 mark), "I don't understand the Fed's monetary framework at all." He goes on to say that he grew up in an era where the Fed used monetary policy to 'lean against' extreme highs and lows in economic cycles, and that Fed policymakers under Janet Yellen missed their opportunity a few years back to return the Fed Fund Rate back more 'neutral' levels during periods of economic strength.

However, evidence suggests the Fed has rarely behaved as Druck suggests--at least for the past three decades. As indicated in the above graph of historical Fed Funds Rates (source here), the Fed never returns rates to levels that match previous cycles. New high water marks in Fed rates are always lower than previous iterations. Consequently, rates have been stair-stepping lower since their peak in the early 1980s.

With the Fed's recent walk back in its tightening policy, the central bank is signaling that it will once again repeat the pattern. The current Fed Funds Rate of almost 2.5% will almost surely mark another lower high in the series.

What drives the Fed to be secularly dovish in its monetary policy? One reason is that the Fed is a political animal. It succumbs to institutional pressures to keep money and credit flowing easily. Fed bureaucrats do not want to be seen as the party poopers that take the punch bowl away. They would surely face political, economic, and social consequences for doing so.

Another explanation is that the Fed simply realizes that it can't return rates to previous levels without imploding the financial system. Each time the Fed forces interest rates lower than true market rates, more credit is created than unhampered markets would deem prudent. Consequently, each cycle of Fed easing results in more debt and leverage than the previous one.

An axiomatic principle of leverage is this: the greater the leverage in the system, the more sensitive the system becomese to any uptick in interest rates. Higher rates increase debt servicing rates. Moreover, higher rates reduce demand (and thus prices) for assets purchased on margin. For leveraged asset owners this is bad news from a balance sheet perspective. Asset values are declining while liabilities remain constant, thereby increasing the likelihood of insolvency.

The Fed knows by lowering interest rates, it creates a more leveraged financial system. If it were to subsequently raise rates back to previous levels, the Fed also knows that it runs the risk locking the system up in the throes of a deflationary spiral.

The Fed's monetary framework that Stan Druckenmiller claims to not understand can be seen as resting on a Hotel California-like paradox. Although it is headed toward a bad destination, Fed interest rate policy can't be reversed without untenable consequences--at least in the eyes of bureacrats.

Labels:

balance sheet,

bureaucracy,

central banks,

credit,

deflation,

Depression,

Fed,

inflation,

institution theory,

intervention,

markets,

measurement,

media,

money,

risk,

socialism,

time horizon,

yields

Sunday, June 9, 2019

Druck Tape

You always feel misunderstood

But you did the best you could

--Ric Ocasek

The always interesting Stan Druckenmiller did two sit downs this week. First was the Economic Club of New York on Monday. Then came CNBC Squawk Box on Friday. Although he covered a similar range of topics both days, including the Fed, trade wars, measuring GDP and inflation, his current investment positioning, entitlements, education, tax rates, capitalism vs socialism, upcoming election, both interviews are worth listening to.

Druck seems an enigma to me. His views on some issues seem true and difficult to counter while he clearly contradicts even himself on other issues. Monitor, for example, the contradictions spread across the threads on capitalism, the need to 'raise revenue,' and 'inequality' during the CNBC discussion.

Regardless, Druck's comments are always thought provoking and help build better thought process.

But you did the best you could

--Ric Ocasek

The always interesting Stan Druckenmiller did two sit downs this week. First was the Economic Club of New York on Monday. Then came CNBC Squawk Box on Friday. Although he covered a similar range of topics both days, including the Fed, trade wars, measuring GDP and inflation, his current investment positioning, entitlements, education, tax rates, capitalism vs socialism, upcoming election, both interviews are worth listening to.

Druck seems an enigma to me. His views on some issues seem true and difficult to counter while he clearly contradicts even himself on other issues. Monitor, for example, the contradictions spread across the threads on capitalism, the need to 'raise revenue,' and 'inequality' during the CNBC discussion.

Regardless, Druck's comments are always thought provoking and help build better thought process.

Saturday, June 8, 2019

Ownership and Control

"Get off my plane!"

--President James Marshall (Air Force One)

If a person possesses property, then that person is often seen as owning it. But possession is not true ownership. True ownership requires that individuals have authority to dispose of the property as they see fit--as long as they do not invade the pursuits of others while doing so.

If someone else can, by law, forcibly influence my disposition process, then I do not truly own the property because I do not completely control how it is used.

Who is legally able to control the disposition of property constitutes the essential difference between capitalism and socialism.

--President James Marshall (Air Force One)

If a person possesses property, then that person is often seen as owning it. But possession is not true ownership. True ownership requires that individuals have authority to dispose of the property as they see fit--as long as they do not invade the pursuits of others while doing so.

If someone else can, by law, forcibly influence my disposition process, then I do not truly own the property because I do not completely control how it is used.

Who is legally able to control the disposition of property constitutes the essential difference between capitalism and socialism.

Labels:

capital,

contracts,

intervention,

markets,

natural law,

property,

socialism

Friday, June 7, 2019

Tax Hypocrisy

Should five percent appear too small

Be thankful I don't take it all

--The Beatles

Larry Elder reinforces our earlier thought. Many who complain about taxes on imports are completely fine with other forms of taxes.

People profess to understand the adverse consequences when taxes hit their pocketbooks only.

Be thankful I don't take it all

--The Beatles

Larry Elder reinforces our earlier thought. Many who complain about taxes on imports are completely fine with other forms of taxes.

Another example below. City council may lift a ticket tax exemption on local non-profits like the zoo and art museum. Effected institutions are protesting that this tax will hurt their business.Democrats/media are hyperventilating over the possible imposition of tariffs "because of the adverse result of higher prices." Yet, the same crowd demands higher "taxes on the rich"--and don't expect any adverse consequences.— Larry Elder (@larryelder) June 3, 2019

Of course, these same institutions are not opposed to local tax levies that shovel tax dollars in their direction.I didn't go to council (you, those texts). But @Enquirer intern Josh Goad did. And he found non-profits aren't exactly happy with an idea that eliminates a ticket tax exemption. https://t.co/P6wlvvYYhh— Sharon Coolidge (@SharonCoolidge) June 6, 2019

People profess to understand the adverse consequences when taxes hit their pocketbooks only.

Thursday, June 6, 2019

Ike's Order

"You remember it. Remember every bit of it, because we're on the eve of a day that people are going to talk about long after we are dead and gone."

--Destroyer Commander (The Longest Day)

The Supreme Commander of D-Day forces was General Dwight D. Eisenhower. His order to all members of the Allied Expeditionary Forces was read by troop commanders prior to the campaign.

Ike's order was also broadcast to the nation by US radio stations early on the morning of June 6th.

--Destroyer Commander (The Longest Day)

The Supreme Commander of D-Day forces was General Dwight D. Eisenhower. His order to all members of the Allied Expeditionary Forces was read by troop commanders prior to the campaign.

Ike's order was also broadcast to the nation by US radio stations early on the morning of June 6th.

Wednesday, June 5, 2019

D-Day

"Keep the sand out of your weapons. Keep those actions clear. I'll see you one the beach."

--Captain John H. Miller (Saving Private Ryan)

As time powers forward, historical events and their dates blur in the rear view mirror--to the point where their significance wanes in the minds of younger generations. One of those dates is June 6, 1944.

I remember the 50th anniversary of D-Day, a.k.a. Operation Overlord and the Normandy Invasion. Much of the Greatest Generation was still able to tell us the story in the first person. It felt real.

Twenty five years later the event seems far more remote. The majority of the people who lived the time are now gone, and the first hand flavor has largely been lost. It is harder to appreciate the magnitude of what happened 75 years ago.

D-Day constituted a great paradox. It was a bloody campaign full of loss and sorrow. But it was also cause for optimism. Once Allied troops were on the ground in France, the world began to envision the end of World War II.

--Captain John H. Miller (Saving Private Ryan)

As time powers forward, historical events and their dates blur in the rear view mirror--to the point where their significance wanes in the minds of younger generations. One of those dates is June 6, 1944.

I remember the 50th anniversary of D-Day, a.k.a. Operation Overlord and the Normandy Invasion. Much of the Greatest Generation was still able to tell us the story in the first person. It felt real.

Twenty five years later the event seems far more remote. The majority of the people who lived the time are now gone, and the first hand flavor has largely been lost. It is harder to appreciate the magnitude of what happened 75 years ago.

D-Day constituted a great paradox. It was a bloody campaign full of loss and sorrow. But it was also cause for optimism. Once Allied troops were on the ground in France, the world began to envision the end of World War II.

Tuesday, June 4, 2019

Starting With Diversification

Staring at the blank page before you

Open up that dirty window

Let the sun illuminate the words that you could not find

--Natasha Beddingfield

Suppose that you are new to investing and you're interested in investing in stocks. You have a modest sum to invest. Like anyone, you'd like to 'make money' on your investments right away. However, your primary goal is to learn how to go about investing in stocks in a manner that will help you achieve financial goals over the long haul.

Here's one way to start. Take the amount of money that you'd like to allocate to stocks and divide it into 4-5 equal portions. If you have $2000 to invest, then it can be divided into 4-5 portions worth $4-500 each. These are the slots, or 'positions,' that you want to fill with stocks.

How to best fill those positions? You may have some ideas already. While thinking about the possibilities, keep in mind an important investment principle known as diversification. You're probably familiar with the saying, "Don't put all your eggs in one basket." A single basket of eggs is risky. Lose it or drop it and all your eggs are gone. Same thing with investing. Although investing all of your funds in a single stock that you love might seem like a sure thing, the future is never sure. Making a concentrated bet leaves you vulnerable to large losses in the event that your investment does not turn out the way you foresee.

Diversification means that you spread risk over a variety of choices, conceptually placing your investment eggs in different baskets so that you're not overly exposed to a particular idea. You've already started the diversification process by establishing those 4-5 slots noted above. This forces you to distribute your investment capital among various stocks.

You should also consider the degree of diversity among your stock picks. Price movements of stocks in similar businesses are often correlated, meaning that they tend to move up and down together. For instance, the prices of bank stocks like Bank of America (BAC) and Wells Fargo (WFC) exhibit significant correlation. Correlation is the enemy of diversification. You can invest in stocks of various companies but if the prices are highly correlated, then you have essentially constructed a portfolio that behaves like a single stock.

In addition to establishing a portfolio with several positions, you can do even better from a diversification standpoint by spreading your stock picks among various industries or sectors. Stocks from different sectors tend to be less correlated. While there are many ways to categorize industry sectors, here is a simple list to consider (in no particular order) when starting out:

Consumer products (consumer products makers)

Retail (brick and mortar stores, on-line sellers)

Healthcare (pharma, medical devices, health insurance)

Technology (computers, software, info services, emerging tech sectors)

Media/Entertainment (traditional media (TV/cable networks, newspapers, social media, media distribution)

Energy (fossil fuel production, refining, distribution, alternative/green energy)

Industrial (basic manufacturing (e.g., autos, chemicals, mining), transportation providers (e.g., trucking, trains, planes))

Utilities (power and heat source generators/distributors)

Telecom (phone, cable, internet service providers)

Finance (banks, brokers, insurance)

The idea is to find candidates from 4-5 of the above sectors to start your stock portfolio. How to identify and research candidates? Stay tuned...

position in WFC

Open up that dirty window

Let the sun illuminate the words that you could not find

--Natasha Beddingfield

Suppose that you are new to investing and you're interested in investing in stocks. You have a modest sum to invest. Like anyone, you'd like to 'make money' on your investments right away. However, your primary goal is to learn how to go about investing in stocks in a manner that will help you achieve financial goals over the long haul.

Here's one way to start. Take the amount of money that you'd like to allocate to stocks and divide it into 4-5 equal portions. If you have $2000 to invest, then it can be divided into 4-5 portions worth $4-500 each. These are the slots, or 'positions,' that you want to fill with stocks.

How to best fill those positions? You may have some ideas already. While thinking about the possibilities, keep in mind an important investment principle known as diversification. You're probably familiar with the saying, "Don't put all your eggs in one basket." A single basket of eggs is risky. Lose it or drop it and all your eggs are gone. Same thing with investing. Although investing all of your funds in a single stock that you love might seem like a sure thing, the future is never sure. Making a concentrated bet leaves you vulnerable to large losses in the event that your investment does not turn out the way you foresee.

Diversification means that you spread risk over a variety of choices, conceptually placing your investment eggs in different baskets so that you're not overly exposed to a particular idea. You've already started the diversification process by establishing those 4-5 slots noted above. This forces you to distribute your investment capital among various stocks.

You should also consider the degree of diversity among your stock picks. Price movements of stocks in similar businesses are often correlated, meaning that they tend to move up and down together. For instance, the prices of bank stocks like Bank of America (BAC) and Wells Fargo (WFC) exhibit significant correlation. Correlation is the enemy of diversification. You can invest in stocks of various companies but if the prices are highly correlated, then you have essentially constructed a portfolio that behaves like a single stock.

In addition to establishing a portfolio with several positions, you can do even better from a diversification standpoint by spreading your stock picks among various industries or sectors. Stocks from different sectors tend to be less correlated. While there are many ways to categorize industry sectors, here is a simple list to consider (in no particular order) when starting out:

Consumer products (consumer products makers)

Retail (brick and mortar stores, on-line sellers)

Healthcare (pharma, medical devices, health insurance)

Technology (computers, software, info services, emerging tech sectors)

Media/Entertainment (traditional media (TV/cable networks, newspapers, social media, media distribution)

Energy (fossil fuel production, refining, distribution, alternative/green energy)

Industrial (basic manufacturing (e.g., autos, chemicals, mining), transportation providers (e.g., trucking, trains, planes))

Utilities (power and heat source generators/distributors)

Telecom (phone, cable, internet service providers)

Finance (banks, brokers, insurance)

The idea is to find candidates from 4-5 of the above sectors to start your stock portfolio. How to identify and research candidates? Stay tuned...

position in WFC

Labels:

capital,

climate,

fund management,

health care,

risk,

supply chain management

Monday, June 3, 2019

Gold Stirring

There's something happening here

What it is ain't exactly clear

--Buffalo Springfield

Gold and the miners stirring over past couple days. Near term downtrends have been broken in the metals themselves. Spot gold up $13 this am to $1318.

Some technicians eyeing $1400 as level where fireworks might start if/when.

position in gold

What it is ain't exactly clear

--Buffalo Springfield

Gold and the miners stirring over past couple days. Near term downtrends have been broken in the metals themselves. Spot gold up $13 this am to $1318.

Some technicians eyeing $1400 as level where fireworks might start if/when.

position in gold

Sunday, June 2, 2019

Relative Poverty

If, when, why, what

How much have you got?

--Pet Shop Boys

Good point made by Prof Groseclose. For many, poverty is defined in relative terms. People who have significantly less than the rich are impoverished. Poverty requires prosperity to exist.

Defining poverty in relative terms smacks of envy, covetousness, resentment

How much have you got?

--Pet Shop Boys

Good point made by Prof Groseclose. For many, poverty is defined in relative terms. People who have significantly less than the rich are impoverished. Poverty requires prosperity to exist.

Viewed thru this distorted lens, when all are poor, there is no poverty.This is a strangely common view nowadays. If it doesn't scare the heck out of you, you're reading it wrong.— Per Bylund (@PerBylund) May 29, 2019

If *everybody* is poor, there's no poverty (!). If *everybody* is starving, there's no hunger. But if someone isn't, there is. So the easiest solution to the problem is... https://t.co/PbjoLTSu6N

Defining poverty in relative terms smacks of envy, covetousness, resentment

Saturday, June 1, 2019

Break On Through

We chased our pleasures here

Dug our treasures there

--The Doors

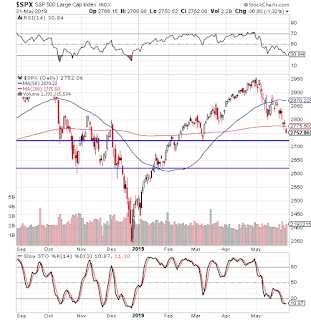

Bulls were hoping that their mid-week defense of the 200 day moving averages would be enough to discourage the bears. However, it wasn't to be as Friday's melt easily pierced the 200 days on both the S&P 500 (SPX) and the Nasdaq Composite (COMP).

A zone of support rests below--roughly between 2600 and 2700 SPX and 6900-7300 COMP. With technical oscillators also creeping into oversold territory, a bounce around here would not be surprising.

If the major indexes cannot regain their footing in this area, then the December lows beckon.

Dug our treasures there

--The Doors

Bulls were hoping that their mid-week defense of the 200 day moving averages would be enough to discourage the bears. However, it wasn't to be as Friday's melt easily pierced the 200 days on both the S&P 500 (SPX) and the Nasdaq Composite (COMP).

A zone of support rests below--roughly between 2600 and 2700 SPX and 6900-7300 COMP. With technical oscillators also creeping into oversold territory, a bounce around here would not be surprising.

If the major indexes cannot regain their footing in this area, then the December lows beckon.

Subscribe to:

Posts (Atom)