Fearless people, careless needle

Harsh words spoken and lives are broken

--Seal

Peter Atwater suggests that EU should shift focus from sovereign bailouts to bank bailouts. He wonders if EU members/citizens have the stomach for it.

I get the idea in the short term. But don't see how it matters over time.

In the US we TARPed the banks et al, thus propping these inefficient institutions up by borrowing more, printing more. Which lowers credit quality and standard of living. Which puts future sovereign debt paying capacity in greater question...

Perhaps it pushes out the pain, but the pain seems inevitable.

position in TLT, SH

Tuesday, November 30, 2010

Monday, November 29, 2010

Storm Warning

If I can't swim after forty days

And my mind is crushed by the crashing waves

Lift me up so high that I cannot fail

Lift me up well

--Jars of Clay

When it comes to market sages, few are 'sagier' than Richard Russell. He's been studying markets since the 1930s, and he's been writing his newsletter since 1958.

People who have been successfully practicing a complex discipline for that length of time have likely acquired large quantities of 'deep smarts' (Leonard & Swap, 2005). Deep smarts can be viewed as deep seated intelligence about the operations of complex systems. This knowledge is largely tacit in that those who possess it have trouble explain just how they arrive at their conclusions.

While it is tempting to attribute tacit knowledge and the decisions that flow from it as linked to emotion and 'gut feel', there is reason to believe that such intelligence is driven by intense pattern recognition processes, where the mind combs vast previous experiences for situations that match the present 'problem' (Simon, 1987).

Few people have developed deeper smarts about markets, particularly w.r.t. price patterns and tape behavior, than Mr Russell.

Russell thinks that stocks face an ugly period ahead. He feels we're in the early stages of breaking a large market topping pattern and that there's alotta room to the downside. He has been of this bearish mindset for a few months now.

His best ideas for weathering the storm continue to be cash and gold. Not very sophisticated, to be sure. But it's hard not to respect someone with his track record.

position in gold, SH

References

Leonard, D. & Swap, W. 2005. Deep smarts: How to cultivate and transfer enduring business wisdom. Boston: Harvard Business School Press.

Simon, H.A. 1987. Making management decisions: The role of intuition and emotion. Academy of Management Executive, 1(1): 57-64.

And my mind is crushed by the crashing waves

Lift me up so high that I cannot fail

Lift me up well

--Jars of Clay

When it comes to market sages, few are 'sagier' than Richard Russell. He's been studying markets since the 1930s, and he's been writing his newsletter since 1958.

People who have been successfully practicing a complex discipline for that length of time have likely acquired large quantities of 'deep smarts' (Leonard & Swap, 2005). Deep smarts can be viewed as deep seated intelligence about the operations of complex systems. This knowledge is largely tacit in that those who possess it have trouble explain just how they arrive at their conclusions.

While it is tempting to attribute tacit knowledge and the decisions that flow from it as linked to emotion and 'gut feel', there is reason to believe that such intelligence is driven by intense pattern recognition processes, where the mind combs vast previous experiences for situations that match the present 'problem' (Simon, 1987).

Few people have developed deeper smarts about markets, particularly w.r.t. price patterns and tape behavior, than Mr Russell.

Russell thinks that stocks face an ugly period ahead. He feels we're in the early stages of breaking a large market topping pattern and that there's alotta room to the downside. He has been of this bearish mindset for a few months now.

His best ideas for weathering the storm continue to be cash and gold. Not very sophisticated, to be sure. But it's hard not to respect someone with his track record.

position in gold, SH

References

Leonard, D. & Swap, W. 2005. Deep smarts: How to cultivate and transfer enduring business wisdom. Boston: Harvard Business School Press.

Simon, H.A. 1987. Making management decisions: The role of intuition and emotion. Academy of Management Executive, 1(1): 57-64.

Dublin Down

Confusion that never stops

Closing walls and ticking clocks

--Coldplay

Ireland becomes the latest recipient of EU bailout funds. Credit spreads of Spain and Portugal blow out more, suggesting stiff competition for next position in the Continental bailout parade.

There is increasing evidence that 'forced austerity' is not sitting well with sovereigns. Those inside bailout countries don't like being told what to do by outsiders. Moreover, ECB suggestions that everyone must share the pain will be distasteful among those who made prudent choices in the past.

Textbook behavior that can be under the heading 'why socialism doesn't work.'

Also, seems like sovereign pushback constitutes deflationary forces against central bank inflationary forces, no?

Hard not to sense that we're a couple steps closer to a collapse of the EU after the wkend activities.

position in TLT

Closing walls and ticking clocks

--Coldplay

Ireland becomes the latest recipient of EU bailout funds. Credit spreads of Spain and Portugal blow out more, suggesting stiff competition for next position in the Continental bailout parade.

There is increasing evidence that 'forced austerity' is not sitting well with sovereigns. Those inside bailout countries don't like being told what to do by outsiders. Moreover, ECB suggestions that everyone must share the pain will be distasteful among those who made prudent choices in the past.

Textbook behavior that can be under the heading 'why socialism doesn't work.'

Also, seems like sovereign pushback constitutes deflationary forces against central bank inflationary forces, no?

Hard not to sense that we're a couple steps closer to a collapse of the EU after the wkend activities.

position in TLT

Sunday, November 28, 2010

Anecdote Antidote

Anecdotal experience tells me that Black Friday weekend was a disaster in this locale. Street traffic near malls looked no different than any other weekend.

Any numbers that show positive yoy comps will be hard for me to believe.

Perhaps folks are doing their shopping online this yr...

Any numbers that show positive yoy comps will be hard for me to believe.

Perhaps folks are doing their shopping online this yr...

Tape It Up

Drawn into the stream

Of undefined illusion

Those diamond dreams

They can't disguise the truth

--Level 42

Nice expression of government intrusion in markets. Over the past 60 yrs, govt employment has quadrupled, while manufacturing employment has been cut nearly in half.

One more data point demonstrating that distance from free markets is growing, not shrinking.

Of undefined illusion

Those diamond dreams

They can't disguise the truth

--Level 42

Nice expression of government intrusion in markets. Over the past 60 yrs, govt employment has quadrupled, while manufacturing employment has been cut nearly in half.

One more data point demonstrating that distance from free markets is growing, not shrinking.

Friday, November 26, 2010

Funny Money

New car, caviar, four star daydream

Think I'll buy me a football team

--Pink Floyd

Nice discussion by Frank Shostak about the invalid assertion that money supply most grow with the supply of goods and services, lest economic activity will be suffocated. This argument is presented by many economists as to why a gold standard would never work(since gold is relatively scarce and cannot be increased in supply at will like paper money). This argument also is used to justify the 'need' for central banks.

Imagine a society where all money ever to be used is created before production begins. No additional money will be added over time. Now production begins. If, over a certain period of time, productivity increases, then each unit of money buys more goods and services (i.e., prices decline). If productivity of goods and services declines, then each monetary unit buys less goods and services (prices increase).

Money itself does not inhibit economic activity. The price of money in terms of the goods and services produced that it can buy may certainly change, but this bears no direct relationship on economic capacity.

In fact, in our hypothetical society, if productivity steadily increases over time, then prices should steadily decline over time. Central bankers and politicians would like us to believe that falling prices are somehow associated with economic armageddon. In a stable money world, however, falling prices are natural outcomes of productive society.

If one's brain is engaged, it should be easy to see that the argument that money supply must somehow be expandable at will is a poor one. Free markets will always seek money that is scarce in supply and that cannot be manipulated.

That is why gold has served as money for thousands of years.

position in XLF, gold

Think I'll buy me a football team

--Pink Floyd

Nice discussion by Frank Shostak about the invalid assertion that money supply most grow with the supply of goods and services, lest economic activity will be suffocated. This argument is presented by many economists as to why a gold standard would never work(since gold is relatively scarce and cannot be increased in supply at will like paper money). This argument also is used to justify the 'need' for central banks.

Imagine a society where all money ever to be used is created before production begins. No additional money will be added over time. Now production begins. If, over a certain period of time, productivity increases, then each unit of money buys more goods and services (i.e., prices decline). If productivity of goods and services declines, then each monetary unit buys less goods and services (prices increase).

Money itself does not inhibit economic activity. The price of money in terms of the goods and services produced that it can buy may certainly change, but this bears no direct relationship on economic capacity.

In fact, in our hypothetical society, if productivity steadily increases over time, then prices should steadily decline over time. Central bankers and politicians would like us to believe that falling prices are somehow associated with economic armageddon. In a stable money world, however, falling prices are natural outcomes of productive society.

If one's brain is engaged, it should be easy to see that the argument that money supply must somehow be expandable at will is a poor one. Free markets will always seek money that is scarce in supply and that cannot be manipulated.

That is why gold has served as money for thousands of years.

position in XLF, gold

Thursday, November 25, 2010

Dragon Tales

Hang on to your hopes, my friend

That's an easy thing to say

But if your hopes should pass away

Simply pretend that you can build them again

--Bangles

Vitaliy's argument that China is a central planning accident waiting to happen resonates w/ me. As he notes, planning has been hailed as superior to unhampered markets a few times in the past century (usually after economic downturns that were driven by planning) only to have the subsequent results, um, disappoint.

Currently China attracts that 'superior' aura.

The problem with central planning systems, as Vitaliy observes, is that bureaucrats in a room are certain to misallocate capital on a large scale over time. This leads to lower standard of living when the bloom comes off the rose.

And absent any market mechanisms to wipe away those misallocations, then those lower living standards are likely to persist (see, East v West Germany, for examples, or the former Soviet Union).

China's GDP has been growing like gangbusters, and now ranks #3 in the world. But much of this is 'blind' growth driven not by capital formation and demand, but by bureaucratic whim. Signs of big capital misallocation patterns are beginning to emerge. For example, Ordos, a city built by planners to house 1.2 million people in Inner Mongolia, remains largely uninhabited.

It is unknowable to forecast with certainty what factor(s) will turn things sour. But it is knowable with certainty that this system will sour.

The world is currently betting a goodly portion of its chips on the Chinese story in interlinked fashion. If the story unravels, then the global economic picture likely turns a hazy shade of winter.

position in Treasuries

That's an easy thing to say

But if your hopes should pass away

Simply pretend that you can build them again

--Bangles

Vitaliy's argument that China is a central planning accident waiting to happen resonates w/ me. As he notes, planning has been hailed as superior to unhampered markets a few times in the past century (usually after economic downturns that were driven by planning) only to have the subsequent results, um, disappoint.

Currently China attracts that 'superior' aura.

The problem with central planning systems, as Vitaliy observes, is that bureaucrats in a room are certain to misallocate capital on a large scale over time. This leads to lower standard of living when the bloom comes off the rose.

And absent any market mechanisms to wipe away those misallocations, then those lower living standards are likely to persist (see, East v West Germany, for examples, or the former Soviet Union).

China's GDP has been growing like gangbusters, and now ranks #3 in the world. But much of this is 'blind' growth driven not by capital formation and demand, but by bureaucratic whim. Signs of big capital misallocation patterns are beginning to emerge. For example, Ordos, a city built by planners to house 1.2 million people in Inner Mongolia, remains largely uninhabited.

It is unknowable to forecast with certainty what factor(s) will turn things sour. But it is knowable with certainty that this system will sour.

The world is currently betting a goodly portion of its chips on the Chinese story in interlinked fashion. If the story unravels, then the global economic picture likely turns a hazy shade of winter.

position in Treasuries

Wednesday, November 24, 2010

Crude Awakenings

After three days in the desert fun

I was looking at a river bed

And the story it told of a river that flowed

Made me sad to think it was dead

--America

For the first time, the International Energy Agency (IEA) has acknowledged in its annual report that we're past 'peak oil.' As noted by the author here, even the IEA's future assumptions about crude oil replacement over the next 20-30 yrs seem pretty courageous.

Seems to me chance favor much higher energy prices over the next decade unless the world economy, particularly w.r.t. China and other big growers, stumbles for a prolonged period. That may very well happen from where I sit, which is why I'm not long a ton of energy as well as other commodities.

That said, crude is still way off its 2008 highs and has been behaving relatively well in an overall market context that has turned pretty volatile. I like energy as an upside hedge against my generally bearish outlook, and will be looking for opportunities to add to my modest position as opportunities arise.

Preferred vehicles continue to be the commodity ETFs/ETNs over energy-related equities.

positions in DBE, DBO, RJI

I was looking at a river bed

And the story it told of a river that flowed

Made me sad to think it was dead

--America

For the first time, the International Energy Agency (IEA) has acknowledged in its annual report that we're past 'peak oil.' As noted by the author here, even the IEA's future assumptions about crude oil replacement over the next 20-30 yrs seem pretty courageous.

Seems to me chance favor much higher energy prices over the next decade unless the world economy, particularly w.r.t. China and other big growers, stumbles for a prolonged period. That may very well happen from where I sit, which is why I'm not long a ton of energy as well as other commodities.

That said, crude is still way off its 2008 highs and has been behaving relatively well in an overall market context that has turned pretty volatile. I like energy as an upside hedge against my generally bearish outlook, and will be looking for opportunities to add to my modest position as opportunities arise.

Preferred vehicles continue to be the commodity ETFs/ETNs over energy-related equities.

positions in DBE, DBO, RJI

Labels:

asset allocation,

China,

energy,

media,

oil,

technical analysis

Tuesday, November 23, 2010

Border Patrol

There is freedom within

There is freedom without

Try to catch the deluge in a paper cap

--Crowded House

Dr J conducts a nice review of the Federal Reserve Act to demonstrate how recent Fed actions have been illegal/and or unconstitutional. Clearly the Fed has overstepped its boundaries.

Perhaps I need to get more familiar w/ the Federal Reserve Act as my knowledge of its specific contents is tiny. I have not paid much attention to it because it seems the FRA itself seems unconstitutional to me. I cannot see how the institution of the Fed does not violate the Constitutional mandate that Congress alone authority to coin money. Congress cannot delegate this power to an agency--particularly one that is not directly accountable to the citizenry. The Constitution was never amended to change Congressional authority in this regard, leaving any subsequent piece of legislation, such as the Federal Reserve Act, as an unconstitutional law.

Now, as Dr J notes, the Fed is now expanding its powers beyong those that can be construed as illegal to begin with.

We have many Fed supporters claiming that increased sentiment against the Fed is 'politicizing' things. This is laughable, as the Federal Reserve is a political construct.

De-politicizing the Fed will only occur when it is taken apart.

There is freedom without

Try to catch the deluge in a paper cap

--Crowded House

Dr J conducts a nice review of the Federal Reserve Act to demonstrate how recent Fed actions have been illegal/and or unconstitutional. Clearly the Fed has overstepped its boundaries.

Perhaps I need to get more familiar w/ the Federal Reserve Act as my knowledge of its specific contents is tiny. I have not paid much attention to it because it seems the FRA itself seems unconstitutional to me. I cannot see how the institution of the Fed does not violate the Constitutional mandate that Congress alone authority to coin money. Congress cannot delegate this power to an agency--particularly one that is not directly accountable to the citizenry. The Constitution was never amended to change Congressional authority in this regard, leaving any subsequent piece of legislation, such as the Federal Reserve Act, as an unconstitutional law.

Now, as Dr J notes, the Fed is now expanding its powers beyong those that can be construed as illegal to begin with.

We have many Fed supporters claiming that increased sentiment against the Fed is 'politicizing' things. This is laughable, as the Federal Reserve is a political construct.

De-politicizing the Fed will only occur when it is taken apart.

Sovereign Stop Payments

She's the dollars, she's my protection

Yeah she's the promise in the year of election

Oh sister, I can't let you go

Like a preacher stealing hearts at a traveling show

--U2

Peter Atwater suggests that perhaps Ireland et al will decide it is in their best interests to default rather than get bailed out. Indeed, "countries don't have friends, they have interests."

Should a string of sovereign defaults ensue, this will surely add additional stress cracks to the already weakened EU infrastructure. Moveover, hard to see how voluntary defaults do not send country borrowing costs higher worldwide.

Meanwhile, pressure has not come off the system even after the EU bailout announcement. And, based on its spreads blowing out this am, Spain has jumped ahead of Portugal as next in line.

position in Treasuries, XLF

Yeah she's the promise in the year of election

Oh sister, I can't let you go

Like a preacher stealing hearts at a traveling show

--U2

Peter Atwater suggests that perhaps Ireland et al will decide it is in their best interests to default rather than get bailed out. Indeed, "countries don't have friends, they have interests."

Should a string of sovereign defaults ensue, this will surely add additional stress cracks to the already weakened EU infrastructure. Moveover, hard to see how voluntary defaults do not send country borrowing costs higher worldwide.

Meanwhile, pressure has not come off the system even after the EU bailout announcement. And, based on its spreads blowing out this am, Spain has jumped ahead of Portugal as next in line.

position in Treasuries, XLF

Monday, November 22, 2010

Irish Ail

I get knocked down

But I get up again

You're never goin' to keep me down

--Chumbawumba

Although markets generally seemed to shrug off Ireland's weekend bailoutl (altho the banks did appear to trade heavy), can't help but think this is beginning of a new round of storms in the EU. Spain and Portugal getting queued up per CDS spreads.

While I never watch CNBC at home, I do turn the station on in the morning when I'm on the road (like now). Was shocked at how little the Irish bailout was covered this am.

Maybe the EU should ask Big Ben to print a few more hundreds...

position in XLF

But I get up again

You're never goin' to keep me down

--Chumbawumba

Although markets generally seemed to shrug off Ireland's weekend bailoutl (altho the banks did appear to trade heavy), can't help but think this is beginning of a new round of storms in the EU. Spain and Portugal getting queued up per CDS spreads.

While I never watch CNBC at home, I do turn the station on in the morning when I'm on the road (like now). Was shocked at how little the Irish bailout was covered this am.

Maybe the EU should ask Big Ben to print a few more hundreds...

position in XLF

Saturday, November 20, 2010

Fly Boy

Pretty much a test post here as I'm blogging from my itouch at 36000 ft en route to SD. Don't want to invest much here since not sure this will post. Full body scan by TSA Gestapo. Countering that is multimedia on this flight to left coast. Free wifi and sat tv. Watching Arkansas v Miss St while typing this. Noice.

Friday, November 19, 2010

The Cisco Disco

I could feel her coming from a mile away

There was no use talking

There was nothing to say

As the band began to play and play

--The Hooters

Initiated a small position in Cisco Systems (CSCO). A few days back the stock was splattered after dialing back future expectations as part of their earnings report.

Minyanville's Fil Zucchi sagely observes that CSCO may reflect decent value here. It's throwing off nearly $10 billion in free cash flow and has about $15 billion in net cash on the balance sheet. At current prices, CSCO's market cap is about $109, making enterprise value ~$94 billion. Enterprise value:FCF less than or equal to 10 feels like good value to me...concur, Fil.

CSCO joins a snivlet of Microsoft (MSFT) added a few months back as the sole stocks under management right now.

positions in CSCO, MSFT

There was no use talking

There was nothing to say

As the band began to play and play

--The Hooters

Initiated a small position in Cisco Systems (CSCO). A few days back the stock was splattered after dialing back future expectations as part of their earnings report.

Minyanville's Fil Zucchi sagely observes that CSCO may reflect decent value here. It's throwing off nearly $10 billion in free cash flow and has about $15 billion in net cash on the balance sheet. At current prices, CSCO's market cap is about $109, making enterprise value ~$94 billion. Enterprise value:FCF less than or equal to 10 feels like good value to me...concur, Fil.

CSCO joins a snivlet of Microsoft (MSFT) added a few months back as the sole stocks under management right now.

positions in CSCO, MSFT

Labels:

asset allocation,

cash,

technical analysis,

valuation

Thursday, November 18, 2010

Showdown

It's all the same

Only the names have changed

Every day

It seems we're wasting away

--Bon Jovi

Sentiment toward the Fed is growing darker. Ron Paul can't recall a time in his career when the Fed as attracted this much media attention.

Now, it is very possible that Ron Paul may become chair of the House subcommittee on monetary policy. Should this come to pass, Dr Paul would control subpeona power over Fed bureaucrats which could, for instance, be used to force Fed officials to lay open their books to Congressional scrutiny.

This has to have politicians on both sides of the aisle shaking in their boots. Three times in the past, bipartisan efforts squelched Paul's appointment as chair. This time, however, preventative efforts are less likely because of rising public interest in the matter and the results of the election two weeks back.

Should Ron Paul get the nod, however, Lew Rockwell is pessimistic about the new chairman's prospects to successfully exercise his newfound power. If Paul wanted to subpoena Fed bureaucrats, both the committee and the House would need to vote in favor of enforcing those subpoenas. Rockwell doubts that will happen, because of bipartisan support for the Fed's nefarious actions.

In any event, high drama is likely if Paul gets the chair. Sit back and watch bipartisan efforts to justify and protect the Federal Reserve, while Dr Paul and a new wave of Tea Party-backed electees seek to tap the social power of the citizenry.

I've long awaited a sequel to Andrew Jackson's 1832 command performance. Is it possible that production is finally getting under way?

Only the names have changed

Every day

It seems we're wasting away

--Bon Jovi

Sentiment toward the Fed is growing darker. Ron Paul can't recall a time in his career when the Fed as attracted this much media attention.

Now, it is very possible that Ron Paul may become chair of the House subcommittee on monetary policy. Should this come to pass, Dr Paul would control subpeona power over Fed bureaucrats which could, for instance, be used to force Fed officials to lay open their books to Congressional scrutiny.

This has to have politicians on both sides of the aisle shaking in their boots. Three times in the past, bipartisan efforts squelched Paul's appointment as chair. This time, however, preventative efforts are less likely because of rising public interest in the matter and the results of the election two weeks back.

Should Ron Paul get the nod, however, Lew Rockwell is pessimistic about the new chairman's prospects to successfully exercise his newfound power. If Paul wanted to subpoena Fed bureaucrats, both the committee and the House would need to vote in favor of enforcing those subpoenas. Rockwell doubts that will happen, because of bipartisan support for the Fed's nefarious actions.

In any event, high drama is likely if Paul gets the chair. Sit back and watch bipartisan efforts to justify and protect the Federal Reserve, while Dr Paul and a new wave of Tea Party-backed electees seek to tap the social power of the citizenry.

I've long awaited a sequel to Andrew Jackson's 1832 command performance. Is it possible that production is finally getting under way?

Wednesday, November 17, 2010

Spinning from Omaha

Other people's thoughts they ain't your hand me downs

Would it be so bad to simply turn around

--Spin Doctors

Warren Buffett could have made this op-ed much more straightforward. He could have just said this:

"Thanks, US Government, for bailing out my firm and others who took too much risk. Since it was you that offered the ultra cheap credit upon which the leveraged house of cards was built, I figured that you'd step in and make us whole.

Indeed, you have made me $ billions at the expense of those who were prudent.

I look forward to the next round of bailouts.

Your partner in moral hazard, WB."

It is easy to regard this piece as an effort to elevate public sentiment in favor of government intrusion--to offset the hawkish tone carried by many incoming members of Congress.

We get it, Warren. You're in the pocket of bureaucrats, and you're returning the favor by spewing spin.

position in XLF

Would it be so bad to simply turn around

--Spin Doctors

Warren Buffett could have made this op-ed much more straightforward. He could have just said this:

"Thanks, US Government, for bailing out my firm and others who took too much risk. Since it was you that offered the ultra cheap credit upon which the leveraged house of cards was built, I figured that you'd step in and make us whole.

Indeed, you have made me $ billions at the expense of those who were prudent.

I look forward to the next round of bailouts.

Your partner in moral hazard, WB."

It is easy to regard this piece as an effort to elevate public sentiment in favor of government intrusion--to offset the hawkish tone carried by many incoming members of Congress.

We get it, Warren. You're in the pocket of bureaucrats, and you're returning the favor by spewing spin.

position in XLF

Labels:

government,

intervention,

leverage,

manipulation,

media,

moral hazard,

risk

Tuesday, November 16, 2010

First User Advantage

Well I've been looking real hard

And I'm trying to find a job

But it just keeps getting tougher every day

--Steve Miller Band

Wealth cannot be created by printing money. However, wealth can be redistributed by printing money.

Nearly all money created in our current system comes from credit creation. This is the domain of the Federal Reserve. The Fed offers credit (currently at near zero cost) to big financial entities (we'll just call them banks here) and quasi government agencies. If the banks and agencies borrow from the Fed, then 'credit money' is created. The banks and agencies become 'first users' of the new money.

Money that is created out of thin air has the most value when it is first created. This is because it takes a while for prices to readjust to the increase in money supply and commensurate increase in demand for things that the new money can buy. After a few exchanges, however, the purchasing power of the new money declines as demand bids prices up.

It should not be hard to figure out who gets wealthier and who gets poorer in this arrangement. The big banks and government get first use of the money. They can buy things like financial assets, property, labor, etc while prices are still relatively low. Subsequently, prices rise. Banks are wealthier. Politicians can deal in favor for their SIGs.

Everyday people don't enjoy the same priviledge. While they are waiting for the new money to trickle down, the dollars that they already hold decline in value because they purchase less of the assets that the banks et al have bid up in price. Those near the bottom of the social pyramid are particularly hurt because they own few financial assets (e.g., stocks and bonds) that move higher on the speculative actions of the first movers. By the time the wave of new money trickles down to Main Street, the average person possesses fewer economic resources than previously.

Presto! Courtesy of the Fed and the politicos, wealth has been redistributed. Resources migrate to the first users at the expense of the late users.

This is the principle of First User Advantage.

If you're looking for factors that widen distribution of income, then you've just found another one.

position in Treasuries, SPX

And I'm trying to find a job

But it just keeps getting tougher every day

--Steve Miller Band

Wealth cannot be created by printing money. However, wealth can be redistributed by printing money.

Nearly all money created in our current system comes from credit creation. This is the domain of the Federal Reserve. The Fed offers credit (currently at near zero cost) to big financial entities (we'll just call them banks here) and quasi government agencies. If the banks and agencies borrow from the Fed, then 'credit money' is created. The banks and agencies become 'first users' of the new money.

Money that is created out of thin air has the most value when it is first created. This is because it takes a while for prices to readjust to the increase in money supply and commensurate increase in demand for things that the new money can buy. After a few exchanges, however, the purchasing power of the new money declines as demand bids prices up.

It should not be hard to figure out who gets wealthier and who gets poorer in this arrangement. The big banks and government get first use of the money. They can buy things like financial assets, property, labor, etc while prices are still relatively low. Subsequently, prices rise. Banks are wealthier. Politicians can deal in favor for their SIGs.

Everyday people don't enjoy the same priviledge. While they are waiting for the new money to trickle down, the dollars that they already hold decline in value because they purchase less of the assets that the banks et al have bid up in price. Those near the bottom of the social pyramid are particularly hurt because they own few financial assets (e.g., stocks and bonds) that move higher on the speculative actions of the first movers. By the time the wave of new money trickles down to Main Street, the average person possesses fewer economic resources than previously.

Presto! Courtesy of the Fed and the politicos, wealth has been redistributed. Resources migrate to the first users at the expense of the late users.

This is the principle of First User Advantage.

If you're looking for factors that widen distribution of income, then you've just found another one.

position in Treasuries, SPX

Municipal Bondage

'Relax,' said the nightman, 'We are programmed to receive.'

'You can check out any time you like, but you can never leave.'

--Eagles

A week or so back, Ireland credit probs seemed to be off many radar screens. Issues here are now coming to light.

The new off-the-screen problem seems to be municipal bonds. Munis have been getting smoked over the last few sessions. Related news flow, however, remains a trickle.

Markets may be envisioning funding crises brewing w/ a new Congress that may be more reluctant to pass the buck...

position in Treasuries

'You can check out any time you like, but you can never leave.'

--Eagles

A week or so back, Ireland credit probs seemed to be off many radar screens. Issues here are now coming to light.

The new off-the-screen problem seems to be municipal bonds. Munis have been getting smoked over the last few sessions. Related news flow, however, remains a trickle.

Markets may be envisioning funding crises brewing w/ a new Congress that may be more reluctant to pass the buck...

position in Treasuries

Monday, November 15, 2010

Eyes Wide Shut

But don't be fooled by the radio

The TV or the magazines

They show you photographs of how your life should be

But they're just someone else's fantasy

--Styx

This brilliant little video on QE2 reminds that our current reality truly is stranger than fiction.

Central to the video is questioning bureaucratic wisdom that inflation is 'good' while deflation is 'bad.' As reasoned by the characters, falling prices in weak economic environments help those with lower incomes get thru hard times. Moreover, as prices come down, investors will put capital (and people) to work.

Government, however, has been working against these natural market forces for many years. This Depression era vid is a testament to the relentless stream of government propaganda seeking to demonize deflationary forces in soft economic periods in favor of inflationary intervention.

We can throw off this falsehood and the destruction it brings if we simply engage our brains.

The TV or the magazines

They show you photographs of how your life should be

But they're just someone else's fantasy

--Styx

This brilliant little video on QE2 reminds that our current reality truly is stranger than fiction.

Central to the video is questioning bureaucratic wisdom that inflation is 'good' while deflation is 'bad.' As reasoned by the characters, falling prices in weak economic environments help those with lower incomes get thru hard times. Moreover, as prices come down, investors will put capital (and people) to work.

Government, however, has been working against these natural market forces for many years. This Depression era vid is a testament to the relentless stream of government propaganda seeking to demonize deflationary forces in soft economic periods in favor of inflationary intervention.

We can throw off this falsehood and the destruction it brings if we simply engage our brains.

Labels:

deflation,

Depression,

Fed,

inflation,

manipulation,

media,

reason

Sunday, November 14, 2010

Deep End

I am not the actor

This can't be the scene

But I am in the water

As far as I can see

--The Who

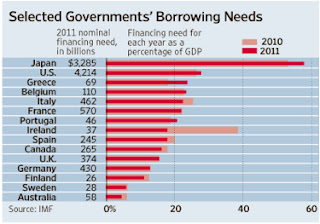

The IMF estimates that total borrowing requirements of key governments will amount to about $10.2 trillion in 2011. This would represent approx 27% of developed economy annual GDP.

As big as this number is, I'm inclined to take the 'over'...

This can't be the scene

But I am in the water

As far as I can see

--The Who

The IMF estimates that total borrowing requirements of key governments will amount to about $10.2 trillion in 2011. This would represent approx 27% of developed economy annual GDP.

As big as this number is, I'm inclined to take the 'over'...

Saturday, November 13, 2010

Intellectually Bankrupt

"Artistic value is achieved collectively by each man subordinating himself to the standards of the majority."

--Ellsworth Toohey (The Fountainhead)

In Ayn Rand's The Fountainhead, an individualistic architect struggles to succeed in an industry dominated by operators who value collusion and adherence to the status quo. The architect's problem is exacerbated by a newpaper columnist who crusades against independent thinking and tilts public opinion against him.

The columnist plays the role of the 'intellectual.' The intellectual has long been viewed as an important character in theories of socialist movements (Schumpeter, 1942; Hayek, 1944). It has been observed that phases in which socialism becomes a determining influence on politics are always preceded by periods in which socialist ideals pervaded the thinking of intellectuals (Hayek, 1949).

What qualifies intellectuals for their positions is not necessarily creative thinking or expertise. In fact those qualities are probably detrimental to the position. Instead, intellectuals are able to talk and write about a wide range of subjects, and they possess positions or habits that enable access to new ideas sooner than the audiences that intellectuals address (Hayek, 1949).

The scope of professions that contributes to the intellectual class is broad. It includes those who are masters of technique for conveying ideas, but who are often rank amateurs in the substance of what they convey. Journalists, teachers, ministers, publicists, commentators, fiction writers, cartoonists, and artists fall into this group, as do many professionals who become carriers of new ideas outside of their own fields. For those people who have not the time or motivation to self-educate, intellectuals serve as gatekeepers to events and ideas. In this sense, intellectuals are highly influential in shaping popular opinion.

While organizations that employ them may claim to be 'intellectually honest' or 'unbiased,' intellectuals are likely to follow their own convictions whenever they have discretion. As such, they will correspondingly slant work that passes through their hands.

Various reasons have been offered as to why intellectuals are biased toward socialism (Hayek, 1944, 1949; Schumpeter, 1942), including:

a) People who obtain high levels of education but who feel underemployed may blame 'capitalism' for their lack of success. When avenues are available to do so, these underemployed intellectuals are likely to disparage capitalism in favor of socialistic alternatives.

b) Intellectuals tend to have little experience in private industry. Absent operating responsibilities in productive enterprise, they lack deep smarts about market behavior.

c) Intellectuals are often attracted to utopian visions offered by socialists. Promises of income equality and social justice drive many intellectuals toward socialistic agendas.

While their role in advancing socialist agendas has escalated over the past century, intellectuals can only exert influence when people do not think for themselves. If individuals decide not to outsource their brains, then demand for intellectual drivel declines.

Independent thought is the intellectual's nightmare.

References

Hayek, F.A. 1944. The road to serfdom. Chicago: University of Chicago.

Hayek, F.A. 1949. The intellectuals and socialism. University of Chicago Law Review, Spring 1949: 417-433.

Schumpeter, J.A. 1942. Capitalism, socialism, and democracy. New York: Harper & Brothers.

--Ellsworth Toohey (The Fountainhead)

In Ayn Rand's The Fountainhead, an individualistic architect struggles to succeed in an industry dominated by operators who value collusion and adherence to the status quo. The architect's problem is exacerbated by a newpaper columnist who crusades against independent thinking and tilts public opinion against him.

The columnist plays the role of the 'intellectual.' The intellectual has long been viewed as an important character in theories of socialist movements (Schumpeter, 1942; Hayek, 1944). It has been observed that phases in which socialism becomes a determining influence on politics are always preceded by periods in which socialist ideals pervaded the thinking of intellectuals (Hayek, 1949).

What qualifies intellectuals for their positions is not necessarily creative thinking or expertise. In fact those qualities are probably detrimental to the position. Instead, intellectuals are able to talk and write about a wide range of subjects, and they possess positions or habits that enable access to new ideas sooner than the audiences that intellectuals address (Hayek, 1949).

The scope of professions that contributes to the intellectual class is broad. It includes those who are masters of technique for conveying ideas, but who are often rank amateurs in the substance of what they convey. Journalists, teachers, ministers, publicists, commentators, fiction writers, cartoonists, and artists fall into this group, as do many professionals who become carriers of new ideas outside of their own fields. For those people who have not the time or motivation to self-educate, intellectuals serve as gatekeepers to events and ideas. In this sense, intellectuals are highly influential in shaping popular opinion.

While organizations that employ them may claim to be 'intellectually honest' or 'unbiased,' intellectuals are likely to follow their own convictions whenever they have discretion. As such, they will correspondingly slant work that passes through their hands.

Various reasons have been offered as to why intellectuals are biased toward socialism (Hayek, 1944, 1949; Schumpeter, 1942), including:

a) People who obtain high levels of education but who feel underemployed may blame 'capitalism' for their lack of success. When avenues are available to do so, these underemployed intellectuals are likely to disparage capitalism in favor of socialistic alternatives.

b) Intellectuals tend to have little experience in private industry. Absent operating responsibilities in productive enterprise, they lack deep smarts about market behavior.

c) Intellectuals are often attracted to utopian visions offered by socialists. Promises of income equality and social justice drive many intellectuals toward socialistic agendas.

While their role in advancing socialist agendas has escalated over the past century, intellectuals can only exert influence when people do not think for themselves. If individuals decide not to outsource their brains, then demand for intellectual drivel declines.

Independent thought is the intellectual's nightmare.

References

Hayek, F.A. 1944. The road to serfdom. Chicago: University of Chicago.

Hayek, F.A. 1949. The intellectuals and socialism. University of Chicago Law Review, Spring 1949: 417-433.

Schumpeter, J.A. 1942. Capitalism, socialism, and democracy. New York: Harper & Brothers.

Friday, November 12, 2010

Toys of the Addict

You talk about things that nobody cares

Wearing other things that nobody wears

You're callin' my name but I gotta make clear

I can't say baby where I'll be in a year

--Aerosmith

Let's say a retailer marks its prices down to super low levels. You like to consume, so you buy boatloads of the discounted goods.

Not only that, but there are lenders out there offering super cheap credit. One of those lenders happens to be, yep, the deep discounting retailer. So you borrow big from the retailer and others so that you can purchase even more uber cheap products.

Over time, you find it increasingly difficult to pay your bills. You're consuming more than your income can support. Moreover, borrowing more funds is getting harder because the cost of credit is increasing. The retailer is still offering credit, although the terms are getting more expensive.

Since you like to consume, you basically shake it off and continue buying those deep discounted goods on credit funded largely by the retailer.

It doesn't take long, however, before pangs of discomfort return. Persisting with the current arrangement seems untenable. So you consider some alternatives:

a) You could reduce or totally cease consumption of the retailer's items. Less consumption increases capacity for saving and paying down debt.

b) You could stop payment on some or all debt (a.k.a. default)--perhaps even while continuing consumption. Lenders, however, will almost certainly cut off any more loans because it will be clear that you are not a good credit risk.

c) You could publicly claim that the retailer is unfairly keeping prices too low and forcing you to consume. You would demand that the retailer raise prices immediately.

As ridiculous as c) seems, this is basically the approach the administration is currently taking with China. It is accusing China of keeping the price of its currency too low and demanding that it strengthen the yuan immediately.

What makes this situation doubly laughable is that the US is making these claims while engaging in its own gigantic schemes of price manipulation. This irony has not been lost on the Chinese and other countries.

Perverse logic is the way of the addict.

position in USD, Treasuries

Wearing other things that nobody wears

You're callin' my name but I gotta make clear

I can't say baby where I'll be in a year

--Aerosmith

Let's say a retailer marks its prices down to super low levels. You like to consume, so you buy boatloads of the discounted goods.

Not only that, but there are lenders out there offering super cheap credit. One of those lenders happens to be, yep, the deep discounting retailer. So you borrow big from the retailer and others so that you can purchase even more uber cheap products.

Over time, you find it increasingly difficult to pay your bills. You're consuming more than your income can support. Moreover, borrowing more funds is getting harder because the cost of credit is increasing. The retailer is still offering credit, although the terms are getting more expensive.

Since you like to consume, you basically shake it off and continue buying those deep discounted goods on credit funded largely by the retailer.

It doesn't take long, however, before pangs of discomfort return. Persisting with the current arrangement seems untenable. So you consider some alternatives:

a) You could reduce or totally cease consumption of the retailer's items. Less consumption increases capacity for saving and paying down debt.

b) You could stop payment on some or all debt (a.k.a. default)--perhaps even while continuing consumption. Lenders, however, will almost certainly cut off any more loans because it will be clear that you are not a good credit risk.

c) You could publicly claim that the retailer is unfairly keeping prices too low and forcing you to consume. You would demand that the retailer raise prices immediately.

As ridiculous as c) seems, this is basically the approach the administration is currently taking with China. It is accusing China of keeping the price of its currency too low and demanding that it strengthen the yuan immediately.

What makes this situation doubly laughable is that the US is making these claims while engaging in its own gigantic schemes of price manipulation. This irony has not been lost on the Chinese and other countries.

Perverse logic is the way of the addict.

position in USD, Treasuries

Thursday, November 11, 2010

Bond Bust

Back at base, bugs in the software

Flash the message 'There's something out there'

--Nena

Treasury bonds have been caught in the Fed's vice. On the one hand, QE2 means that the Fed will print $900 billion out of thin air, which is inflationary (bad for bonds). On the other hand, the Fed has pledge that the printed proceeds will be used to buy Treasuries (good for bonds).

For the last couple of weeks, the inflationary side of the vice has been winning, as long bonds have been hammered.

Selling has resided in the last couple of days, and charts give some indication of exhaustion and pending trend reversal. Not a bad entry point for a long side try...

position in TLT

Flash the message 'There's something out there'

--Nena

Treasury bonds have been caught in the Fed's vice. On the one hand, QE2 means that the Fed will print $900 billion out of thin air, which is inflationary (bad for bonds). On the other hand, the Fed has pledge that the printed proceeds will be used to buy Treasuries (good for bonds).

For the last couple of weeks, the inflationary side of the vice has been winning, as long bonds have been hammered.

Selling has resided in the last couple of days, and charts give some indication of exhaustion and pending trend reversal. Not a bad entry point for a long side try...

position in TLT

Make It Loud

I look at all of the people

Doing it over and over

--OMD

Jim Rogers weighs in on Ben Bernanke and the Fed. Nothing really new from his perspective. But it does seem like the anti-Fed perspective is getting out there, as reflected by the comments of Bethany McLean (didn't know she's no longer w/ Fortune).

Can only hope this discussion continues to get louder...

position in XLF

Doing it over and over

--OMD

Jim Rogers weighs in on Ben Bernanke and the Fed. Nothing really new from his perspective. But it does seem like the anti-Fed perspective is getting out there, as reflected by the comments of Bethany McLean (didn't know she's no longer w/ Fortune).

Can only hope this discussion continues to get louder...

position in XLF

Wednesday, November 10, 2010

Reducing Income Inequality

If I told you what it takes to reach the highest high

You'd laugh and say nothing's that simple

--The Who

Interesting article in the most recent Journal of Finance by Beck, Levine, and Levkov (2010). The researchers assess the impact of banking deregulation from 1976 to 1994 on income distribution.

Common wisdom is that industry regulation is necessary to improve social welfare. Otherwise the rich get richer at the expense of the poor.

The researchers found the opposite. After controlling for various economic and sociodemographic variables, income disparity actually narrowed during the study period. Social welfare, as reflected by income inequality, improved with bank deregulation.

While surprising to some, these findings should actually be expected. Regulation squelches competition and raises barriers to entry in an industry--effectively protecting the franchises of incumbents. A mountain of research suggests that innovation and efficiency gains are most often achieved by new enterprises rather than by the entreched establishment.

Cutting regs encourages Schumpeter's (1942) capitalistic 'process of creative destruction.' This process pushes general standards of living higher, not lower.

We're doing the opposite currently--saddling economic environments with ever more interventionary action by government. And the chasm between rich and poor widens...

Another laughably sad situation.

position in XLF

Reference

Beck, T., Levine, R., & Levkov, A. 2010. Big bad banks? The winners and losers from bank deregulation in the United States. Journal of Finance, 65: 1637-1667.

Schumpeter, J.A. 1942. Capitalism, socialism & democracy. New York: Harper & Brothers.

You'd laugh and say nothing's that simple

--The Who

Interesting article in the most recent Journal of Finance by Beck, Levine, and Levkov (2010). The researchers assess the impact of banking deregulation from 1976 to 1994 on income distribution.

Common wisdom is that industry regulation is necessary to improve social welfare. Otherwise the rich get richer at the expense of the poor.

The researchers found the opposite. After controlling for various economic and sociodemographic variables, income disparity actually narrowed during the study period. Social welfare, as reflected by income inequality, improved with bank deregulation.

While surprising to some, these findings should actually be expected. Regulation squelches competition and raises barriers to entry in an industry--effectively protecting the franchises of incumbents. A mountain of research suggests that innovation and efficiency gains are most often achieved by new enterprises rather than by the entreched establishment.

Cutting regs encourages Schumpeter's (1942) capitalistic 'process of creative destruction.' This process pushes general standards of living higher, not lower.

We're doing the opposite currently--saddling economic environments with ever more interventionary action by government. And the chasm between rich and poor widens...

Another laughably sad situation.

position in XLF

Reference

Beck, T., Levine, R., & Levkov, A. 2010. Big bad banks? The winners and losers from bank deregulation in the United States. Journal of Finance, 65: 1637-1667.

Schumpeter, J.A. 1942. Capitalism, socialism & democracy. New York: Harper & Brothers.

Labels:

freedom,

government,

intervention,

measurement,

reason

Tuesday, November 9, 2010

Reversal of Fortune

Oh, you're a loaded gun

Oh, there's nowhere to run

No one can save me

The damage is done

--Bon Jovi

A few days back I began another 'pyramiding' trade in the gold (GLD) and silver (SLV) ETFs. Adding higher in mo-mo fashion is typically not my bag, but it has helped me participate in these strong trending moves while keeping me mindful of risk (by using gains to subsidize additional risk at higher prices).

However, the kind of action we saw this am--gappy, seemingly indiscriminant price chasing--always makes me uncomfortable. Particularly so when the pattern strings together in parabolic fashion. Silver sprinted out of the gate and was bid up another 3-4% , with spot prices north of $29/oz. Gold followed w/ another new high for the move above $1420.

The action was too frothy for my tastes, though, and I kicked both positions into the morning feeding frenzy.

Better lucky than smart, as early afternoon saw a major reversal. Both GLD and SLV just missed marking outside days to the downside after flipping over on huge volume. The hi/lo range on silver today was ~10%.

We'll see whether this was merely the inevitable release of near term speculative pressure, or whether this marks the beginning of a counter move. Can't help but spy that gap on SLV down at 24ish...

On a related note, the USD had a solid day to the upside gaining about 1%.

positions in gold, silver, UUP

Oh, there's nowhere to run

No one can save me

The damage is done

--Bon Jovi

A few days back I began another 'pyramiding' trade in the gold (GLD) and silver (SLV) ETFs. Adding higher in mo-mo fashion is typically not my bag, but it has helped me participate in these strong trending moves while keeping me mindful of risk (by using gains to subsidize additional risk at higher prices).

However, the kind of action we saw this am--gappy, seemingly indiscriminant price chasing--always makes me uncomfortable. Particularly so when the pattern strings together in parabolic fashion. Silver sprinted out of the gate and was bid up another 3-4% , with spot prices north of $29/oz. Gold followed w/ another new high for the move above $1420.

The action was too frothy for my tastes, though, and I kicked both positions into the morning feeding frenzy.

Better lucky than smart, as early afternoon saw a major reversal. Both GLD and SLV just missed marking outside days to the downside after flipping over on huge volume. The hi/lo range on silver today was ~10%.

We'll see whether this was merely the inevitable release of near term speculative pressure, or whether this marks the beginning of a counter move. Can't help but spy that gap on SLV down at 24ish...

On a related note, the USD had a solid day to the upside gaining about 1%.

positions in gold, silver, UUP

Labels:

asset allocation,

dollar,

gold,

silver,

technical analysis

QE2 then Bailout2?

Now we're back in the fight

We're back on the train, hey

Oh, back on the chain gang

--Pretenders

The Bank of America (BAC) situation continues to merit attention, me thinks. A $2 trillion balance sheet with assets of questionable quality. Plus the bank is bogged down in the fraudclosure mess.

If this house of cards implodes, then Bailout 2 looms large...

The stock had been trading like death on a cracker until it popped with the overall sector last week. Altho I'm not playing it this way, the set up right here seems like a decent defined risk 'pop and drop' entry for traders who wanna bang w/ Boo in this name.

Regardless, keep half an eye on this situation...

position in SH, XLF

We're back on the train, hey

Oh, back on the chain gang

--Pretenders

The Bank of America (BAC) situation continues to merit attention, me thinks. A $2 trillion balance sheet with assets of questionable quality. Plus the bank is bogged down in the fraudclosure mess.

If this house of cards implodes, then Bailout 2 looms large...

The stock had been trading like death on a cracker until it popped with the overall sector last week. Altho I'm not playing it this way, the set up right here seems like a decent defined risk 'pop and drop' entry for traders who wanna bang w/ Boo in this name.

Regardless, keep half an eye on this situation...

position in SH, XLF

Labels:

debt,

leverage,

mortgage,

ponzi,

real estate,

technical analysis

Monday, November 8, 2010

Fed Folly

There's a room where the light won't find you

Holding hands while

The walls come tumbling down

When they do, I'll be right behind you

--Tears for Fears

Fed chairman Ben Bernanke's Washington Post piece following last week's QE2 announcement seems destined for the history books. It has long been apparent that those at the Federal Reserve either don't believe or don't understand basic laws of economics. But Bernanke's statements last week elevate that institutional incompetence to a new level.

The most laughable passage is this one:

"This [quantitative easing] approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur lending. Increased spending will lead to higher incomes and profits that, in a virtuous cycle, will further support economic expansion."

Even novice minds should recognize that if such a 'virtuous cycle' could be created merely by printing paper, then we'd all be bathing in prosperity by now. The virtuous cycle the Mr Bernanke seeks to put in motion is called a bubble. And there should be little lingering doubt that the Fed is a chronic bubble blower.

To all those people wringing their hands over the increasing chasm between rich and poor, consider the central bank's role in widening that gap. As Bernanke notes above, he wants to jack financial asset prices higher. Financial assets, not base salaries, form the bread and butter of the wealthy.

Meanwhile, lower income people bear the consequential brunt of Fed policy. Tiny yields on saving vehicles where the poor and elderly park the bulk of their financial assets. Ultra cheap lending rates that encourage excessive borrowing and debt. Higher prices on basic necessities as markets bid commodity prices (below) thru the roof.

Bubble blowing creates no virtuous economic cycle. It does not relieve pressure at the bottom of the social pyramid. It increases squalor.

Perhaps the recent election will drive action to reverse the corrosive effects of central banking in the United States. While hopeful, I realize that history stacks the odds against it.

Absent proactive change in this regard, it's hard not to forecast an epic crack up--one that will make events over the past couple years appear tame in comparison.

position in USD, Treasuries, SPX

Holding hands while

The walls come tumbling down

When they do, I'll be right behind you

--Tears for Fears

Fed chairman Ben Bernanke's Washington Post piece following last week's QE2 announcement seems destined for the history books. It has long been apparent that those at the Federal Reserve either don't believe or don't understand basic laws of economics. But Bernanke's statements last week elevate that institutional incompetence to a new level.

The most laughable passage is this one:

"This [quantitative easing] approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur lending. Increased spending will lead to higher incomes and profits that, in a virtuous cycle, will further support economic expansion."

Even novice minds should recognize that if such a 'virtuous cycle' could be created merely by printing paper, then we'd all be bathing in prosperity by now. The virtuous cycle the Mr Bernanke seeks to put in motion is called a bubble. And there should be little lingering doubt that the Fed is a chronic bubble blower.

To all those people wringing their hands over the increasing chasm between rich and poor, consider the central bank's role in widening that gap. As Bernanke notes above, he wants to jack financial asset prices higher. Financial assets, not base salaries, form the bread and butter of the wealthy.

Meanwhile, lower income people bear the consequential brunt of Fed policy. Tiny yields on saving vehicles where the poor and elderly park the bulk of their financial assets. Ultra cheap lending rates that encourage excessive borrowing and debt. Higher prices on basic necessities as markets bid commodity prices (below) thru the roof.

Bubble blowing creates no virtuous economic cycle. It does not relieve pressure at the bottom of the social pyramid. It increases squalor.

Perhaps the recent election will drive action to reverse the corrosive effects of central banking in the United States. While hopeful, I realize that history stacks the odds against it.

Absent proactive change in this regard, it's hard not to forecast an epic crack up--one that will make events over the past couple years appear tame in comparison.

position in USD, Treasuries, SPX

Sunday, November 7, 2010

Why Can't We Cooperate? Pt II

Oh, that ain't working, that's the way you do it

Get your money for nothing, get your chicks for free

--Dire Straits

Previously we pondered our general unwillingness to work together on problems that have a national scope. Employing a market-based approach, we proposed that if the market for solving our nation's problems was truly unhampered, then lack of cooperation reflects absence of voluntary exchange between those with ideas about how to fix problems, and those that would need to execute potential solutions.

Simply put, buyers and sellers have yet to perceive mutual value when it comes to national problem solving, and a market has not yet been made that motivates voluntary cooperation in this regard.

This explanation is not entirely satisfactory, however, because the unhampered market assumption is questionable. Empirical evidence suggests that, contrary to the beliefs of many, large scale free markets generally don't exist in our country. And in the political domain, where many problems of national scope are positioned, it is absolutely certain that related markets operate under hampered conditions.

Political markets are hampered because property rights are not respected. Our current goverment structure permits politicians to confiscate resources from citizenry and redistribute them with discretion.

Rather than stimulating voluntary exchange, this situation creates a market for political favor where buyers, known as special interest groups (SIGs), seek to purchase resources from sellers, known as politicians. This constitutes a hampered market situation because resources for sale have been obtained by coercive means. Some of the exchanges are involuntary in nature.

Hampered markets for political favor are likely to crowd out unhampered markets for voluntary exchange with near certainty. This is because of the axiomatic Law of Parsimonny, which states that humans generally seek the greatest amount of satisfaction possible relative to the labor given up. In markets for political favor, it is possible for many individuals to acquire needs-satisfying resources by expending less effort than it would take to obtain those same resources thru productive labor and voluntary exchange.

Because markets for political favor offer the possibility of getting 'something for nothing,' human nature is likely to bid such markets up, while markets for voluntary exchange shrink from the scene.

The ramifications for broad cooperation should be apparent. Politicians broker involuntary exchange between parties who would not trade on similar terms if property rights were respected. SIGs form to increase bargaining power for confiscated resources. Other SIGs form to keep resources from being confiscated--particularly when democratic process provides an avenue for SIG operations.

Voluntary exchange diminishes as people seek to satisfy their needs via political channels. People are also busy trying to protect their property from confiscation.

Clearly this situation is not conducive to widespread voluntary cooperation.

This seems a reasonable answer to Jon Stewart's question. We can't work together as long as free markets are circumvented by markets for political favor.

Remove the power to confiscate resources from government's hands, and watch voluntary cooperation increase.

Get your money for nothing, get your chicks for free

--Dire Straits

Previously we pondered our general unwillingness to work together on problems that have a national scope. Employing a market-based approach, we proposed that if the market for solving our nation's problems was truly unhampered, then lack of cooperation reflects absence of voluntary exchange between those with ideas about how to fix problems, and those that would need to execute potential solutions.

Simply put, buyers and sellers have yet to perceive mutual value when it comes to national problem solving, and a market has not yet been made that motivates voluntary cooperation in this regard.

This explanation is not entirely satisfactory, however, because the unhampered market assumption is questionable. Empirical evidence suggests that, contrary to the beliefs of many, large scale free markets generally don't exist in our country. And in the political domain, where many problems of national scope are positioned, it is absolutely certain that related markets operate under hampered conditions.

Political markets are hampered because property rights are not respected. Our current goverment structure permits politicians to confiscate resources from citizenry and redistribute them with discretion.

Rather than stimulating voluntary exchange, this situation creates a market for political favor where buyers, known as special interest groups (SIGs), seek to purchase resources from sellers, known as politicians. This constitutes a hampered market situation because resources for sale have been obtained by coercive means. Some of the exchanges are involuntary in nature.

Hampered markets for political favor are likely to crowd out unhampered markets for voluntary exchange with near certainty. This is because of the axiomatic Law of Parsimonny, which states that humans generally seek the greatest amount of satisfaction possible relative to the labor given up. In markets for political favor, it is possible for many individuals to acquire needs-satisfying resources by expending less effort than it would take to obtain those same resources thru productive labor and voluntary exchange.

Because markets for political favor offer the possibility of getting 'something for nothing,' human nature is likely to bid such markets up, while markets for voluntary exchange shrink from the scene.

The ramifications for broad cooperation should be apparent. Politicians broker involuntary exchange between parties who would not trade on similar terms if property rights were respected. SIGs form to increase bargaining power for confiscated resources. Other SIGs form to keep resources from being confiscated--particularly when democratic process provides an avenue for SIG operations.

Voluntary exchange diminishes as people seek to satisfy their needs via political channels. People are also busy trying to protect their property from confiscation.

Clearly this situation is not conducive to widespread voluntary cooperation.

This seems a reasonable answer to Jon Stewart's question. We can't work together as long as free markets are circumvented by markets for political favor.

Remove the power to confiscate resources from government's hands, and watch voluntary cooperation increase.

Labels:

capital,

competition,

government,

intervention,

productivity,

reason,

socialism

Saturday, November 6, 2010

Why Can't We Cooperate?

A thousand skeptic hands

Won't keep us from the things we plan

Unless we're clinging to the things we prize

--Howard Jones

In a speech at a liberal pre-election rally last weekend, comedian Jon Stewart wondered aloud why Americans can't work more collaboratively to solve our nation's problems. He cited examples of people from diverse backgrounds who work together daily. Why can't we have more of that?

Stewart was describing examples of market activity. Markets are people engaging in exchange. People do so because they have needs that they want to satisfy (self-interest is axiomatic to human behavior), and cooperative exchange helps individuals achieve higher levels of satisfaction than otherwise possible.

Markets are not just associated with material exchange. There are also markets for ideas, knowledge, companionship, power, etc. Indeed, gains from market exchange may be more psychic than material.

Markets, then, constitute a basic form of social organization.

In unhampered (a.k.a. 'free') markets, property rights of the individual form the basis for exchange. This means that an exchange can only occur if both sides voluntarily engage in the trade. This holds true in product markets, where spectacular chains of widespread voluntary cooperation often assemble to produce even the simplest of products.

The same principle holds true in non product markets. For example, if I have an idea about how the world should function, then I can offer it to others but I cannot force them to accept it. I also cannot coerce others to do things in order for my vision to become reality.

Unhampered markets promote freedom because property rights are respected, meaning that exchange is done on a voluntary basis.

Circling back to Jon Stewart's question, then, one possible answer is that there are not two sides to 'the market for voluntarily solving problems at a national level. Current ideas/programs being offered by some (sellers/supply) have found insufficient support among those necessary to convert those ideas into reality (buyers/demand).

This answer is not totally satisfactory, however, because it does not address the very real possibility that an unhampered market do not exist in this case.

We'll continue this discussion in future missives.

Won't keep us from the things we plan

Unless we're clinging to the things we prize

--Howard Jones

In a speech at a liberal pre-election rally last weekend, comedian Jon Stewart wondered aloud why Americans can't work more collaboratively to solve our nation's problems. He cited examples of people from diverse backgrounds who work together daily. Why can't we have more of that?

Stewart was describing examples of market activity. Markets are people engaging in exchange. People do so because they have needs that they want to satisfy (self-interest is axiomatic to human behavior), and cooperative exchange helps individuals achieve higher levels of satisfaction than otherwise possible.

Markets are not just associated with material exchange. There are also markets for ideas, knowledge, companionship, power, etc. Indeed, gains from market exchange may be more psychic than material.

Markets, then, constitute a basic form of social organization.

In unhampered (a.k.a. 'free') markets, property rights of the individual form the basis for exchange. This means that an exchange can only occur if both sides voluntarily engage in the trade. This holds true in product markets, where spectacular chains of widespread voluntary cooperation often assemble to produce even the simplest of products.

The same principle holds true in non product markets. For example, if I have an idea about how the world should function, then I can offer it to others but I cannot force them to accept it. I also cannot coerce others to do things in order for my vision to become reality.

Unhampered markets promote freedom because property rights are respected, meaning that exchange is done on a voluntary basis.

Circling back to Jon Stewart's question, then, one possible answer is that there are not two sides to 'the market for voluntarily solving problems at a national level. Current ideas/programs being offered by some (sellers/supply) have found insufficient support among those necessary to convert those ideas into reality (buyers/demand).

This answer is not totally satisfactory, however, because it does not address the very real possibility that an unhampered market do not exist in this case.

We'll continue this discussion in future missives.

Labels:

freedom,

manufacturing,

markets,

productivity,

property

Friday, November 5, 2010

On Reserve

With one foot in the past

Now just how long will it last

No, no, no have you no ambition

--Tears for Fears

Had to snip one from Minyanville's Peter Atwater:

Banks stocks are up because the Federal Reserve is going to allow holding companies to increase dividends.

Stocks are up because the Federal Reserve is going to do QE2.

The dollar is up or down because of what the Federal Reserve is going to do.

Commodities are up or down because of what the Federal Reserve is going to do.

The market is the Federal Reserve.

position in USD

Now just how long will it last

No, no, no have you no ambition

--Tears for Fears

Had to snip one from Minyanville's Peter Atwater: